The actual excise tax value is based on the blue book value as established by the vehicle identification number (vin). Calculate 60% of the state sales tax due for the next month’s return.

Sales Tax Calculator

To calculate the right sales tax in oklahoma you’ll need to add up the state, county and city rates for your location.

How to calculate sales tax in oklahoma. For example, in oklahoma city, the combined rate is 8.375% and in muskogee it is 9.15%. Currently, combined sales tax rates in oklahoma range from 4.5 percent to 11.5 percent, depending on the location of the sale. Excise tax on boats and outboard motors is based on the manufacturer's original retail selling price of the unit.

If the purchased price falls within 20% of the blue book value, then the purchase price will be used. If it's not within that range, an average value is used to derive the excise tax due. Cities and/or municipalities of oklahoma are allowed to collect their own rate that can get up to 5.1% in city sales tax.

However, there are additional tax rates in both the counties and major cities of oklahoma. Sales tax calculator | sales tax table the state sales tax rate in oklahoma is 4.500%. To use our oklahoma salary tax calculator, all you have to do is enter the necessary details and click on the calculate button.

3.25% of the purchase price (or taxable value, if different) used vehicle: Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due. Every 2021 combined rates mentioned above are the results of oklahoma state rate (4.5%), the county rate (0% to 3%), the oklahoma cities rate (0% to 5.1%).

With local taxes, the total sales tax rate is between 4.500% and 11.500%. Most vehicles, all terrain vehicles, boats or outboard motors are assessed excise tax on the basis of After a few seconds, you will be provided with a full breakdown of the tax you are paying.

If the purchase price is too low or. When calculating the sales tax for this purchase, steve applies the 4.5% state tax rate for oklahoma, plus 3.75% for edmond’s city tax rate. Depending on local municipalities, the total tax rate can be as high as 11.5%.

If $100 worth of books is purchased from an online retailer and no sales tax is collected, the buyer would become liable to pay oklahoma a total of $100 × 4.5% = $4.50 in use tax. However, in addition to that rate, oklahoma has some of the highest local sales taxes in the country,. To file sales tax in oklahoma, you must begin by reporting gross sales for the reporting period, and calculate the total amount of sales tax due from this period.

The base sales tax rate in oklahoma is 4.5%. Oklahoma are not assessed oklahoma excise tax, provided they title and register in their state of residence. As a result, the combined sales tax rate can vary quite a bit.

The easiest way to do this is by downloading our lookup tool to get the detail you need in seconds. If $1,000 worth of goods are purchased in a jurisdiction with a 5.5% sales tax rate, no use tax is owed to oklahoma because the foreign jurisdiction's sales tax rate is greater then. Calculate 60% of your average state sales tax due for the months you reported taxable transactions during the calendar year.

As a business owner selling taxable goods or services, you act as an agent of the state of oklahoma by collecting tax from purchasers and passing it along to the appropriate tax authority. You may also be interested in printing a oklahoma sales tax table for easy calculation of sales taxes when you can't access this calculator. Calculate 60% of your state sales and use tax due for the same month of the previous calendar year.

How 2021 sales taxes are calculated in oklahoma city. The state general sales tax rate of oklahoma is 4.5%. A customer living in edmond, oklahoma finds steve’s ebay page and purchases a $350 pair of headphones.

At a total sales tax rate of 8.25%, the total cost is $378.88 ($28.88 sales tax). The state sales tax rate in oklahoma is 4.50%. The oklahoma (ok) state sales tax rate is currently 4.5%.

$20.00 on the 1st $1500.00 of value + 3.25% of the remainder. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.oklahoma has a 4.5% statewide sales tax rate , but also has 356 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase.

Depending on the zipcode, the sales tax rate of oklahoma city may vary from 4.5% to 9.1% The sales tax added to the original purchase price produces the total cost of the purchase. You can use our oklahoma sales tax calculator to determine the applicable sales tax for any location in oklahoma by entering the zip code in which the purchase takes place.

The state of oklahoma provides all taxpayers with three choices for filing their taxes. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20% of the average retail value of the car, regardless of condition. The oklahoma city, oklahoma, general sales tax rate is 4.5%.

