Please view our content policy and acceptable uses policy to see what types of information you can ask for in a survey. Partly in response to a 2011 inspector general for tax administration report showing that illegal immigrants made extensive use of tax credits, congress included provisions in both the 2015 path act and the 2017 tax cuts and jobs act designed to curtail in part illegal immigrant receipt of such programs.

2020 Instructions For Schedule H 2020 Internal Revenue Service

Once you are issued an ssn, use it when paying your estimated taxes.

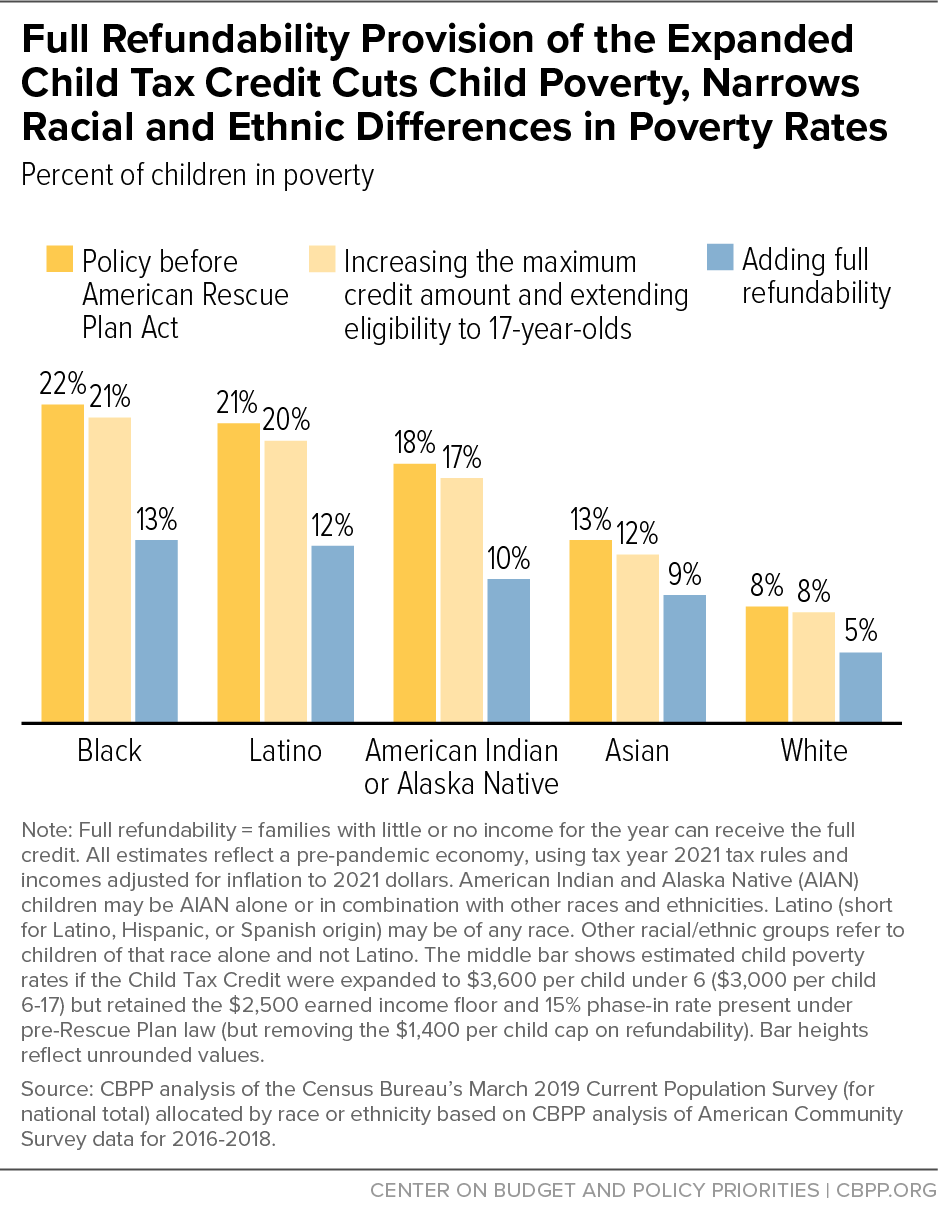

Tax credit survey social security number. Because we allow them to! Due to limitations of the census data, the figures do not reflect irs rules that require children to have a social security number to qualify for the child tax credit. At that time, no social security number was required.

