You can quickly access latest government news from all province (finance ministry when available) you can use your prefferred canadian language. 3.5% on the hotel room only (not charged on anything else.) then on top of that 5% gst and 9.975 qst (sorry terry, we went to additive sales tax in january).

Get Started With Bim 10 Phases To A Successful Bim Implementation Strategy Infographic Building The Digital Building Information Modeling Strategy Infographic Bim

Calculate quebec residents sales taxes outside canada.

Hotel tax calculator quebec. These prices are based on the lowest standard rates for a double room, excluding taxes and excluding breakfast, unless otherwise specified. A hotel tax of 3%, as well as gst (goods and services tax) of 5% and tvq (quebec sales tax) of 7.5%, are added to. The rate you will charge depends on different factors, see:

The tourism tax rate in alberta is 4% and is called tourism levy tax. Your average tax rate is 22.0% and your marginal tax rate is 35.3%. Below there is simple income tax calculator for every canadian province and territory.

We have a grizzly bear image! 1, 2012 this sales tax is scheduled to raise to 9.5 percent. If you make $52,000 a year living in the region of ontario, canada, you will be taxed $11,432.

Or you can choose tax calculator for particular province or territory depending on your residence. Tax calculation is available for any canadian province. Press “calculate” and you’ll see the tax amount(s) as well as the grand total (subtotal + taxes) appear in the fields below.

Ensure that the “find subtotal (before tax)” tab is selected. The tax on lodging is calculated only on the price of the overnight stay. The qst was consolidated in 1994 and was initially set at 6.5%, growing over the years to the current amount of 9.975% set in 2013.

Collected monthly new york city 14.375% (combined sales, hotel and local taxes) plus $3.50 per night. The accommodation unit is rented to an intermediary (a person, such as a tour operator, who rents it to another person); Here, the gst is la taxe sur les produits et services, or tps, while the provincial sales tax is la taxe de vente du quebec, or tvq.

However, in some provinces, harmonized sales tax (hst) must be used. Sales taxes for quebec residents to other provinces in canada for 2021. Calculating the tax on lodging.

You can now click save to save current calculation. The quebec tax brackets, quebec tax rates, and quebec basic personal amount are used to calculate the quebec income tax calculator. No sales tax have to be applied > reverse calculator of the.

The value of the breakfast, parking or any other services provided with the accommodation unit must be excluded from the price on which the 3.5% tax is applied. Tax billed by the operator of an establishment 3.5% tax on lodging billed on the price of an overnight stay. To calculate the subtotal amount and sales taxes from a total:

2% municipal and regional district tax (mrdt) on lodging in 45 municipalities and regional districts. The province of quebec follows a provincial sales tax model rather than the hst model, so there are two separate taxes to monitor. Tax calculation is also available for canadian territories.

If the physical location of your business is in quebec, you have to file your returns with revenu québec using its forms, unless you are a person that is a selected listed financial institution (slfi) for gst/hst or quebec sales tax (qst) purposes or both. Kelowna's dmf may be 1.5%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

As of 2011, the provincial sales tax in quebec was 8.5 percent; Basically 18.999125% on hotel rooms. Current gst rate for alberta in 2021.

The global sales tax for ab is calculated from goods and services tax (gst) in canada rate (5%) only. Some communities, such as downtown victoria, have an additional destination marketing fee of 1.0% (which i believe is voluntary). If your accounting software is already set up to refer to canadian taxes such as the gst, pst and.

However, it is $3.50 per overnight stay if: Hotel room rates and taxes. The tax on lodging is usually 3.5% of the price of an overnight stay.

In quebec, revenu québec generally administers the gst/hst. Hotels in most parts of bc will be 15% (5% gst, 8% pst (short term accommodaton only), 2% mrdt (formerly known as hotel tax). An intermediary rents an accommodation unit to another person.

This tax calculator is used for income tax estimation.please use intuit turbotax if you want to fill your tax return and get tax rebate for previous year. Current bc personal tax rates in british columbia and federal tax rates are listed below and check. Gst 5%+ pst 7% on most goods and services.

The following table provides the gst and hst provincial rates since july 1, 2010. In quebec, the provincial sales tax is called the quebec sales tax (qst) and is set at 9.975%. Quebec is one of the provinces in canada that charges separate provincial and federal sales taxes.

Select hotels in vancouver levy an additional 1.5 % destination marketing fee (dmf) on top of the 2% mrdt, which makes a total of 3.5% additional taxes on some accommodation in vancouver. In canada each province and territory has its own provincial income tax rates besides federal tax rates. There is no general provincial sales tax pst and not hst (harmonized sales tax) in alberta.

