Enter gst/qst inclusive price and calculate reverse gst and qst values and gst/qst exclusive price. 5% if you’re looking for a reverse gst only calculator, the above is a great tool to use.

Botswana Tax Calculator Apk Download Defensive Programmers

Alberta, british columbia (bc), manitoba, northwest territory, nunavut, quebec, saskatchewan, yukon gst tax rate:

Reverse tax calculator quebec. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. The average monthly net salary in canada is around 2 997 cad, with a minimum income of 1 012 cad per month. You can use the calculator to compare your salaries between 2017, 2018, 2019 and 2020.

You can use an online reverse sales tax calculator or figure it out yourself with a reverse sales tax formula. Accountants, bookkeepers and financial institutions in canada rely on us for payroll expertise and payroll services for their clientele. The following table provides the gst and hst provincial rates since july 1, 2010.

Other provinces in canada do not use the hst and instead use a distinct goods and services tax (gst) and/or provincial sales. In normal circumstances, a supplier of services or goods is liable to pay the reverse goods and services tax (gst). For the reverse calculation gst and qst, you must take the amount with taxes and divided by the combined rate of 1.14975 to obtain the original amount without the two taxes.

The reverse sales tax formula below shows you how to calculate reverse sales tax. The quebec income tax salary calculator is updated 2021/22 tax year. The harmonized sales tax, or hst, is a sales tax that is applied to most goods and services in a number of canadian provinces:

Usage of the payroll calculator. The rate you will charge depends on different factors, see: The calculation of the gst and qst can also be done in one step, you must use the rate of 14.975% to calculate both taxes.

If you make $52,000 a year living in the region of ontario, canada, you will be taxed $11,432. Alberta atlantic british columbia large loss ontario prairies quebec alberta atlantic british columbia large loss ontario prairies quebec northern ontario test test alberta test atlantic test british columbia test large loss test northern ontario test ontario test prairies test quebec test. There are two options for you to input when using this online calculator.

Understanding the reverse goods and services tax (gst) now that you have a good grasp of the goods and services tax (gst), we can now see what exactly is the reverse goods and services tax (gst). Online calculators > financial calculators > reverse sales tax calculator reverse sales tax calculator. The calculator is updated with the tax rates of all canadian provinces and territories.

Overview of sales tax in canada. That means that your net pay will be $40,568 per year, or $3,381 per month. Most states and local governments collect sales tax on items that.

Here, the gst is la taxe sur les produits et services, or tps, while the provincial sales tax is la taxe de vente du quebec, or tvq. You will need to input the following: To use the sales tax calculator, follow these steps:

The qst was consolidated in 1994 and was initially set at 6.5%, growing over the years to the current amount of 9.975% set in 2013. An online reverse sales tax (remove sales tax) calculation for residents of canadian territories and provinces (with high accuracy). Any input field of this calculator can be used:

The province of quebec follows a provincial sales tax model rather than the hst model, so there are two separate taxes to monitor. Income tax calculations and rrsp factoring for 2021/22 with historical pay figures on average earnings in canada for each market sector and location. Current (2021) gst rate in canada is 5% and qst rate in québec is 9.975%.

Reverse sales tax calculator to calculate price before tax and the tax amount based on the final price and sales tax percentage. 7 rows income tax calculator quebec 2020. Trusted by thousands of businesses, paymentevolution is canada's largest and most loved cloud payroll and payments service.

Use our income tax calculator to quickly. Salary calculations include gross annual income, tax deductible elements such as child care, alimony and include family related. Your average tax rate is 22.0% and your marginal tax rate is 35.3%.

Enter either the sales tax amount in dollars (such as 10 for $10) or the sales tax rate (such as 8.5 for 8.5%0. For the first option, enter the sales tax percentage and the net price of the item which is a monetary value. Quebec is one of the provinces in canada that charges separate provincial and federal sales taxes.

New brunswick, newfoundland and labrador, nova scotia, ontario, and prince edward island. This places canada on the 12th place in the international labour organisation statistics for 2012, after france, but before germany. Enter the final price or amount.

