The amount of taxes you have to pay for a transaction depends on your federal tax bracket, how much total income you make in a year, and the time you kept the investment. Stash growth members gain access to roth ira and traditional ira accounts.

Pin On Finances

In order for a user to be eligible for a stash banking account, they must also have opened a taxable brokerage account on stash.

How to report stash on taxes. Stash invest accounts are taxable brokerage accounts. You’ll want to verify that of course, i. Visa is a registered trademark of visa international service.

Go to settings select statements and documents select tax documents to find them on the web: It determines how much credit you can get, the interest rates you pay on your loans, and how much it might ultimately cost you to buy a house or a car, among other things. Before we begin, please note that nothing written in this article should be construed as investment, legal, or tax advice.

This means you will need to pay taxes on money you make through capital gains, dividends, and income interest. Visa is a registered trademark of visa international service. If you do not have a 1099 form from stash, then you do not have anything to report on your tax return.

In order for a user to be eligible for a stash banking account, they must also have opened a taxable brokerage account on stash. Advisory products and services are offered through stash investments llc, an sec registered investment adviser. To start, gather all forms and documentation you received.

If one of the funds in your portfolio increases in value, and you sell that investment at a higher value than you bought it at, you’ve made some money and. In order for a user to be eligible for a stash banking account, they must also have opened a taxable brokerage account on stash. To find them in the app:

To put it another way: In order for a user to be eligible for a stash banking account, they must also have opened a taxable brokerage account on stash. In order for a user to be eligible for a stash banking account, they must also have opened a taxable brokerage account on stash.

Visa is a registered trademark of visa international. Taxact is here to help you navigate all of the additional forms you need to report stocks and investments on your tax return this year. During tax season, stash will mail you a physical copy of all the tax information.

Stash’s highest tier, stash+, adds quite a few more features. Stash will email you when your tax forms become available. The exact percentage you pay is the same as your income tax bracket.

Visa is a registered trademark of visa international. If you have not received a 1099 form from stash, you should check your online stash account to see if a 1099 form has been provided for you. Stash will make your relevant tax documents available online in mid february.

You can access historical documents year round tax documents section of account management. I think you have to report only if you sold stock and then take it out of stash, ie transfer profit or loss back to your bank account. You are required by the irs to report income earned from capital gains and other applicable distributions.

To find them in the app: Go to home screen go to settings select statements and documents select tax documents to find them on the web: Is a digital financial services company offering financial products for u.s.

Each year, stash will send you a tax statement so that you can file your taxes appropriately. In order for a user to be eligible for a stash banking account, they must also have opened a taxable brokerage account on stash. If you will receive stash tax forms, they should be available on or before february 16, 2021, in the stash app or on the web.

Please address specific questions on taxes to. The investments you make with stash are taxed the same way as any other investment. Stash does not monitor whether a customer is eligible for a particular type of ira, or a tax deduction, or if a reduced contribution limit applies to a customer.

Stash is not a bank or depository institution licensed in any jurisdiction. In order to open a stash account, you must be at least 18 years of age. The world’s rich and powerful are stashing $500 billion in this tax haven.

If your capital losses exceed your capital gains in any year, you can use up to $3,000 of your loss to reduce that year’s taxable income and carry the rest forward to offset gains in future. These are based on a customer’s individual circumstances. There are two classifications of capital gains tax:

Visa is a registered trademark of visa international. Visa is a registered trademark of visa international service. Any historical returns, expected returns or probability projections are hypothetical in nature and may not reflect actual future performance.

Your credit score is a key part of your financial life. The forms you’ll be receiving represent your account activity from the previous calendar year or any activity completed to qualify for that year’s contributions. If you do have a 1099 b form, here are the steps to follow to enter any investment gains/losses on sales:

You can access your documents in the tax documents section of your stash profile. You can access your documents in the tax documents section of your stash profile. Stash will email you when your tax forms become available.

South dakota has no members in the bloomberg billionaires index of. Try to improve your credit score by paying bills on time and paying down debt. How to improve your credit score.

Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities. In general, if you hold your investments for longer than a year, you will avoid paying. By itself it is impossible to tell if you owe taxes or not.

How Investments Are Taxed - Stash Learn

Should You Claim 0 Or 1 On Your Tax Return Tax Return Personal Financial Planning Tax

The Stash 1099 Tax Guide

Stash App Taxes Explained - How To File Your Stash Taxes - Youtube

Sp Global Market Intelligence Business Intelligence Solutions Marketing Global Market

Iphone 12 Series-full Price Comparison Of Iphone 12 Iphone 12 Max Iphone 12 Pro Iphone 12 Pro Max Iphone New Iphone Iphone Price

