Remove vat from a figure. Multiply the price/figure by 1.

![]()

Uktaxcalculatorscouk - Terms And Conditions And Site Disclaimer Uk Tax Calculators

Add 1 to the percentage expressed as a decimal.

Reverse tax calculator uk. Only 3 easy steps for vat calculation: Uk income tax calculator shows your take home pay and paye owed to hmrc. Just enter your salary into our uk tax calculator.

So, if contributing 5 percent, enter '5%'. If contribution £50, enter '50'. For example, if a tip 6 percent was added to the bill to make it $115, work out 15 ÷ 100 = 0.15.

How to calculate taxes for residents of the united kingdom (vat) in 2021 For example, the uk vat rate is 20%, which means you would do price/figure x 1.2. Calculate the amount of vat by choosing the rate that suits you and apply the following formula amount excluding vat x (vat rates/100).

Adding vat to £1.00 is £1.20, add 20%. Rerverse calculator of the vat in uk 20%, 5% or 0% free reverse calculator of vat in united kingdom in 2021 If you buy services subject to the reverse charge, you must enter the vat charged as output tax on your vat return.

Following is the reverse sales tax formula on how to calculate reverse tax. If this service was worth £100, the amount of the reverse charge would be £20, or £100 x 20%. Check when you must use the.

The calculator will automatically adjust and calculate any pension tax reliefs applicable. Enter the net or gross sum. This reduction applies irrespective of age.

Formulas to calculate the united kingdom vat. Work out the vat on a price or figure. Our uk tax calculator checks the tax you pay & your net wage.

Make sure you do not enter the net value of the purchase as a net sale. Freeagent automatically calculates and adds the reverse charge to your vat return. Vat calculator preset to uk rates.

Calculate the vat inclusive portion of a price for a product or service. You can work out vat in two ways by removing / reversing vat or adding / including vat. When you're done, click on the calculate! button, and the table on the right will display the information you requested from the tax calculator.

We are so committed to providing online calculators to calculate answers to anything imaginable that if you don’t see a. Click remove vat to deduct vat from figure or add vat to calculate amount with vat. Unlike our salary calculator, where your salary calculation results are updated in one shot, here you just need to enter, or slide the top gross income stick, and.

It uniquely allows you to specify any combination of inputs when trying to figure out what your gross income needs to be for the desired net income. More information about the calculations performed is available on the about page. The reverse tax calculator calculate net earnings to gross earnings.

For example, £100 is the price x 1.2 = £120 which is. Income tax calculator is quick and easy to use. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim.

Type in your gross amount and we will automatically remove the vat at the standard rate of 20%. The net amount is the gross amount minus the vat amount removed. This is based on income tax, national insurance and student loan information from april 2021.

You'll be able to see the gross salary, taxable amount, tax, national insurance and student loan repayments on annual, monthly, weekly and daily bases. The calculator takes into account medicare levy and the low income tax rebate, but does not take into account other rebates such as the family tax benefits & social security rebates. How to calculate reverse tip percentage.

The amount of tax (including vat) is the addition of the amount excluding vat + vat amount. The vat amount removed line shows how much vat has been removed from the gross amount. Find out about the domestic reverse charge for supplies of building and construction services from 1 march 2021.

Wanna calculate your net worth at 3 in the morning, or calculate your one rep weight lifting max after your afternoon workout, or even calculate how much tile you need before starting your weekend bathroom remodeling project?. Divide the percentage added to the original by 100. Read more in our guide to charging and reclaiming vat.

This is the most advanced income tax calculator providing a visual breakdown of how your salary is broken up for tax and other deduction purposes.

