Refer to some nonresidents with u.s. An estate tax return may need to be filed for a decedent who was a nonresident and not a u.s.

Federal Estate Tax Session 3 De Paul University

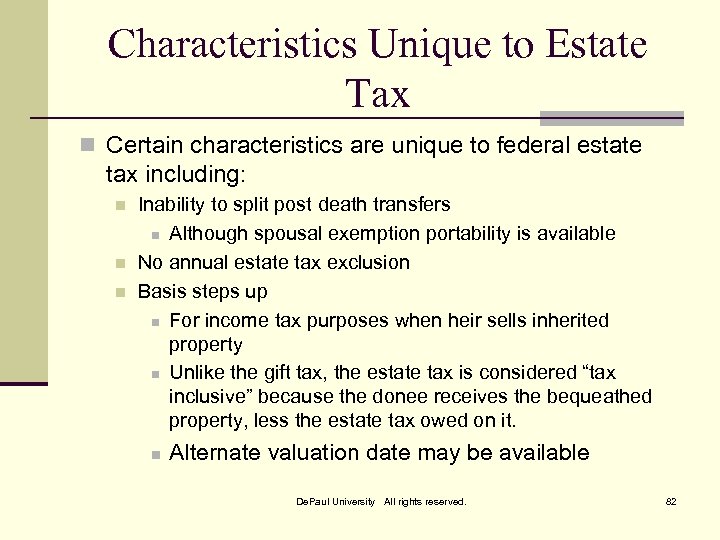

Portability allows a surviving spouse the ability to transfer the deceased spouse’s unused exemption amount (dsuea) for estate and gifts taxes to a surviving spouse, so long as the portability election is made on a timely filed federal estate tax return (irs form 706).

Portability estate tax return. The federal estate tax exemption is indexed for inflation, so it. Formally, this is called the deceased spouse unused election (dsue). What does portability of the estate tax exemption mean?

Much like an income tax return, an estate tax return is filed with the irs and on the estate tax return the family will outline all of the decedent’s assets, which he or she. Portability occurs when a surviving spouse files an estate tax return for the purpose of calculating and capturing any estate tax credit left unused in the estate of the first spouse to die. The election to transfer a dsue amount to a surviving spouse is known as the portability election.

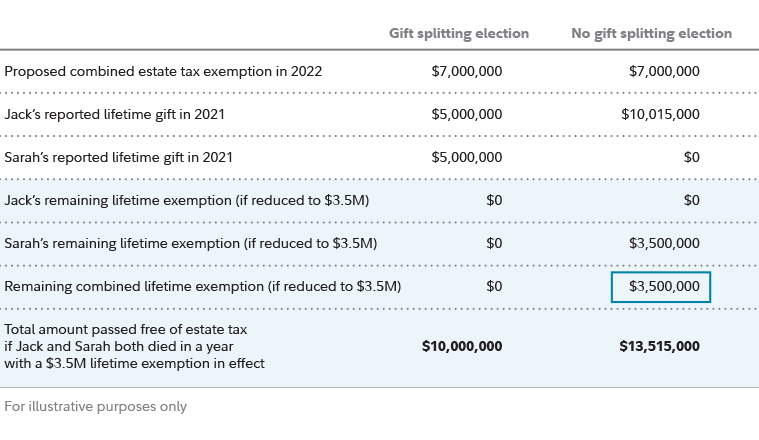

Portability election—the executor must a file a federal estate tax return (regardless of the size of the gross estate), if the executor wants to elect to permit the decedent’s surviving spouse to use the decedent’s unused exclusion amount. When filing form 706, the tax return assumes that you elect portability. The effect of portability is that a married couple has a combined $23.4 million exemption from the federal estate and gift tax and a combined $10 million exemption from the maryland estate tax for 2021.

As a general rule, failing to timely file an estate tax return means that the dsue is not portable to the surviving spouse. So, this is a discussion you can have with the family to make sure they understand the cost and the potential benefits of portability and they can make the right decision of whether or not to make that election. But there is some relief.

