The second installment will be due february 1, 2022 and will be delinquent if. Questions answered every 9 seconds.

California Sales Tax - Small Business Guide Truic

The 2018 united states supreme court decision in south dakota v.

Orange county ca sales tax. How 2021 sales taxes are calculated in orange. The orange county sales tax rate is %. The first installment will be due november 1, 2021 and will be delinquent if paid after december 10, 2021.

Orange county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in orange county, california. Sales tax in california varies by location, but the statewide vehicle tax is 7.25%. The county has a sales tax of 9.5%.

The orange county sales tax is collected by the merchant on all qualifying sales made. If you need access to a database of all california local sales tax rates, visit the sales tax data page. This is the total of state and county sales tax rates.

The state of california currently charges a sales tax rate of 6%. 1305 rows lowest sales tax (7.25%) highest sales tax (10.75%) california sales tax: View 10 years of tax bills and 2 years of payments.

The orange county, california sales tax is 7.75%, consisting of 6.00% california state sales tax and 1.75% orange county local sales taxes.the local sales tax consists of a 0.25% county sales tax and a 1.50% special district sales tax (used to fund transportation districts, local attractions, etc). The current total local sales tax rate in orange county, ca is 7.750%. Within the county, a handful of cities charge a higher sales tax.

Questions answered every 9 seconds. The orange county sales tax rate is 0.25%. Where california sales tax money goes the state of california keeps 6.00% of the sales tax collected and the additional 1.25% goes to the county (1%) and city (.25%) funds.

Brandeis is the owner of brandeis & associates, llc. 141 sales tax jobs available in orange county, ca on indeed.com. Orange county collects an additional 0.50% which brings the orange county sales tax.50% higher than the state minimum sales tax of 7.25%.

Tax certificate sale real estate taxes become delinquent on april 1 of each year. The combined sales tax rate imposed by the state and the county presently stands at 7.75%. The california state sales tax rate is currently %.

Of the 7.25%, 1.25% goes to the county government. This is the total of state and county sales tax rates.the california state sales tax rate is currently 6%. 1788 rows california city & county sales & use tax rates (effective october 1,.

The minimum combined 2020 sales tax rate for orange county, california is 7.75%. Pay/review/print property tax bill & related information. Property taxes in california are limited to 1% of a property’s market value, and its annual increase is restricted to 2%.

As an example, consider los angeles county. The orange, california, general sales tax rate is 6.5%.depending on the zipcode, the sales tax rate of orange may vary from 6.5% to 7.75% every 2021 combined rates mentioned above are the results of california state rate (6.5%), the county rate (0.25%), and in some case, special rate (1.5%). Review or pay current/previous year taxes.

The december 2020 total local sales tax rate was also 7.750%. Ad a tax advisor will answer you now! On or before june 1, the tax collector must conduct […]

Apply to inside sales representative, closer, tax professional and more! To pay property taxes in person at the county service center, click here for parking options during construction. California has a 6% sales tax and orange county collects an additional 0.25%, so the minimum sales tax rate in orange county is 6.25% (not including any city or special district taxes).

The advertising and collection cost is added to the delinquent bill. While california is not one of the states with the lowest property taxes, it’s not far behind with an average of 0.73% and 0.69% in oc. Orange county also assesses a sales tax for some items, including a standard rate of a quarter of a percent and a special tax rate of 1.5%.

The local government, cities, and districts collect up to 2.5%. On top of the state’s minimum sales tax, individual counties and cities also charge a sales tax. After real estate taxes become delinquent, they are advertised in a local newspaper once per week for three consecutive weeks.

This table shows the total sales tax rates for all cities and towns in orange. There is no city sale tax for orange. These records can include orange county property tax assessments and assessment challenges, appraisals, and income taxes.

Ad a tax advisor will answer you now! California has 2,558 cities, counties, and special districts that collect a local sales tax in addition to the california state sales tax.click any locality for a full breakdown of local property taxes, or visit our california sales tax calculator to lookup local rates by zip code. The minimum combined 2021 sales tax rate for orange county, california is.

