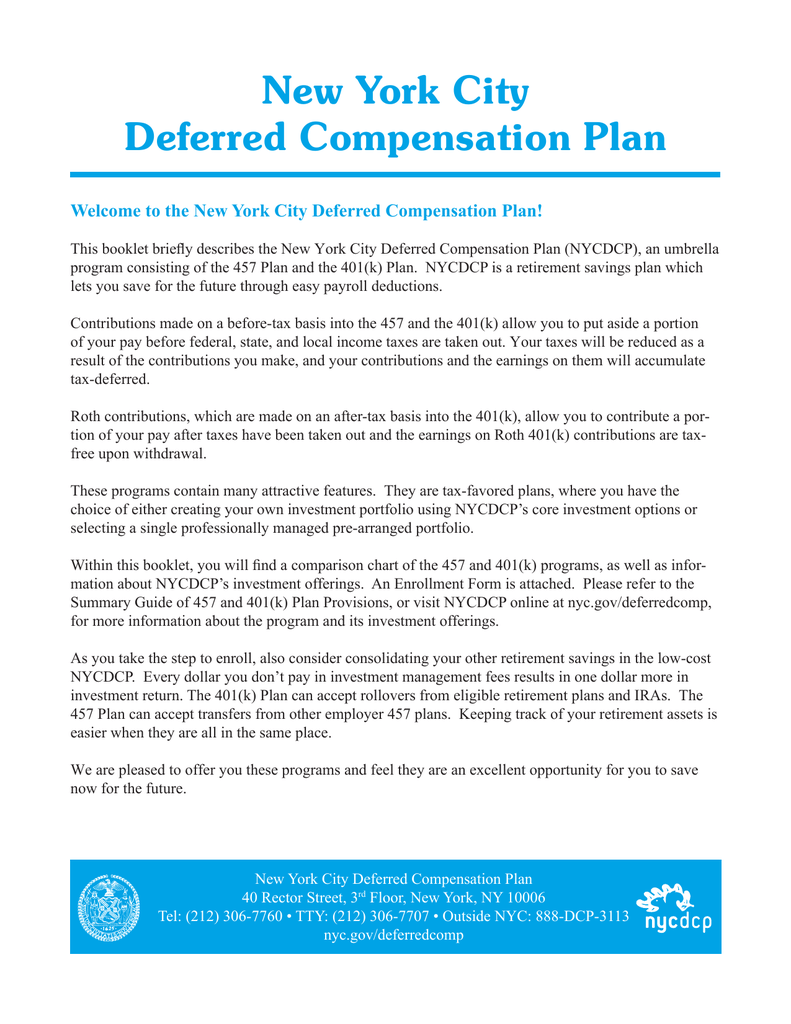

However, distributions are still taxed as ordinary income. Please note that state taxes are entered in a separate entry field.

/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)

Estimating Taxes In Retirement

Answer id 610 updated 12/03/2019 08:53 am.

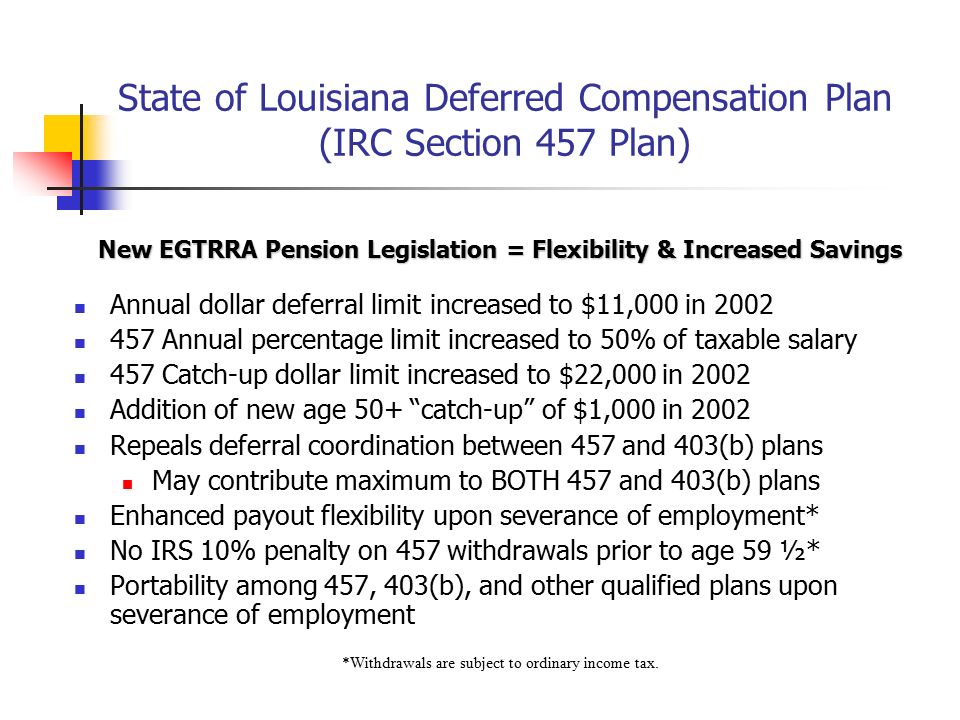

How much state tax do you pay on a 457 withdrawal. Funds taken from a retirement plan after you have reached retirement age.; For example, your retirement income is taxable at the 0.587 percent rate when you make up to $5,050, as of 2011. In contrast, qualified plans are developed for the rank and file as well as for highly compensated employees.

