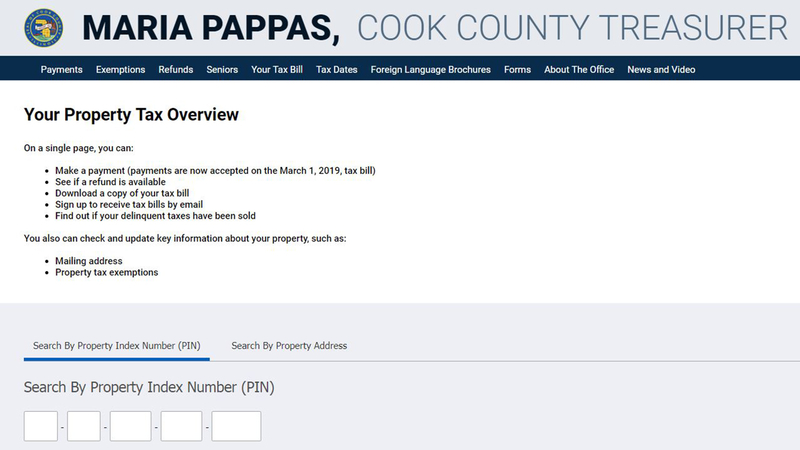

For example, taxes for tax year 2019 are due in 2020. Delinquent property tax search check to see if your taxes are past due.

Nearly 500 Proviso Properties With Roughly 68m In Unpaid Taxes Fees Headed For Tax Sale Village Free Press

Under illinois law, the treasurer's office is required to conduct a scavenger sale every two years.

Cook county treasurer delinquent property taxes. If the taxes remain delinquent, they will be offered for sale at the 2018 annual tax sale, which begins november 5, 2021. In a statement released sept. When delinquent or unpaid taxes are sold by the cook county treasurer's office (at an annual sale or scavenger sale), the clerk's office can provide you with an estimate cost of redemption, detailing the amount necessary to redeem (pay) your taxes and remove the threat of losing your property.

When delinquent or unpaid taxes are sold by the cook county treasurer’s office, the clerk’s office handles the redemption process, which allows taxpayers to redeem, or pay, their taxes to remove the risk of losing their property. Variety of property tax responsibilities. The saginaw county treasurer offers three ways to make your delinquent property tax payment process as convenient as possible:

