What can the irs child tax credit tools do? At some point the portal will be updated to allow you to update how many dependants you have.

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Wheres My Refund - Tax News Information

If you earned less than $12,400 (or less than $24,800 if you are married), you can use getctc, a simplified tax filing portal to get the child tax credit, receive a missing stimulus payment, and get cash now.

Child tax credit portal update dependents. Updating the portal or any changes next year could also result in an additional payment next year if you were underpaid. The child tax credit update portal allows users to make sure they are registered to receive advance payments. In the future, the child tax credit update portal may allow for updates to family size and marital status.

If you have not filed a tax return, you can sign up to get the child tax credit. Going forward, it's still unclear if. 2 will apply to the aug.

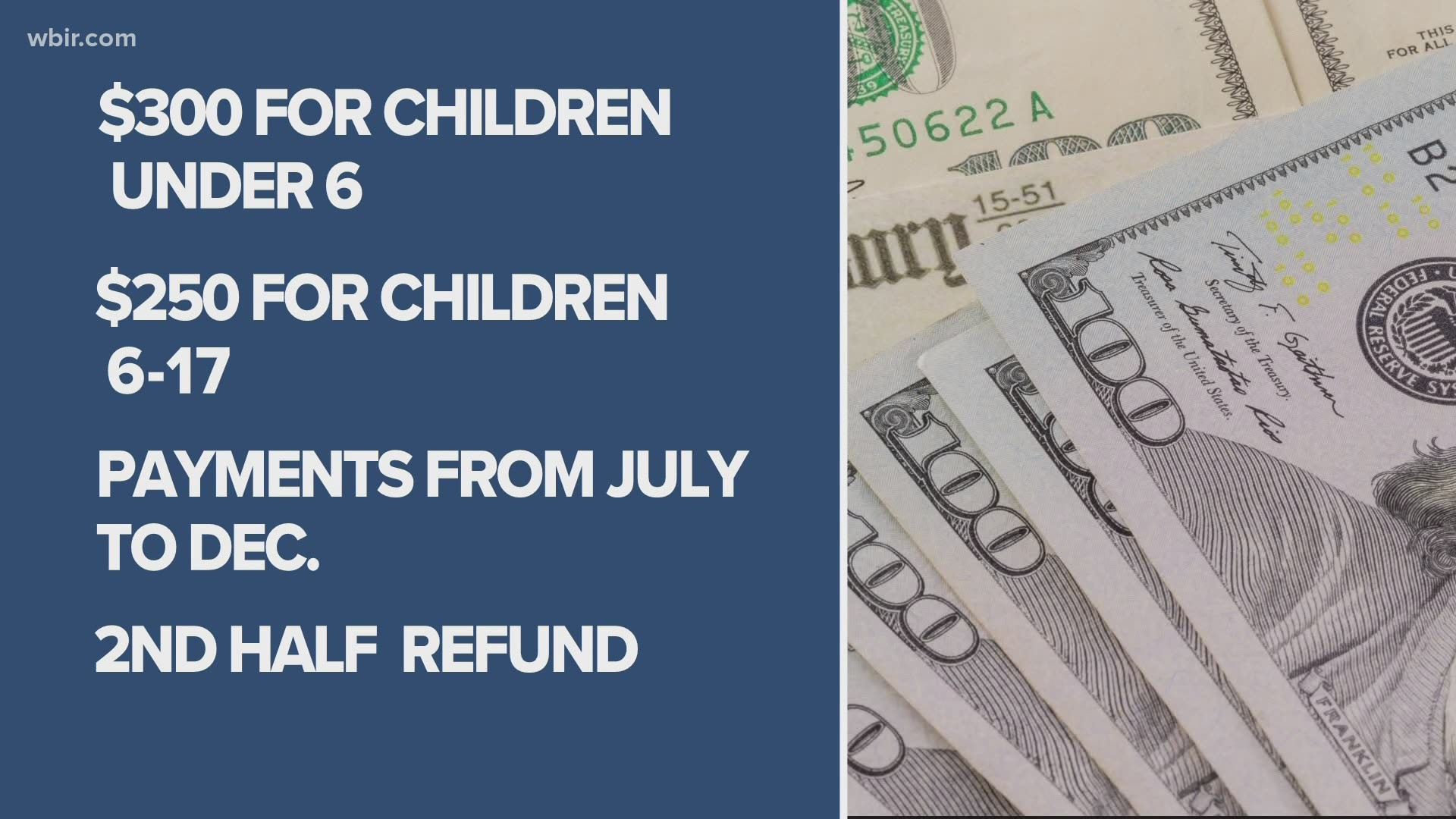

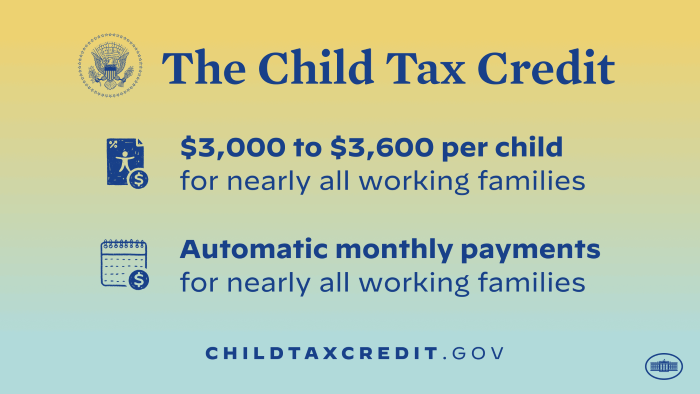

Hey everyone, i just want to make sure i'm not crazy, and that we are indeed still waiting for the irs portal to update so that we can make changes to our dependents/marital status/income for the advance child tax credit. Check enrollment, update your information, or opt out in the irs child credit update portal! The first half of that credit has been delivered in monthly payments of up to $300 for children under 6 and $250 for those aged 6 to 17.

The bank account update feature was added to the child tax credit update portal, available only on irs.gov. Here's how they help parents with eligible dependents: Here is a direct link to the portal that let’s you sign up to adjust your child tax credit — and, in your case, add a newborn.

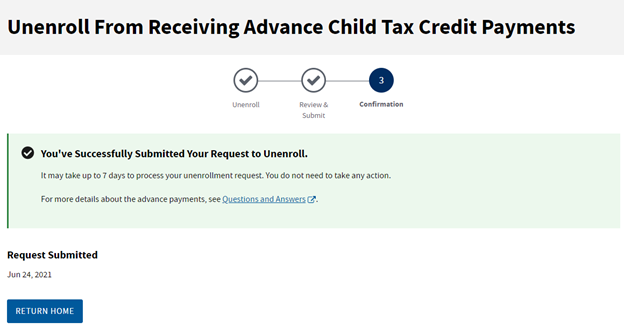

The deadline to unenroll or update your information on the child tax credit update portal was 11:59 p.m. Eastern time on november 29, 2021. The child tax credit update portal allows users to make sure they are registered to receive advance payments.

The child tax credit update portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. Here’s how they help parents with eligible dependents: The advance child tax credit portal should be updated next week which will allow you to add dependents.

To reduce the chances of an overpayment, you will be able to update the irs later this summer about changes to your dependents, marital status, and income through the child tax credit portal. The child tax credit update portal. Here's how they help parents with eligible dependents:

While it has limited features at the minute there are plans to roll out more functions later this month including updating the ages of your. Important changes to the child tax credit will help many families get advance payments of the child tax credit starting in the summer of 2021. If the irs doesn't have your bank account information, you'll get a paper check or debit card in the.