5 457(b) distribution request form 1 page 3 federal tax law requires that most distributions from governmental 457(b) plans that are not directly rolled over to an ira or other eligible retirement plan be subject to federal income tax withholding at the rate of 20%. The tax penalty for an early withdrawal from a retirement plan is equal to 10% of the amount that is included in your income. 8 if employer 457 matching contributions are made to a 401(a) defined contribution plan,

If you withdraw $10,000 from your 401 (k) over the course of the year, you will only pay income taxes on that $10,000. For example, if you fall in the 12% tax bracket rate, you can expect to pay up to 22% in taxes, including a 10% early withdrawal penalty if you are below 59 ½. State income tax withholding is mandatory at a rate of 7.75% if the recipient is a maryland resident and the payment is subject to 20% federal withholding.

If you made contributions that were subject to income taxes, you may not owe taxes on the entire withdrawal. Use this calculator to see what your net withdrawal would be after taxes are taken into account. If your tax withholdings and/or estimated tax payments are not enough

If you have a 457(b), you can withdraw funds from the account without facing an early withdrawal penalty. Your estimated federal tax rate. Pension or annuity payments that are paid regularly (weekly, monthly, or.

Beneficiary distributions avoid the early withdrawal penalty of 10 percent, regardless of the age of the beneficiary. The internal revenue service has the same contribution limits to a 457. What is a 457 plan?

If you have a 457 plan and you die, your beneficiary can take distributions from the plan immediately. If you are unsure, the calculator will choose 25%. You may request to have withholding to states other than where you reside or if you reside outside of maryland.

Income tax withholding on most withdrawals. However, if you make between $5,050 and $10,100, ohio assesses you $29.64 plus 1.174 percent for all. By changing any value in the following form fields, calculated values are immediately provided for displayed output.

There is no penalty for an early withdrawal, but be prepared to pay income tax on any money you withdraw from a 457 plan (at any age). The answer is yes, you will need to pay federal and state tax. How much tax do you pay on a 457 withdrawal?

Are distributions from a state deferred (section 457) compensation plan taxable by new york state? When you make a withdrawal from a 401(k) account, the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made. Sure enough, you’ll pay taxes on your withdrawals, but you won’t be subject to the 10 percent penalty as 457 plans don’t follow erisa rules.

The amount you wish to withdraw from your qualified retirement plan. Withdrawing money from a qualified retirement account, such as a 457 plan, can create a sizable tax obligation. Can your roll a 457 plan into an ira?

Other than these, many of the things that make a 401(k) apply to 457s, such as the contribution limits. Beneficiaries can avoid taxation by rolling over the 457 distribution to a qualified retirement. It is possible to withdraw your entire account in one lump sum, though this will likely push you into a higher tax bracket for the year, so it’s smart to take distributions more gradually.

However, distributions received after the pensioner turned 59 1/2 would qualify for the private pension and annuity income exclusion of up to $20,000. Withdrawals are subject to income tax. Use the ‘filing status and federal income tax rates’ table to assist you in estimating your federal tax rate.

You must pay this penalty in addition to regular income tax. There is no way to give you an exact answer (i would need to see the entire tax return) but the tax will be about 25% of the withdrawal amount, about $38,000 on a withdrawal of $150,000. But if you’ve been saving in a 403(b), you’ll take a 10% penalty surtax on any distributions you take before you hit age 59.5.

The more money you make, the more ohio taxes you. Mandatory 20% federal income tax withholding on the payment. Contributions to the 457 plan reduce the 457 deferral limits when those contributions vest and are subject to any applicable fica taxes.

State income tax withholding may also apply. Just like other retirement plans, you do need to start taking distributions from your 457 plan by the age of 70 and a half years old. Complete section 2 of the 457 basic withdrawal form.

You can withdraw your money from 457 before age 59½ without a 10% penalty, unlike a 401(k), but you will owe taxes on any withdrawal.

Ufadbaorg

State Of Louisiana Deferred Compensation Plan Irc Section 457 Plan New Egtrra Pension Legislation Flexibility Increased Savings Annual Dollar Deferral - Ppt Download

457 Plan Withdrawal

457 Plan Withdrawal Calculator

How A 457 Plan Works After Retirement

Fdlwigov

Resourcesfinalsitenet

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

2022 401k Contribution Limits Rules And More

Fascorecom

Usrbcwealthmanagementcom

Btuorg

Michigan State Tax 401k Withdrawal

Tiaaorg

Ursorg

Lasersonlineorg

Brooklinemagov

New York City Deferred Compensation Plan

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

2022 401k Contribution Limits Rules And More

How To Access Retirement Funds Early