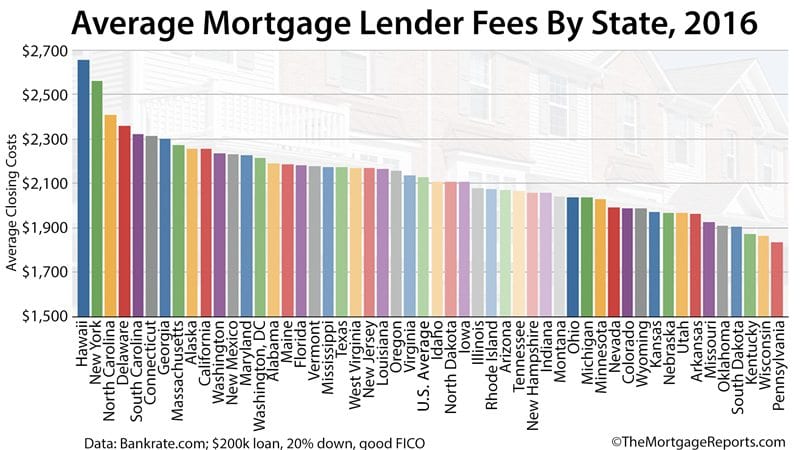

In other words, you can calculate the transfer tax in the following way: State laws usually describe transfer tax as a set rate for every $500 of the property value.

Nyc Nys Seller Transfer Tax Of 14 To 2075 Hauseit

Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property that's changing hands.

