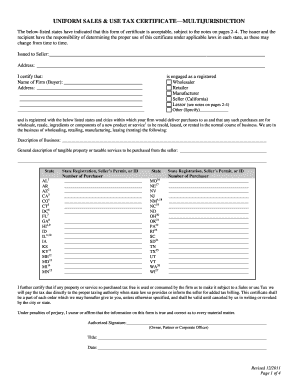

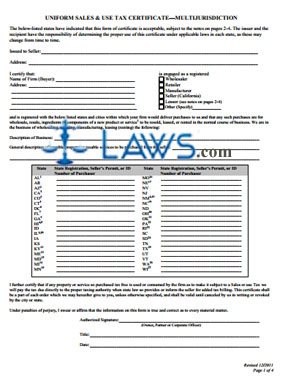

The certificate itself contains instructions on its use, lists the states that have indicated to the. The multistate tax commission (mtc) revised its multijurisdictional uniform sales & use tax exemption/resale certificate on january 22, 2018 to reflect two state changes.

2011 Mtc Uniform Sales Use Tax Certificate - Multijurisdiction Fill Online Printable Fillable Blank - Pdffiller

Rhode island allows this certificate to be used to claim a resale exemption only when the item will be.

Multistate tax commission resale certificate. Incorrectly issuing a multijurisdictional form can. The commission has developed a uniform sales & use tax resale certificate that 36 states have indicated can be used as a resale certificate. As a seller, you may also accept resale certificates from others who wish to purchase items for resale.

To find the resale certificate for a specific state, you can visit the department of revenue website for that state. The certificate may be in any form so long as it contains: The commission has developed a uniform sales & use tax resale certificate that 36 states have indicated can be used as a resale certificate.

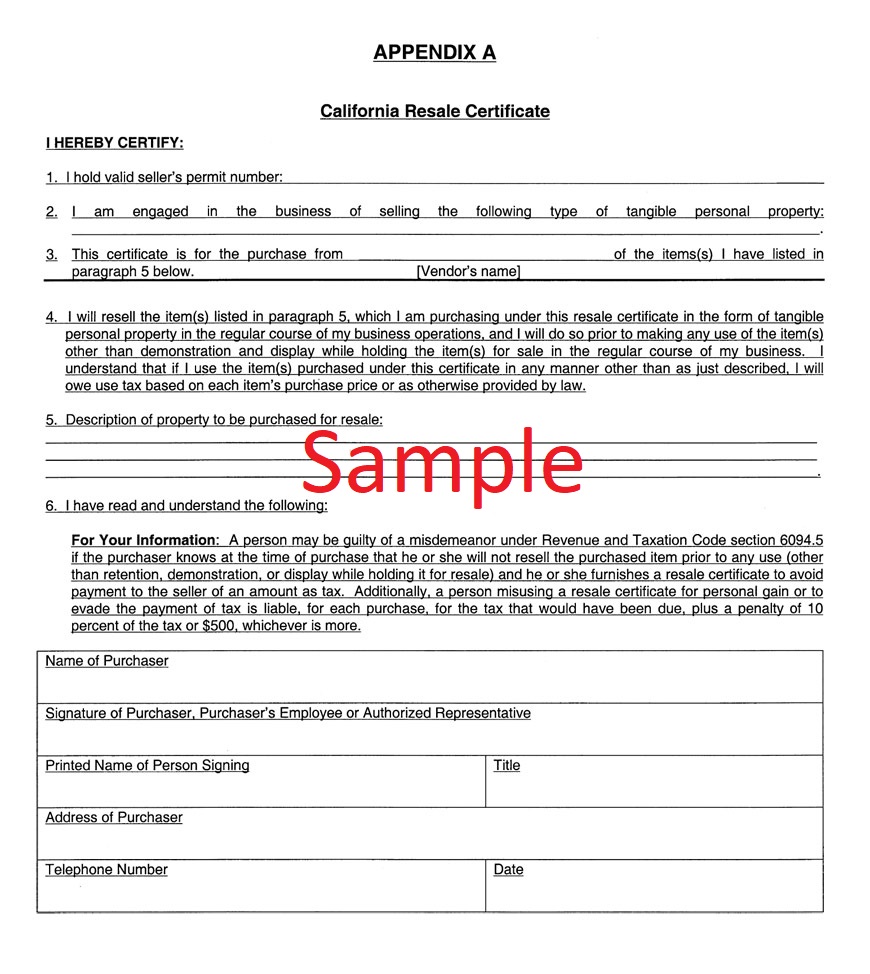

Allows the multistate tax commission's uniform. Multistate tax commission multijurisdiction resale certificates. Along with many other states, california adopted the mtc certificate.

