The internal revenue service keeps copies of all versions of tax form 1040 for up to six years. Determining the statute of limitations on assessment.

Tax Relief In 2021 Relief Tax Accounting

However, beware, the irs may have much more time to collect than ten years depending on the circumstances.

How long does the irs have to get back taxes. A common belief that many taxpayers have is that the irs cannot take any actions against them if 10 years or more have passed since they last filed a tax return. Technically, except in cases of fraud or a back tax return, the irs has three years from the date you filed your return (or april 15, whichever is later) to charge you (or, “assess”) additional taxes. If your collections expiration date is approaching, the irs may expect you to pay more each month to maximize the amount they can collect.

To the best of my knowledge and my experience in 30+ years of representing taxpayers before the irs, they do not keep returns for more that 10 to 15 years. The same can be said for those filing this week via extension. Typically, it takes around 21 days to process.

In most cases, the irs goes back about three years to audit taxes. This can take over 3 weeks to be processed and refunded to you. However, the exact timing depends on a range of factors, and.

Most people will get their tax refund within three weeks, but it varies based on how you file and how you get your refund. For example, if an individual's 2018 tax return was due in april 2019, the irs acts within three years from the due date to audit that person. How the irs audits tax returns.

The irs is limited to 10 years to collect back taxes, after that, they are barred by law from continuing collection activities against you. The irs generally has three years from the later of the due date of the return or the actual filing date of the return to assess a tax due on the taxpayer. If you owe money to the irs, the longest that this agency can go back and audit your finances is 10 years.

The key is to act quickly and work out a resolution as soon as possible. Usually, the tax liability will get “charged off” after about ten years. The tool is updated daily so you don’t need to check more often.

For most cases, the irs has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due. The irs may maintain other tax forms for more than six years. After you verify your identity how long does it take to get your taxes back.

This means if it took the irs the full 21 days to issue your check and your bank five days to post it, you could be waiting a total of 26 days to get your money. If the taxpayer never filed or filed late, the statute of limitations does not start until they file. However, it’s possible your tax return may require additional review and take longer.

Then the request gets stamped with an electronic postmark. The vast majority of tax refunds are issued by the irs in less than 21 days, according to the irs. The good news is that the irs can’t pursue collections from a taxpayer forever.

There are some circumstances, however, that allow the irs to bypass the statute of limitations. Has the most up to date information available about your refund. The time to audit taxes can be extended.

If you submitted a tax return by. Then it is forwarded to the government. The time period (called statute of limitations) within which the irs can collect a tax debt is generally 10 years from the date the tax was officially assessed.

The irs says it could take upwards of 120 days to process tax returns once they have all the information they need. First, the legal answer is in the tax law. After that time, as required by law, it destroys them, according to the irs.

The irs issues more than 9 out of 10 refunds in less than 21 days. The irs typically has ten years to collect taxes. There is an irs statute of limitations on collecting taxes.

In special circumstances they may keep returns for longer periods, but it is generally impossible to even obtain return s after 8 yrs. Direct deposit and mail in return: However, the irs does offer programs for americans to get back on track with their taxes.

Normally within two weeks this early in the season a. It can take up to 2 months for the irs to send back your tax credit. Let’s break down the refund schedule and.

It is true that the irs can only collect on tax debts that are 10 years or younger.

Irs Tax Problems And How To Easily Get Them Resolved Today Irs Taxes Tax Preparation Tax Preparation Services

The Irs Has Extended The Tax Day Deadline From April 15th To June 15th Does This Make A Difference To You Httpsfinanceyahoocom Tax Deadline Tax Day Irs

Tips On Filing Taxes - One Of The Biggest Stress-causing Problems Is The Need To File Back Taxes With Either The State Filing Taxes Debt Payoff Printables Tax

Irs Back Taxes Everything You Need To Know Explained Tax Help Tax Tax Debt Relief

We Help Taxpayers Get Relief From Irs Backtaxes Do You Qualify For Irs Back Tax Relief Get A Free Review Free On Business Tax Deductions Tax Help Tax Time