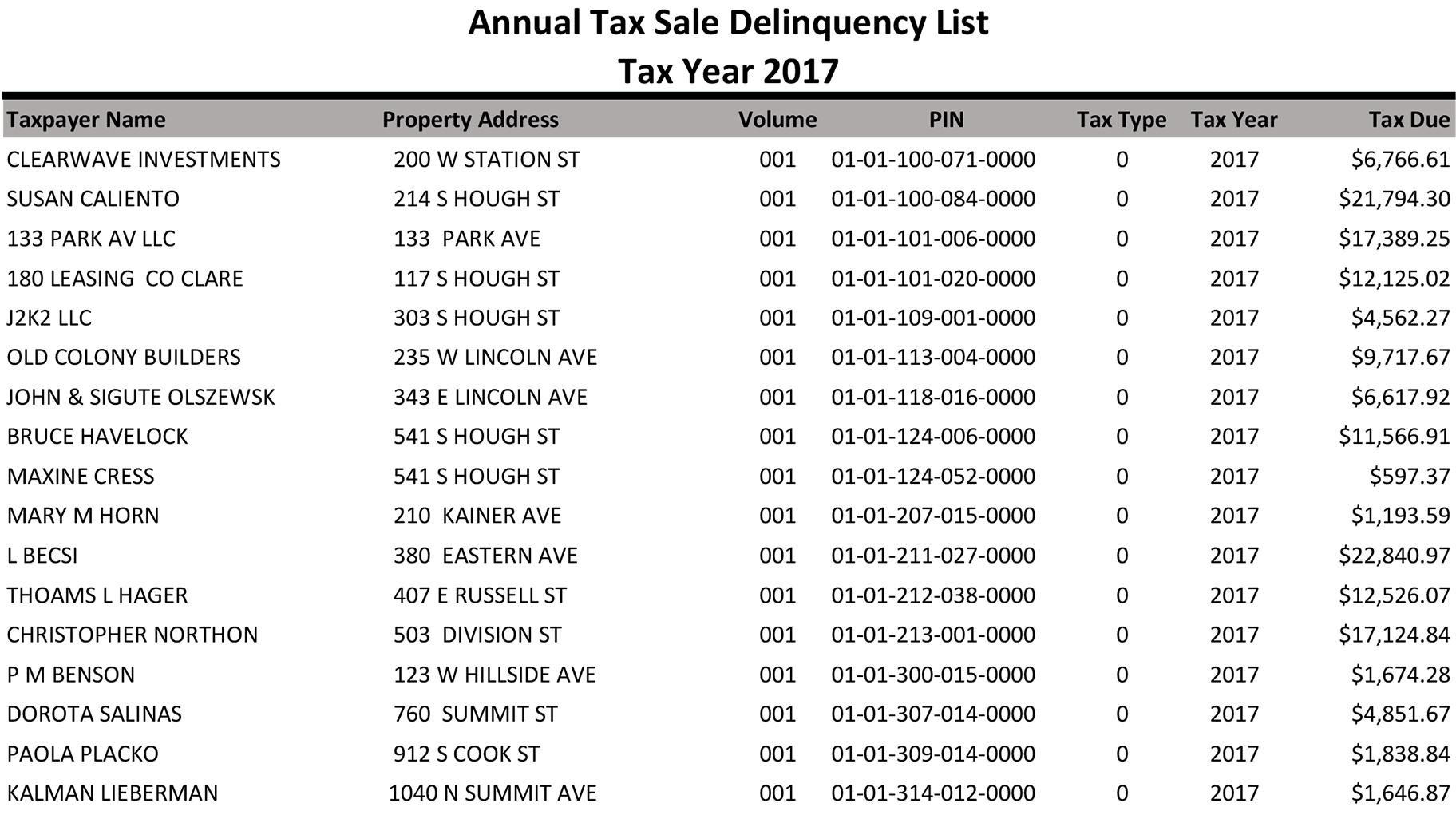

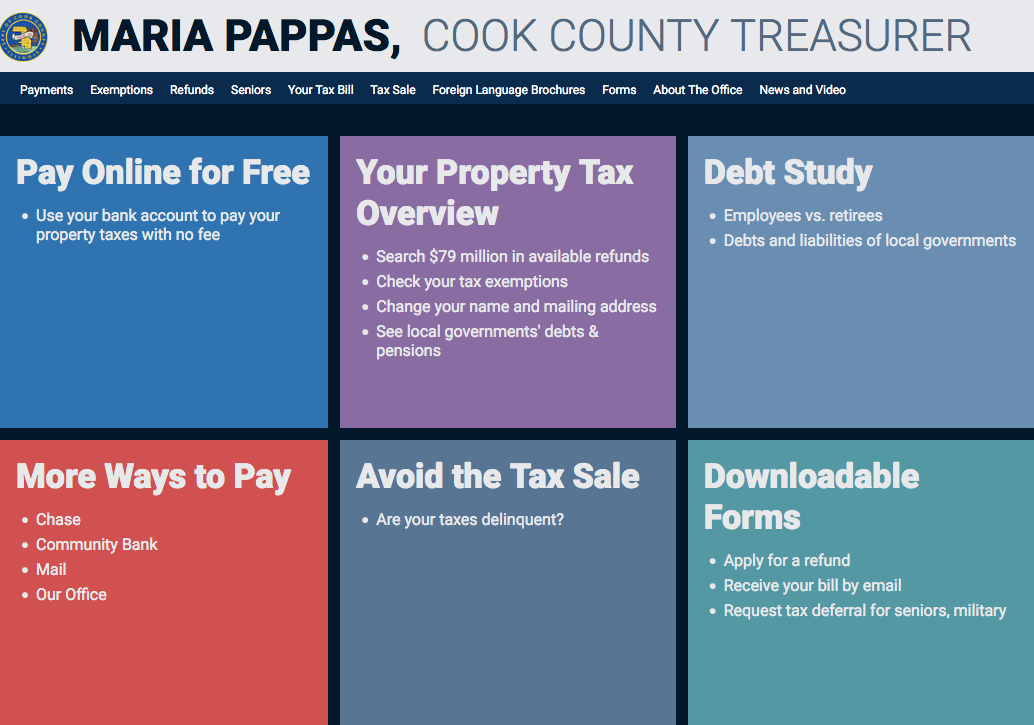

Lists of all the properties, by municipality and chicago ward, are published on cookcountytreasurer.com. About $163.4 million in unpaid 2018 property taxes (that were to be paid in 2019) is due on 36,000 homes, businesses and land in cook county, pappas said. The annual sale includes properties in cook county eligible for sale due to delinquent tax year 2009 property taxes (including, without limitation, general property taxes, back taxes, etc.) and/or delinquent special assessments.

That office generates the bulletins displayed on the tax bill in the area just above the payment coupon. Search for your own property, in addition to family and friends, and share this information with them before the april 3 deadline. Cook county treasurer's office announces 2011 supplemental scavenger sale for delinquent property taxes.

