The parent that has over 50 percent of the time is the custodial parent and gets the deduction. If you do not file a joint return together but both of you claim the child as a qualifying child, the irs will choose the parent with whom the.

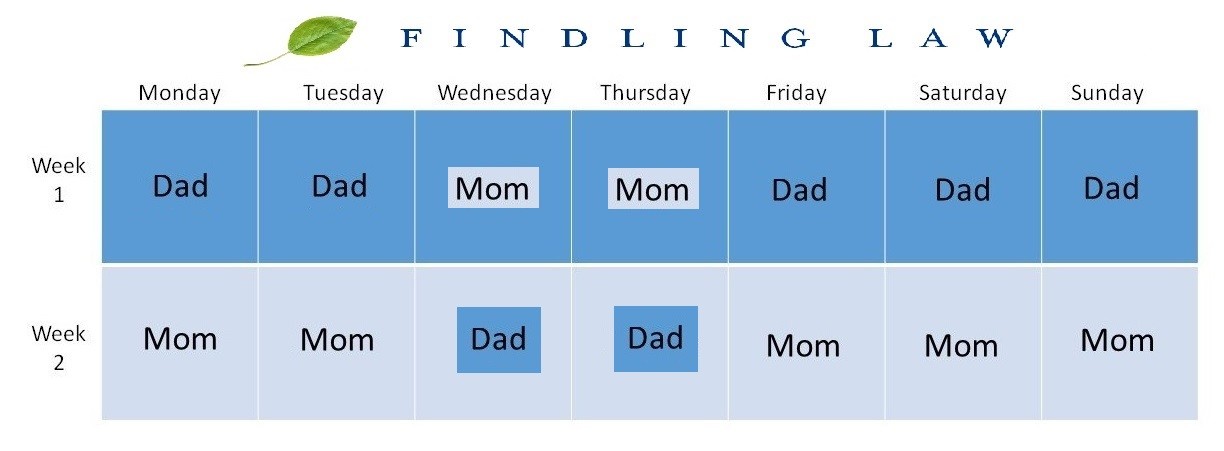

Parenting Time Holiday Schedule Michigan Holiday Visitation Laws

If they qualify, the custodial parent can claim these:

Who claims child on taxes with 50/50 custody michigan. (this is true for parents without an exact 50/50 custody split.) Transferring tax credit to your ex in a 50/50 custody arrangement. The irs rule is whomever has the kids for the majority of the time claims them, and in cases with 50/50, the parent providing more than 50% of their costs claims them.

The one who had custody for more than 1/2 of the year can claim the child as a dependent, child care expenses, earned income tax credit and, if eligible, head of household. More 1 found this answer helpful found this helpful | 1 lawyer agrees If there is a legal father (see paternity establishment ) and custody is disputed, or if parents are divorcing, either parent can file a complaint requesting custody with the circuit court in the county where they live.

As a custodial parent who spent the most time with the child during the year, you will be entitled to claim head of household, earned income credit and dependent care credit. For starters, any child age 17 or older can choose the parent he/she prefers to live with. Only the custodial parent may claim the child as a tax dependent and file as head of household.

50/50 custody is usually the preferred solution for the colorado divorce courts as it is seen as beneficial to the child for both parents to contribute equally to his or her upbringing. Generally speaking, a judge will take the time to interview children between the ages of 9 and 17 to find out what their preferences are when it comes to living arrangements and child custody. A custodial parent is a parent who has the child living with him or her and has primary care, custody and responsibility for the child.

To determine which parent can treat the child as a qualifying child in order to claim tax benefits, irs rules employ the following tiebreakers: Only one person can claim a specific dependant. Where two or more taxpayers eligible to claim a specific dependant cannot agree on who will receive the credit, it is denied to all of them.

For shared custody arrangements, both parents would normally qualify to claim each child. The court has ruled joint “parenting time” or custody, with both you and your spouse spending approximately equal time with your child. It is the parent who spends the most time with the children.

Who claims child on taxes with joint custody? Who claims a child on taxes after a custody case? Often, with joint custody arrangements, the court will order that the parents take turns claiming the child, with one parent claiming the child one year, the other parent the next year.

In general, the parent who houses the child for most of the year is going to count as the custodial parent. Mom doesn’t have 50% custody so mom should not be claiming the child; The parent with physical custody will claim the child on his or her taxes unless the court has said otherwise.

Then, who is the custodial parent. If the numbers of nights are the same, then the parent with the highest adjusted gross income will be able to claim the child. Who claims child on taxes with 50 50 custody?

However, two restrictions can cause issues: With that said, if you want your 1/2, you have to file an rfo with the court and ask the court to order it. Earned income credit (eic) the parent claiming the child for the tax year will be able to claim all of these:

Sometimes if there is more than one child, the court will divide the children between the. Any individual seeking legal advice for their own situation should retain their own legal counsel as this response provides information that is general in nature and not specific to any person's unique situation. When you address the issue of claiming children on.