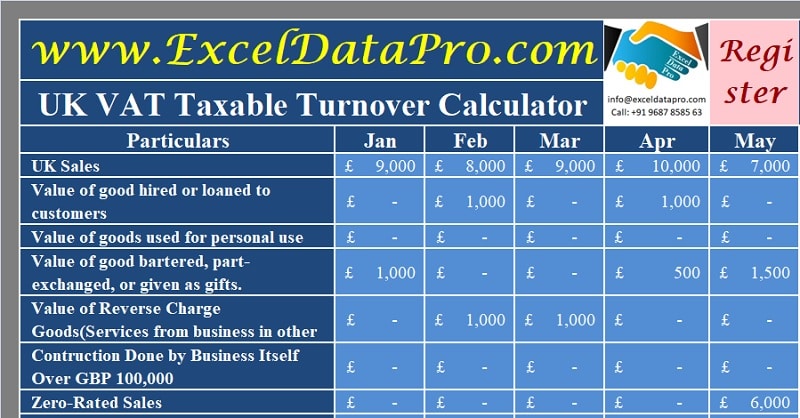

Download Uk Vat Taxable Turnover Calculator Excel Template - Exceldatapro

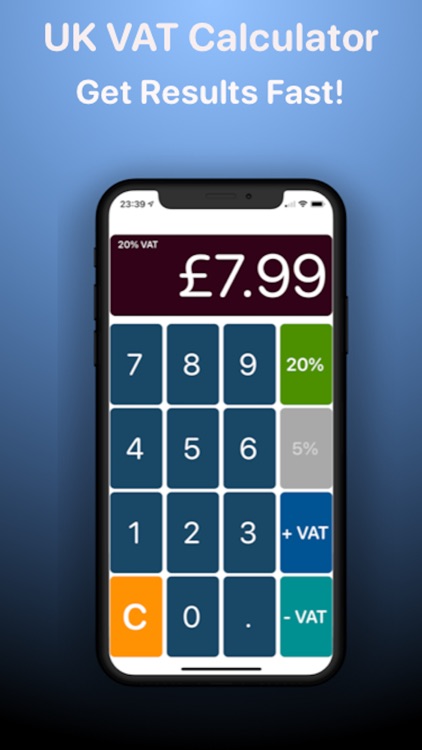

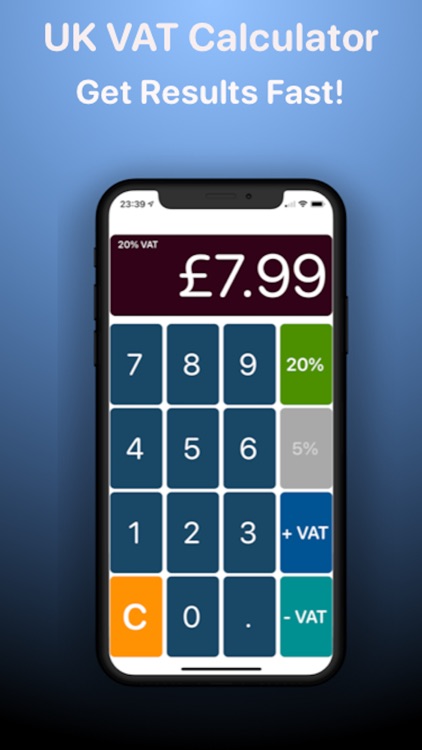

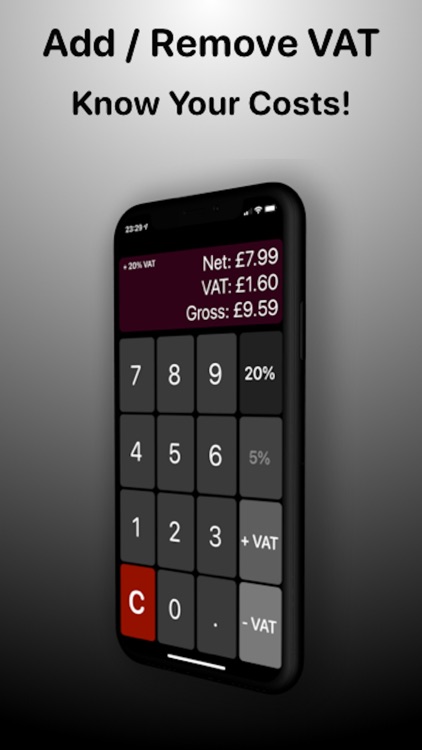

Vat Calculator Uk Sale Tax By D App Online Ltd

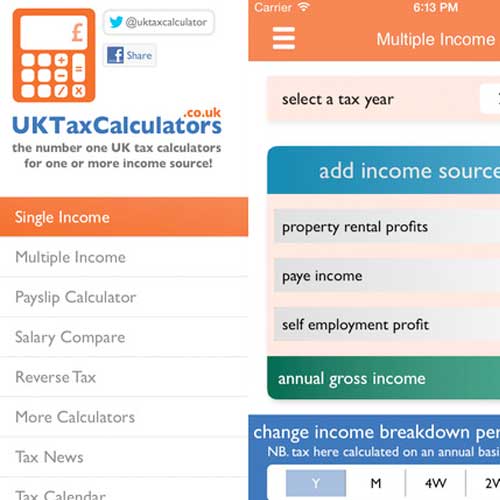

Personal Tax Uk Tax Calculators

Austrian Vat Calculator - Vatcalculatoreu

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

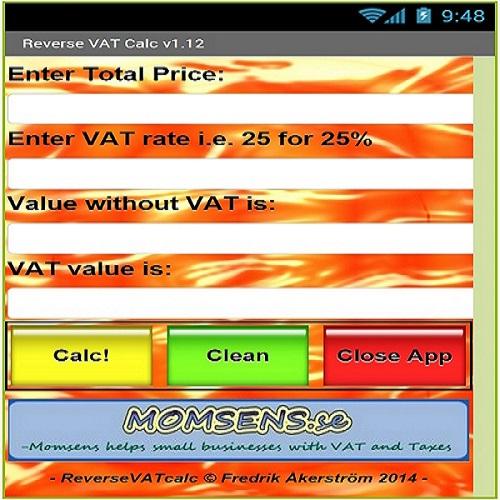

Backward Vat Calculator - Accounting Finance Blog

Indian Gst Calculator - Gstcalculatornet

Benefit In Kind Tax Calculator Uk Tax Calculators

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

Vat Calculator 2021 - Add Or Remove Value Added Tax Online

Our Guide To The Domestic Reverse Charge Aston Shaw

Uk Tax Calculators Apps On Google Play

Vat Calculator Uk Sale Tax By D App Online Ltd

Vat Calculator Uk Online - Calculate Value Added Tax Instantly

Vat Calculator Uk Sale Tax By D App Online Ltd

Alberta Gst Calculator - Gstcalculatorca

Vat Calculator Uk Sale Tax By D App Online Ltd

2016-17 Tax Calculator App Update Now Available Free In The App Store Uk Tax Calculators

Tax On Bonus - How Much Do You Take Home Uk Tax Calculators