Estate planning can take a lot of work and a lot of knowledge. When a resident dies with an estate valued at more than $1 million, the state requires that the estate pay taxes on a graduated rate of up to 16 percent.

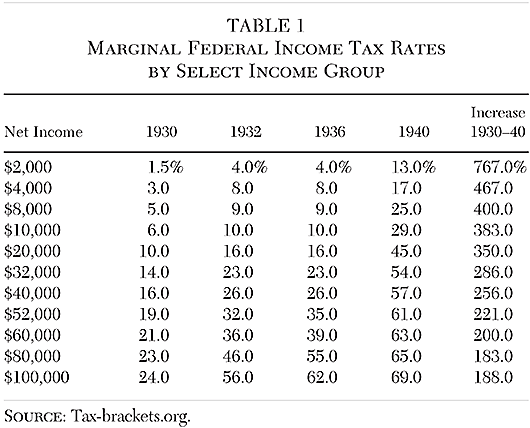

The Economic Impact Of Tax Changes 19201939 Cato Institute

Within 9 months after date of decedent's death

Massachusetts estate tax rates table. Ma residential tax rates 2020 the property tax on a home can have a significant impact on real estate values in a town, as it affects how much buyers can afford to pay. No estate tax or inheritance tax. The maximum credit for state death taxes is $64,400 ($38,800 plus $25,600).

Massachusetts uses a graduated tax rate, which ranges between 0.8% and a maximum of 16%. The top estate tax rate is 16 percent (exemption threshold: The state sales tax rate in massachusetts is 6.25%, but you can customize this table as.

If you're responsible for the estate of someone who has died, you may need to file an estate tax return. In this example, $400,000 is in excess of $1,040,000 ($1,440,000 less $1,040,000). The massachusetts estate tax is equal to the amount of the maximum credit for state death taxes.

However, the estate tax exemption threshold in massachusetts is just $1 million. Tax / mill rate commercial tax / mill rate; For a nonresident decedent with massachusetts property, the imposed massachusetts estate tax is determined by the percentage of the taxable estate which is real and tangible property located in massachusetts.

Federal taxable estate massachusetts real and tangible property. Again, this means that if a massachusetts resident dies and leaves behind an estate valued at less than $1 million, it would not be subject to the estate tax. If a buyer takes out a mortgage on a house or condominium, many lenders will collect the property tax monthly from the borrower, and pay the city or town directly.

An estate valued at $1 million will pay about $36,500. Massachusetts has an estate tax on estates over $1 million. If you're responsible for the estate of someone who died, you may need to file an estate tax return.

The median property tax in massachusetts is $3,511.00 per year for a home worth the median value of $338,500.00. The tax rate is progressive, with a maximum rate of 16 percent.1 furthermore, the massachusetts tax The credit on $400,000 is $25,600 ($400,000 ×.064).

Massachusetts levies an estate tax on estates worth more than $1 million. The progressive estate tax rates top out at 16%. 564 main street, suite 302, waltham, ma 02452 | phone:

(compare these rates to the current federal rate of 40%.) Estate tax rates range from 0.8% to 16%. The maximum massachusetts estate tax is generally an amount equal to the federal credit for state death taxes computed using the internal revenue table in effect on december 31, 2000 (see table on following page).

If the estate is worth less than $1,000,000, you don't need to file a return or pay an estate tax. If the estate is worth less than $1,000,000, you don't need to file a return or pay an estate tax. includes information and forms. Your estate will only attract the 0% tax rate if it’s valued at $40,000 and below.

Like illinois, massachusetts uses the federal credit for state death taxes table to determine. If you were to translate the amount owed into a tax rate on the portion of the estate that exceeds the massachusetts exemption amount of $1 million, the top rate would be 16%—that is, you would not be taxed more than 16%. Counties in massachusetts collect an average of 1.04% of a property's assesed fair market value as property tax per year.

If you’re living in the bay state and are looking for information about the massachusetts estate tax, this guide has all the information you’ll need. Massachusetts estate tax returns are required if the gross estate, plus adjusted taxable gifts, computed using the internal revenue code in effect on december 31, 2000, exceeds $1,000,000. This increases to $3 million in 2020)

The top estate tax rate is 16 percent (exemption threshold: Even then, only the portion of the estate that exceeds $11.58 million will be taxed, at a maximum rate of 40 percent. In massachusetts, an estate tax is generally applied to estates which exceed $1 million, based on a progressive rate scale, with rates starting at.08% and increasing to 16%.

Estates valued at greater than $1 million may be taxed on a graduated scale of up to 16 percent. Tax amount varies by county.

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

The Economic Impact Of Tax Changes 19201939 Cato Institute

States With An Inheritance Tax Recently Updated For 2020

Estate Tax Exemption 2021 - Amount Goes Up Union Bank

2021 Guide To Potential Tax Law Changes

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

2022 Tax Brackets 2022 Federal Income Tax Brackets Rates

States With Highest And Lowest Sales Tax Rates

State Corporate Income Tax Rates And Brackets Tax Foundation

How Do Millionaires And Billionaires Avoid Estate Taxes

How Can I Avoid The Massachusetts Estate Tax - Heritage Law Center

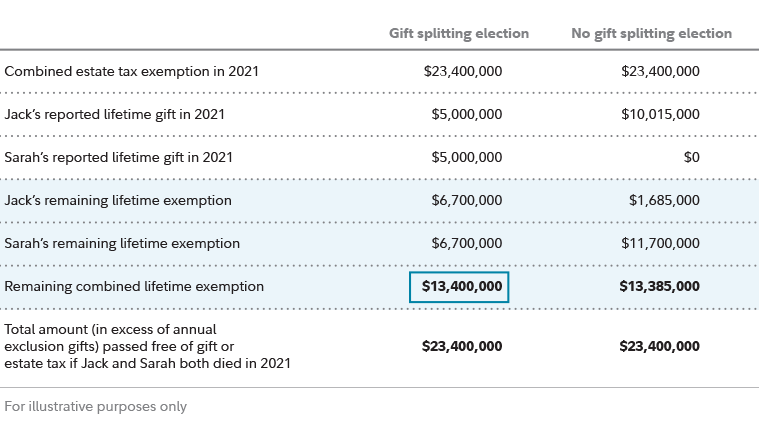

Estate Planning Strategies For Gift Splitting Fidelity

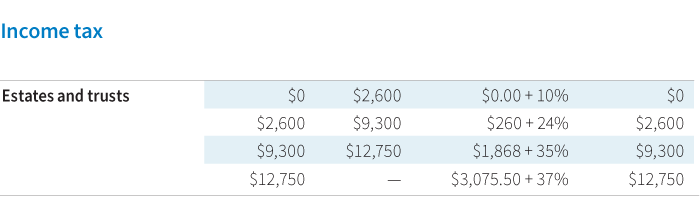

The Kiddie Tax Changes Again - Putnam Investments

A Guide To Estate Taxes Massgov

Massachusetts Estate And Gift Taxes Explained Wealth Management

The Economic Impact Of Tax Changes 19201939 Cato Institute

The Kiddie Tax Changes Again - Putnam Investments

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With An Inheritance Tax Recently Updated For 2020