The american taxpayer relief act of 2012 (atra) made permanent the portability of estate tax exemption between spouses. The portability of a deceased spouse’s unused estate tax exemption is an important concept and is even more so in 2020, which is a pivotal year in so.

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

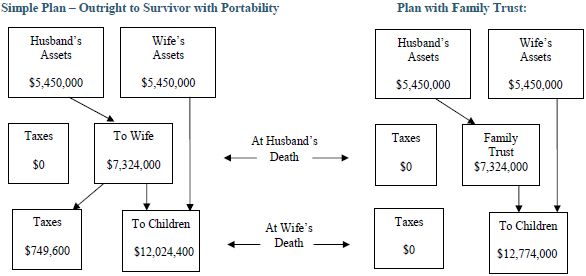

Two important aspects to remember are that the portability exemption is only available to married couples and only applies to federal estate taxes.

Portability estate tax exemption. The surviving spouse can use the unused portion of the predeceased spouse’s estate and gift tax exemption, After all, electing “portability” could mean that a surviving spouse could have double the estate tax exemption at the second death (currently $5,430,000 x 2 = $10,860,000). Later, in january of 2013, president obama signed another important piece of legislation into law, the american taxpayer relief act (atra).

The current estate tax exemption is $5,250,000 for each decedent. The concept of portability of a person's unused gift and estate tax exemption became law. Since 2010, the portability rule allows any unused lifetime estate and gift tax exemption of a deceased spouse to be transferred to the surviving spouse, ensuring it isn’t lost.

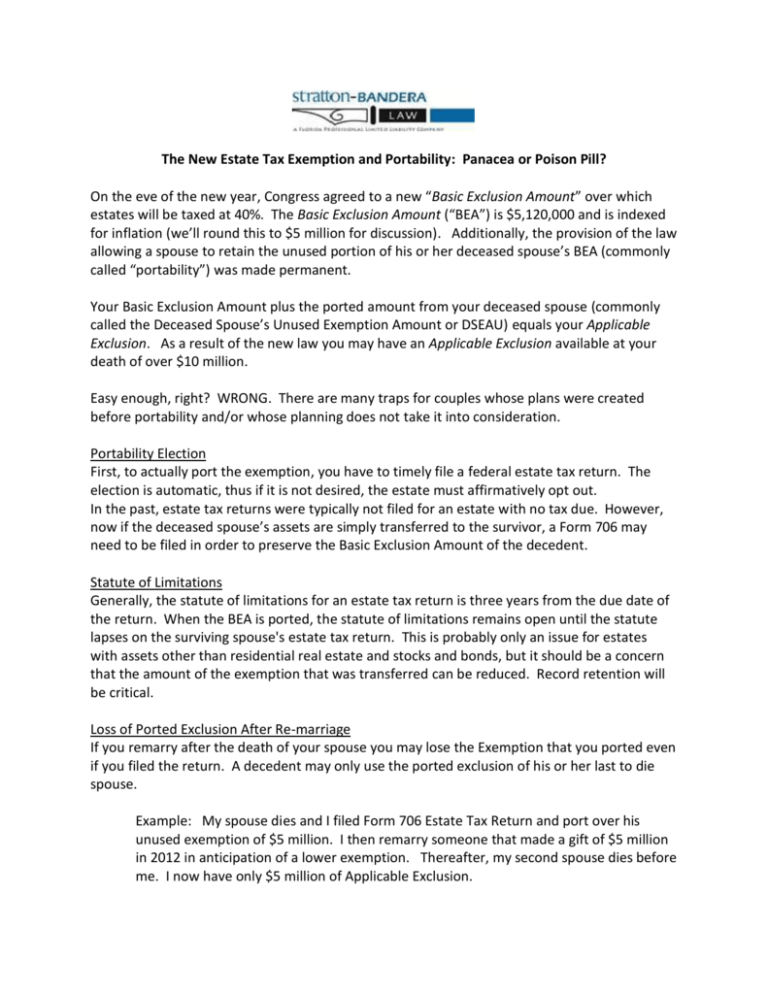

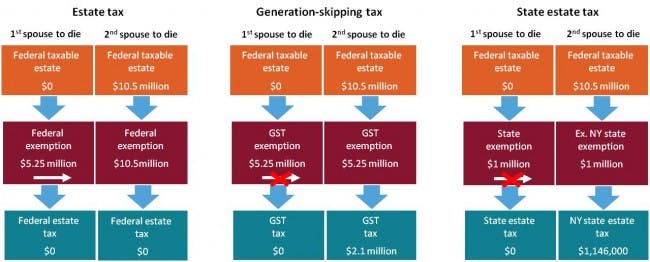

If one spouse dies before another and doesn’t use 100% of his/her estate tax exemption, the surviving spouse can use the remaining. The need for splitting the estate into “marital” and “credit shelter”. The portability feature means that when one spouse dies and his or her estate value does not use up to the total available estate tax exemption, the unused portion of the estate tax exemption is then added to the available estate tax exemption for the.

