, mn sales tax rate. Depending on the zipcode, the sales tax rate of duluth may vary from 8.375% to 8.875%.

Tax Forfeited Land Sales In 2021 St Louis County Pike Lake Land For Sale

Sales tax applies to most retail sales of goods and some services in minnesota.

Duluth mn sales tax 2021. See 2021 sales and use tax law changes to learn about new or expanded sales tax exemptions, june. “(allete's) 2021 full year results are anticipated to be in the range of $3.00 to $3.30 per share, on a consolidated basis, transitioning to increased earnings in 2022 and beyond.” It is based on the total purchase price or fair market value of the vehicle, whichever is higher.

Report the duluth sales and use tax when you report your minnesota sales and use tax. The duluth sales tax rate is %. Refund period is may 1st through may 15th, 2021 please print complete all items

How 2021 sales taxes are calculated in duluth. Duluth use tax is line number 321. Duluth use tax applies when you are located in the city and you buy items or services without paying the duluth.

A new proposed duluth tourism tax allocation list was released today by the mayor's office, with 40. You may owe use tax on taxable goods and services used in minnesota when no sales tax was paid at the time of purchase. There is no applicable county tax.

For tax rates in other cities, see minnesota sales taxes by city and county. So far in 2021, the tax has brought in $9,309,474, which is 35% more than projected. Each local tax is reported on a separate line of your return.

Minnesota sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. The duluth, minnesota sales tax is 8.38% , consisting of 6.88% minnesota state sales tax and 1.50% duluth local sales taxes.the local sales tax consists of a 1.00% city sales tax and a 0.50% special district sales tax (used to fund transportation districts, local attractions, etc). Louis county transit sales use tax and duluth general sales tax are paid to the state of minnesota via the minnesota department of revenue website.

The 55806, duluth, minnesota, general sales tax rate is 8.875%. How 2021 sales taxes are calculated for zip code 55806. Find your minnesota combined state and local tax rate.

The minimum combined 2021 sales tax rate for duluth, minnesota is. When a vehicle is acquired for nominal or no monetary consideration, tax to be paid is based on the average value of similar vehicles. Duluth announces tourism tax allocation plans for organizations in 2022.

The combined rate used in this calculator (8.875%) is the result of the minnesota state rate (6.875%), the duluth tax rate (1.5%), and in some case, special rate (0.5%). This is the total of state, county and city sales tax rates. This amount is in addition to the minnesota sales tax (6.875%), st.

The duluth, minnesota, general sales tax rate is 6.875%. The duluth sales tax is collected by the merchant on all qualifying. Last year visit duluth received $1.5 million from the tourism tax fund.

A salary of $100,000 in harrisburg, pennsylvania should increase to $116,250 in duluth, minnesota (assumptions include homeowner, no child care, and taxes are not considered. You can print a 8.875% sales tax table here. Local tax rates in minnesota range from 0% to 1.5%, making the sales tax range in minnesota 6.875% to 8.375%.

The city of duluth says tourism tax collections for food and. The 8.875% sales tax rate in duluth consists of 6.875% minnesota state sales tax, 1.5% duluth tax and 0.5% special tax. City of duluth treasury division, room 120, city hall, duluth mn 55802‐1187 (218) 730‐5047 2020 tax year sales tax refund for persons 65 years of age or older file by april 30, 2021 :

The december 2020 total local sales tax rate was also 8.875%. The current total local sales tax rate in duluth, mn is 8.875%. Harrisburg, pennsylvania vs duluth, minnesota.

823 rows click here for a larger sales tax map, or here for a sales tax table. The county sales tax rate is %. Duluth mayor emily larson proposes 2022 budget with 6% property tax levy increase larson brought her proposed general fund budget of $97.1 million dollars for next year before council.

Sales tax is due on most purchases or acquisitions of motor vehicles. Louis county transit sales/use tax (0.5%) and duluth general sales tax (1.5%). We also administer a number of local sales taxes.

The minnesota sales tax rate is currently %. 2021 cost of living calculator: Duluth sales tax is line number 320;

Employment Opportunities City Of Duluth Career Pages

610 Sparkman Ave Duluth Mn 55803 - Realtorcom

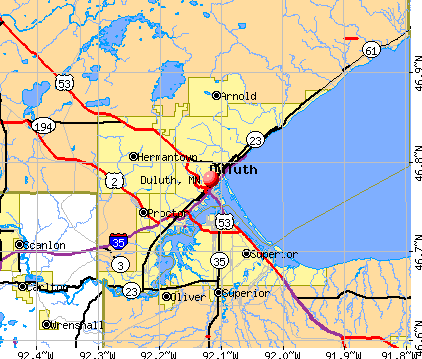

Duluth Minnesota Mn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

4423 Mc Culloch St Duluth Mn 55804 - Realtorcom

1133 Denney Dr Duluth Mn 55805 - Realtorcom

Mill Overlay Of E Superior St- 45th Ave E To 60th Ave E

4202 Minnesota Ave Duluth Mn 55802 - Mls 6097795 - Coldwell Banker

Duluth Minnesota Mn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

1102 E 4th St Duluth Mn 55805 Mls 6099517 Edina Realty

2959 Devonshire St Duluth Mn 55806 - Realtorcom

3818 Gladstone St Duluth Mn 55804 - Realtorcom

Duluth Minnesota Mn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Residential And Commercial Solar Energy In Duluth Mn

2034 Gearhart St Duluth Mn 55811 - Realtorcom

1102 E 4th St Duluth Mn 55805 Mls 6099517 Edina Realty

2333 W 11th St Duluth Mn 55806 - Realtorcom

Treasury

1203 103rd Ave W Duluth Mn 55808 - Realtorcom

Duluth Mn