Using a self employment expense tracker and finding tax deductions are critical to By the way, it’s free.

Bonus Vs Payroll Tax

Federal taxes are progressive (higher rates on higher levels of income), while states have either a progressive tax system or a flat tax rate on all income.

Nh bonus tax calculator. The results are broken up into three sections: Calculates federal, fica, medicare and withholding taxes for all 50 states. Census bureau) number of cities that have local income taxes:

Using the united states tax calculator. If you make $55,000 a year living in the region of new york, usa, you will be taxed $12,213.that means that your net pay will be $42,787 per year, or $3,566 per month. And remember to pay your state unemployment.

Check out our new page tax change to find out how federal or state tax changes affect your take home pay. The maximum an employee will pay in 2021 is $8,853.60. Use this calculator to help determine.

Calculate withholding on special wage payments such as bonuses. Bonus payroll, pay, salary, paycheck calculator, pay check, payroll tax calculator, tax calculators, salary calculator, take home pay calculator, wage calculator. This free, easy to use payroll calculator will calculate your take home pay.

As the employer, you must also match your employees. This new hampshire hourly paycheck calculator is perfect for those who are paid on an hourly basis. Last updated november 27, 2020

There are 8 states which don’t have income tax and 1 state (new hampshire) that has no wage income tax. A calculator to quickly and easily determine the tip, sales tax, and other details for a bill. First, enter your 'gross salary' amount where shown.

A cash bonus is treated similarly to wages, and is taxed as such. (or use the expertise of a tax pro to help you do so.) signing bonus tax. The income tax rate varies from state to state.

Signing bonus taxes would fall in the above category if received via cash gift. Recently accepted a new job? Using deductions is an excellent way to reduce your new hampshire income tax and maximize your refund, so be sure to research deductions that you mey be able to claim on your federal and new hampshire tax returns.

New hampshire hourly paycheck calculator. Next, select the 'filing status' drop down menu and choose which option applies to you. The bonus payroll calculator (percentage method) tags:

This is a popular tax tool, for good reason. This tax withholding estimator works for most taxpayers. Withhold 6.2% of each employee’s taxable wages until they earn gross pay of $142,800 in a given calendar year.

Designed for mobile and desktop clients. Use this app to split bills when dining with friends, or to verify costs of an individual purchase. New employers should use 1.2%.

0% (5% tax on interest and dividends) median household income: It simply refers to the medicare and social security taxes employees and employers have to pay: Valid receipt for 2016 tax preparation fees from a tax preparer other than h&r block must be presented prior to completion of initial tax office interview.

New hampshire income tax rate: If your state doesn’t have a special supplemental rate, see our aggregate bonus calculator. Plan smarter with the help of these payroll tax calculators.

May not be combined with other offers. New hampshire bonus tax percent calculator results. The state has the right to adjust its rates quarterly, so look out for notices to make sure you pay the right taxes each quarter.

Supports hourly & salary income and multiple pay frequencies. Your average tax rate is 22.2% and your marginal tax rate is 36.1%.this marginal tax rate means that your immediate additional income will be taxed at this rate. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local w4 information.

An annual bonus from your employer is always a. Use this calculator to help determine. You will report the bonus as wages on line 1 of tax form 1040.

If you are filing taxes and are married, you have the option to file your taxes along with your partner. In the next section, we'll show you how you can reduce your tax bill with deductible expenses. People with more complex tax situations should use the instructions in publication 505, tax withholding and estimated tax.

Estimate how much you’ll get, or owe, by answering some simple questions about your life, income, and expenses. For 2021, new hampshire unemployment insurance rates range from 0.1% to 7.0% with a taxable wage base of up to $14,000 per employee per year. Below are your new hampshire salary paycheck results.

New hampshire paycheck quick facts. Using the united states tax calculator is fairly simple. Don't feel so intimidated by your tax liability after using our free 1099 taxes calculator.

Taxes On Military Bonuses Military Benefits

New Hampshire Payroll Tools Tax Rates And Resources Paycheckcity

Bonus Tax Calculator Percentage Method Businessorg

Results New Hampshire Bonus Tax Calculator - Percent Paycheckcity

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

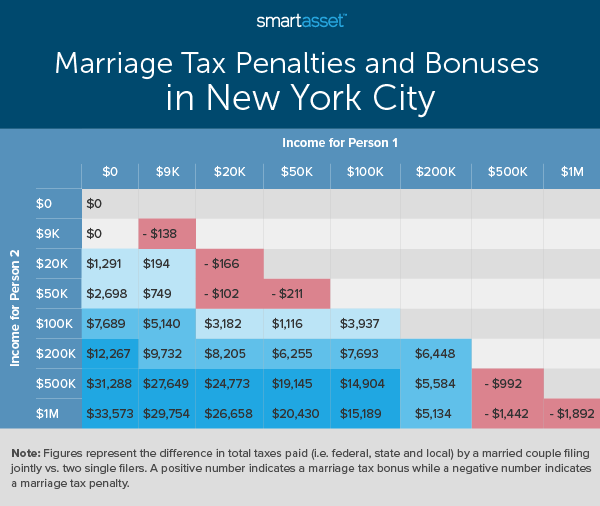

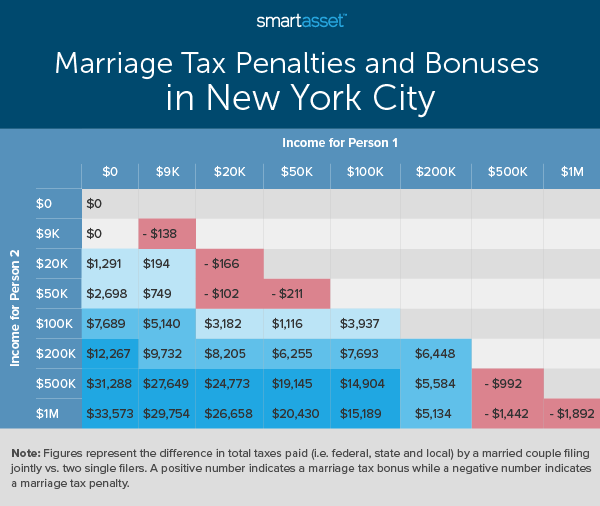

Marriage Tax Penalties And Bonuses In America 2020 Study

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

Llc Tax Calculator - Definitive Small Business Tax Estimator

Bonus Tax Rate Hr Block

Llc Tax Calculator - Definitive Small Business Tax Estimator

Delaware Taxes De State Income Tax Calculator Community Tax

Bonus Tax Rate Hr Block

How Is Tax Liability Calculated Common Tax Questions Answered

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

Free Paycheck Calculator Hourly Salary Usa Dremployee

Llc Tax Calculator - Definitive Small Business Tax Estimator