Withhold 6.2% of each employee’s taxable wages until they earn gross pay of $142,800 in a given calendar year. Report tax to federal and other relevant agencies.

How Much Should I Set Aside For Taxes 1099

Unemployment account number and tax rate.

Missouri employer payroll tax calculator. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Now onto the big stuff. The withholding calculator is designed to.

This missouri state tax calculator is used to calculate the taxes for the missouri withholding calculator, unemployment taxes for both employee and employer.missouri state has personal income tax (a.k.a. Overview of missouri taxes missouri has a progressive income tax rate that ranges from 0% to 5.40%. The free online payroll calculator is a simple, flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

Withhold employee and employer funds. If the state has an outstanding loan for 2 years and is unable to pay back the loan in full by november 10th of the second year, the 6% rate will be reduced by only 5.1%, changing the percentage an. Switch to missouri hourly calculator.

It is not a substitute for the advice of an accountant or other tax professional. Louis payroll expense tax ,. 401k, 125 plan, county or other special deductions;

The maximum an employee will pay in 2021 is $8,853.60. The missouri salary calculator is a good calculator for calculating your total salary deductions each year, this includes federal income tax rates and thresholds in 2022 and missouri state income tax rates and thresholds in 2022. Free federal and missouri paycheck withholding calculator.

If an employer pays state taxes timely, the 6% rate will be reduced by 5.4% and the employer will pay their federal ui tax at a rate of.6%. Tax professionals can use the calculator when testing new tax software or assisting with tax planning.; As the employer, you must also match your employees.

The top tax bracket is 5.4%, which applies to employees who make more than $8,585.00 annually. The department of revenue has a number of. Computes federal and state tax withholding for paychecks;

You can find your unemployment account number on the annual tax rate notice received from the missouri department of labor. Chances are, it’s the last thing you want to think about, but getting it right is something that really matters to both your employees and your friendly neighborhood tax. The timely compensation deduction is computed as follows:

The basic process runs down as such: We will even make your tax payments and complete all quarterly and annual tax filing and reporting requirements. In addition, any residents, as well.

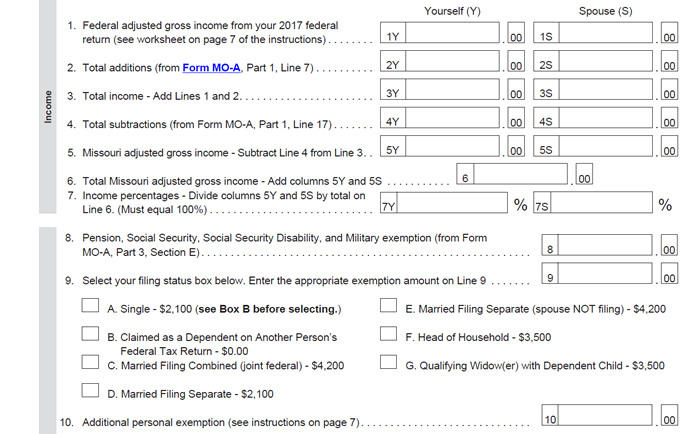

The first step to calculating payroll in missouri is applying the state tax rate to each employee’s earnings. Instead you fill out steps 2, 3, and 4.) What are my state payroll tax obligations?

The paycheck calculator may not account for every tax or fee that applies to you or your employer at any time. Calculate your employee’s payroll tax. 2 percent 0 to $5,000.

It simply refers to the medicare and social security taxes employees and employers have to pay: The information provided by the paycheck calculator provides general information regarding the calculation of taxes on wages for missouri residents only. Withholding taxes) in addition to federal payroll taxes.

Flexible, hourly, monthly or annual pay rates, bonus or other earning items; Employers can use the calculator rather than manually looking up withholding tax in tables.; It’s a progressive income tax, meaning the more money your employees make, the higher the income tax.

When paying missouri withholding taxes the state offers a compensation deduction to the employer when taxes are paid in a timely manner. Details of the personal income tax rates used in the 2022 missouri state calculator are published below the. The payroll taxes for the city of saint louis in the state of missouri are federal unemployment insurance tax , 2021 social security payroll tax (employer portion) , medicare withholding 2021 (employer portion) , missouri unemployment insurance tax , st.

With checkmark payroll services you can be confident that your payroll is safe hands. The ins and outs of payroll taxes it can be a little daunting when it’s time to get out that calculator and run payroll. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

1 percent $5,001 to $10,000. Calculate your state, local and federal taxes with our free payroll income tax calculator, simply choose your state and you are all set.

