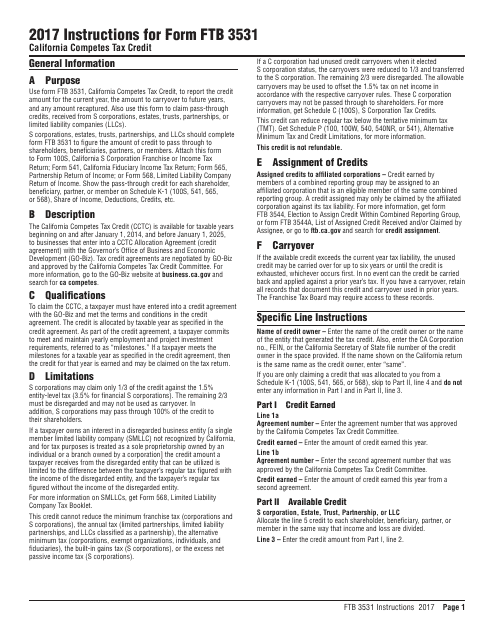

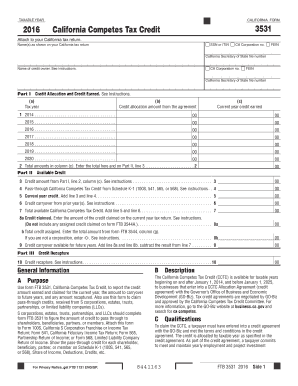

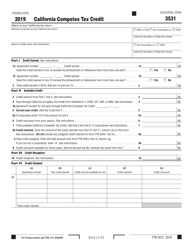

Use form ftb 3531, california competes t ax credit, to report the credit amount earned and claimed for the current year , the amount to carr yover to future years, and any amount recaptured. Paid preparer’s california earned income tax credit.

Review Of The California Competes Tax Credit

You can print other california tax forms here.

California competes tax credit form. We will update this page with a new version of the form for 2022 as soon as it is made available by the california government. Please send us your information to know what is the best way to help you. More about the california form 3531 tax credit.

Sorrento awarded california competes tax credit. Instructions for 3593 form, extension of time for payment of taxes by a corporation expecting a net operating loss carryback: Tax credit agreements will be negotiated by the governor’s office of business and economic development and approved by the california competes tax credit committee.

