Can’t be the dependent of another person. You could be banned from claiming eitc for the next two years.

Earned Income Tax Credit Tax Graph Income Tax Tax Credits Income

Claim the eitc for prior years.

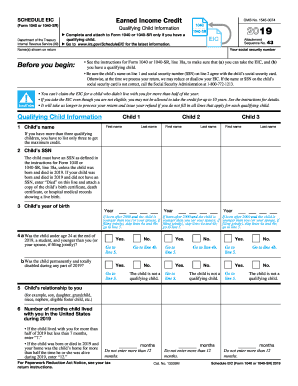

How to claim eic on taxes. Lines 1 through 3 are for the names, social security numbers (or tax identification numbers), and dates of birth for each qualifying child. To prevent filing issues, write your children’s names as they appear on their. If you qualify, efile.com will calculate the correct amount of your credit and fill out the right forms for you to claim it.

Schedule eic line by line. It is still possible to file your tax return for free when claiming the eitc. Start by writing your name at the top of the form.

How to claim the earned income credit on your tax return. If you can claim the eic on your federal income tax return, you may be able to take a similar credit on your state or local income tax return. Other videos from the same category.

If accepted, you will need to file an amended return (1040x) to show the additional form/information. You might need to file form 8862, information to claim earned income credit after disallowance, before you can claim the eic again. 15 has ruled that medicaid waiver payments, even though excluded from income, are still earned income for purposes of claiming refundable tax credits like the additional child tax credit and the earned income tax credit

The only way to claim the earned income tax credit is to file some sort of tax return, so if you haven’t filed before you wouldn’t have had the opportunity to claim these tax credits. The first article in this series discussed the issue of who qualifies for the earned income credit (eic), and the second article outlined how the credit is actually calculated. The earned income credit is one of the best tax credits you can claim.

To claim the earned income credit for last year, you must amend your return by filing tax form 1040x by the later of these dates: If you were eligible, you can still claim the eitc for prior years: If it gets rejected, however, just log back in to your tax return add the form and make any other necessary corrections.

The child doesn’t have to be your dependent.² must be at least age 25 but under age 65 as of december 31.³ filing status can’t be married filing separately. No, the eic is not only for parents. The credit amount is worth more for eligible taxpayers with children, but an eligible person with no dependents can also claim the earned income tax credit.

For 2018, if you file your tax return by april 15, 2022; How do i claim the eitc? For 2017, if you file your tax return by april 15, 2021;

To find out if you were eligible, use the eitc qualification assistant. You will need your 2019 return with your earned income listed to complete this within the program. The investment income limitation has been increased to $10,000

To get the eitc, you must file a tax return, even if you are not required to file taxes, and claim this credit on your return. It can open the door to a larger tax refund. First, eic stands for the earned income credit (or some people call it eitc for earned income tax credit, they’re the same thing.) the key phrase here is “earned income”.

For 2016, if you file your tax return by july 15, 2020; I own my business so i don’t get a w2 but i still earn income. Qualifying child can’t be used by more than one person to claim the eic.

This article will discuss how a taxpayer may claim the credit when he files his annual income tax return with the irs. Within three years from the due date of your original return within two years from the date you paid the tax For tax year 2020, taxpayers impacted by covid19 can elect to use either the 2019 or 2020 earned income to figure the 2020 earned income tax credit or the 2020 child tax credit.

You can not add the form/information to your original tax return once it has been filed and accepted by the irs. The online tax app will automatically determine if you qualify for the earned income tax credit. Affordable, simple taxes await, so be sure to sign up or log in today to get started.

Claiming the eitc is easy if you prepare your tax return on efile.com! You earn income from a job—like working at target, or you might be self employed like me. Simply input your earned income from 2019 when prompted, and we’ll calculate your return both ways to figure which gives you the most eic—and for one flat $25 rate!

The tax court in feigh, (2019) 152 tc no. Claiming the earned income credit is easy with 1040.com. If you do not have your 2019 return, you can request a transcript of the.

How To Claim An Earned Income Credit By Electronically Filing Irs Form 8862

Pin On Organization

What Are The Eic Earned Income Credit Table Amounts 2021 2022

Summary Of Eitc Letters Notices Hr Block

Form 1040 Earned Income Credit Child Tax Credit - Youtube

What Should I Know About The Adoption Tax Credit Tax Credits Income Tax Tax Deductions

Benefits Of The Earned Income Tax Credit Eitc

Qualifying For The Eic - Tax Office Associates

Earned Income Credit Pine Tree Legal Assistance

What You Need To Know About The Earned Income Tax Credit In 2021 Forbes Advisor

What Is The Earned Income Tax Credit Eitc And Do I Qualify For It County 17

Unemployed In 2020 But Need The Eic Use Your 2019 Earned Income

Earned Income Tax Credit Montanalawhelporg Free Legal Forms Info And Legal Help In Montana

Earned Income Tax Credit Things To Know Credit Karma Tax

Earned Income Credit Hr Block

Eic - Frequently Asked Questions Eic

2020 Form Irs 1040 - Schedule Eic Fill Online Printable Fillable Blank - Pdffiller

National Tax Reports Irs Tax Forms Income Tax Return Mean People

Earned Income Tax Credit How To Claim The Eitc In 2021 Nasdaq