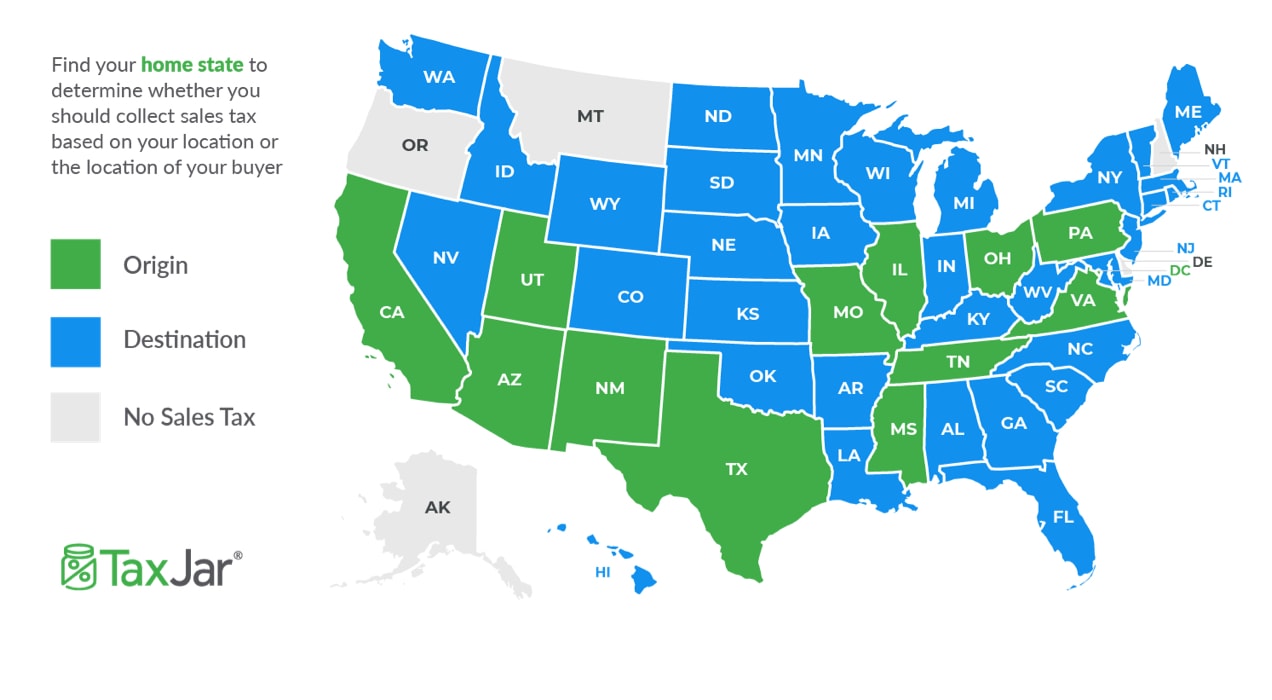

How To Charge Your Customers The Correct Sales Tax Rates

State Sales Tax Jurisdictions Approach 10000 Tax Foundation

States With Highest And Lowest Sales Tax Rates

Idaho Retirement Tax Friendliness Retirement Calculator Property Tax Investing

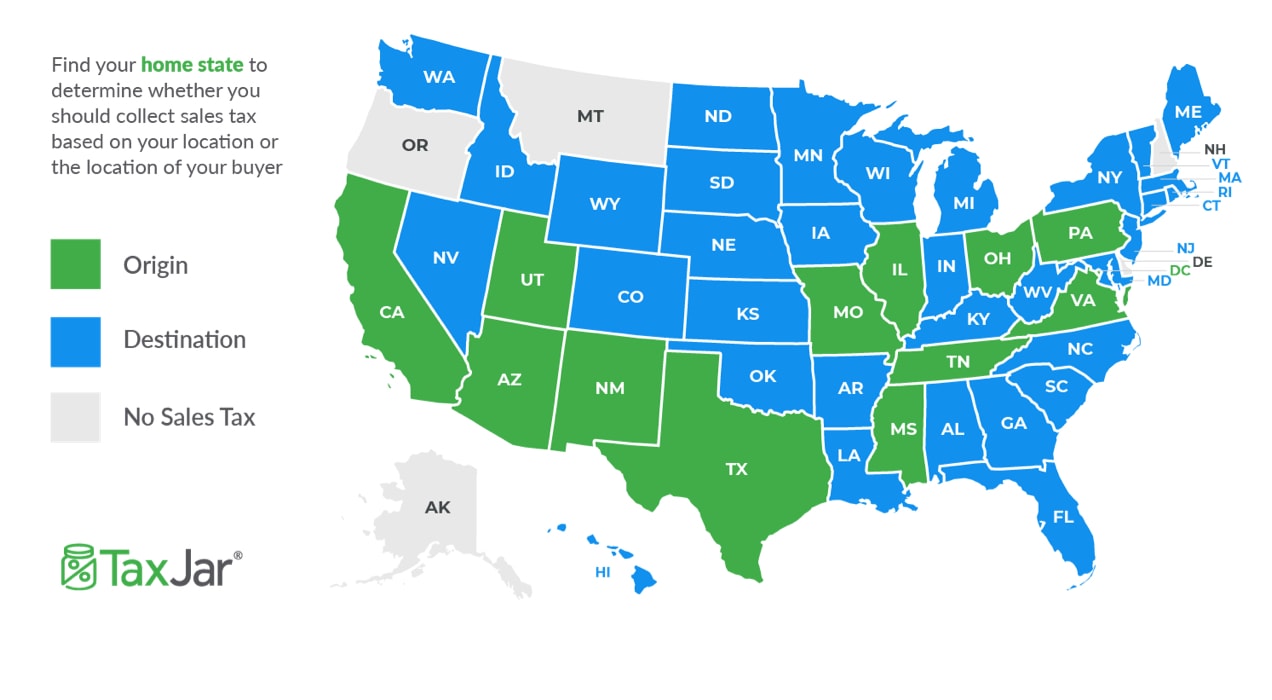

Use Tax Vs Sales Tax Whats The Difference - Taxjar

Simple Resume Design Idea Resume Design Creative Resume Design Simple Resume

Oklahoma Retirement Tax Friendliness Smartassetcom Income Tax Brackets Retirement Retirement Income

How To Charge Your Customers The Correct Sales Tax Rates

In My Dreams - Activity 1 Calculating Sales Tax And Discounts Real Life Math Middle School Math Teaching

