Search by address search by parcel number. This search may take over three (3) minutes.

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Visa debit = $3.95 all other plastic = 2.60% of total tax.

Pay indiana property taxes online. Contact the indiana department of revenue (dor) for further explanation if you do. Click on the link above to complete an application. Hendricks county does not receive any portion of the convenience fee.

If you are having trouble searching, please visit assessor property cards to lookup the address and parcel number. Intax supports the ability to file and pay electronically for the following taxes: Have spring or fall installment automatically deducted from your checking account on property tax due day.

How do i check on my property taxes? Pay for property taxes in clay county, indiana using this online service! Please contact your county treasurer's office.

When you receive a tax bill you have several options: You can setup an automatic payment through your bank with online bill pay. Offered by county of rush, indiana.

Pay your property taxes in rush county, indiana using this online service! Please use the following methods of payment for property taxes: You will need your tax bill and checkbook or credit card.

The state treasurer does not manage property tax. Pay by mail to pay your bill by mail, please. It could have been better!

Warrickcounty.gov and click on the quick link “pay. If your property is up for tax sale, making payment online will not remove it from the sale. Please be sure to list your tax id# on your check for reference.

These tax types will move to intime in july 2022. 124 main rather than 124 main street or doe rather than john doe). It could have been better!

Offered by county of clay, indiana. A convenience fee (varies by the type of electronic payment) will be added to your total. How was your experience with papergov?

10333 n meridian street suite 270 indianapolis, in 46290 phone: Using this service, you can pay for your property tax bill in howard county, indiana online! Credit and debit card transactions will incur a convenience fee of 2.35% of your total tax liability.

In case of delinquent taxes, the sale of real property to pay for such delinquencies may be ordered by the treasurer. Your total payment, including the credit card online transaction fee will be calculated and displayed prior to the completion of your transaction. Please be sure to allow enough time for your bank to prepare the check and have it postmarked by the due date.

Box 3445, evansville, in 47733. Quickly search, submit, and confirm payment through the pay now button. ****real and personal property taxes for the 2020 pay 2021 year are due on may 10, 2021 for the 1st installment and on november 10, 2021 for the 2nd installment.*** the whitley county treasurer offers several convenient options to make real and personal property tax payments.

You need to come in the office and bring cash or certified funds. For best search results, enter a partial street name and partial owner name (i.e. Pay your property taxes in vermillion county, indiana using this online service!

In case you missed it, the link opens in a new tab of your browser! The transaction fee is 2.5% of the total balance due. Innkeeper form 2018 property taxes in cass county will be due, spring may 10, 2021 and fall november 10, 2021.

For personal property and mobile home judgment information and amounts only contact: Personal property and mobile homes certified to court for judgment can be paid online through american financial credit services. The primary duty of the treasurer is that of tax collector.

May 10, 2021 grant county treasurer. Send in a payment by the due date with a check or money order. Tax bill information online payment options.

Pay by phone toll free: The treasurer is an elected position authorized by article 6, section 2 of the indiana constitution and serves a four (4) year term. How was your experience with papergov?

Make sure you are paying for local payments enter our location information (indiana, vanderburgh county) follow the directions online disclaimer: If you have any questions please call the office. November 10, 2021 401 s adams st suite 229.

In case you missed it, the link opens in a new tab of your browser! Full and partial payments accepted.

