Businesses may register for employer withholding accounts from the department of Register with the department of labor in each state where you have employees to obtain your state tax id number so that you can remit taxes.

How To Calculate Payroll Taxes Payroll Taxes Payroll Bookkeeping Business

They must then estimate their total.

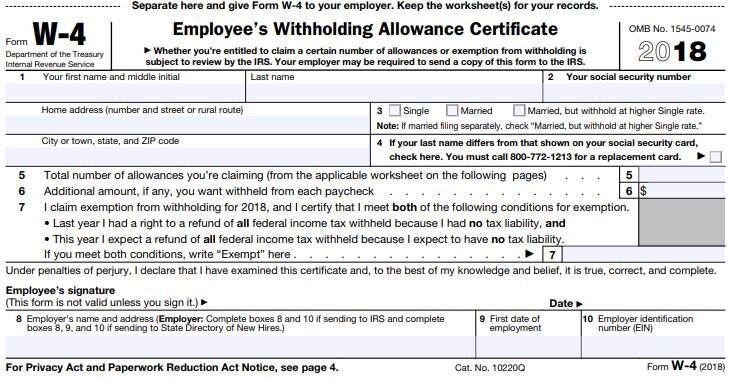

How do i get my employer to withhold more tax. The employee is responsible for any tax due that was not paid through withholding when he files his ohio sd 100, school district income tax. Learn what wages are subject to state income tax withholding (these wages may be different from federal regulations). This form lets you calibrate how much is taken out of your paycheck each pay period.

Categories federal tax withholding tables tags can employer withhold more tax, can i ask my employer to withhold more tax, employer tax withholding 2021, employer tax withholding tables 2021, how do i get my employer to withhold more tax, how much tax do i withhold from my employee, payroll tax withholding calculator 2021 It is required for any business with employees and most other businesses. Your employer is required to withhold federal income taxes (and state income taxes in most states) under federal and state laws.

This gives the employer an idea about how much amount of tax to withhold from the employee’s paycheck. Learn more about how we make money.last edited march 4, 2020. If the taxes withheld monthly are too low, you’ll have to pay the difference back in april.

If you are an alabama employer with alabama residents working outside the state of alabama, you will need to withhold alabama income tax on those residents unless you are withholding tax for the state in which the employee is working in. How can i obtain an employer withholding account number? No, this is not an option.

Obtain a state employer tax permit which in some states is the equivalent of a state ein. This usually happens only in special circumstances where your employee can show that the withholding rate will result in them having more tax withheld than is required to cover the total tax they will need to pay in the year. However, if there are unpaid social security or medicare taxes on tips by the 10th of the month after the month employees reported the tips, you do not have to collect the taxes.

Register your business with the secretary of state where your employee works. You will withhold any unpaid income taxes from employees’ paychecks, up to the end of the year. It is a bit odd that 0 exemptions produced no withholding, but it may be that you are in a state that has a high income threshold for taxation.

Mark the uncollected amount as an adjustment on your form 941. When you make payments to employees, certain contractors and other businesses, you need to withhold an amount from the payment and send it to the australian taxation office (ato). Employer identification number online at www.irs.gov.

Categories federal withholding tables tags can employer withhold more tax, can i ask my employer to withhold more tax, employer tax withholding 2021, employer tax withholding tables 2021, how do i get my employer to withhold more tax, how much tax do i withhold from my employee, payroll tax withholding calculator 2021 leave a comment Hire a registered agent in that. The ein is similar to a social security number for a business.

An employer required to withhold pa personal income tax must first obtain an ein from the irs, then register with the department of revenue. The employer is required to start withholding school district tax when notified by the employee submitting the form ohio it 4. Adjusting your paycheck tax withholding to keep more money in your bank account.

This is called payg withholding, and works to prevent workers from having a large amount of tax to pay at the end of the financial year. Make an additional or estimated tax payment to. Your payee must get our approval to reduce the amount you would normally withhold by completing a payg withholding variation application.

If you are an employer with employees working in the state of alabama, you will need to register with the department of revenue for a withholding tax account number. Adjust your tax withholding to get more money per paycheck. Note that this won’t change how much you ultimately pay in taxes.

Don’t file with the irs.