Only about a quarter of the cities in california actually charge a sales tax of 7.25%. The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. Property taxes in california and orange county explained.

California Sales Tax Rates By City County 2021

Transfer Tax - Who Pays What In Orange County California

Understanding Californias Property Taxes

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Understanding Californias Property Taxes

Understanding Californias Property Taxes

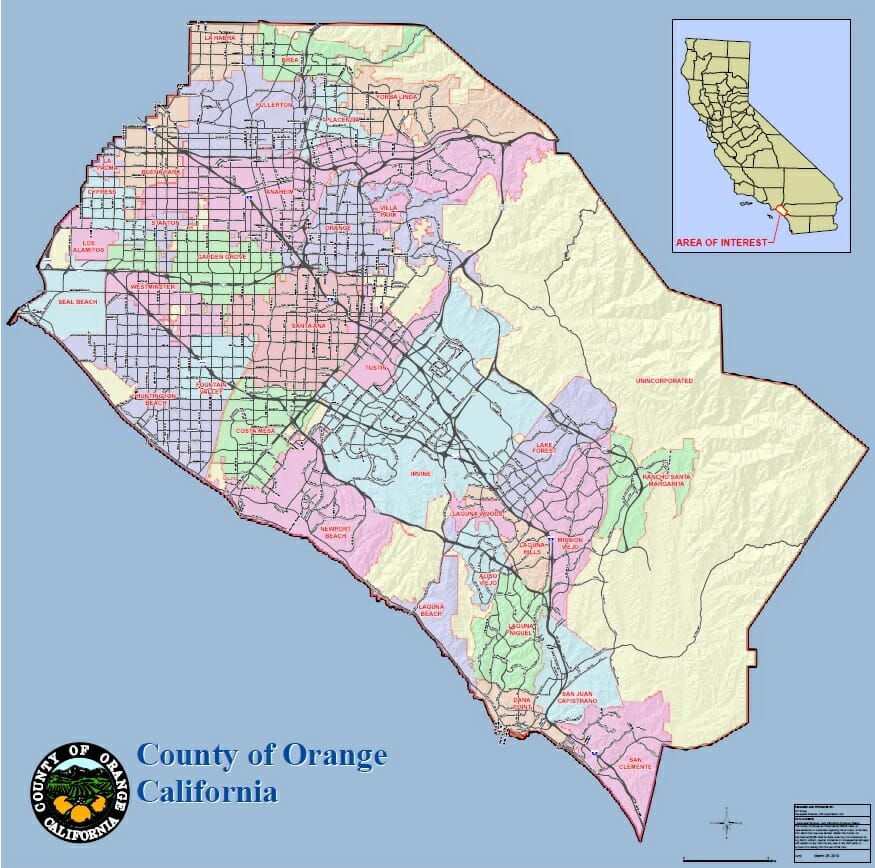

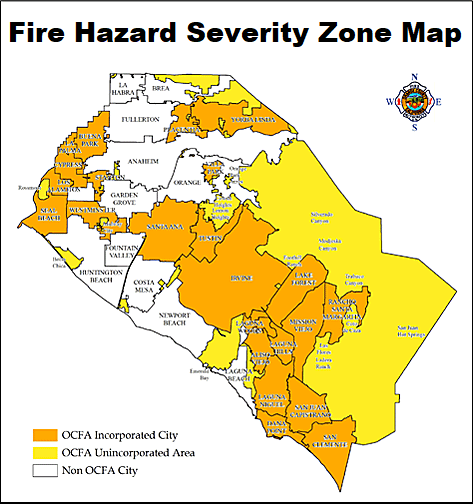

Orange County Maps Enjoy Oc

Understanding Californias Sales Tax

Orange County Homes With No Mello Roos Orange County Mello Roos Properties

Will You Pay More For Weed Than Your Friends It May Depend On Your Citys Taxes - Los Angeles Times