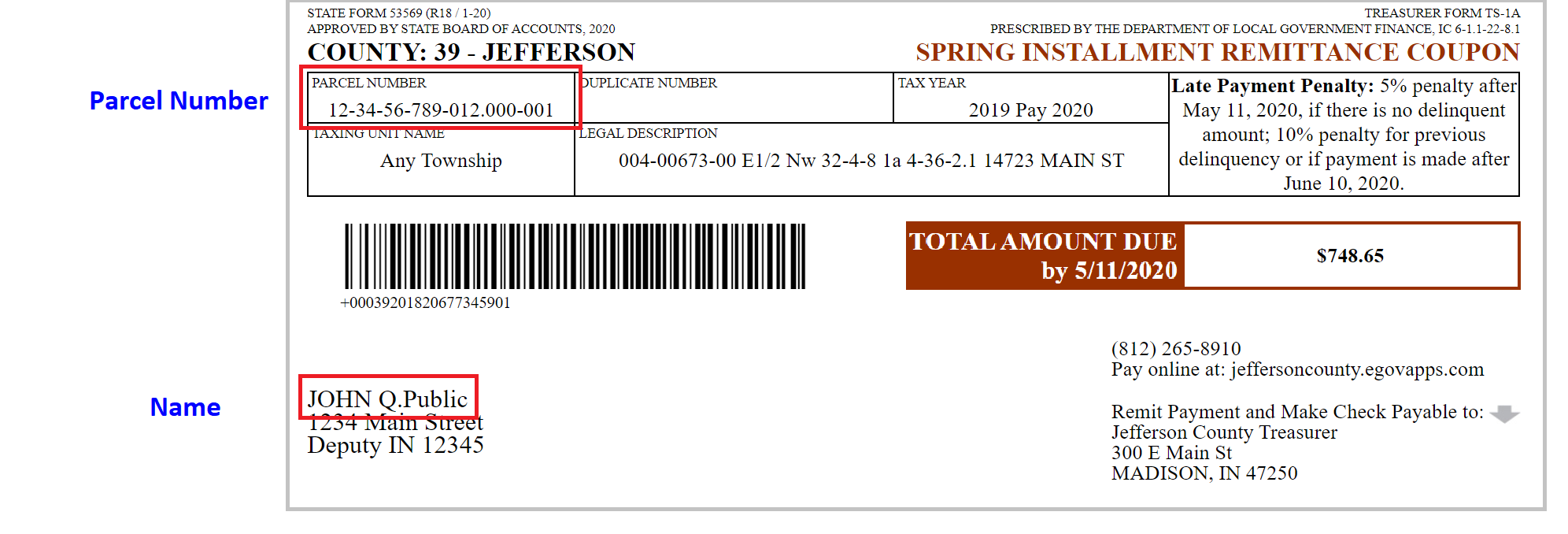

Jefferson County In

Deducting Property Taxes Hr Block

Pennsylvania Property Tax Hr Block

The Official Website Of City Of Union City Nj - Tax Department

Property Tax - Polk County Iowa

Disabled Veterans Property Tax Exemptions By State

Paying Your Taxes

Treasurer

Look Uppay Property Taxes

Pay Property Taxes Online

Blog Us Tax Lien Association Buying Property Investing Real Estate Investor

Property Tax Comparison By State For Cross-state Businesses

Property Tax Payments Cant Be Postponed But Late Fees May Be Waived - Times Of San Diego

Last Day For Biggest Property Tax Bill Discount Nears

Real Property Tax Howard County

How To Calculate Property Tax And How To Estimate Property Taxes

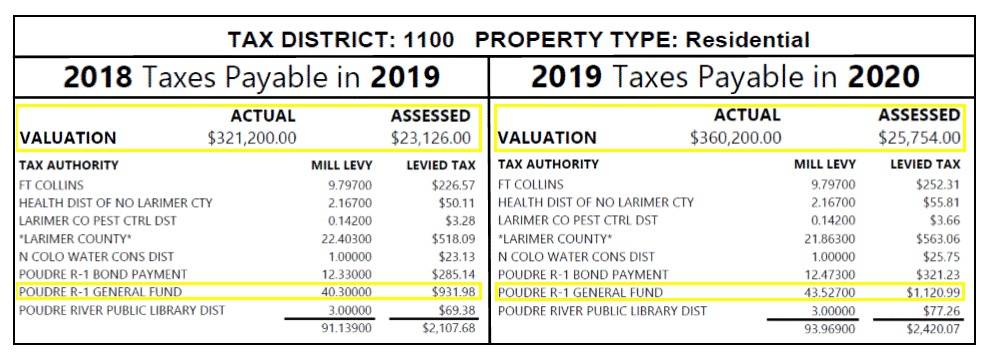

Property Tax Assessment Larimer County

How To Cut Your Property Taxes Creditcom

Who Pays The Highest Property Taxes Property Tax Real Estate Staging Denver Real Estate