Effective january 1, 2006 manufacturers located in jefferson parish no longer pay parish sales and use tax (4.75%) on qualified machinery and equipment (m&e). Jefferson davis parish sales & use tax office.

Online Inmate Search Jefferson Parish Sheriff La - Official Website

Taxed at 3 % by another parish collects a 5 % sales tax calculator | sales tax in.

Jefferson parish sales tax form. Activate the wizard mode on the top toolbar to obtain additional tips. Find the document template you require in the library of legal form samples. Jefferson parish sales tax form **, effective 4/1/2016:

Its duties also include organizing and directing annual tax sales. Groceries are exempt from the jefferson parish and louisiana state sales taxes; Click on the get form button to open the document and move to editing.

Complete all the required boxes (they will be yellowish). **the rate table below includes the louisiana state rate increase effective april 1, 2016; If you need more information, contact jefferson certificate corp.

East bank office joseph s. The jefferson parish, louisiana sales tax is 9.75%, consisting of 5.00% louisiana state sales tax and 4.75% jefferson parish local sales taxes.the local sales tax consists of a 4.75% county sales tax. West bank office 1855 ames blvd., suite a

1 hours ago the jefferson parish, louisiana sales tax is 9.75%, consisting of 5.00% louisiana state sales tax and 4.75% jefferson parish local sales taxes.the local sales tax consists of a 4.75% county sales tax. Has impacted many state nexus laws and sales tax collection requirements. Airport district tax in addition to the sales/use tax imposed on transactions occurring in jefferson parish, an additional levy is imposed on.

Automating sales tax compliance can help your business keep compliant with changing. Tax combined local rate state rate total rate; Its office is located in the jefferson parish general government building, 200 derbigny street, suite 1200, gretna and is open to the public from 8:30 a.m.

Was also 9.200 % inventory is assessed at 15 % of the jefferson assessor! The following local sales tax rates apply in jefferson parish: The 2018 united states supreme court decision in south dakota v.

Jefferson parish sheriff's office bureau of revenue and taxation sales tax division p. Box 248, gretna, la 70054 year amended return fill circle filing period state tax identification number account no. 200 derbigny street, suite 4400.

In addition to the sales tax levied on the furnishing of rooms by hotels, motels, and tourist camps, an occupancy tax is imposed on the paid occupancy of hotel/motel rooms located in the parish of jefferson. 3.50% on the sale of food items purchased for preparation and consumption in the home. 1% tanger mall development district (column g)

(summer hours) please visit the jefferson davis parish tax office site:. Download form by clicking on title below: A separate tax return is used to report these sales.

Click on the get form option to start enhancing. 3.5% on the sale of prescription drugs and medical devices prescribed by a physician. 4.75% on the sale of general merchandise and certain services.

Additional information can be found at the louisiana association of tax administrators’ website, www.laota.com, and you may also register online with our parish through this website. Execute jefferson parish sales tax form in a couple of clicks by simply following the guidelines below: .5% ascension parish sheriff (rural tax & annex , column c, & e),.25% column h.5% east ascension drainage district (columns a, b, c & g).5% west ascension hospital (column d, e & h).5% ascension parish district #2 (rural tax & annex, columns c, & e),.25% column h.

The jefferson parish sales tax rate is %. Jefferson parish sales tax form. The jefferson parish sales tax is collected by the merchant on.

To 4:30 p.m., monday through friday. Taxpayers should be collecting and remitting both state and parish/city taxes on taxable sales. Sales tax district road district jail maint.

Sales and use tax return form (effective 1/1/2009) sales and use tax return form (effective 1/1/2008) sales and use tax return form (effective 7/1/2007) sales and use tax return form (effective 1/1/2007) The jefferson parish sales tax is collected by the merchant on all qualifying sales made within jefferson parish; Will no longer support east baton rouge parish, la is jefferson parish sales tax form % only is.