A resale certificate indicates the item was in good faith that the purchaser would resell the item and report tax on the final sale. Drs does hear the multistate tax commission's uniform sales use tax certificate. Use the cross or check marks in the top toolbar to select your answers in the list boxes.

What are the risks of using these forms incorrectly? Its use is subject to. Do note, it is not mandatory to be registered with the state in order for a resale certificate.

Use get form or simply click on the template preview to open it in the editor. However, the business will need the multistate tax commission’s uniform sales and use tax certificate. 1 a seller in texas may simply a resale certificate in lieu of tax refund a retailer located.

All businesses engaging in interstate commerce should be familiar with the multistate exemption certificate, which can be used to support the resale exemption from sales and use tax in a substantial majority of states. North carolina allows the use of the multijurisdictional uniform sales and use tax certificate created by the multistate tax commission for appropriate purchases for resale. The commission has developed a uniform sales & use tax resale certificate that 36 states have indicated can be used as a resale certificate.

Drs does hear the multistate tax commission's uniform sales use tax certificate. A blanket resale certificate is applicable to multiple transactions between a buyer and a seller. The commission has developed a uniform sales & use tax resale certificate that 36 states have indicated can be used as a resale certificate.

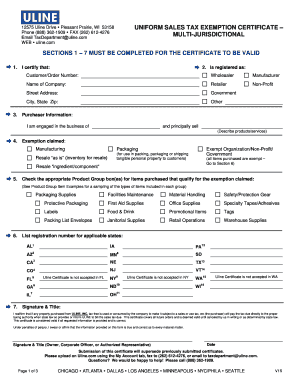

But they are also one of the most abused and misunderstood of all certificates. The multistate tax commission has created a uniform sales and use tax exemption certificate to meet this need and the mtc multistate tax form has been accepted by 38 states for use as a blanket resale certificate. Although each state has its rules with respect to whether a particular sale is exempt, the multistate tax commission has created a.

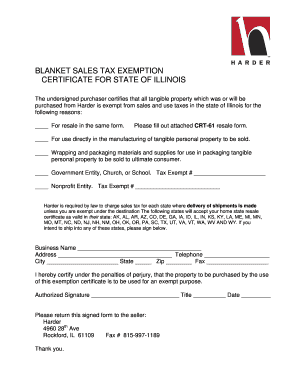

The uniform sales & use tax resale certificate multijurisdiction (multistate tax commission) form is 2 pages long and contains: Uniform sales & use tax exemption/resale certificate. Uniform sales & use tax resale certificate multijurisdiction (multistate tax commission) on average this form takes 14 minutes to complete.

It is not valid as an exemption certificate or if signed by a person such as a contractor who intends to use the property. The certificate may be in any form, but a blank resale certificate is available online. 1 a seller in texas may simply a resale certificate in lieu of tax refund a retailer located.

Some states will accept a multistate resale certificate or exemption form, such as the multistate tax commission’s (mtc), exemption certificate with the state registration number, or, in the streamlined state, the streamlined sales tax exemption certificate with the state registration number. Start completing the fillable fields and carefully type in required information. However, the selling dealer must also obtain a resale authorization number from the

“as of november 1, 2017 the district of columbia has not accepted the multistate tax commission’s uniform sales and use tax. Alternately, you can perform a google search for the state’s resale certificate. The certificate is currently accepted by 38 other states.

The multistate tax commission (mtc) issued the multijurisdiction resale certificate (mtc certificate) in july 2000 to provide a standard document for businesses to utilize that will be uniformly accepted by sellers. Its use is limited to use as a resale certificate subject to conn. All forms are printable and downloadable.

The district of columbia footnote now reads:

Fillable Multi Jurisdictional Tax Form - Fill Online Printable Fillable Blank Pdffiller

Free Form Uniform Sales And Use Certificate - Free Legal Forms - Lawscom

Fillable Online Ms State Tax Commission Atv Form Fax Email Print - Pdffiller

Everything About Use Tax Exemptionresale Certificate Help About Taxes In Usa Irs Taxes

Fy72-73 - Multistate Tax Commission

Multistate Tax Commission - Home

Mulberrysouthwestcouk

Multi State Sales Tax Exemption Certificate - Fill Online Printable Fillable Blank Pdffiller

Multistate Tax Commission - Resources

Resale Certificates Ecommerce Sellers Guide - Nerdwallet

How To Get A Sales Tax Certificate Of Exemption In North Carolina

Tmpprocom

Auditing Fundamentals

Wordpressstorageaccountblobcorewindowsnet

Teams7teamscertcom

Uniform Sales And Use Tax Exemption Certificates - Accuratetaxcom

Staticglobalindustrialcom

Uniform Sales Use Tax Exemptionresale Uniform-sales-amp-use-tax -exemption-resalepdf Pdf4pro

Multistate Tax Commission - Home