San francisco expects to raise $250 million annually from a recent gross receipts tax increase, imposed on just 400 firms. Therefore, for 2018, both payroll expense tax and grt are payable by san francisco businesses.

2

San francisco (in california) has a gross receipts tax on businesses with more than $1,170,000 in combined taxable san francisco gross receipts or more than $320,000 in taxable san francisco payroll expenses.

San francisco gross receipts tax apportionment. Learn how to reduce your tax bill. We can also identify appropriate tax treatment that is consistent with good business practices and states’ applicable tax laws and rules. San francisco payroll (see instructions) e2.

Determining the gross receipts tax. Total payroll (see instructions) e1. All persons interested in the matter of proposition c on the november 6, 2018 san francisco ballot, authorizing an increase in specified business taxes to fund specified homeless services in san francisco, and all matters and proceedings related thereto) has the effect of invalidating the homelessness gross receipts tax in article 28 of the business and tax regulations code,.

Exemptions & exclusions from gross receipts tax. San francisco expects to raise $250 million annually from a recent gross receipts tax increase, imposed on just 400 firms. Gross receipts payroll apportionment e2.

Exempted from the grt are small businesses with less than $1,000,000 in san francisco gross receipts.[10] this number is adjusted annually for inflation, putting the. San francisco’s gross receipts tax (grt) is calculated based on individual employees’ time spent in sf. Taxpayers deriving gross receipts from business activities both within and outside san francisco must generally allocate and/or apportion gross receipts to san francisco using rules set forth in business and tax regulations code sections 956.1 and 956.2.

In an effort to eliminate this perceived tax disincentive, in november 2012 san francisco voters passed proposition e (“prop e”), enacting the gross receipts tax, which went into effect on january 1, 2014. San francisco’s new gross receipts tax effective january 1, 2014 last november, san francisco voters passed proposition e, the gross receipts tax and business registration fees ordinance (“gross receipts tax”). 1, mandatory combined reporting for payroll expense tax

Pwc’s state and local tax (salt) practice can help you with strategies to manage your state and local tax issues by recommending solutions that are consistent with your company’s overall business objectives. If you are engaged in multiple business activities complete a worksheet for each business activity to calculate your san francisco gross receipts. If your business activities are wholly within san francisco, you are not eligible to allocate or apportion gross receipts.

50% less time in the city may mean a 50% reduction in tax owed. Businesses that use the “technology” code must apportion receipts to san francisco based on the location of the business’s customers, which often results in apportionment of less than 100 percent. In addition to transitioning from a payroll expense tax to a gross receipts tax, prop e also shifts the city’s business registration fee to be measured by gross.

The changes go into effect on january 1, 2014, but it is important to be aware of the new tax and how it will affect your business. On november 26, 2013, the san francisco board of supervisors approved amendments to the san francisco business and tax regulations code (“code”), providing for penalty relief for delinquent gross receipts tax (“grt”) installment payments. Apportionment for this section is 50% real, personal, tangible and intangible property and 50% based on payroll (section 953.5(c)) san francisco gross receipts may be reduced by amounts paid in the tax year to a subcontractor possessing a valid business registration certificate with the city to the extent those amounts were included in the amount your business allocated to the.

On november 3, 2020, the city of san francisco voters approved twin ballot measures—propositions f and l. Effective in 2021, proposition f 1 (1) repeals the 0.38 percent payroll expense tax, (2) increases the gross receipts tax rates across industries as well as increasing the annual registration fees for certain taxpayers, (3) decreases the annual. Note that san francisco payroll and total payroll in lines a20 and a21 are for all business activities.