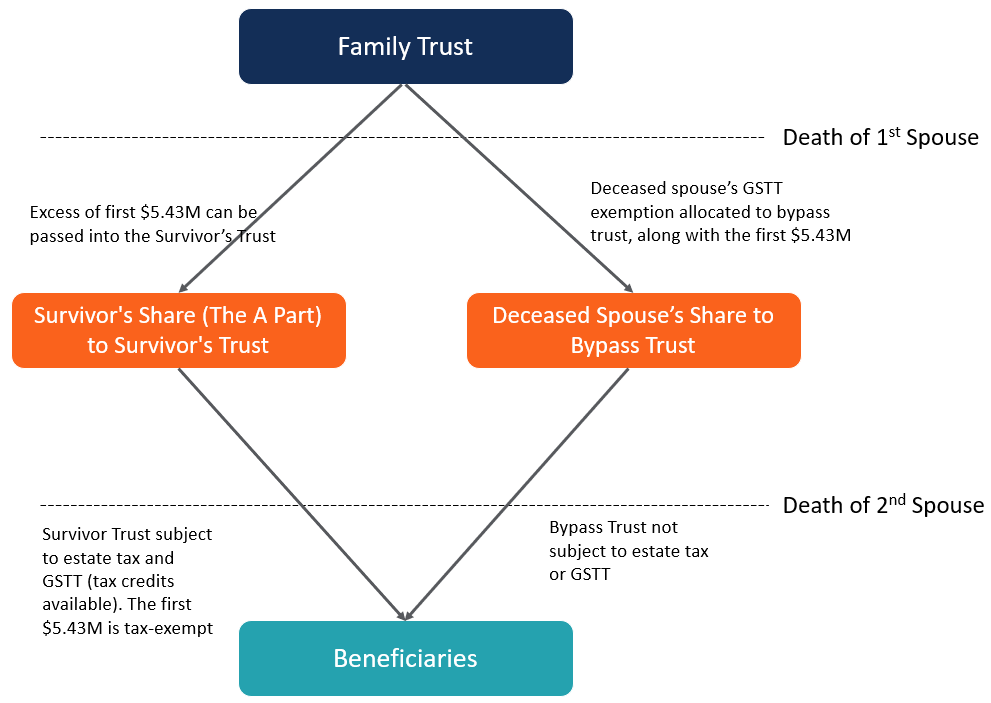

Since in 2015 the federal estate tax exemption is $5.43 million per person (the exemption changes every year since it is indexed for inflation), this means that a married couple can potentially pass on $10.68 million to their heirs free from federal estate taxes. Any estate that is filing an estate tax return only to elect portability and did not file timely or within the extension provided in rev. The good news is that a surviving spouse does not have to file form 706 when the estate’s gross value (which includes prior taxable gifts) is less than the basic exclusion amount.

The due date of the estate tax return is nine months after the decedent's date. An estate tax return is a return that a decedent’s family would file upon the passing of the taxpayer. In order to elect portability of the decedent's unused exclusion amount (deceased spousal unused exclusion (dsue) amount) for the benefit of the surviving spouse, the estate's representative must file an estate tax return (form 706) and the return must be filed timely.

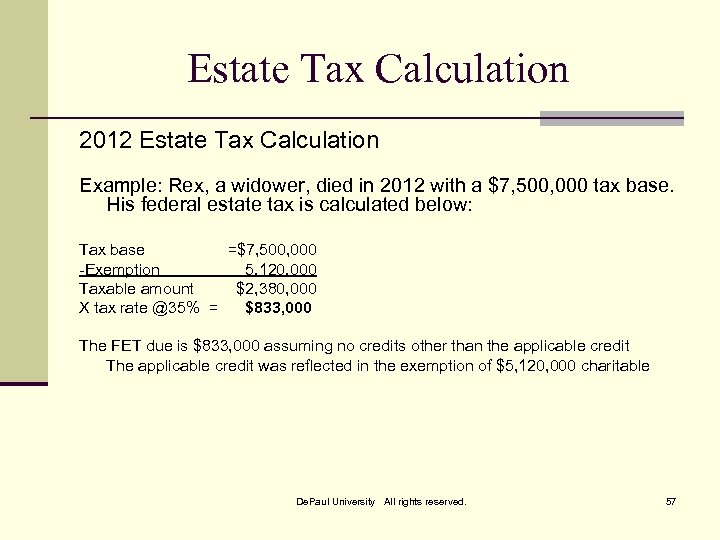

Again, to elect portability the deceased spouse’s estate has to file an estate tax return and, if that isn’t otherwise required, that introduces some complexity and some cost into that process. In order to elect portability, estate tax returns must be filed by estates that are not otherwise required to file based on the value of the gross assets in the estate. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her $5,000,000 (in 2011, or $5,120,000 in 2012, $5,250,000 in 2013, $5,340,000 in 2014, and $5,430,000 in 2015) federal estate tax exemption, then the surviving spouse can make an election to pick up the unused exemption and add it.

While somewhat confusing, the form offers helpful instructions for completing and filing the return. Assets must file estate tax returns to learn more. To properly make the portability election, the surviving spouse must timely file a federal estate tax return, known as the “united states estate.

The portability election went into effect for deaths occurring on or after january 1, 2011.

Federal Estate Tax Session 3 De Paul University

Estate Planning Strategies For Gift Splitting Fidelity

Estate Trust Gift Tax For 2014 - Bette Hochberger Cpa Cgma

A-b Trust - Overview Purpose How It Works Advantages

Form 706 Estate Tax Return Presented By - Ppt Download

Federal Estate Tax Portability - The Pollock Firm Llc

Federal Estate Tax Session 3 De Paul University

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation-skipping Transfer Tax Return Definition

Form 706 Estate Tax Return Presented By - Ppt Download

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

Federal Estate Tax Session 3 De Paul University

Federal Estate Tax Session 3 De Paul University

Pin On Taxes And Accounting

Understatement Of Gain Does Not Extend Limitation Period Httpbacklyltita Limitation Period In 2020 Estate Planning Income Tax Federal Income Tax

Federal Estate Tax Session 3 De Paul University

Federal Estate Tax Session 3 De Paul University

Navigating The Portability Rules - Ppt Download

This Is Another In A Series Of Blogs On The Basics Of Estate Planning Perhaps The Most Common Mistake Estate Planning Estate Planning Attorney Traditional Ira

Marriage Conversation Cards Marriage Conversation Cards Marriage Cards