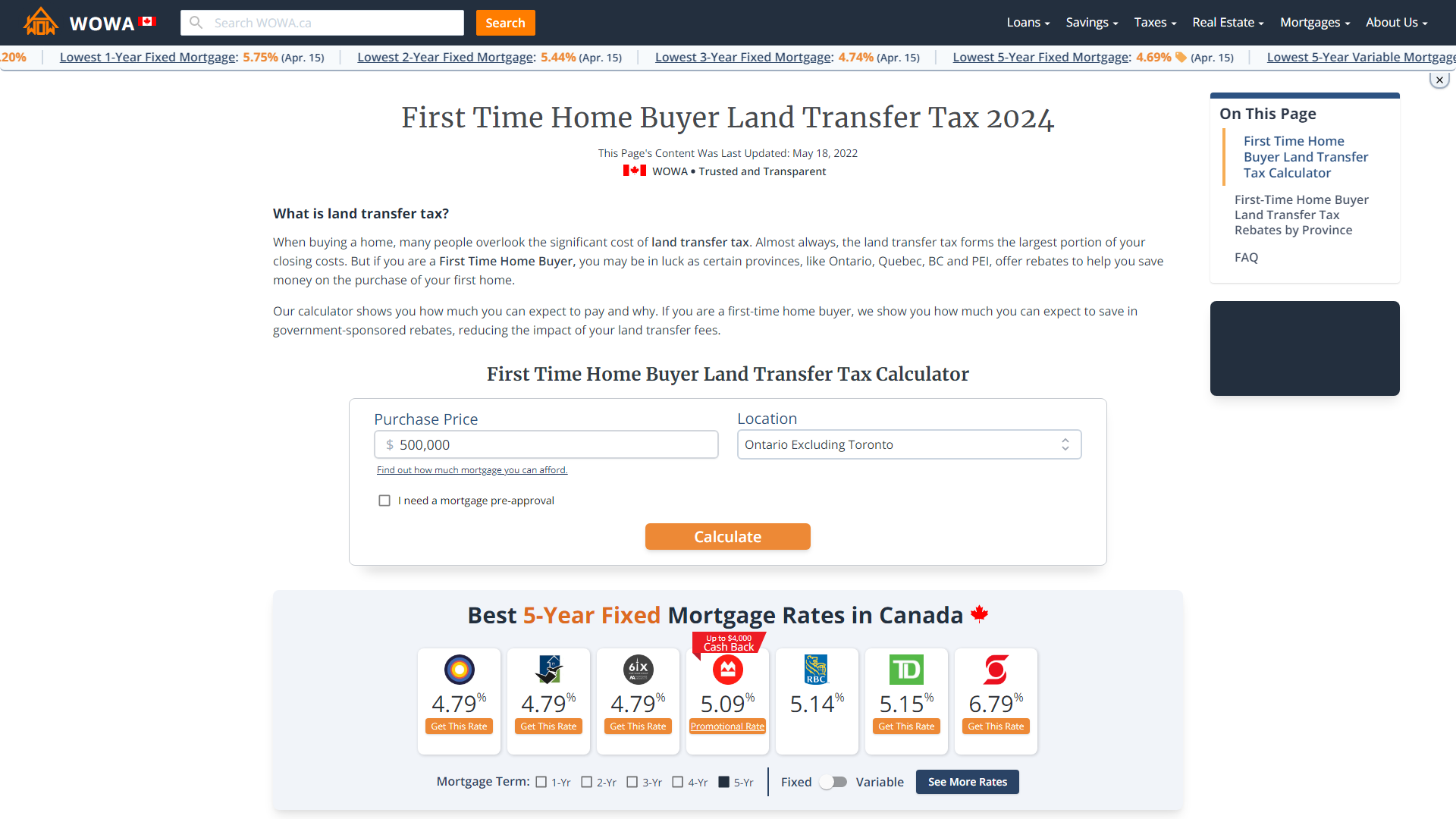

Refinance closing costs transfer taxes. It does not apply to refinances in pa but the lender may have a policy of disclosing in case it applies. For instance, lets assume that you refinance your mortgage for $200,000 and you had $5,000 to close the deal. You can't include in your basis the fees.

There are other costs that could be wrapped up in your mortgage, including taxes and government fees, prepaids, initial escrow payment at closing and more. This tax is usually a small percentage of the value, or. This is what was offered to us.

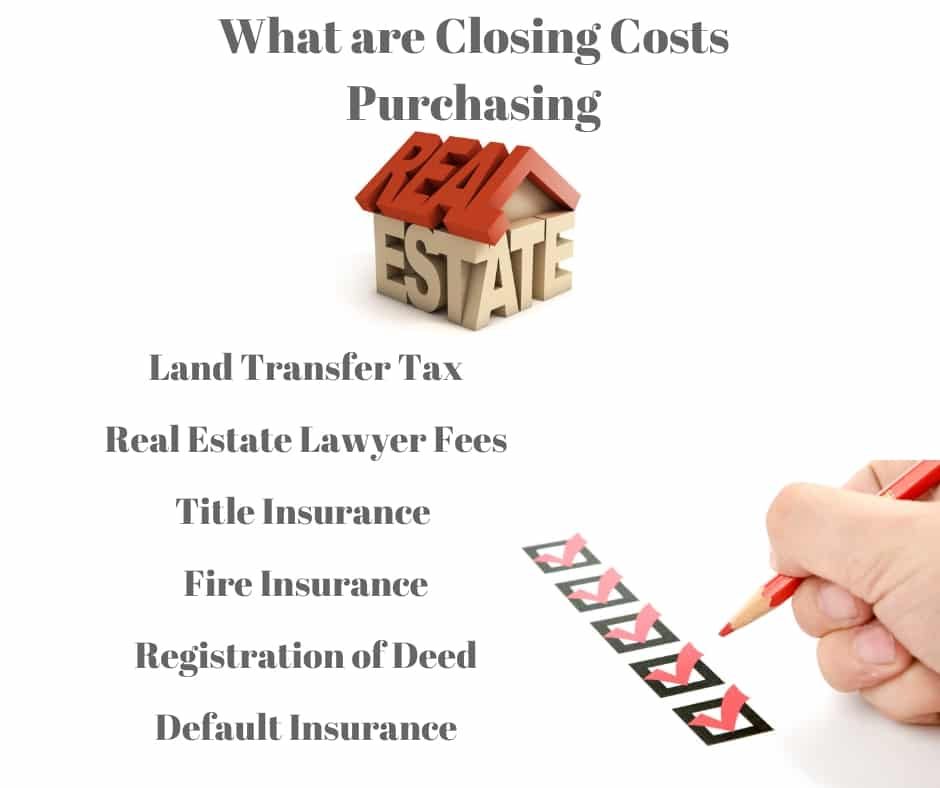

They average about $5,000, according to freddie mac, and include credit report fees, origination fees, appraisal fees, and recording costs. This rate may be different for each minnesota county or wisconsin. Federal title & escrow company.