2

Missouri Paycheck Calculator - Smartasset

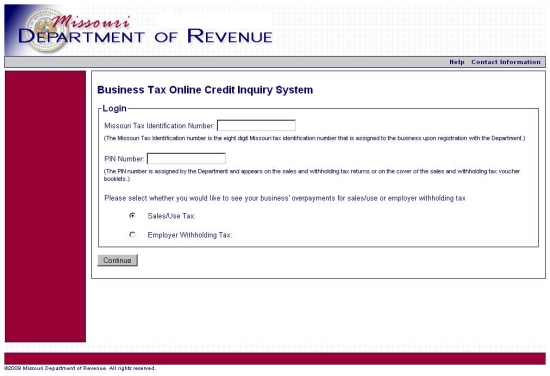

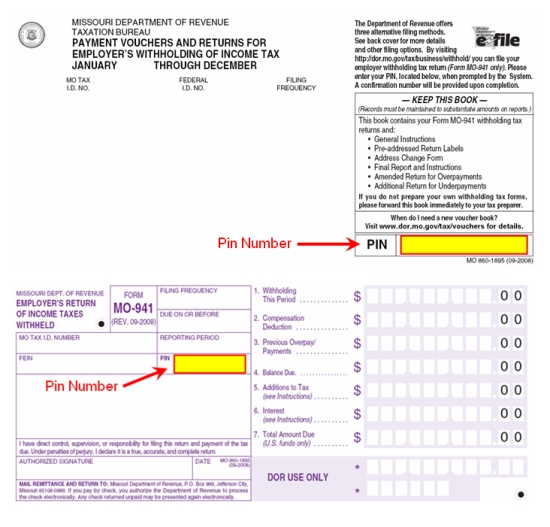

Withholding Tax Credit Inquiry Instructions

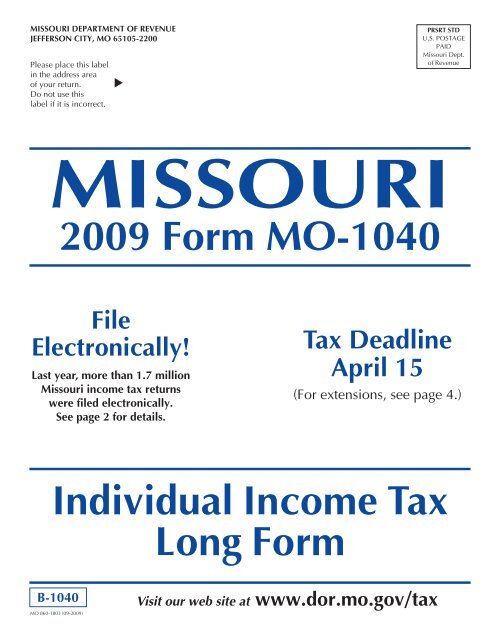

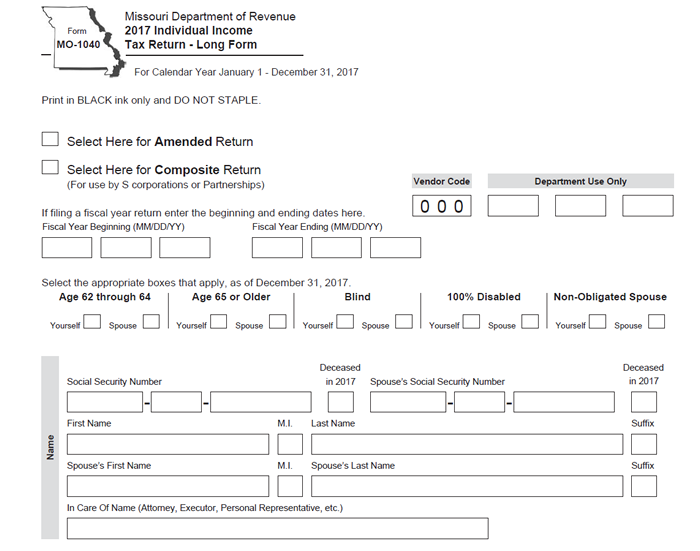

New Forms

Payroll Software Solution For Missouri Small Business

Missouri Salary Calculator 2022 Icalculator

Rosas Payroll Calculator Pdf Payroll Payments

Individual Income Tax

Missouri Wage Calculator - Minimum-wageorg

Llc Tax Calculator - Definitive Small Business Tax Estimator

Mo-1040 Individual Income Tax Return - Long Form - Missouri

2

Withholding Tax Credit Inquiry Instructions

Pdf Third-party Income Reporting And Income Tax Compliance

Self-employed Tax Calculator Small Business Bookkeeping Business Tax Self Employment

Missouri Income Tax Rate And Brackets Hr Block

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Missouri Paycheck Calculator - Smartasset

New Forms