If you are paying on meals the total tax would be 14.975%. Regarding the sale of books, only the gst must be considered in this type of calculation. That means that your net pay will be $40,568 per year, or $3,381 per month.

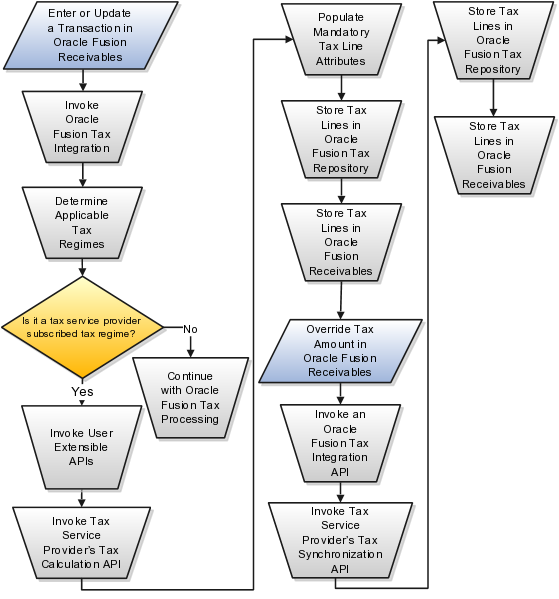

Oracle Fusion Applications Financials Implementation Guide

179 Annuities Photos - Free Royalty-free Stock Photos From Dreamstime

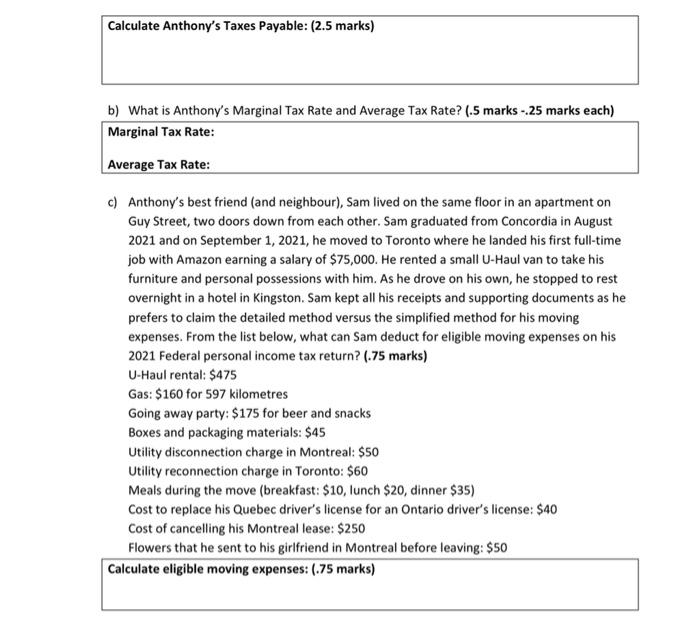

Solved Mini-case B 45 Marksanthony Was Supposed To Cheggcom

Solved 6 Questions Solutionzip This Or That Questions Advertising Costs Electricity Cost

Pin On Books Paper Ephemera Vintage By Gotvintage Shops

![]()

Job Vacancies At Mcdermott In Dubai Dubai Mcdermott Job

How Much Does It Cost To Build A House In Toronto Building A House Building Cost To Build

2

Job Vacancies At Mcdermott In Dubai Dubai Mcdermott Job

2

Ryan Wiley Business Card - Burlington On Mortgage Brokers Mortgage Brokers Mortgage Home Mortgage

179 Annuities Photos - Free Royalty-free Stock Photos From Dreamstime

Download Premium Image Of Budget Planning Bookkeeping Accounting Concept About Tax Wage Cost Control Tax Credit And Bookkeeping 55711 Bookkeeping Services Bookkeeping Bookkeeping And Accounting

Hawaii Income Tax Brackets 2020 Income Tax Brackets Tax Brackets Income Tax

Pin On Books Paper Ephemera Vintage By Gotvintage Shops

Sustainability Free Full-text An Innovative Gis-based Territorial Information Tool For The Evaluation Of Corporate Properties An Application To The Italian Context Html

Canada Provides More Study And Work Permit Flexibility For Candidates Earn Money Online Ways To Earn Money Income Tax

Pin On Orcamentario

The Best Option For Business Owners Will It Be Salary Or Dividends Financial Post