How Much Does Your State Collect In Sales Taxes Per Capita

Understanding Californias Sales Tax

How To Calculate Sales Tax - Video Lesson Transcript Studycom

State And Local Sales Taxes In 2012 Tax Foundation

Oklahoma Sales Tax - Taxjar

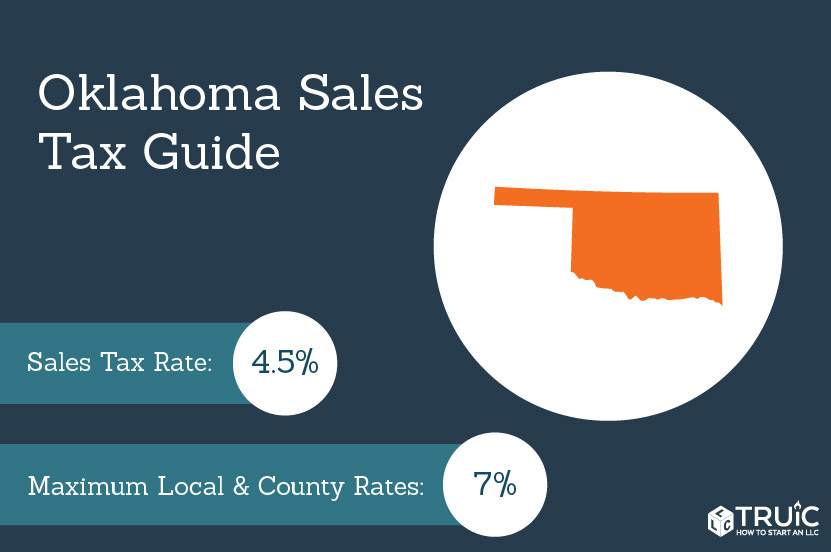

Oklahoma Sales Tax - Small Business Guide Truic

How A Taxpayer May Obtain A Sales Tax Refund Zip2tax News Blog Tax Refund Sales Tax Refund

Improving Your Checkout Experience Through Case Studies Case Study How To Apply Improve Yourself

Total Sales Tax Per Dollar By City - Oklahoma Watch

How Is Tax Liability Calculated Common Tax Questions Answered