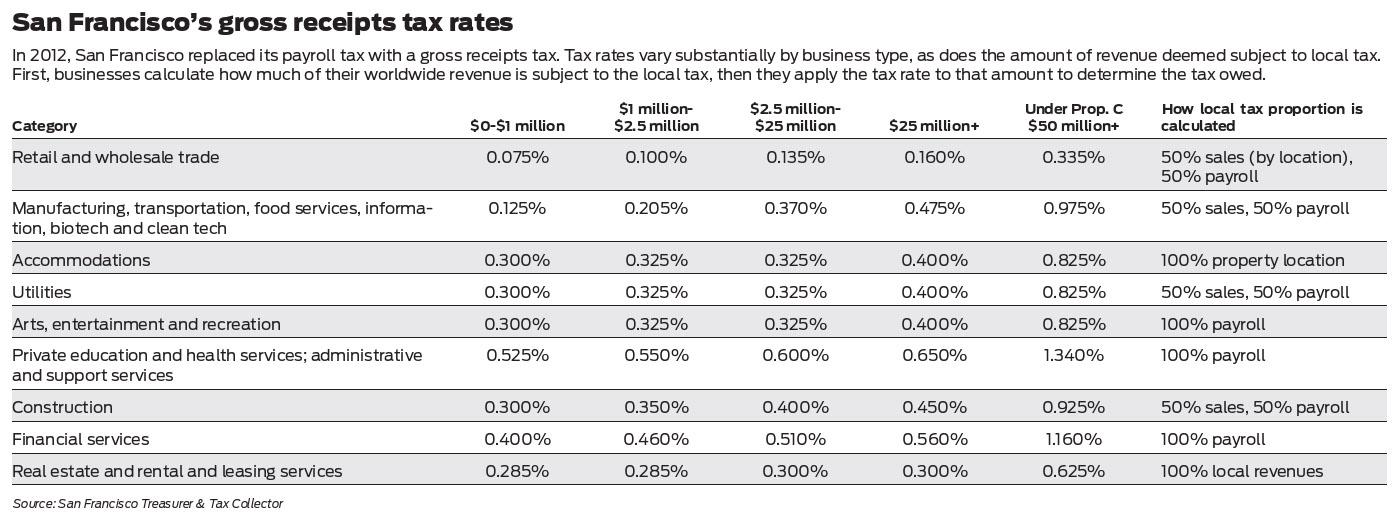

The rate of the grt is dependent upon the type of business activities and the amount of gross receipts. 5 businesses conducting business both within and outside san francisco must apportion their gross receipts to determine gross. All persons deriving gross receipts from business activities both within and outside the city shall allocate and/or apportion their gross receipts to the city, using the rules set forth in section 956.1 and 956.2, in the manner directed in sections 953.1.

The ordinance replaces the existing payroll expense tax on the privilege of doing business in san francisco with a tax that is based on gross receipts from business conducted within the city. The gross receipts tax and business registration fees ordinance, or simply “ordinance,” was approved by san francisco voters on november 6, 2012. Consideration should be given as to whether a filing obligation exists and how payroll expenses and gross receipts should be apportioned to the city.

1, 2014, and ending with 100 percent gross receipts tax for tax year 2018. The rules surrounding the san francisco payroll expense and gross receipts taxes, as well as the city’s new economic nexus standard, are unique and complex. It determines for san francisco tax purposes that a “technology” naics code is most appropriate.

San Francisco Gross Receipts Tax

Which States Have A Gross Receipts Tax Tax Foundation

Annual Business Tax Returns 2020 Treasurer Tax Collector

Joshua Browder On Twitter Just Heard Back From The San Francisco Tax Office According To Them They Consider 100 Of Your Revenue To Be In San Francisco For The New Gross Receipts

Sfelectionssfgovorg

Annual Business Tax Return Treasurer Tax Collector

2

San Francisco Passes Proposition C To Increase Gross Receipts Tax On Commercial Landlords - The Registry

Prop C Would Raise Sfs Gross Receipts Tax Heres What That Means

2

Annual Business Tax Return Treasurer Tax Collector

San Francisco Gross Receipts Tax Clarification

Gross Receipts Tax And Business Registration Fees Ordinance Ppt Download

Annual Business Tax Returns 2020 Treasurer Tax Collector

2

The Purpose Of The Sales Factor Is To Reflect Market Sales To The State Where Those Sales Are Made - Pdf Free Download

Annual Business Tax Returns 2019 Treasurer Tax Collector

Chapter 6 Value Added Tax A Major Replacement Alternative - Pdf Free Download

Prop C Would Raise Sfs Gross Receipts Tax Heres What That Means