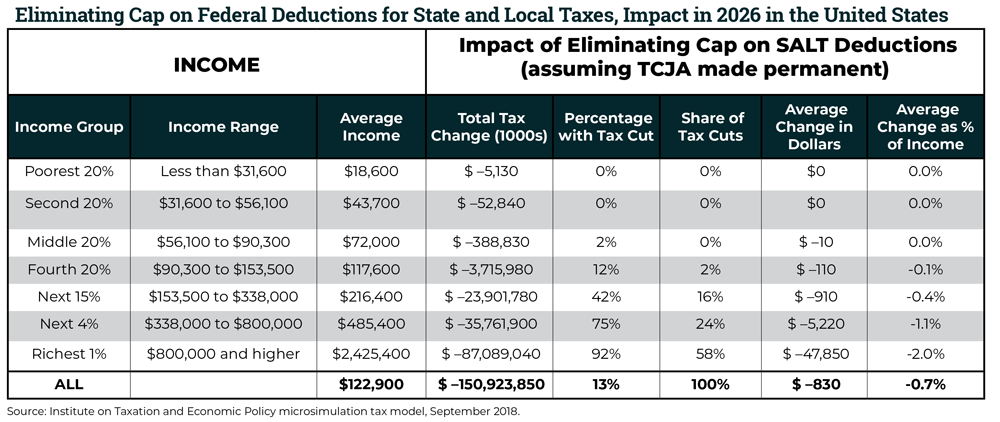

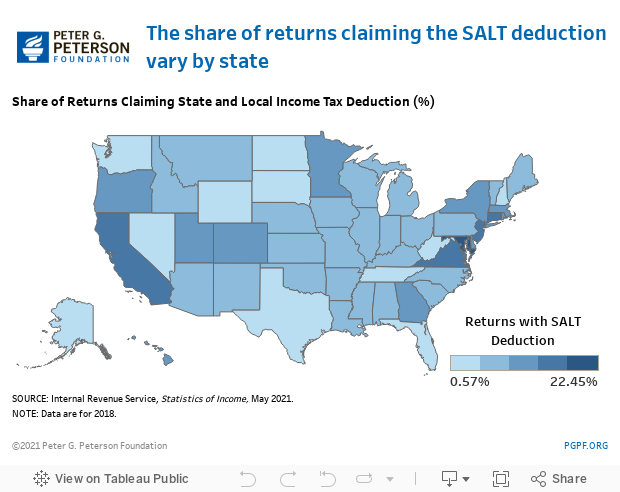

Now, the salt tax cap is set to expire in 2025. The franchise tax board estimated in 2018 that the salt deduction limit cost californians an additional $12 billion a year in federal taxes.

Hand Embroidered Purse Floral Bag Cloth Pouch Small Handbag Satin Ribbons Embroidery Metal Clasp Blue Denim Soft Cosmetic Pink Lilas Daisies - Cosmetic Tax Guide Inheritance Tax Income Tax Return

Republicans, looking for ways to finance their own tax cuts in 2017, capped the amount of state and local taxes that households could deduct from their federal tax.

Salt tax deduction news. The revised salt deduction is designed to raise revenue, at least on paper, because both plans would restore the $10,000 cap for all after 2025. Republicans created a $10,000 cap on the salt deduction in their 2017 tax law. Salt deduction in democrats' spending bill would slash taxes for rich americans by $200b:

House democrats on friday passed their $1.75 trillion spending package with a temporary increase for the limit on the federal deduction for. In theory, a limit on a. Under current law, the cap would expire that year.

In 2018, trump placed a cap on the salt deduction in order to recover revenue lost from various tax cuts. This limit applies to single filers, joint filers, and heads of household. An unlimited deduction is dead, and the question now is what kind of limitation, said former house aide george callas, who assisted in the.

This cap remains unchanged for your 2020 and 2021 taxes. But in 2017, congress enacted trump’s tax reform, which limited the amount of state and local taxes that taxpayers could deduct up to $10,000. The deduction has a cap of $5,000 if your filing status is married filing separately.

Republicans created a $10,000 cap on the salt deduction in their 2017 tax law. However, a possible compromise among house democrats to raise the salt deduction to $72,500 would represent genuine progress. Whether limiting the salt deduction is good or bad.

News november 17, 2021 at 10:31. Would give an unlimited deduction on federal returns for state and local taxes, or salt, under a certain. Democrats are working on a series of compromises aimed at loosening the restrictions on the state and local tax deduction, or salt deduction, though some wanted to eliminate the cap entirely, bloomberg reports.

Curbing the deduction forces americans to pay taxes on income that’s. The bbba would raise the salt deduction limitation from $10,000 per year to $80,000 per year from 2022 through 2030, lower it to $10,000 in 2031, and then eliminate it. House speaker nancy pelosi is fighting to repeal the cap.

