Last day to file property tax exemptions: Payments can be made on this website or mailed to our payment processing center at p.o.

2

Please type the text from the image.

Kern county property tax payment. The first installment of kern county property tax bills will become delinquent if not paid b…. Correspondence must include the assessor tax number and be mailed to: Lien date for the assessment of property on the assessment roll:

Box 541004, los angeles, ca 90054. Tax payments only must be mailed to: See detailed property tax report for 10804 thunder falls ave, kern county, ca.

You must pay your property taxes according to the tax bill you received or penalties and interest will incur. You can pay your property tax using these methods: The 'owner search' is the best way to find a property.

The first installment is due on 1st november with a payment deadline on 10th december. Start by looking up your property or refer to your tax statement. Property tax payment due on by dec.

Kern county property records are real estate documents that contain information related to real property in kern county, california. Fraud, waste, and abuse in kern county government; The first round of property taxes is due by 5 p.m.

Last day to file business property statements without penalty The kern county treasurer and tax collector is warning people not to be late otherwise a. In order to avoid a 10% late penalty, property tax payments must be submitted or postmarked on or before that time.

Pay property taxes | kern county, ca. Last day to pay second installment of regular property taxes (secured bill) without penalty: Kerr county tax office phone:

Select the property view details link. Tax bills were mailed to all property owners whose addresses were on file with the county assessor as of jan. If you inadvertently authorize duplicate transactions for any reason and those duplicate authorizations result in payments returned for insufficient or uncollected funds, an additional $27 returned payment fee for each duplicate transaction will be charged.

Find property assessment data & maps. Property owners are encouraged to make their tax payments online at kcttc.co.kern.ca.us or by mail at: Here you will find answers to frequently asked questions and the most.

If a reduction in assessed value is warranted, a notice of correction and a revised tax bill or refund based on the difference in value will be processed by. No cash payments will be accepted, kaufman said. Do not include correspondence with your payment.

The various payment methods available include mailing a check, cash, or money order to the kcttc payment center, p.o. The first installment of kern county property tax bills will become delinquent if not paid by 5 p.m., friday, dec.10. The california constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

Look up your property here 2. Secured tax bills are paid in two installments: File an exemption or exclusion.

Press enter or click to play code. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a.

2

International Per Diem Rates 2020 Httpsinternationalperdiemrates2020freetaxfreecom Tax Refund Freetax Irs Irs Kern County County Thank You For Dinner

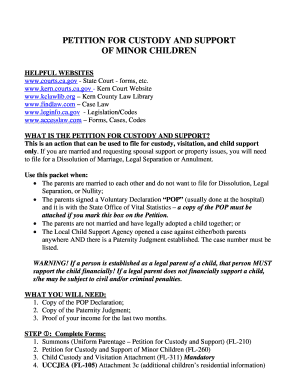

Kern County Court Forms - Fill Online Printable Fillable Blank Pdffiller

Kern County Treasurer And Tax Collector

Kern County Property Taxes Due Next Week Kget 17

Campaign Toolkit United Way Of Kern County

Jordan Kaufman Kern County Treasurer-tax Collector - Home Facebook

2-1-1 Kern County United Way Of Kern County

Kern County Grant Deed Form - Fill Online Printable Fillable Blank Pdffiller

Kern County Treasurer And Tax Collector

Home - Water Association Of Kern County

Kern County Sheriff Restraining Order Form Fill Out Pdf Forms Online

Kern County Clerk

Kern County Treasurer And Tax Collector

Supervisorial District 3 Map Kern County Ca

Jordan Kaufman Kern County Treasurer-tax Collector - Home Facebook

Housing Authority Of The County Of Kern Creating Brighter Futuresone Home One Family At A Time

Kern County Treasurer And Tax Collector

Kern County Property Deeds - Mo5mlcom