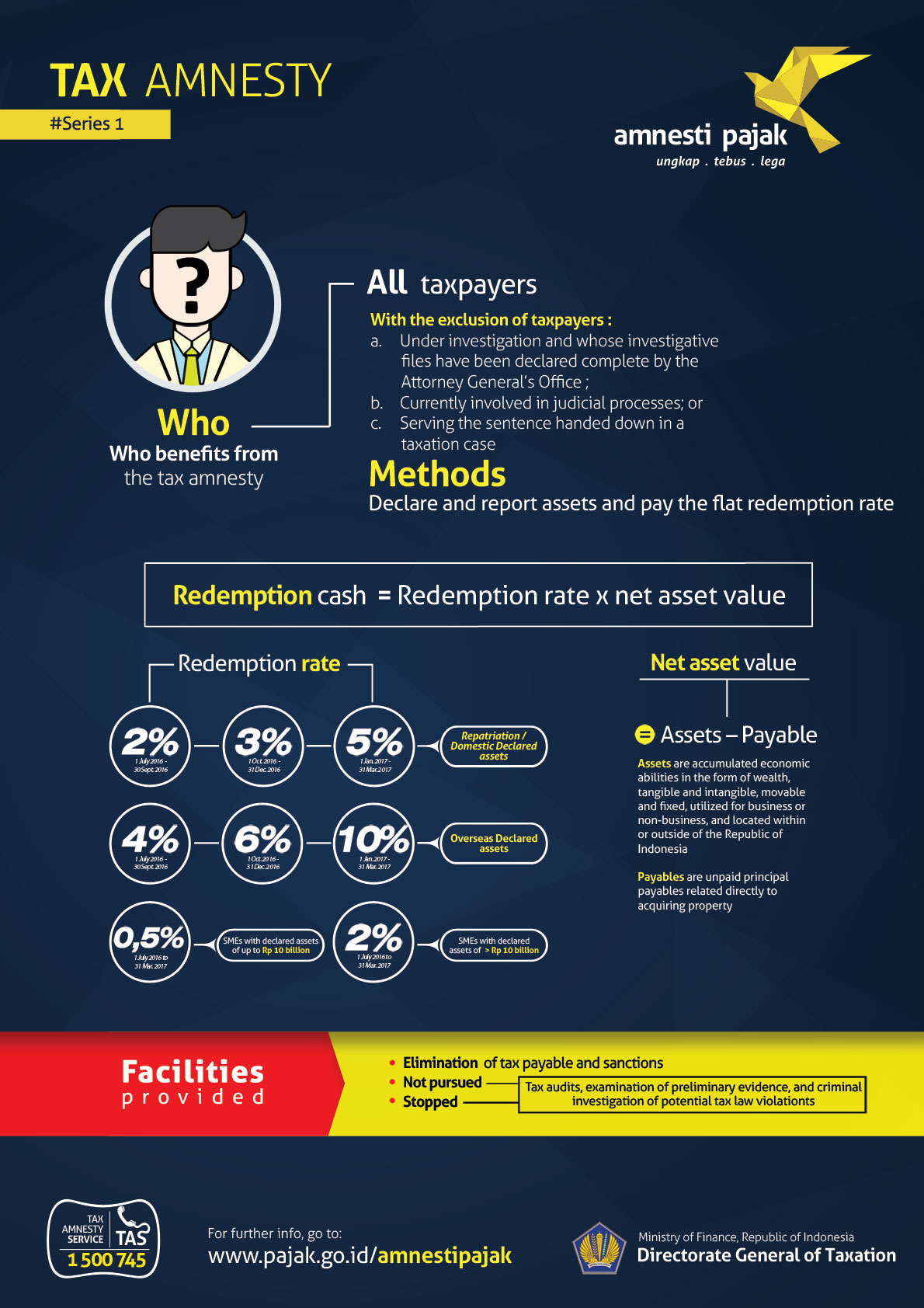

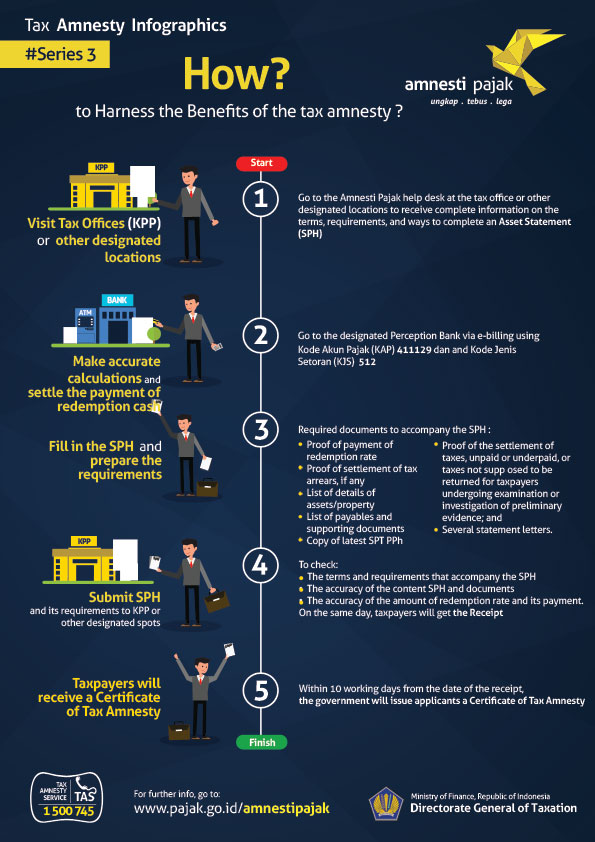

High Hopes On Tax Amnesty

How Us Companies Stash Billions Overseas Tax-free Billmoyerscom Paying Taxes Corporate Tax Rate Us Companies

How To Read Your Brokerage 1099 Tax Form - Youtube

Dustin For 10292016 Comics Kingdom Comics Comic Strips

Corvus Raises 32 Million To Inject Ai Into Insurance Products Risk Management Data Science Tech Marketing

Projected Profit And Loss Template Profit And Loss Statement Statement Template Newsletter Templates

Stash App Taxes Explained - How To File Your Stash Taxes - Youtube

Individual Taxes Return Preparation Service In New York Queens Tax Questions Filing Taxes Free Tax Filing

Free Coins Png Svg Icon Coin Icon Social Media Icons Free Finance Icons

Exploring Crif High Mark Credit Information Services Finance Blog Financial Health Business Rules

High Hopes On Tax Amnesty

Starter Bundle Stash Builder Cloth Sanitary Pad Csp Ecofriendly Cloth Pads Mama Cloth Light 10inch Regular 12inch Heavy Cloth Sanitary Pads Cloth Pads Sanitary Pads

File Comments Against New Crypto Fincen Rule Coin Center Leader Urges Criptomoneda Cadena De Bloques Dinero