For example, you are often asked for your ss # for a new bank account, credit union, or when applying for a drivers license. If you are an itin tax number holder, you can apply for a social security number, for example after getting an ead. Now, the ssn has become a de facto national identification number for taxation and other purposes

Creating demographic questions to collect information such as. You needed your social security number or an individual taxpayer id number (itin) to access and use the tool. Eligible persons who owe no taxes, or whose tax liability is smaller than their tax credit, receive all or part of the eitc as a direct payment.

If you are an individual living in the us, you can either have an individual tax identification number, or a social security number. This omission likely has little effect on most of the estimates shown here; You may not claim a ctc or actc for a child with an individual taxpayer identification.

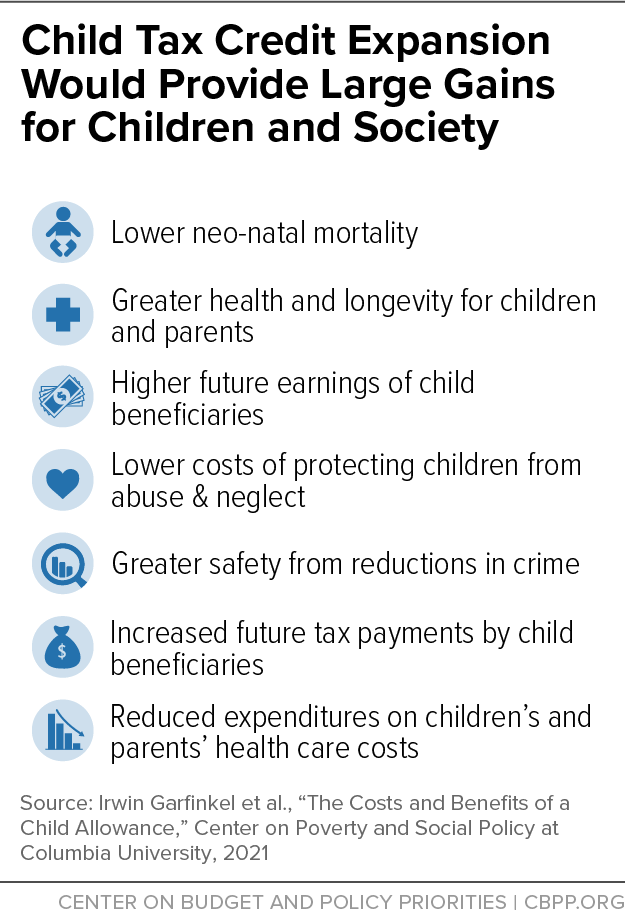

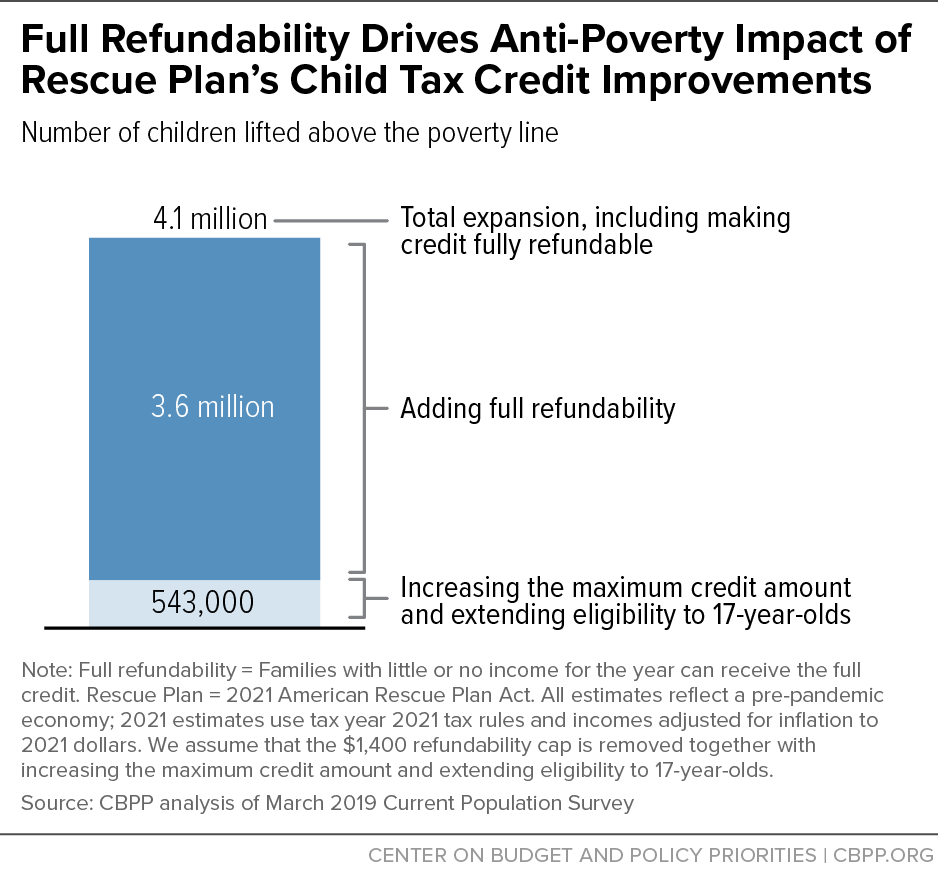

Generate a random fake social security number. What is us social security number? 27 million children in families with low or no income received less than the full child tax credit or no credit at all before the rescue plan made the full child tax credit fully available in 2021, as per.

“no credit shall be allowed under this section to a taxpayer with respect to any qualifying child unless the taxpayer includes the social security number of such child on the return of tax for. Income tax credits for individuals attach to your tax return. Asking for the social security number on an application is legal in most states, but.

The client would apply for a social security number for each child and immediately file four tax returns to claim their $1000 tax credit per child for the current year and past three years. Is it safe to put your social security number on an online tax credit screening? It is issued to an individual by the social security administration.

However, when the worker already has a tin (taxpayer identification number) or social security number, the employer doesn’t need to verify citizenship. Employers can verify citizenship through a tax credit survey. Find answers to 'do you have to fill out work opportunity tax credit program by adp?

