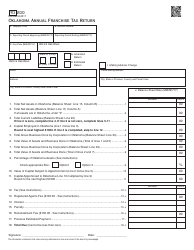

In oklahoma, the maximum amount of franchise tax a corporation can pay is $20,000. The oklahoma corporate income tax rate is 6%.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

• complete the applicable income tax schedules on pages 3, 4 and 5.

Oklahoma franchise tax return form. The maximum amount of franchise tax that a corporation may pay is $20,000.00. Oklahoma tax commission income tax p.o. Suspension and reinstatement (a) filing.

If you haven’t made one yet, you can, through google or facebook. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended, do not qualify to file a combined income and franchise tax return. When a corporation’s franchise tax.

Corporations that remitted the maximum amount of franchise tax for The remittance of estimated franchise tax must be made on a tentative (estimated) franchise tax return (form 200). The tax rate is $1.25 for each $1,000 of capital invested or used in oklahoma.

Corporations required to file a franchise tax return, may elect to file a combined corporate income and franchise tax return. 2020 oklahoma resident individual income tax forms and instructions. Oklahoma annual franchise tax return.

(mm/dd/yy) this page contains the balance sheet which completes form 200: Oklahoma annual franchise tax return (form 200). Time and place for filing corporate returns shall be due no later than 30 days after

Add the pdf you want to work with using your camera or cloud storage by clicking on the +symbol. The oklahoma individual income tax rates range from 0.5% to 5.25%. Required on forms filed with the oklahoma tax commission pursuant to title 68 of the oklahoma statutes and regulations thereunder, for identification purposes, and are deemed to be part of the confidential files and records of the oklahoma tax commission.

Ad access any form you need. Mailing instructions please mail your completed return, officer information and payment to oklahoma tax commission. The franchise tax is calculated at a rate of $1.25 per $1,000 of capital employed in or apportioned to the business's outpost in oklahoma.

How is franchise tax calculated? • franchise tax computation the basis for computing oklahoma franchise tax is the balance sheet as shown by your books of account at the close of the last preceding (from income tax return) (from income tax return) (lines:

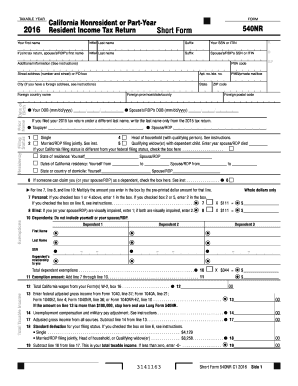

The franchise tax is calculated at the rate of $1.25 for each $1,000.00 of capital employed in or apportioned to oklahoma. Oklahoma resident income tax return • form 511: Log in to your signnow account.

Sales tax relief credit form • instructions for the direct deposit option • 2020 income tax tables. You may file this form online or download it at tax.ok.gov. All corporations that do business in oklahoma must file the franchise tax.

Complete, edit or print your forms instantly. Only those corporations with capital of $201,000.00 or more are required to remit the franchise tax. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended, do not qualify to file a combined income and franchise tax return.

• instructions for completing the form 511: Once an election is made, it is binding until a corporation submits a request to the otc to. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax return.

You may file this form online or download it at www.tax.ok.gov. Eligible entities are required to annually remit the franchise tax. The franchise tax applies solely to corporations with capital of $201,000 or more.

On or before july 1, 2014, each corporation, regardless of its prior filing status, must file either a franchise tax return or an election to use the corporation's income tax return due date as the due date for payment and filing of the corporation's franchise tax return. • complete sections one and three on pages 1 and 2. On the oklahoma tax commission website, go to the business forms page.

The franchise tax return is due july 1. Download or email fillable forms, try for free now!