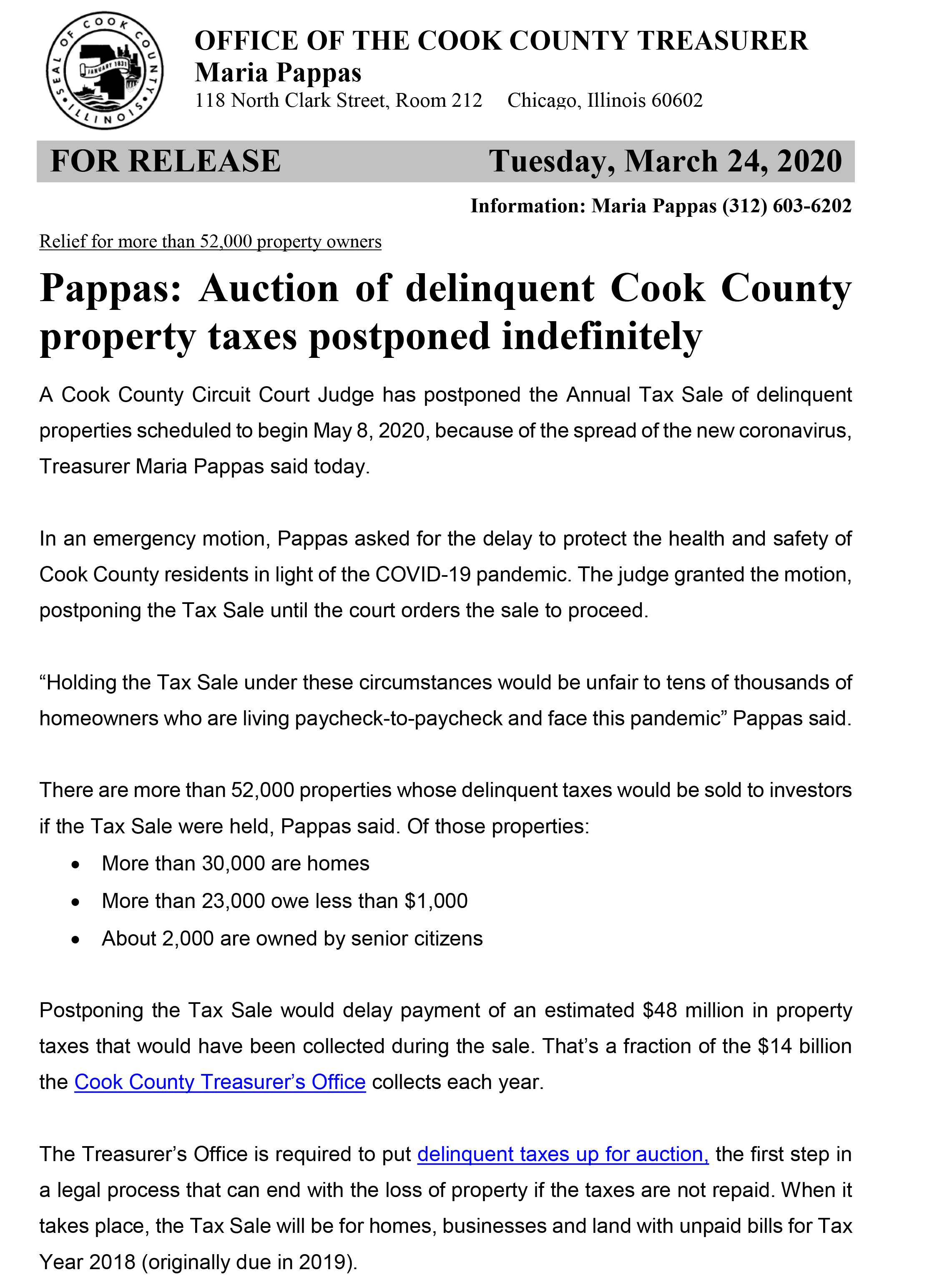

5 — the first in more than two years. The tda is a legal document that initiates the process of the property to be sold at a tax deed sale, conducted by the clerk & comptroller’s office. As a result, approximately 100,000 homeowners will have additional months to pay previously due taxes before the treasurer is mandated to seek a judicial order to sell their property at the yearly tax sale.

Cook county property taxes are collected one year after they are imposed. Records for delinquent taxes for prior years are the responsibility of Chicago (wls) — cook county treasurer maria pappas is planning to conduct the first sale of delinquent property taxes in more than two years on november 5.

Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. About $163.4 million in unpaid. Records for delinquent taxes for prior years (currently defined as tax year 2007 and earlier) are the responsibility of the clerk's office.