Ok let me explain, uc is based on the adults circumstances on income and circumstances so it is available for unemployed or people on a low income to top up your salary, it is not available for people who earn money, ie your ex/ the child element of uc pays out for how ever many kids you have, check the gov website in actually fact it is really easy to understand. Whether you have primary custody or joint custody of a child after divorce, the fact remains that only one person can claim the child on each year’s tax forms. In this case, the parent will be able to claim the child.

If only one of you is the child's parent, the child is treated as the qualifying child of the parent; According to the irs, the custodial parent is the parent who the child spent the most number of nights with over the past tax year. Child and dependent care expense exclusion or credit for any expenses paid;

But what happens when both parents share joint custody of a child and actually split the time equally, 50/50? Head of household filing status; By default, the irs gives this right to the custodial parent—that is, the parent with whom the child lives for more than half of the year.

Both of you could claim the child, but not for the same tax benefit. Unless ordered or agreed otherwise, those are the rules. However, there are exceptions to.

If he had them for 50% or more of the time, and if he covers more than 50% their costs, he gets to claim them. Which parent claims the children on taxes with equal parenting time can be decided between the parents, and with the help of an accountant, you both may be able to work out an arrangement that saves you both on taxes. By default, the irs gives this right to the custodial parent—that is, the parent with whom the child lives for more than half of the year.

T’s much less simple for children under the age of 17. Again, the rule for claiming children on your taxes is relatively simple: When parents divorce or separate, the law allows only one of them to claim their child as a tax dependent.

The parent with the higher adjusted gross income (agi) gets to claim the child if custody is split exactly 50/50, which is technically difficult when there are 365 days in a year. When parents divorce or separate, the law allows only one of them to claim their child as a tax dependent. If it is a case between two parents, the parent who had the child physically in their home for more nights during the year gets to claim the child.

The income rule is the tie breaker if the number of days are equal. The parent who has custody for the greater part of the year typically gets to claim the child as a dependent for tax purposes.

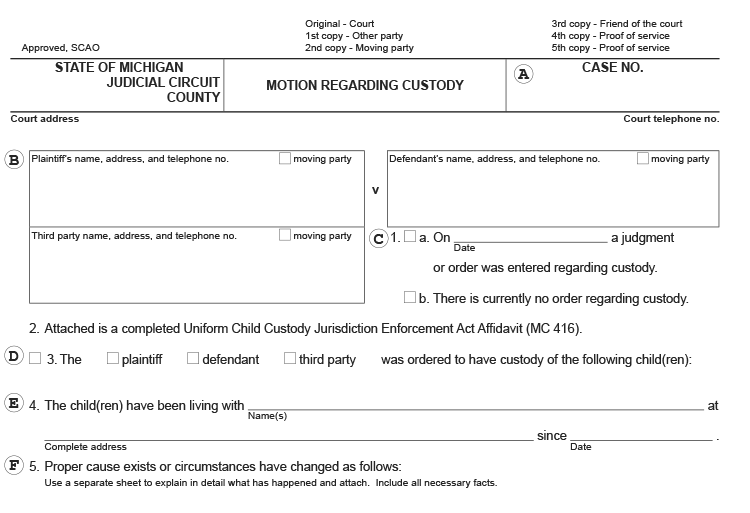

Courtsmichigangov

Special Circumstances In Michigan Child Custody Mi

Is Withholding A Child From Visitation Against The Law Family Law Rights

Taxes Have Changed For Divorced Parents Heres What You Need To Know

Claiming Child As A Dependent In A Michigan Judgment Of Divorce Is Provision Modifiable Or Not

Parenting Time Schedules In A Michigan Divorce

What Is Form 8332 Releaserevocation Of Release Of Claim To Exemption For Child By Custodial Parent - Turbotax Tax Tips Videos

Do I Have To Pay Child Support If I Share 5050 Custody

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law

Child Tax Exemption And Michigan Law

Divorce Laws In Michigan 2021 Guide Survive Divorce

Who Claims Children On Taxes With 5050 Joint Custody In 2020

Child Custody In Michigan Critical New Information

Divorce In Michigan Everything You Need To Know

Who Gets To Claim The Tax Exemptions For Minor Children In Michigan Kershaw Vititoe Jedinak Plc

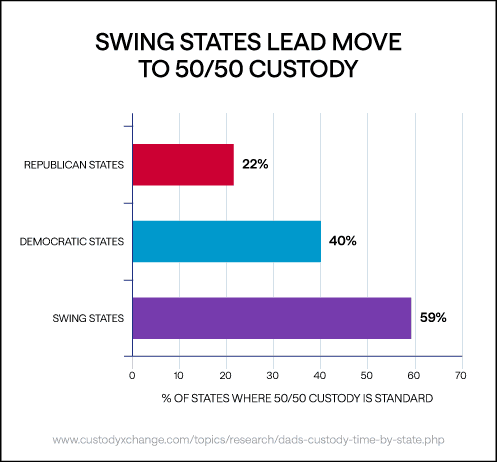

How Much Custody Time Does Dad Get In Your State

Frequently Asked Michigan Child Custody Questions Cordell Cordell

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/114274370-56a870af3df78cf7729e1a2a.jpg)

Irs Tiebreaker Rules For Claiming Dependents

Michigan Parenting Plan Custody Agreement Guidelines Mi