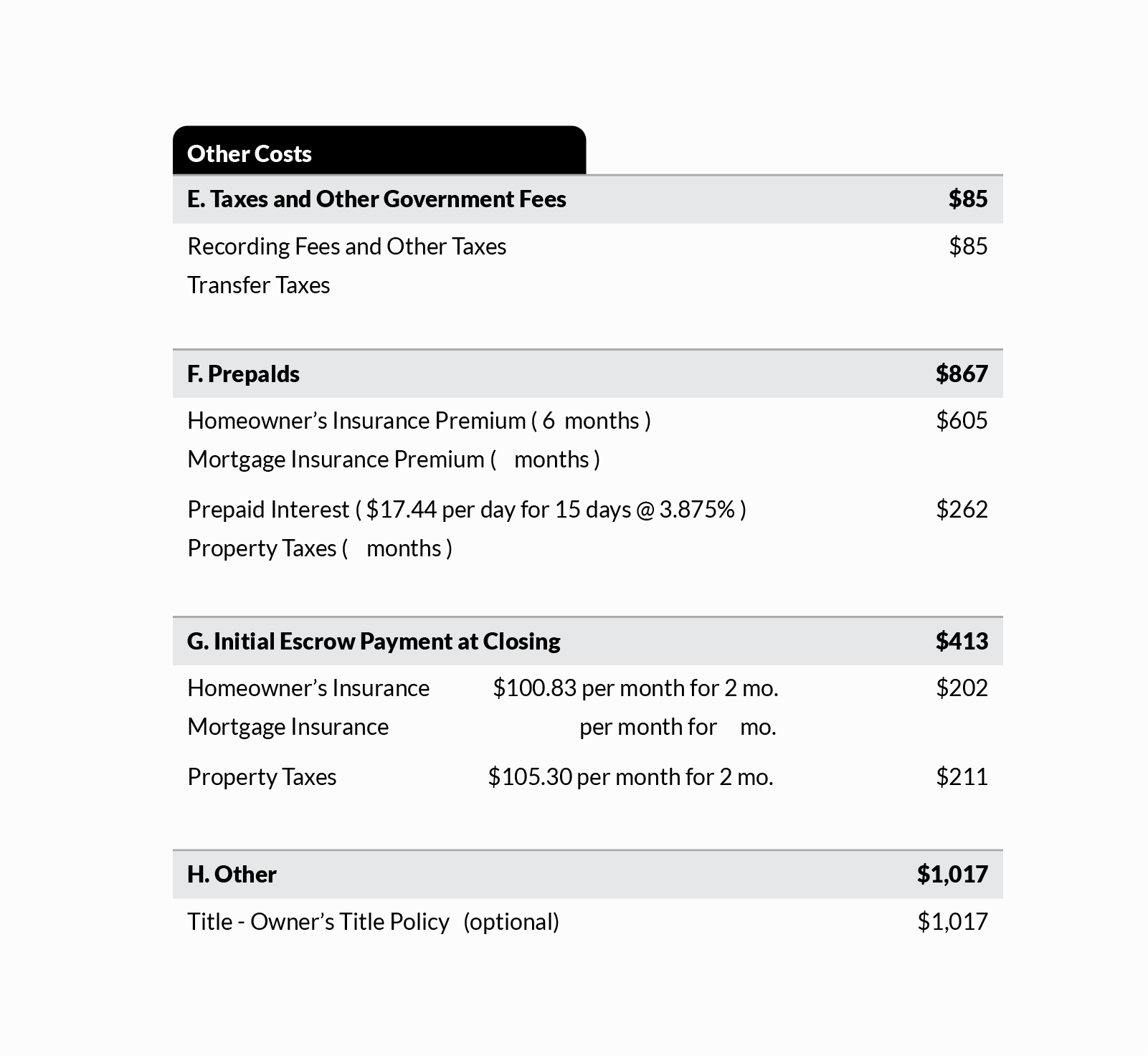

Title policies (both owners and lenders), appraisals, settlement fees, recording fees, land surveys and transfer tax. Average total closing costs with taxes. Connecticut title insurance and transfer tax calculator.