Godzilla - Monsters Inc By Roflo-felorezdeviantartcom On Deviantart Godzilla Funny Godzilla Godzilla Franchise

2

Form 540 - Fill Online Printable Fillable Blank Pdffiller

Oklahomagov

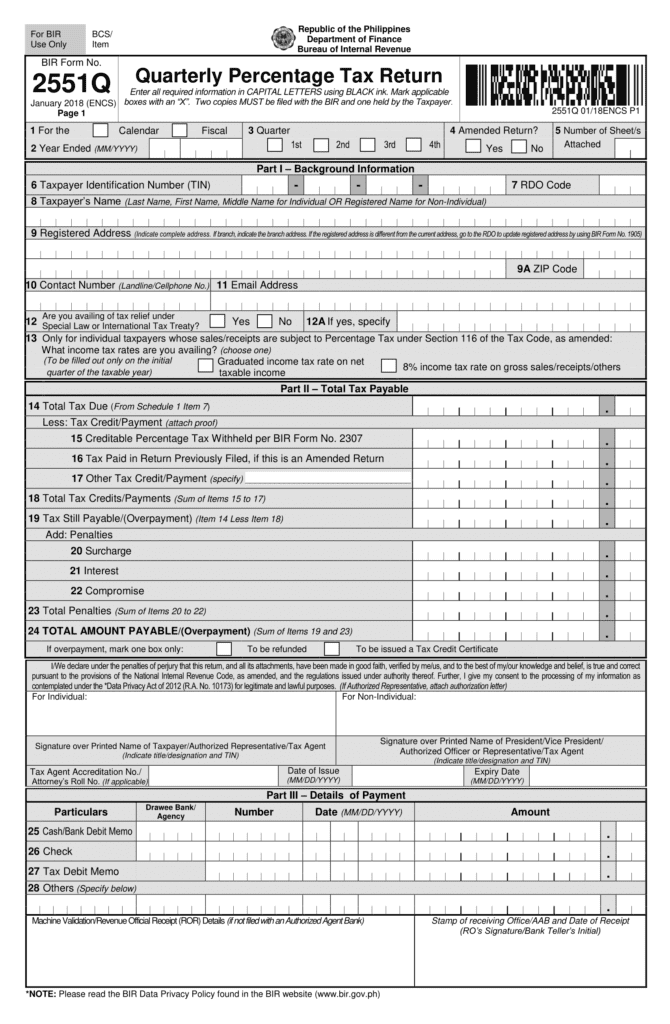

Complete Guide To Quarterly Percentage Tax Bir Form 2551q

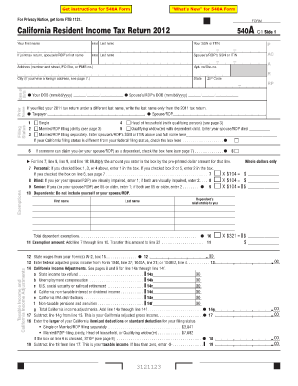

2012-2021 Form Ca Ftb 540a Fill Online Printable Fillable Blank - Pdffiller

California Tax Forms 2020 Printable State Ca 540 Form And Ca 540 Instructions

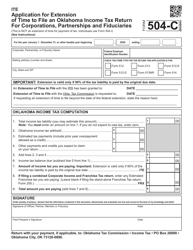

Form 504-c Download Fillable Pdf Or Fill Online Application For Extension Of Time To File An Oklahoma Income Tax Return For Corporations Partnerships And Fiduciaries - 2020 Oklahoma Templateroller

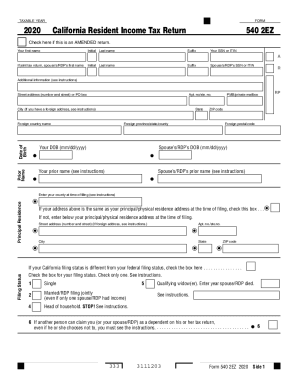

Form 540 2ez - Fill Out And Sign Printable Pdf Template Signnow

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Tax Return 2016 - Fill Out And Sign Printable Pdf Template Signnow

/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)