I don't feel safe to provide any of those information when i'm just an applicant.' from u.s. The portal intended to make it easier for families to receive monthly child tax credit payments, as well as any stimulus checks they may be eligible to receive. You can find your social security number (ssn) on your physical social security card.

This alone, was not illegal. The social security number will be verified through the social security administration (ssa) master earnings file (mef). How to find your social security number // social security offices.

However, the preparer often used a us address to fraudulently claim the earned income credit (eic). Most controversial is the practice of employers asking for social security numbers from every applicant whether the individual will receive further consideration or not. Social security number spouse's social security number your first name initial last name spouse’s first name initial last name please print using blue or black ink.

As per the us laws, you cannot hold both, the itin tax number and the ssn, simultaneously. Generate another fake social security number Other places you can find your ssn number are on w2s, tax returns and bank statements.

Social security offers three options to verify social security numbers: Can i ask for credit card details, ssns, or other personal information? The biden administration increased the minimum payouts from the child tax credit, under the american rescue plan, from $2,000 to $3,600 for children under 6 and $3,000 for children ages 6 to 17.

In order to claim a child tax credit (ctc) or an additional child tax credit (actc), the qualifying child must have a social security number (ssn) that is valid for employment and is issued before the due date of the income tax return (including extensions). Social security number, it has become an easy way for different organizations to identify us. So why do these organizations insist on requiring your social security number to identify you?

Get answers to your biggest company questions on indeed. It's asking for social security numbers and all. The latino share of children benefiting, however, may be somewhat overstated.

Temporary (working) residents, permanent residents, and citizens. In the past the child tax credit has been restricted to families who are eligible for a social security number (ssn), excluding many whose immigration status does not allow one. A taxpayer should continue to use their social security number to pay their estimated taxes once it has been issued even if it is not valid for employment or no longer valid for employment.

