560, 236 s.w.2d 474 (1951). Fayette county collects, on average, 0.89% of a property's assessed fair market value as property tax.

4200 Nutmeg Dr Lexington Ky 40513 - Realtorcom

Maintaining list of all tangible personal property;

Fayette county lexington ky property tax search. The median property tax in fayette county, kentucky is $1,416 per year for a home worth the median value of $159,200. The fayette county cooperative extension office will see a slight increase of $1 for a $200,000 home, bringing the total average tax bill to $8 for the extension service tax. The fayette county property valuation, located in lexington, kentucky, determines the value of all taxable property in fayette county, ky.

Maintaining list of all tangible personal property collecting… The land records department is responsible for recording legal documents according to the kentucky revised statutes. Find fayette county residential property records including deed records, titles, mortgages, sales, transfers & ownership history, parcel, land, zoning & structural descriptions, valuations, tax assessments & more.

Fayette county, kentucky property valuation administrator page overview the property valuation administrator's office is responsible for: Enjoy the pride of homeownership for less than it costs to rent before it's too late. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents.

Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property. Free fayette county recorder of deeds property records search. Kentucky is ranked 880th of the 3143 counties in the united states, in order of the median.

Certificates of delinquency will be recorded in the fayette county clerk's office on all unpaid property tax bills the day after the final payment deadline for the current tax year. Yearly median tax in fayette county. For information on these bills, please contact the fayette county clerk's office.

Please enclose a check or money order payable to “fayette county sheriff” along with your tax bill coupon. Limestone ste 265 lexington, ky 40507 tel. Public property records provide information on land, homes, and commercial properties in lexington, including titles, property deeds, mortgages, property tax assessment records, and other documents.

You can find all information in detail on the pva’s website. They are maintained by various government offices in fayette county, kentucky. The department of revenue mails a courtesy notice two months prior to expiration showing tax and registration fees due.

Any delinquent property tax owed on any other vehicle may prohibit registration renewal. Free fayette county property tax records search. Some of the documents recorded in our office are mortgages, deeds, wills, marriage licenses, liens, releases and corporate records.

Search for free fayette county, ky property records, including fayette county property tax assessments, deeds & title records, property ownership, building permits, zoning, land records, gis maps, and more. Please do not hesitate to contact our office with any questions or concerns. Please call or visit our website bill search inquiry screen to obtain the amount due.

A total of 119,226 property tax bills with a face value of $389,490,441 are being. To process by mail, send to. Netr online • fayette • fayette public records, search fayette records, fayette property tax, kentucky property search, kentucky assessor.

Our records go back to around 1792, the year kentucky became the fifteenth state. The property valuation administrator's office is responsible for: Fayette county property records are real estate documents that contain information related to real property in fayette county, kentucky.

We are confident that the new system will be a huge improvement and the longer we are on the new software the better our checks and balances will be. If you cannot enclose a tax bill coupon, please write the tax bill number, account number, and property address on your check or money order. From that date on, a search on any bill which does not show a status of paid indicates that the bill may be delinquent.

The test as to sufficiency of description in a deed is whether the land can actually be located therefrom. Find fayette county residential property tax records including land & real property tax assessments & appraisals, tax payments, exemptions, improvements, valuations, deeds, mortgages, titles & more. Of course, a deed, to be valid, must contain a description of the property to be conveyed.

A lexington property records search locates real estate documents related to property in lexington, kentucky. Property assessments performed by the assessor are.

254 Quebec Way Lexington Ky 40515 - Realtorcom

3300 Fall Ct Lexington Ky 40515 - Realtorcom

948 Rockbridge Rd Lexington Ky 40515 - Realtorcom

1687 Traveller Rd Lexington Ky 40504 - Realtorcom

4987 Tynebrae Rd Lexington Ky 40515 - Realtorcom

3 Lansdowne Ests Lexington Ky 40502 - Realtorcom

701 Old Dobbin Rd Lexington Ky 40502 Realtorcom

3761 Kenesaw Dr Lexington Ky 40515 - Realtorcom

621 Severn Way Lexington Ky 40503 Realtorcom

1109 N Limestone Lexington Ky 40505 - Realtorcom

645 Winnie St Lexington Ky 40508 - Realtorcom

3280 Buckhorn Dr Lexington Ky 40515 - Realtorcom

1307 Richmond Rd Lexington Ky 40502 - Realtorcom

1052 The Lane Lexington Ky 40504 - Realtorcom

Lexington-fayette Kentucky Ky Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Lexington Ky Crime Rates And Statistics - Neighborhoodscout

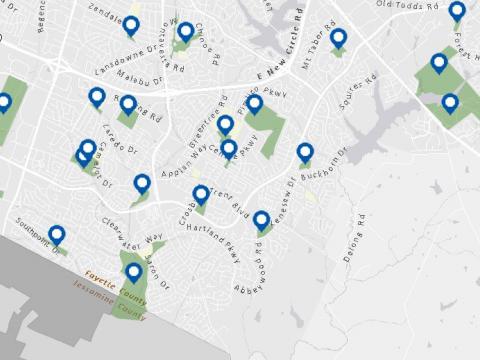

Geographic Information Services City Of Lexington

369 Colony Blvd Lexington Ky 40502 - Realtorcom

Lexington Ky City Property Taxes Wont Go Up Lexington Herald Leader