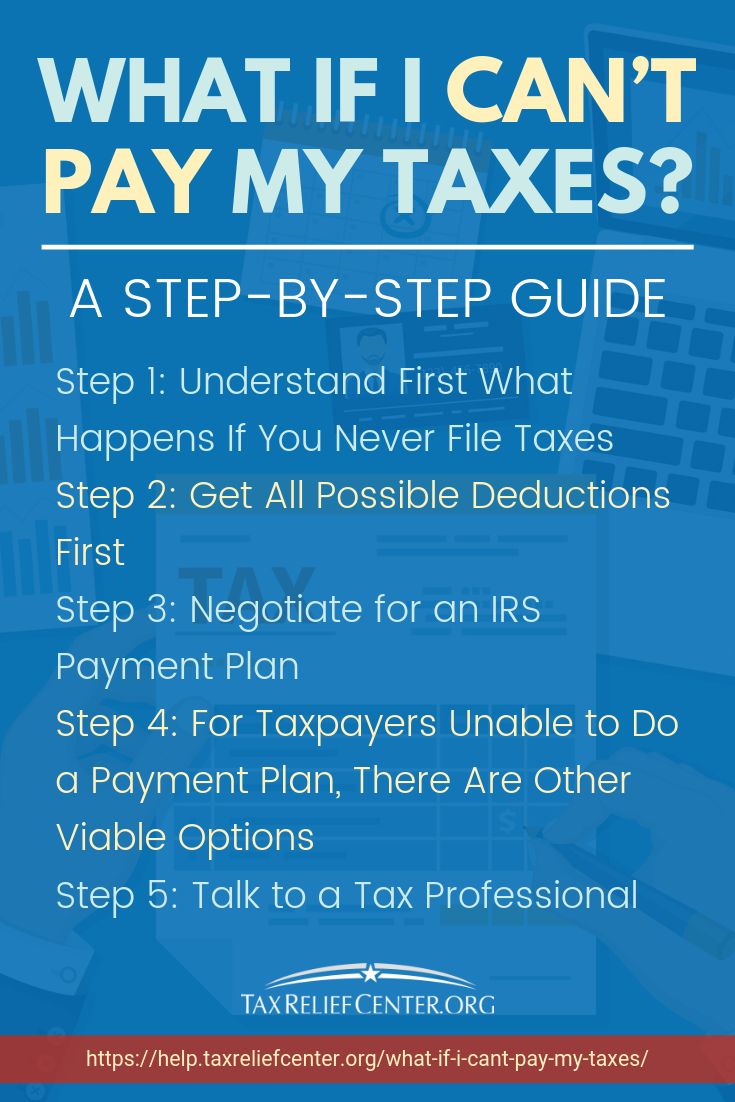

What If I Cant Pay My Taxes By April 15 Tax Relief Center Tax Prep Checklist Tax Prep Small Business Bookkeeping

Tax Attorney Offering Free Consultation Tax Lawyer Tax Attorney Irs Taxes

Irs Penalty Calculator Infographic Tax Relief Center Budget Planner Irs Budgeting

Get Out Of Irs Tax Debt And End Problems With Back Taxes - Debtcom Tax Debt Debt Solutions Debt

Do You Want To Know What Is Federal Tax Rate On Retirement Income Youve Come To The Right Place Read On To Find Out Tax Deductions Types Of Taxes Irs

What To Do When You Owe Back Taxes Infographic Business Tax Deductions Business Tax Tax Help

Questions And Answers About The Irs Status Currently Not Collectible Tax Help Irs Tax Refund

Defense Tax Group - Hire Our Tax Attorney Get Your Irs Tax Problems Solved Defense Tax Group Is A Focused Tax Relie Irs Taxes Tax Attorney Payroll Taxes

Taxpayers Spout Off On Twitter Infographic Infographic Charts And Graphs Tax Refund

The Turbotax Tax Refund Calculator Tax Refund Tax Refund Calculator Turbotax

Get Your Irs Refund Cycle Chart 2021 Here Tax Refund Business Tax Deductions Money Template

Money-saving Tax Preparation With Prices To Suit Your Budget Irs Taxes Tax Preparation Filing Taxes

Delinquent Taxes Infographic How To Pay Off Or File Late Taxes Tax Help Tax Refund Irs Taxes

Tax Debt What To Do If You Owe Back Taxes To The Irs Tax Debt Debt Irs Taxes