The cap on the salt deduction started in 2018 because of the tax cuts and jobs act, a tax reform passed in 2017. Approximately 125,000 erie county households experienced a tax increase because of the limit placed on the salt deduction, with the average increase reported at $815 a year.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained - Vox

You Cant Say Corporate Corruption Didnt Have A Good Run With This Deduction Facts Didyouknow Did You Know Turn Ons Sayings

Salt Tax Deduction How Does The Salt Deduction Work Marca

Giai Djap Ve Thue Can Ho Mini Gia Re Ke Toan

Us Lawmakers Pepper Congress With Pleas For Salt Tax Break - Florida Phoenix

Repealing The Federal Tax Laws Cap On State And Local Tax Salt Deductions Is No Improvement Itep

80 Inspiring Collection Of Information Technology Security Resume Examples Cover Letter For Resume Resume Examples Cover Letter Tips

Salt Deduction Bidens Spending Bill Why A Flat Tax Should Be Considered - Steve Forbes Forbes - Youtube

Tax Deduction Definition Taxedu Tax Foundation

How An 80000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400000 Or Less

Mortgage Interest Deduction Reviewing How Tcja Impacted Deductions

The Salt Deduction The Second-biggest Item In Democrats Budget That Gives Billions To Rich - The Washington Post

Self Employment Tax Rate Higher Income Investing Dividend Income

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained - Vox

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja Deduction Inherited Ira Standard Deduction

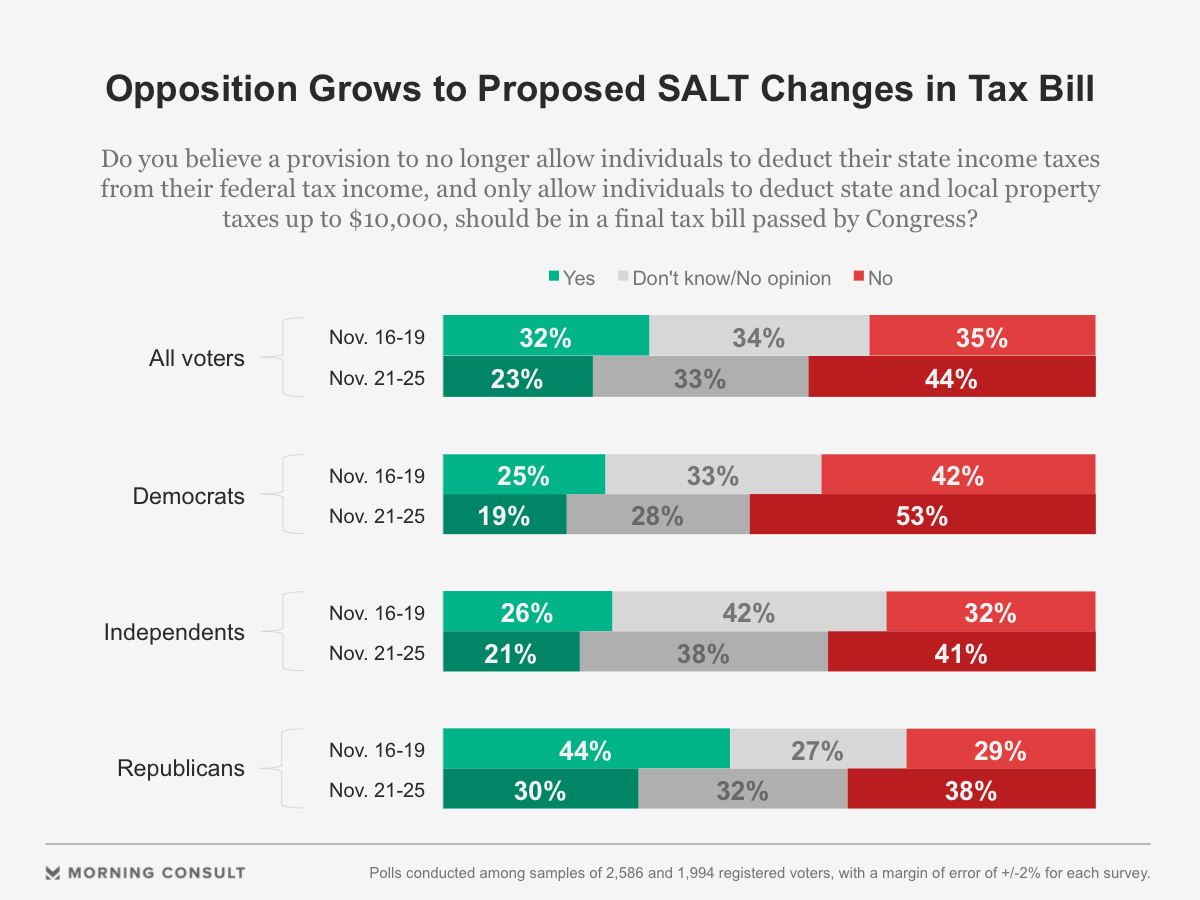

Voters Increasingly Oppose Proposed Salt Deduction Changes

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

The Likely End Of The Salt Tax Deduction Litigation