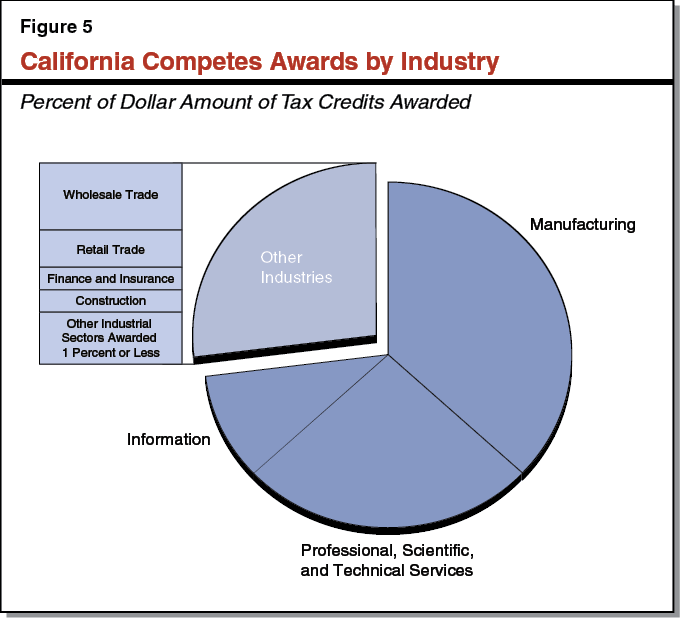

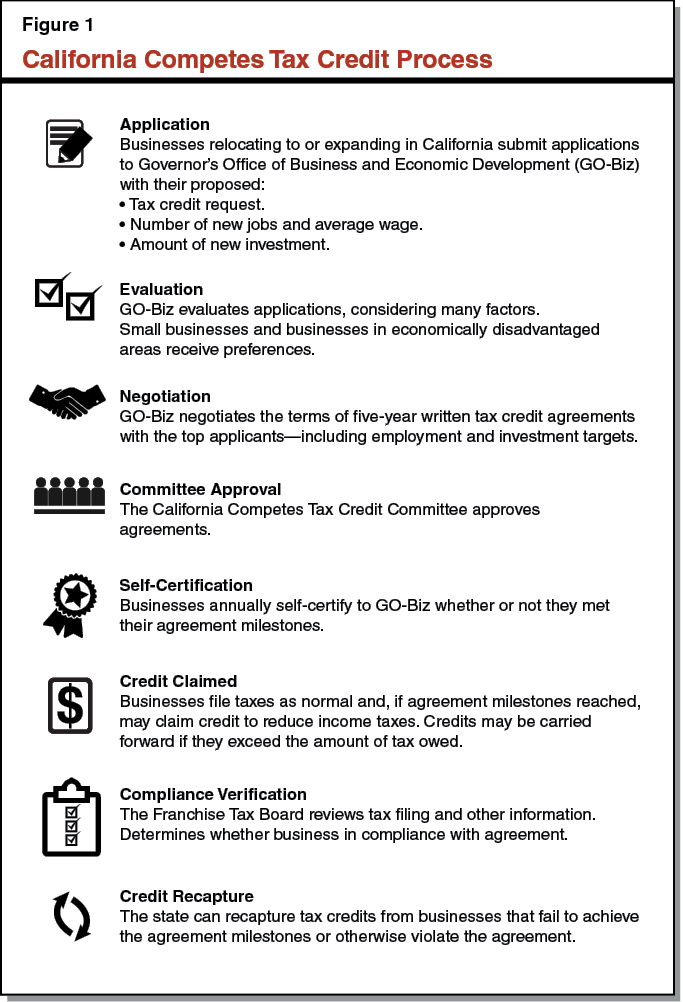

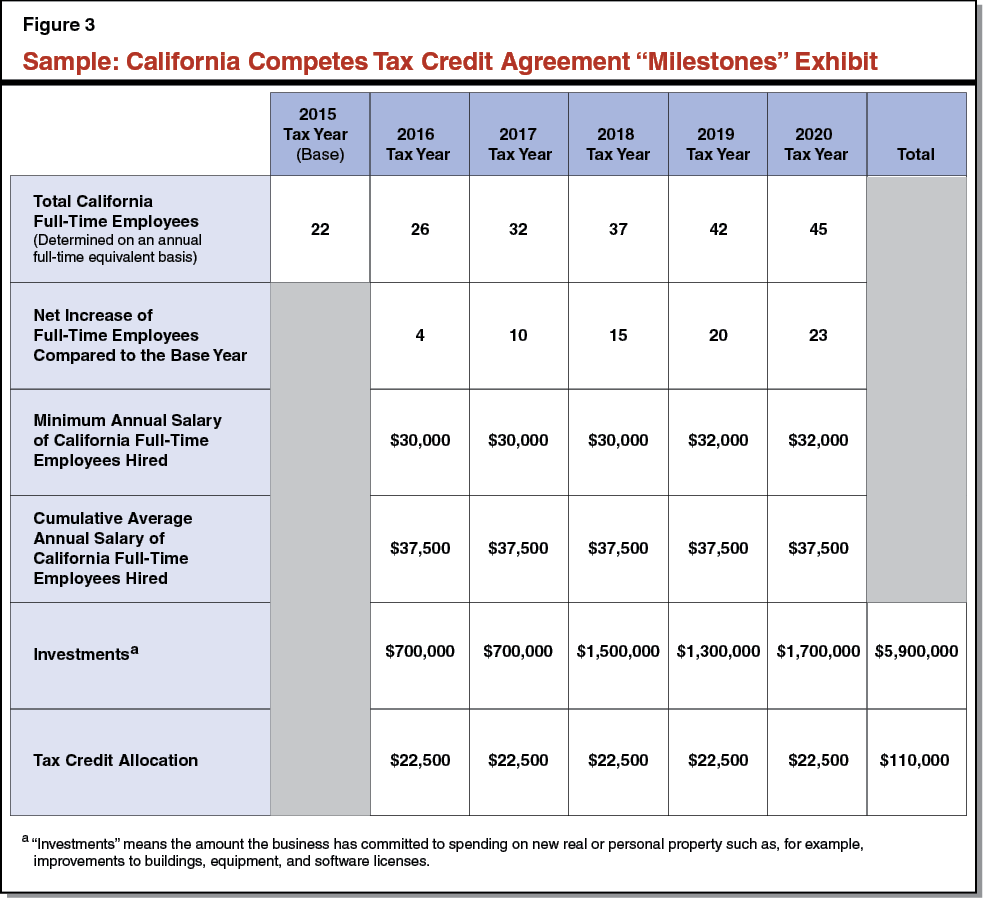

Businesses of any industry, size, or location compete for over $180 million available in tax credits by applying in one of the three application periods each year. The california competes tax credit (cctc) is an income or franchise tax credit. The personal income tax law and the corporation tax law allow a credit (calcompetes tax credit) against the taxes imposed under those laws, for each taxable year beginning on and after january 1, 2014, and before january 1, 2030, in an amount as provided in a written agreement between the governor’s office of business and economic development and.

How does my business claim the credit on its tax return? Any earned credit, regardless of whether it is claimed in that year, should be reported on ftb 3531, california competes tax credit. Other california individual income tax forms:

The franchise tax board will begin reviewing california competes tax credit agreements of most credit recipients in july of this year, and may recommend recapture of the credit if recipients fail to meet the conditions set forth in those agreements. The california competes tax credit (cctc) is an income or franchise tax credit available to businesses that want to come to or stay and grow in california. San diego, california, united states.

Businesses that plan to increase headcount or incur capital expenditure in the next 5 years can ask the state for income tax credit. November 07, 2021 13:08 et | source: Extension of time for payment of taxes by a corporation expecting a net operating loss carryback:

Srne, sorrento) today announced that the california competes tax credit committee has approved the california competes tax credit allocation agreement (the “agreement”) between sorrento and the california governor’s office of business and economic development. Use form ftb 3531, california competes tax credit, to report the credit amount earned and claimed for the current year, the amount to carryover to future years, and any amount recaptured. For additional information see form ftb 3531 instructions.

The california competes tax credit is an income tax credit available to business that want to relocate in california or stay and grown in the state. They can get california income tax credits equal to 5% to 10% of their total investment. Choose in which area you need help