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

2

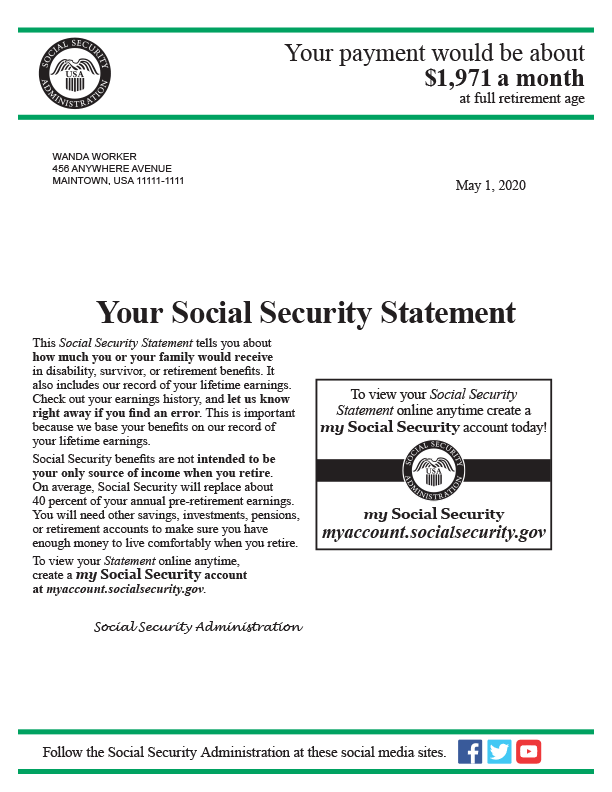

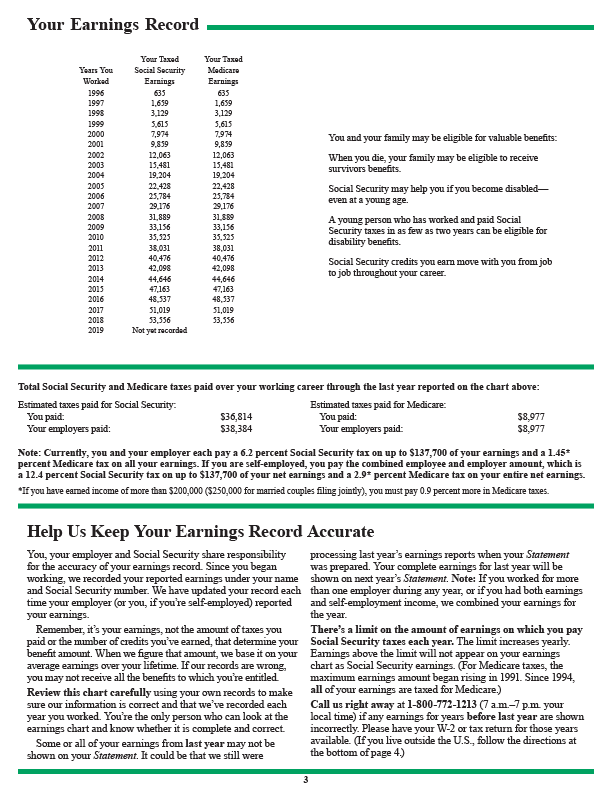

Analysis Of Benefit Estimates Shown In The Social Security Statement

How Has Socialsecurity Helped To Reduce Poverty In America Social Security National Academy Social

2

What Is A Tax Credit Screening When Applying For A Job - Welp Magazine

Analysis Of Benefit Estimates Shown In The Social Security Statement

Direct Deposit Form Template Word Best Of Sample Direct Deposit Form 8 Download Free Documents In Form Example Templates Directions

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Is My Old United States Social Security Number Still Valid

House Bill Takes Major Steps Forward For Children Low-paid Workers Center On Budget And Policy Priorities

Army Counseling Form 4856 Da Form 4856 Financial Counseling Example

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Publication 531 2020 Reporting Tip Income Internal Revenue Service

Publication 926 2021 Household Employers Tax Guide Internal Revenue Service

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Analysis Of Benefit Estimates Shown In The Social Security Statement

Can I Find My Date Of Birth With My Social Security Number - Quora