To opt in, text libtax to us411 for special offers. If you use northwest registered agent as your llc in texas, receive notification reminders to file your annual reports on time, annual tax reminders, and new state information reminders.

Notice Of 2021 Tax Year Proposed Tax Rate For City Of Austin Austintexas Gov

As of november 18, austin county, tx shows 2 tax liens.

Sales tax office austin texas. Main office texas comptroller of public accounts lyndon b. [click here to access link] truth in taxation summary. The latest sales tax rates for cities starting with 'h' in texas (tx) state.

There are a total of 815 local tax jurisdictions across the state, collecting an average local tax of 1.377%. Certain tax records are considered public record, which means they are available to the public, while. Interested in a tax lien in austin county, tx?

The city receives 10.7143% of total mixed beverage tax receipts collected in austin. Change of address on motor vehicle records. Enjoy the pride of homeownership for less than it costs to rent before it's too late.

Austin tax records include documents related to property taxes, business taxes, sales tax, employment taxes, and a range of other taxes in austin, texas. Registration renewals (license plates and registration stickers) vehicle title transfers. In texas, austin is ranked 294th of 2209 cities in treasurer & tax collector offices per capita, and 291st of 2209 cities in treasurer.

The travis county tax office collects local property taxes and court fines and fees for the jp courts and county courts at law; Johnson state office building 111 east 17th street austin, texas 78774. Texas has state sales tax of 6.25% , and allows local governments to collect a local option sales tax of up to 2%.

If the first tuesday of the month is a holiday, the tax sale will be held on the first wednesday of the month. Sale listings are published in the austin chronicle at least 21 days before the sale and are. Texas comptroller of public accounts lyndon b.

Waco, texas 76701 waco tx state tax office at 801 austin ave. Learn more about obtaining sales tax permits and paying your sales and use taxes for your business. By state law, on january 1, a tax.

The state levies a sales and use tax of 6.25% on sales of tangible personal property and certain services. Cities, counties, and transit authorities may add to the sales tax rate up to a maximum combined state and local rate of 8.25%. Bruce elfant is your current tax assessor/collector.

Tax records include property tax assessments, property appraisals, and income tax records. Rates include state, county, and city taxes. Taxes are billed in october of each year and are due upon receipt of the statement.

Breakdown of your local property taxes. On the west steps of the county courthouse, 1000 guadalupe st., austin, tx 78701. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services.local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent.

2020 rates included for use while preparing your income tax deduction. This county tax office works in partnership with our vehicle titles and registration division. Registers and titles motor vehicles;

5501 airport blvd austin, tx 78751. Amelia street bellville, texas 77418. State tax office at 801 austin ave.

How does a tax lien sale work? Johnson state office building 111 east 17th street austin, tx 78774 local phone (sales tax department): Lowest sales tax (6.25%) highest sales tax (8.25%) texas sales tax:

Average sales tax (with local): 1 toll free phone (sales tax department): And registers citizens to vote.

On this website on the forms page, at the austin county appraisal district office located at 906 e. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. Tax sales are held the first tuesday of the month at 10 a.m.

There are 3 treasurer & tax collector offices in austin, texas, serving a population of 916,906 people in an area of 313 square miles.there is 1 treasurer & tax collector office per 305,635 people, and 1 treasurer & tax collector office per 104 square miles. Submit the bidder registration (solicitud para participar en las subastas de propiedades) and the $10 fee online, in person or by mail to the main tax office at 5501 airport blvd., austin, tx 78751, at least five business days before the date of the sale. Texas grants sales and use tax exemptions on machinery and equipment utilized in the manufacturing process.