The personal income tax law and the corporation tax law allows various credits against the taxes imposed by those laws, including (1) in modified conformity to a credit allowed by federal income tax laws, a credit under both laws in an amount equal to 15% of the excess of qualified research expenses for the taxable year over the base amount, as defined, and, for. This form is for income earned in tax year 2020, with tax returns due in april 2021. We last updated california form 3531 in march 2021 from the california franchise tax board.

We last updated the california competes tax credit in march 2021, so this is the latest version of form 3531, fully updated for tax year 2020. The california competes tax credit (cctc) is an income tax credit available to businesses that want to locate in california or stay and grow in california. 1 the first step to complete the application is to create an account by selecting the create an account button on the login screen as shown below.

The goal of this program is to encourage businesses to stay and grow in california. For purposes of this article, the following definitions shall apply: To claim the credit, use ftb 3531, california competes tax credit.

California form 3531 general information a purpose use form ftb 3531, california competes tax credit, to report the credit amount earned and claimed for the current year, the amount to carryover to future years, and any amount recaptured. Contact a member of reed smith’s california team if you have any questions concerning the california competes tax credit.

Download Instructions For Form Ftb3531 California Competes Tax Credit Pdf 2017 Templateroller

Download Instructions For Form Ftb3531 California Competes Tax Credit Pdf 2017 Templateroller

Review Of The California Competes Tax Credit

2

Fillable Online 2018 Form 3531 - California Competes Tax Credit Instructions 2018 Form 3531 - California Competes Tax Credit Instructions Fax Email Print - Pdffiller

Rsm Usall Llp All Rights Reserved 2016 Rsm

Form Ftb3531 Download Fillable Pdf Or Fill Online California Competes Tax Credit - 2019 California Templateroller

2

Review Of The California Competes Tax Credit

What Is Ctcc - Herrera And Company

Form 3531 - Fill Online Printable Fillable Blank Pdffiller

2

Ca Competes Tax Credit Power Point

Fillable Online 2019 California Form 3531 California Competes Tax Credit 2019 California Form 3531 California Competes Tax Credit Fax Email Print - Pdffiller

Form Ftb3531 Download Fillable Pdf Or Fill Online California Competes Tax Credit - 2019 California Templateroller

California Competes Tax Credit Cctc California Incentives Group

Business Attorney

3531 Form Fillable California Competes Tax Credit

2