29 at the portal, irs.gov/childtaxcredit2021. The child tax credit update portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. That means you will start getting a monthly advance, probably in november if you do it now.

The child tax credit update portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. A family with a child born in 2021 can file a 2021 tax return in the spring to get the full payment as a lump sum. Parents can now use the child tax credit update portal to check on their payments credit:

Advance child tax credit update for adding dependents and late payments for september. Any updates made by aug. But no matter what month your child was born in 2021, you get the entire tax credit for the year.

If you’re missing payments for september there were delays at the irs and now they are fixed. The child tax credit update portal currently lets families see their eligibility, manage their payments and unenroll from the advance monthly payments. They stated that the portal would be updated to allow for these changes in late summer, and by god if summer isn't over yet.but there's been no update that i.

Changes must be made before 11:59 pm et on nov. If something happens that you are unable to get the payments, you can still get the full child tax credit for that child when you file in 2021. You can use it now to view your payment history (including if the money is coming by paper.

13 payment and all subsequent monthly. The online tools are useful for a variety of reasons. Most people who the child tax credit update portal shows as eligible for advance child tax credit payments can update certain information and will be able to update changes to income, dependents.

Those payments are going out today and over the weekend. The child tax credit update portal currently lets families see their eligibility, manage their payments, update their income details and unenroll from the advance monthly payments.

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Child Tax Credit Dates Last Day For December Payments Marca

Child Tax Credit You Can Opt-out Of Monthly Payment Soon Abc10com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update Irs Launches Two Online Portals

Child Tax Credit 2021 What To Do If You Didnt Get A Payment Or Got The Wrong Amount - Cbs News

Child Tax Credit 2021 Who Will Qualify For Up To 1800 Per Child This Year Fox Business

2021 Child Tax Credit Payments Does Your Family Qualify

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca

Child Tax Credit Update November 15 Sign-up Deadline Marca

Monthly Child Tax Credit Payments Begin Arriving For Families July 15 - Kentucky Center For Economic Policy

New Child Tax Credit Explained When Will Monthly Payments Start 9newscom

Irs Child Tax Credit Payments Start July 15

Families Get A 300 Child Tax Credit Increase In Time For Thanksgiving Community News

Child Tax Credit Payments Begin Arriving Today For Almost One Million Kids In State - Abc 36 News

The Child Tax Credit Toolkit The White House

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update Next Payment Coming On November 15 Marca