Cook county treasurer maria pappas is preparing to conduct the first cook county delinquent property tax sale on nov. If your unpaid taxes have been sold (at an annual tax sale, scavenger sale or over the counter), the clerk's office can provide you with an estimate cost of. When delinquent or unpaid taxes are sold by the cook county treasurer's office, the clerk's office handles the redemption process, which allows taxpayers to redeem, or pay, their taxes to remove the risk of losing their property.

If the property owner fails to pay the delinquent taxes within two years from the date of delinquency, the tax certificate holder may file a tax deed application (tda), per florida statute 197.502. Every year, the cook county treasurer’s office is required to conduct an annual tax sale and biennial scavenger sale of delinquent pins and parcels. There are numerous problems facing the city like crime, school, ethical problems and those “beyond human imagination,” she said, and what matters to cook county.

More than 38,000 homes in cook county could end up being sold because of unpaid property taxes, a large majority in african american communities. Sb 1335 allows the cook county treasurer to delay the yearly tax sale for homeowners who are delinquent on their property taxes. Cash, money order, certified check, personal checks are accepted for first year delinquents up to january 1st., visa, mastercard and discover are accepted

Although scheduled to begin may 8, 2020, a cook county circuit court judge postponed the annual tax sale of delinquent properties because of the coronavirus, per the emergency motion filed by cook county treasurer maria pappas. When delinquent or unpaid taxes are sold by the cook county treasurer’s office, the clerk’s office handles the redemption process, which allows taxpayers to redeem, or pay, their taxes to remove the risk of losing their property. Any unpaid balance due may then be subject to sale to a third party.

Accommodate tax buyers placing bids. The cook county clerk’s office has a variety of property tax responsibilities. The cook county treasurer is.

Delinquent taxes for tax year 2017 and earlier are the jurisdiction of the cook county clerk's office. 13, pappas’s office said that “about $163.4 million in unpaid 2018 property taxes (that were to be paid in 2019) is due on 36,000 homes, businesses and land. Delinquent cook county property tax auctions to be delayed.

The annual sale will be conducted utilizing the services of realauction.com and will Our office has collected every delinquent property and included in the below spreadsheet. Delinquent cook county property taxes totaling $189.6 million on 56,976 properties is scheduled to be auctioned at the annual tax sale that begins may 3, 2019, treasurer maria pappas said today.

Cookcountyclerkilgov

Cook County To Sell Off Tax Delinquent Properties To Highest Bidders Chicago News Wttw

/cdn.vox-cdn.com/uploads/chorus_image/image/63440626/pappasofficeprepaylowres.0.jpg)

Cook County Treasurer Urges Property Owners To Pay Delinquent Taxes - Chicago Sun-times

Delinquent Tax Deadline Looms For 45k Property Owners In Cook County Chicago News Wttw

Cook County Delinquent Property Taxes Highest In 4 Years Crains Chicago Business

Annual Cook County Tax Sale Postponed Indefinitely City Of Blue Island

Thousands Of Languishing Vacant And Abandoned Properties With Unpaid Taxes Harm Black Neighborhoods And Suburbs Cook County Treasurer Says Program Aimed At Fixing The Problem Is Not Working - Chicago Tribune

Cook County Will Hold First Tax Sale In Two Years In November

2021 Property Tax Bill Assistance Cook County Assessors Office

Cook County Property Tax Sale To Be Held In November Treasurer Maria Pappas Announces - Abc7 Chicago

Cook County Property Owner Tax Bill Payments Extended Until October 1st West Suburban Journal

Cook County 2018 Property Tax Bills Online Now - Abc7 Chicago

I Gotta Get Outta Here Cook County Treasurers Further Comments On Spike In Delinquent Property Tax Bills Wirepoints Wirepoints

Senator Jacqueline Y Collins - Time Is Running Out To Pay Off Delinquent Property Taxes In Cook County Before These Accounts Go To Auction May 3 Nearly Half Of The 45000 Delinquent

Thousands Of Languishing Vacant And Abandoned Properties With Unpaid Taxes Harm Black Neighborhoods And Suburbs Cook County Treasurer Says Program Aimed At Fixing The Problem Is Not Working - Chicago Tribune

/cdn.vox-cdn.com/uploads/chorus_image/image/63506344/img_2438.0.jpg)

Cook County Alerting Investors Delinquent Property Taxpayers Of Coming Tax Sale - Chicago Sun-times

Ald Carlos Ramirez-rosa On Twitter A Judge Has Granted Cookcounty Treasurer Maria Pappas Emergency Motion To Delay The Annual Property Tax Sale Under State Law The Treasurers Office Is Required To

The Cook County Treasurers Office - Jaime Andrade State Representative 40th District Facebook

Pappas Auction Of Delinquent Cook County Property Taxes Postponed Indefinitely Alderman Tom Tunney 44th Ward Chicago