The option of portability can make a significant difference when it comes to taxation of an estate. The 2010 tax act provided that a person could use the gift and estate tax exemption not used by his or her deceased spouse, in addition to his or her own exemption. That is, the irs has years from the initial three filing deadline to challenge the estate tax return.

If the estate representative did not file an estate tax return within nine months after the decedent's date of death, or within fifteen months of the decedent's date of death (if a six month extension of time for filing the estate tax return had been obtained), the availability of an extension of time to elect portability of the dsue amount depends on whether the estate has a filing requirement,. How does estate tax portability work? So what does “portability” of the estate tax exemption mean?

More specifically, it’s a process where a surviving spouse can pick up and use the unused estate tax exemption of a deceased spouse. Portability, an estate planning tool available only to married couples, is the ability of a surviving spouse to receive or “port over” the unused estate tax exemption from the deceased spouse. In simple terms, portability of the federal estate tax exemption between married couples comes into play if the first spouse dies and the value of the estate does not require the use of all of the deceased spouse’s federal exemption from estate taxes.

Many older estate plans were based upon an assumption that the combined estates of spouses would exceed the estate tax exemption, which prior to 2000, was $675,000, and as late as 2008 had only increased The “portability election” refers to the right of a surviving spouse to claim the unused portion of the federal estate tax exemption of their deceased spouse and add it to the balance of their own exemption. However, if the estate tax return includes an election to allow portability of the dsue amount to the surviving spouse, then the time limit on when the irs can review

Limitations for a properly filed estate tax return is three years. Tax portability is a helpful tax benefit that should be considered when crafting your estate plan. The atra made the portability of the estate tax permanent.

The portability of the federal estate tax exemption for married couples eliminated the need to plan in such a way. The portability of the federal estate tax exemption was introduced along with other significant changes to estate tax rules. Portability of the estate tax exemption the american tax relief act of 2012 (atra) signed into law on january 3, 2013, by president obama extended the opportunities for “portability” of a decedent’s unused estate tax exemption.

Estate tax portability applies to married couples only. Since in 2015 the federal estate tax exemption is $5.43 million per person (the exemption changes every year since it is indexed for inflation), this means that a married. For example, if the deceased spouse died in 2021 and did not use all of his/her $11.7 exemption during lifetime (such as by transferring property.

Exemption amounts with yet further increases due to inflation. Portability allows a surviving spouse the ability to transfer the deceased spouse’s unused exemption amount (dsuea) for estate and gifts taxes to a surviving spouse, so long as the portability election is made on a timely filed federal estate tax return (irs form 706). Sim ply put, portability is a way for spouses to combine their exemption from estate and gift tax.

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

The Portability Of The Estate Tax Exemption

Exploring The Estate Tax Part 2 - Journal Of Accountancy

Portability In Estate Tax Exemptions

Is Ab Trust Planning Still Effective

Form 706 Extension For Portability Under Rev Proc 2017-34

The New Estate Tax Exemption And Portability Panacea Or Poison

Credit Shelter Trusts And Portability Eagle Claw Capital Management

Rbcwm-usacom

A Guide To Estate Planning - Family And Matrimonial - United States

Estate Planning With Portability In Mind Part Ii The Florida Bar

Adler Adler Portability Of Estate Tax Exemption

Portability Becomes Permanent - Baker Tilly

Mastering Portability - Ultimate Estate Planner

Federal Estate Tax Portability - The Pollock Firm Llc

Estate Tax Portability Preserving It For The Benefit Of Your Heirs

Form 706 Extension For Portability Under Rev Proc 2017-34

What Surviving Spouses Need To Know About The Marital Portability Election Natural Bridges Financial Advisors

Portability - How It Works For Estate Tax - Batson Nolan