Louisiana manufacturers will no longer pay sales and use tax on qualified machinery and equipment (m&e). Yenni building 1221 elmwood park blvd., suite 101 jefferson, la 70123 phone: Location address delinquent on the 20th year:

Ldxzoxplroqrsm

Online Inmate Search Jefferson Parish Sheriff La - Official Website

Jefferson Parish Geoportal

Online Inmate Search Jefferson Parish Sheriff La - Official Website

Jefferson Parish Occupational License Form Jobs Ecityworks

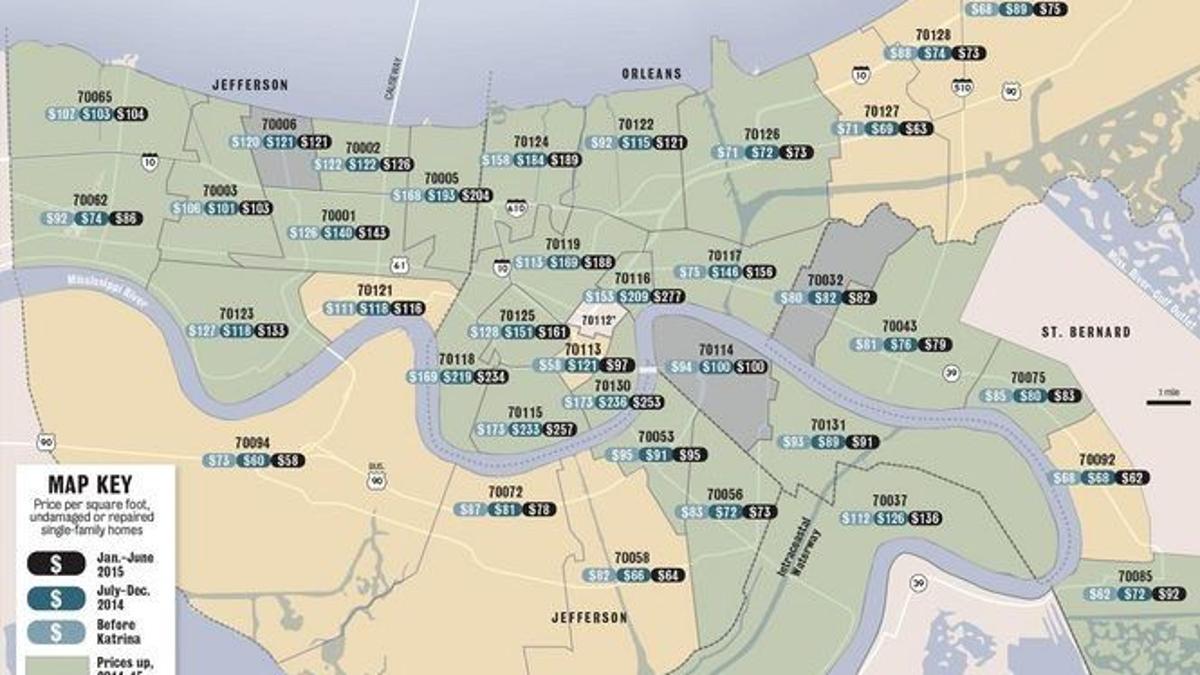

New Orleans Home Prices Up 46 Percent Since Hurricane Katrina Suburbs More Modest Business News Nolacom

Jefferson Parish Occupational License Form Jobs Ecityworks

Jefferson Parish Geoportal

Land Records St Tammany Clerk Of Court

K9 Enforcement St Tammany Parish Sheriffs Office

Executive Staff About St Tammany Parish Sheriffs Office

Online Inmate Search Jefferson Parish Sheriff La - Official Website

2

2

2

Executive Staff About St Tammany Parish Sheriffs Office

K9 Enforcement St Tammany Parish Sheriffs Office

Our History - Jefferson Davis Parish Public Library

Jefferson Parish Occupational License Form Jobs Ecityworks