Check home page if you need sales tax calculator for other province or select one listed on the right sidebar. For the second option, enter the sales tax percentage and the gross price of the item which is a monetary value. The harmonized sales tax, or hst, is a sales tax that is applied to most goods and services in a number of canadian provinces:

In quebec, the provincial sales tax is called the quebec sales tax (qst) and is set at 9.975%. New brunswick, newfoundland and labrador, nova scotia, ontario, and prince edward island.it ranges from 13% in ontario to 15% in other provinces and is composed of a provincial. The amount can be hourly, daily, weekly, monthly or even annual earnings.

If your accounting software is already set up to refer to canadian taxes such as the gst, pst and. This marginal tax rate means that your immediate additional income will be taxed at this rate. Select your state alberta british columbia manitoba new brunswick newfoundland and labrador nova scotia northwest territories nunavut ontario prince edward island quebec saskatchewan yukon

Like income tax, calculating sales tax often isn't as simple as x amount of money = y amount of state tax. in texas, for example, the state imposes a 6.25 percent sales tax as of 2018. Hst reverse sales tax calculation or the harmonized reverse sales tax calculator of 2021 for the entire canada, ontario, british columbia, nova scotia, newfoundland and labrador and many more canadian provinces Sales tax amount or rate:

The resulting amount includes gst and qst. Provinces and territories with gst:

Reverse Gst Hst Pst Qst Calculator 2021 All Provinces In Canada

Bc Sales Tax Gst Pst Calculator 2021 Wowaca

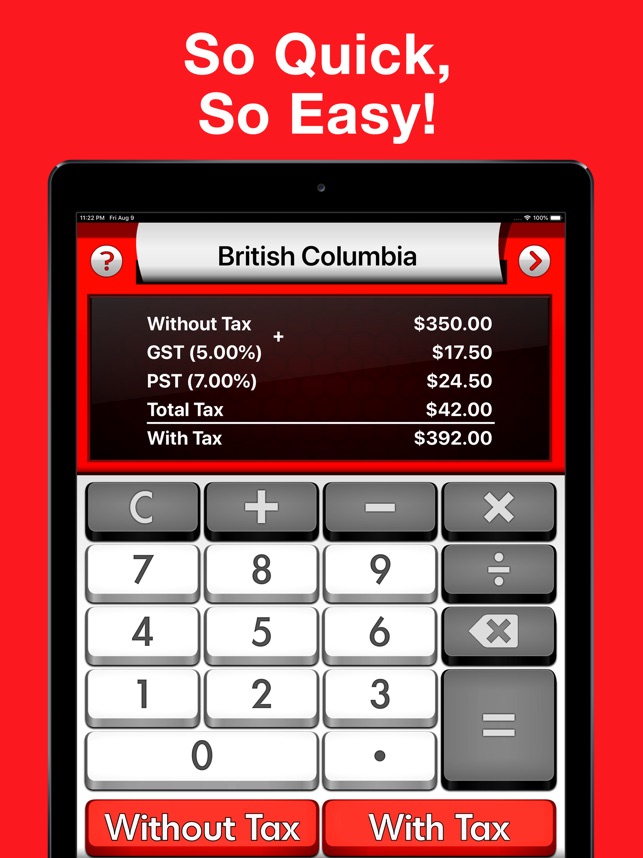

Sales Tax Canada Calculator On The App Store

Canada Sales Tax Calculator On The App Store

Canada Provides More Study And Work Permit Flexibility For Candidates Earn Money Online Ways To Earn Money Income Tax

Canada Federal And Provincial Income Tax Calculator Wowaca

Gst Calculator Goods And Services Tax Calculation

Quebec Sales Tax Gst Qst Calculator 2021 Wowaca

Reverse Hst Calculator - Hstcalculatorca

Bc Income Tax Calculator Wowaca

Canada Sales Tax Calculator By Tardent Apps Inc

Get Started With Bim 10 Phases To A Successful Bim Implementation Strategy Infographic Building The Digital Building Information Modeling Strategy Infographic Bim

Pst Calculator - Calculatorscanadaca

Manitoba Income Tax Calculator Wowaca

Canadian Sales Tax Calculator - Windows 10 Download

Reverse Sales Tax Calculator - 100 Free - Calculatorsio

Land Transfer Tax And Cmhc Calculators For Your Website Ratehubca

How To Calculate Sales Tax In Excel

Download Quebec Sales Tax Calculator Free For Android - Quebec Sales Tax Calculator Apk Download - Steprimocom