Questions answered every 9 seconds. It comes in fourth for combined income and sales tax rates at 11.0%, behind new york, new jersey, and connecticut.

Irs Form 540 California Resident Income Tax Return

I'll probably be bombarded with calls, ferrari said.

Owe state taxes california. California is one of 43 states that collects state income taxes and currently has the highest state income tax rate in the u.s. Welcome to the california tax service center, sponsored by the california fed state partnership. I'll probably be bombarded with calls, ferrari said.

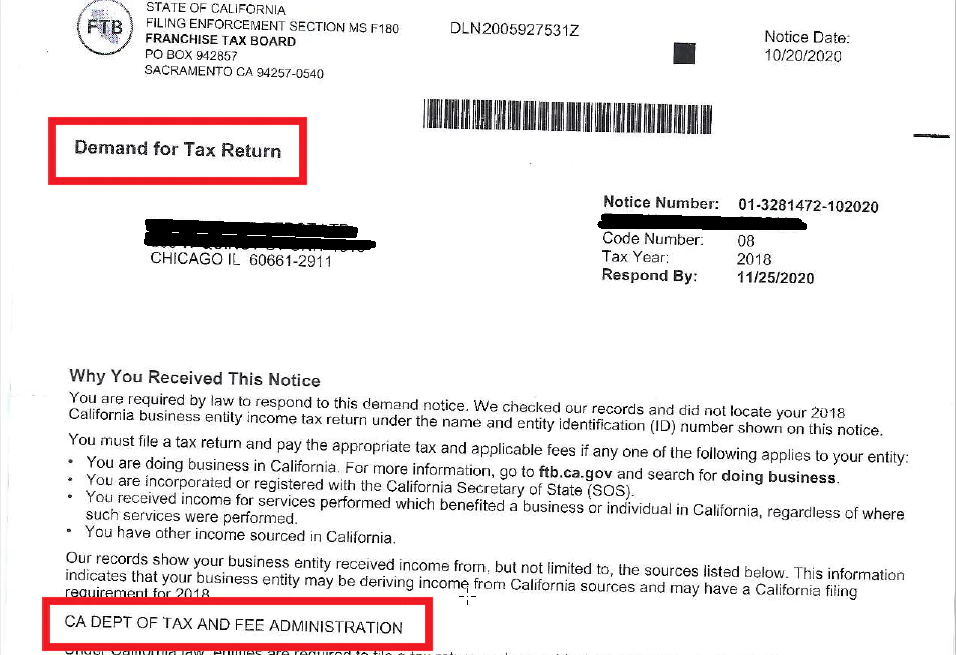

Our partnership of tax agencies includes board of equalization, california department of tax and fee administration, employment development department, franchise tax board, and internal revenue service. Orange county tax preparer of 25 years, maria ferrari, worried her clients may owe the state cash because of the technical glitch. Ftb is required by law to publish a list of the 500 largest tax delinquencies in excess of $100,000 twice a year and update the list when names are removed.

Questions answered every 9 seconds. Just before the trial, california. Do you live in california?

They appealed to the california supreme court. This is similar to the federal income tax system. Include a letter of explanation that describes the issue, including recipient taxpayer name and identification number (ssn or itin).

What is california tax rate 2020? Some states have a flat tax rate on incomes, also known as the fair tax. California state tax rates are 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% and 12.3%….california state tax rates and tax brackets.

I won my case in district court in california, against the california franchise tax board. In all, there are 10 official income tax brackets in california, with rates ranging from as. Here's who must pay california state tax &

Orange county tax preparer of 25 years, maria ferrari, worried her clients may owe the state cash because of the technical glitch. Typo sends man's tax refund to a complete stranger Those who don’t pay their state income taxes contribute to california’s tax gap — the difference between taxes owed and taxes paid.

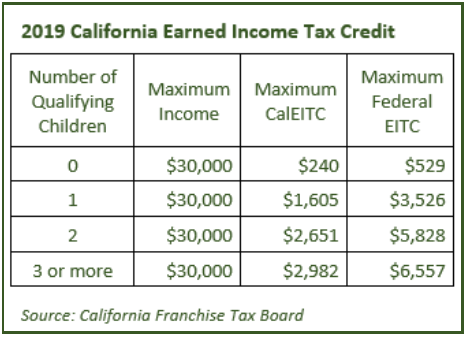

— more than one million taxpayers in california may be owed more money in the way of bigger tax credits, and possibly the golden state stimulus, because of. In pennsylvania, the flat tax rate in 2020 was 3.07%, meaning that someone who earns $100,000 would only pay $3,070 in state income. California state tax rates are 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% & 12.3%.

Ad a tax advisor will answer you now! They appealed to the appeals court. How to pay online to make your payment online.

Payment arrangements can be made for those who are unable to. Sometimes, people don’t pay their taxes. I was in negotiations with the franchise tax board to begin making monthly payments when all of a sudden the levied by b of a bank account and took the $1,500.

California has a progressive income tax, which means rates are lower for lower earners and higher for higher earners. The california franchise tax board is responsible for collecting personal income tax and corporate income tax in the state of california. Orange county tax preparer of 25 years, maria ferrari, worried her clients may owe the state cash because of the technical glitch.

Why do you owe california state taxes? If you received payment and have a problem, follow these steps: California, for instance, has the highest state income tax rate in the united states.

California taxpayers are required to pay their taxes to the ftb. The list is replaced when updated. If so, you’re probably screwed.

This happened about 5 weeks ago. The undersigned certify that, as of july 1, 2021 the internet website of the franchise tax board is designed, developed and maintained to be in compliance with california government code sections 7405 and 11135, and the web content accessibility guidelines 2.1, or a subsequent version, as of the date of certification, published by the web accessibility initiative of the world wide web. Paid too little (you owe taxes) if you expect to owe over a certain amount, you must make estimated tax payments throughout the year.

Paying taxes owed to the state of california can be completed either online, in person, by mail or by telephone. Other problems with your payment. There are 43 states that collect state income taxes.

I owe the state of california back taxes to the approximate tune of $20,000. Its tax sits at 13.3%. An extra 1% may apply.

Ad a tax advisor will answer you now! The different types of taxes you could be paying. Both personal and business taxes are paid to the state franchise tax board.

The undersigned certify that, as of july 1, 2021 the internet website of the franchise tax board is designed, developed and maintained to be in compliance with california government code sections 7405 and 11135, and the web content accessibility guidelines 2.1, or a subsequent version, as of the date of certification, published by the web accessibility initiative of the world wide web consortium at a.

What Are Californias Income Tax Brackets - Rjs Law Tax Attorney

How To Calculate California Sales Tax 11 Steps With Pictures

Letters Ftbcagov

Scv News Lookup Table To Help When Filling Out California Income Tax Return - Scvnewscom

California Tax Forms Hr Block

California Wealth And Exit Tax Would Be An Unconstitutional Disaster - Foundation - National Taxpayers Union

Sco 2020_02summary

I Owe California Ca State Taxes And Cant Pay What Do I Do

2020 Form 540 2ez Personal Income Tax Booklet California Forms Instructions Ftbcagov

How To Calculate California Sales Tax 11 Steps With Pictures

Handling A Ca Franchise Tax Board Ftb Demand Letter For Out Of State Online Sellers Capforge

Blog Upstart Wealth

Understanding Californias Sales Tax

California Ftb Rjs Law Tax Attorney San Diego

The Limits Of Nudging Why Cant California Get People To Take Free Money Planet Money Npr

Californias Tax System A Primer

Wheres My State Refund Track Your Refund In Every State

Understanding Californias Sales Tax

California Use Tax Information