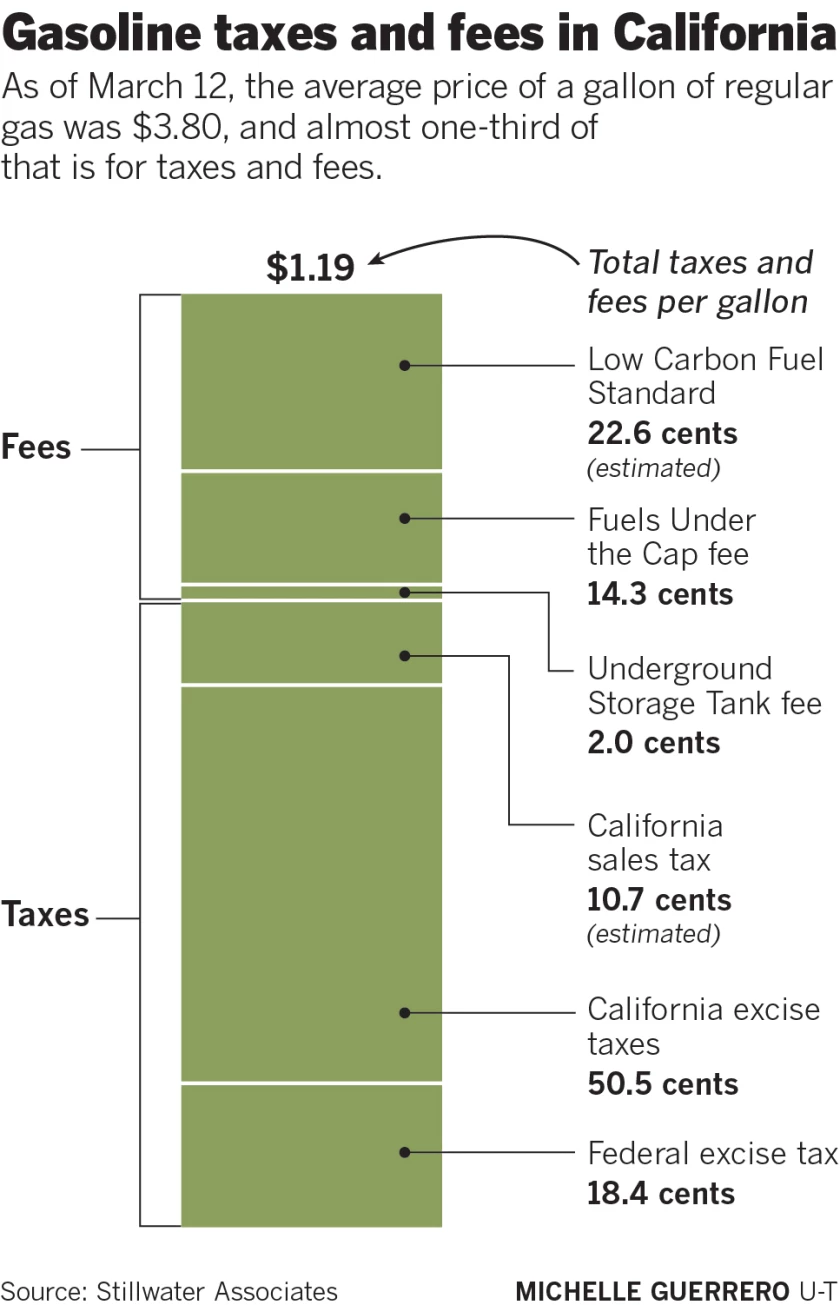

How Much Are You Paying In Taxes And Fees For Gasoline In California - The San Diego Union-tribune

Understanding Californias Property Taxes

Sales Tax In Orange County Enjoy Oc

Orange County Maps Enjoy Oc

Food And Sales Tax 2020 In California Heather

Understanding Californias Property Taxes

Transfer Tax - Who Pays What In Orange County California

California Sales Tax - Small Business Guide Truic

Orange County Maps Enjoy Oc