How To Withhold Payroll Taxes For Your Small Business

Best Ways To Get The Most Money When You Fill Out Your W-4 Form Tax Forms How To Get Money Fillable Forms

What Are Payroll Taxes Employers Need To Withhold Payroll Taxes From Employee Wages And Self-employed People Payroll Taxes Payroll Small Business Accounting

How To Calculate Withholding Tax As An Employer Or Employee - Ams Payroll

What To Do When Excess Social Security Tax Is Withheld - Stanfield Odell Tulsa Cpa Firm

Pin On Body

Download W2 Form 2016 Fillable Form W 4 Employee S Withholding Allowance Tax Forms Income Tax Form

An Example Of A W-4 Form And About How To Fill Out Various Important Sections Best Tax Software Tax Refund Proposal Writer

Warning To All Employees Review The Tax Withholding In Your Paycheck Otherwise A Big Tax Bill May Be Waiting For You Greenbush Financial Group

W3 Form Explanation 3 Unbelievable Facts About W3 Form Explanation Reference Letter For Student Unbelievable Facts Printable Job Applications

Federal And State W-4 Rules

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

What Is Form W-4 Tax Forms Job Application Form Rental Agreement Templates

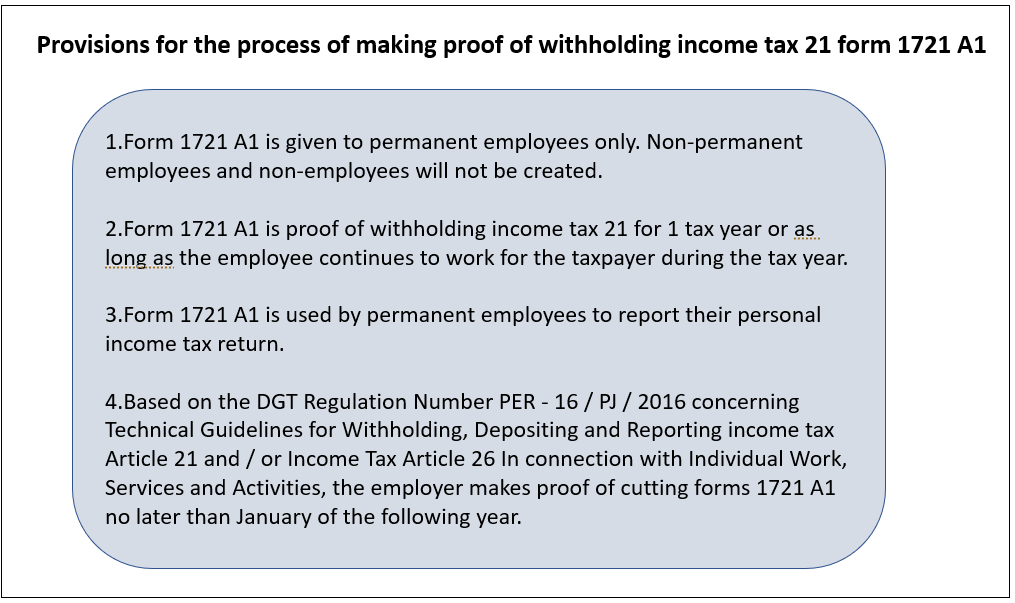

Guide To Withholding Tax In Indonesia - Acclime Indonesia

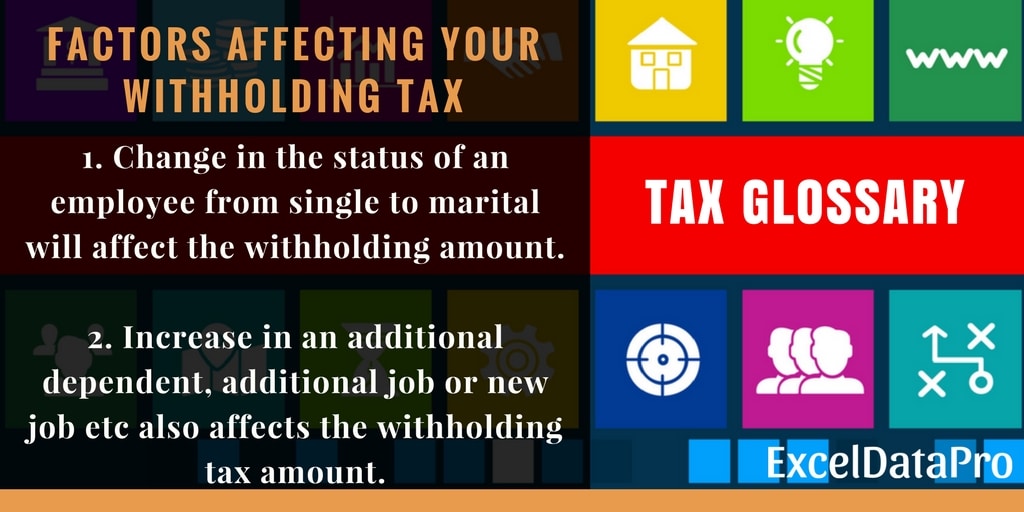

What Is Withholding Tax - Federal Income Tax - Exceldatapro

What Are Employee And Employer Payroll Taxes Ask Gusto

Indonesia Payroll And Tax Guide

Irs Improves Online Tax Withholding Calculator Cpa Practice Advisor

Understanding Your W-4 Mission Money