How much are closing costs on a refinance? Anyone have experience with mortgages, specifically closing costs? They include transfer taxes, which are paid when a property changes hands or.

We are proud pioneers of creating a better. The tax is calculated per $100 of 'price', 'loan amount' or 'mortgage amount'. Mortgage refinance closing costs typically range from 2% to 6% of your loan amount, depending on your loan size.

The total cost of a refinance depends on a number of factors like your lender and your home’s value. Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing. These can include the lender’s origination fee, appraisal and inspection fees, title search and insurance fees, and other costs.

Taxes and other government fees: Closing, or settlement, costs are expenses related to the application and loan process. Closing costs on a refinance are similar to the closing costs involved with buying a home.

Other states charge a fee everytime there is a new mortgage recorded. Closingcorp average closing costs are defined as the average fees and transfer taxes required to close a conventional purchase transaction in a geographical area. Unsurprisingly, those fees add up.

If you are using $100,000 of your loan money to do renovations on an investment property, you may deduct 50% of your total closing costs, or $2,500 in this case. Transfer taxes are considered part of closing costs, meaning they are paid out when the home sale is finalized. How much are closing costs on a va loan?

A number of factors determine your specific. Fees for refinancing a mortgage. The amount is $0 when 'minnesota county' is 'other.

Percentage of loan amount (with taxes) dc. (total price/$100) x.70 = doc stamps cost Many counties in minnesota require a conservation fee payment.

If these costs relate to business property, items (1) through (3) are deductible as. Total deed of trust (mortgage) tax :. These costs consist of fees from the following service types:

Total closing costs *recording fees & transfer taxes deed of trust (mortgage) tax : Many states charge a fee/tax when a home is sold, sometimes that is paid by the seller, sometimes by the buyer. Whereas refinance closings costs increased marginally to $2,398, a 4.87% change from the reported 2020 average of $2,287.

In terms of costs, transfer taxes run the spectrum from hundreds to thousands of dollars depending on where the property is located. I don't know if this represents the going rate or if any of it is much higher than it should be. National average closing costs for a refinance are $5,749 including taxes and $3,339 without taxes, according to 2019 data from closingcorp, a real estate data and technology firm.

$ 568,535 $ 13,722 $. Several factors determine how much you can expect to pay in refinance closing costs. You’ll see recording fees here, which are the fees for legally entering the new deed and mortgage into the public records.

Luckily, these fees are a small fraction of the total fees you’ll be paying to close a loan. For instance, the transfer tax in north carolina is. The nice thing about refinancing is that you may not have to pay those costs out of pocket, especially.

This connecticut title insurance and transfer tax calculator will estimate the title insurance rates and transfer tax for one to four family, owner occupied residential units and condominiums. Title insurance rates are filed with the state of connecticut, but not regulated. Average total closing costs without taxes.

Capital expenses incurred during a refinance include owner's title insurance, transfer taxes, surveys, recording fees, legal fees, utility installation expenses, sales commissions and abstract fees.

Refinancing Your House How A Cema Mortgage Can Help

Nyc Nys Seller Transfer Tax Of 14 To 2075 Hauseit

Closing Costs That Are And Arent Tax-deductible Lendingtree

Closing Costs - Suslaw

The Complete Guide To Closing Costs In Nyc Hauseit

Ontario Land Transfer Tax Calculator Real Estate Lawyer Fees 450

First Time Home Buyer Land Transfer Tax Rebate Criteria

What Are Transfer Taxes

Closing Costs - Why They Matter And What You Will Pay

Seller Closing Costs Net Calculator Tutorial

Understanding Mortgage Closing Costs Lendingtree

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Reducing Refinancing Expenses - The New York Times

The Loan Estimate And Closing Disclosure What They Mean - Nerdwallet

No-closing-cost Mortgage Is It Actually Worth It - Credible

Closing Costs Ontario You Must Know Before Buying Or Selling Property

Todays Mortgage Closing Costs Listed For All 50 States

Nyc Mortgage Recording Tax Of 18 To 1925 2021 Hauseit

Understanding Mortgage Closing Costs Lendingtree