Resume Samples And How To Write A Resume Resume Companion Manager Resume Good Resume Examples Job Resume

Amazon Distribution Building In Southeast Austin Has A New Owner

Salesforce Shifts Away From In-person Work The 9-to-5 Workday Is Dead San Francisco The Guardian

Pin By Sudie Bernard On Gaming In 2021 Cool Photos Love Photos Perfect Image

Sources Hbo Netflix Lease Space In Austin Area For Projects - Austin Business Journal

Austin Office Insight Q3 2021 Jll Research

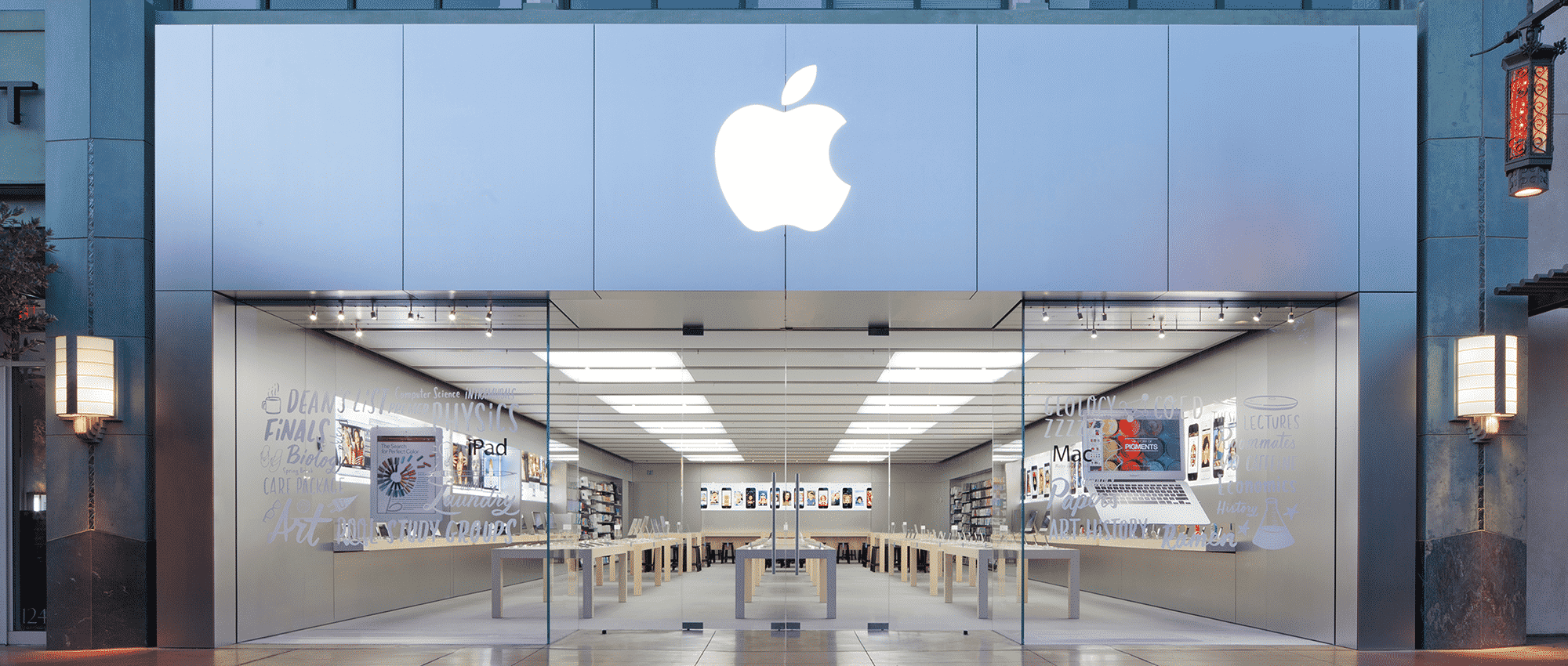

Apples Austin Offices Headquarters History Details Predictions

Realty Austin Office Locations

Realty Austin Office Locations

Austin Locations Reed Smith Llp

Wood Windows Spanish Style Homes Spanish Home Decor Spanish Style Bedroom

Sell My House Fast London - Sell My House Fast Sell My House Sell Your House Fast Sell My House Fast

Austin Was Destined To Replace Silicon Valley Then The Pandemic Hit By Adam Bluestein Marker

Why Austin Texas Is One Of The Best Cities For Business

Medical Vocational Trade School In Austin Tx Sci

Budget Austintexasgov

Apples Austin Offices Headquarters History Details Predictions

Law Firm In Ho Chi Minh City For Legal Service Ant Lawyers In 2021 Ho Chi Minh City Ho Chi Minh Minh

Austin Office Insight Q3 2021 Jll Research