Form 990 Return Of Organization Exempt From Income Tax Definition

Corporate Tax In The United States - Wikiwand

California Tax Forms Hr Block

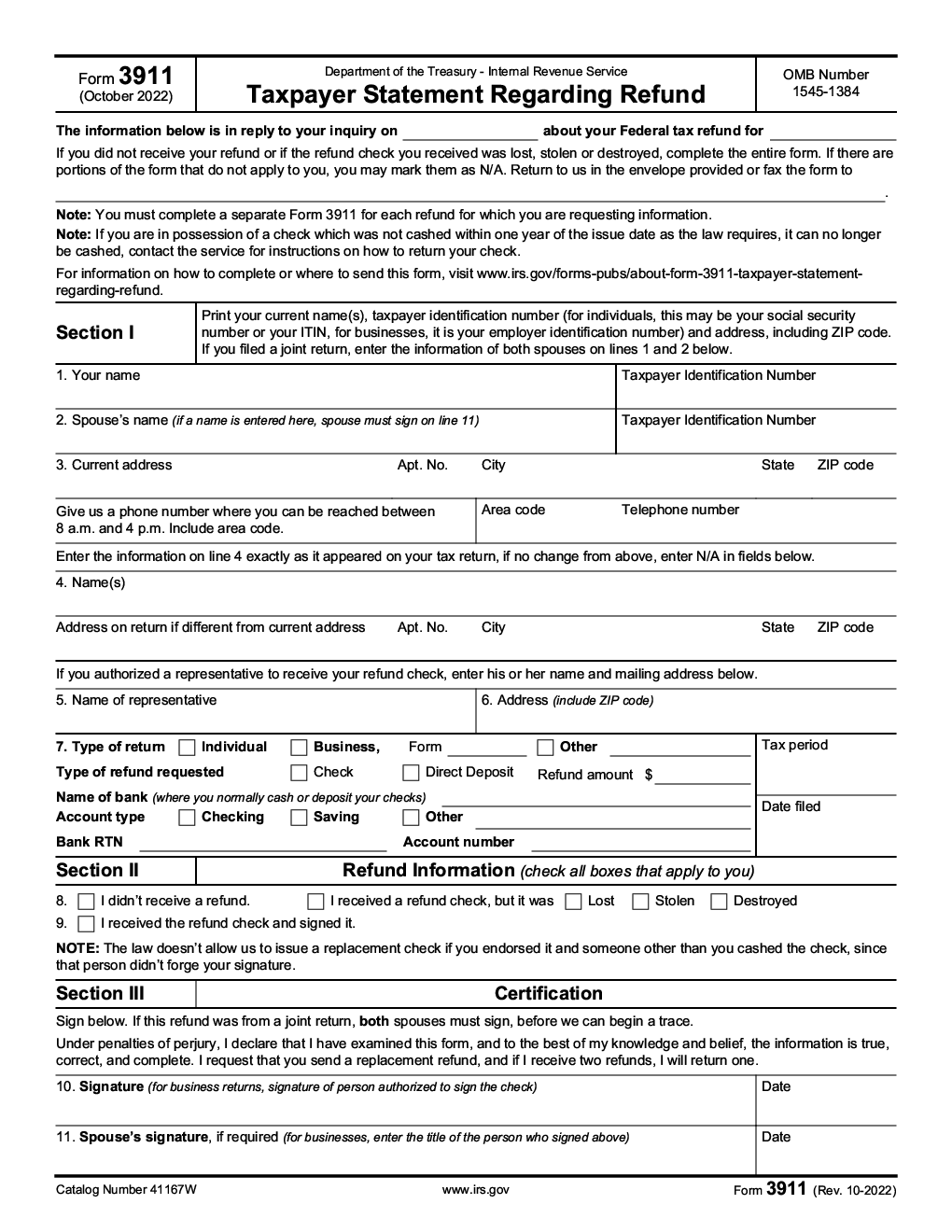

Irs 3911 Form Blankerorg

2015 Nc State Tax Forms And Instructions

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K-1 Beneficiarys Share Of Income Deductions Credits Etc Definition

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog