Joe biden expanded the child tax credit scheme from $2,000 to $3,600 earlier this year. If you've verified your eligibility and your account says that your payments were issued.

August Child Tax Credit Payments Issued Heres Why Yours Might Be Delayed Wgn-tv

Your amount changes based on the age of your children.

Child tax credit 2021 dates and amounts. For 2021 only, the child tax credit amount is increased from $2,000 for each child age 16 or younger to $3,600 per child for kids. Child tax credit family element: For all other tax filing statuses, the phaseout limit is $200,000.

$3,000 for children ages 6 through 17 at the end of 2021. The ctc income limits are the same as last year but there is no longer a minimum income, so anyone who’s otherwise eligible can claim the child tax credit. To get the full enhanced ctc — which amounts to $3,600 for children under 6 years old and $3,000 for kids ages 6 to 17 years old — single taxpayers must earn less than $75,000 and joint filers.

Half the amount will be provided in monthly. And the next payment will be on friday, july 30, 2021. This year, the american rescue plan (arp) increased the ctc from $2,000 per child to as much as $3,000 or $3,600, depending on the age of the child, for many families.

The irs bases your child's eligibility on their age on dec. Published fri, nov 26 202110:35 am est. The official dates for the monthly payments are:

May 28, 2021 (includes january and april payments) july 30, 2021; The may 28, 2021 includes the payments for january (1st quarter) and april (2nd quarter). While the october payments of the child tax program have been sent out, many parents have said they did not receive their september check.

Ccbycs is paid separately from ccb and the payment dates are on: Here are the payment dates to keep track of november through december 2021 and in 2022: For both age groups, the rest of the payment.

The 2021 child tax credit payment dates — along with the deadlines to opt out — are as follows: 15 (opt out by oct. How next year's credit could be different.

That is why president biden strongly believes that we should extend the new child tax credit for years and years to come. Ccb payments increased in july 2021 to keep up with inflation. $3,600 for children ages 5 and under at the end of 2021;

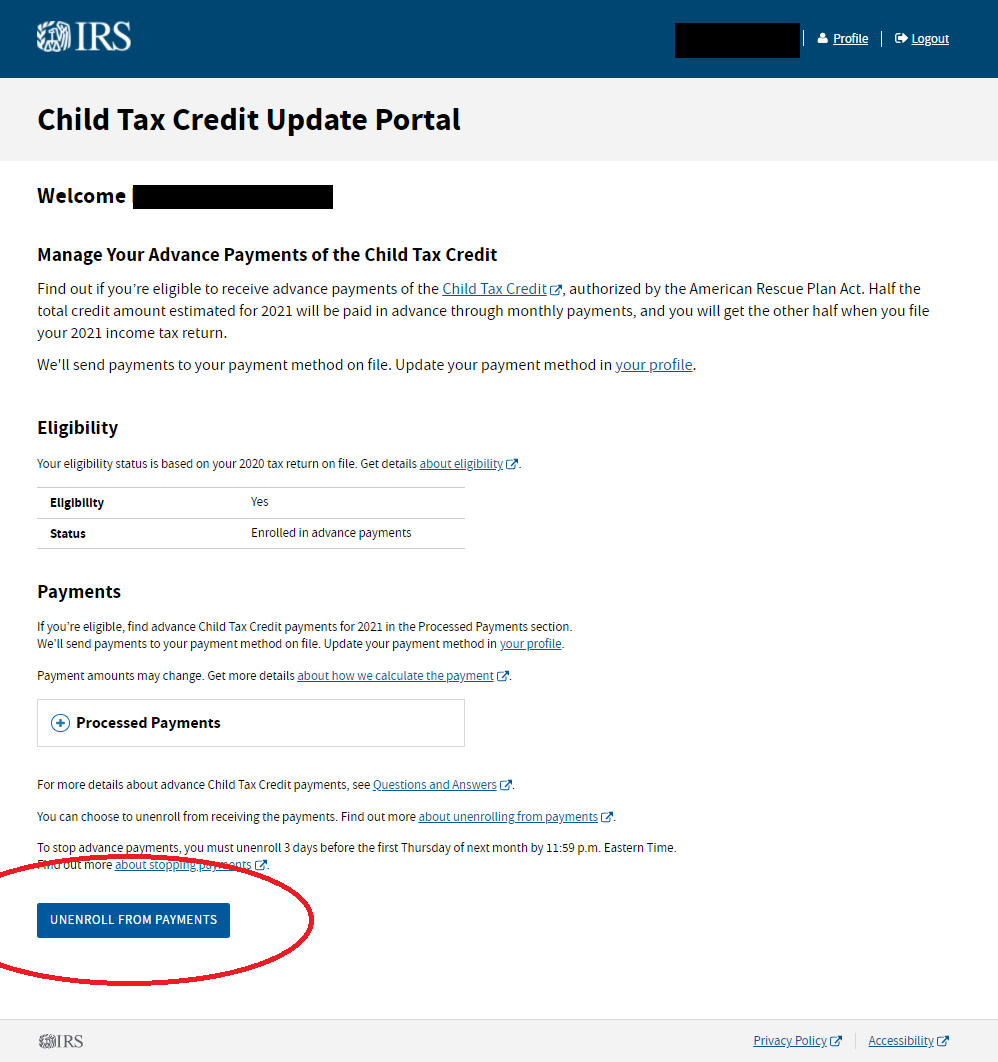

The payment dates for ccb young child supplements for 2021 are: By declining the monthly advance payments of child tax credit (ctc), parents who are eligible can claim the full 2021 child tax credit (up to $3,600 for a child under 6 and up to $3,000 for a. Ccb young child supplement (ccbycs) payment dates 2021.

How much is the child tax credit worth?. 2021 to 2022 2020 to 2021 2019 to 2020; 15 (opt out by nov.

29) what happens with the child tax credit payments after december? 29 is the final day to make changes for the last child tax credit payment this year. For tax year 2021, the child tax credit is increased from $2,000 per qualifying child to:

For 2021, the maximum child tax credit is $3,600 per child age five or younger and $3,000 per child between the ages of six and 17. The child tax credit calculator can help you figure out if you are within the income limits and how much you can get back. That's an increase from the regular child tax credit of.

The new child tax credit enacted in the american rescue plan is only for 2021. Your adjusted gross income is what matters. 15 (opt out by nov.

15 (opt out by aug. 15 (last payment of 2021) tax season 2022 (remainder of money) Ccb young child supplement payment dates.

The $500 nonrefundable credit for other dependents amount has not changed. For 2021, the total credit for eligible families is as much as $3,600 for each child under 6 (monthly payments are up to $300) and up to $3,000 for each child 6 to 17 (up to $250 monthly). They will receive $3,600 per qualifying child, under age 6 at the end of 2021.

To be eligible for the child tax credit, married couples filing jointly must make less than $400,000 per year. Ages five and younger is up to $3,600 in total (up to $300 in advance monthly) ages six to 17 is up to $3,000 in total (up to $250 in advance monthly) additionally, a portion of your amount is reduced by $50 for every $1,000 over certain income limits (see the faqs below). 13 (opt out by aug.

Eligible families can receive a total of up to $3,600 for each child under age 6 and up to $3,000 for each one ages 6 through 17 for 2021.

Irs Child Tax Credit Payments Start July 15

Child Tax Credit Update Families Will Get Paid 7200 Per Child In 2022 By Irs - Fingerlakes1com

Child Tax Credit 2022 How To Receive Your Payments Next Year Marca

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt-out Of September Payments As Parents Flock To Irs Portal

Child Tax Credit 2021 How To Track September Next Payment Marca

2021 Child Tax Credit Advanced Payment Option - Tas

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Child Tax Credit Definition Taxedu Tax Foundation

Decembers Payment Could Be The Final Child Tax Credit Check What To Know - Cnet

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What To Know About The First Advance Child Tax Credit Payment

Ea_hqrg-etgyqm

Child Tax Credit 2021 Payments How Much Dates And Opting Out - Cbs News

Child Tax Credit 2021 8 Things You Need To Know - District Capital

The Child Tax Credit Toolkit The White House

2021 Child Tax Credit Heres Who Will Get Up To 1800 Per Child In Cash And Who Will Need To Opt Out

Child Tax Credit Definition Taxedu Tax Foundation

Child Tax Credit Dates Next Payment Coming On October 15 Marca