At 1.5 per cent of total earnings, moveup’s dues are lower than most canadian unions. These are regarded as personal in nature and therefore are not deductible.

Where Do I Enter My Union And Professional Dues Hr Block Canada

You can claim a tax deduction for these amounts on.

Are union dues tax deductible in canada. Ad get unlimited tax deduction questions answered online & save time. In the case of voluntary associations, dues are not deductible. Workers used to be able to deduct union dues, but they could only do so if they had enough other eligible deductions that it was worthwhile to file an “itemized” tax return ― and even then, the eligible expenses had to amount to more than.

I claimed my union dues even though my employer put zero in box 212 of my t4. Through the regional pay system, public works and government services canada collects union dues directly from unionized employees’ pay. Tax tip you may be eligible for a rebate of any gst/hst you paid as part of your dues.

You can only deduct union dues, membership fees and assessments to provide payments to unemployed union members. Claiming a deduction for union or professional dues. Union dues and professional association fees are tax deductible.

Annual dues of a member of a trade union are not deductible, however, to the extent that they are, in effect, levied. Ad get unlimited tax deduction questions answered online & save time. I work for a trade union.

Before sending in the requested document i decided to contact my employer about the matter and they told me that union dues are no longer tax deductible. “the dues are not treated as income, so there is taxpayer subsidy to a degree.” Accordingly, cma dues would not be deductible but provincial college fees would be.

This is because by law you are not required to participate in these associations to maintain your credentials. Annual union dues for membership in a trade union or association of public servants. (a) for or under a superannuation fund or plan, (b) for or under a fund or plan for annuities, insurance or similar benefits, or.

For example, membership in the canadian medical association is not required to practise medicine, while membership in the provincial college of physicians and surgeons is necessary. You can only deduct certain types of union dues or professional membership fees from your income tax filings. However, there are a few exceptions, and if your union dues meet one of them you are in luck

Dues pay the cost of contract negotiations, grievance and arbitrations, training for members, legal fees, and much more so employees no longer have to go at it alone. What does the employer do with the union dues that are deducted from an employee’s pay? Union dues are deductible only if you itemize on schedule a in lieu of taking the standard deduction.

The amount of union dues that you can claim is on box 44 of the t4 slip issued by your employer. And, because dues are tax deductible, it works out to be much less. Can i claim the dues to the canadian legion and similar service clubs?

View solution in original post. For example, if your annual income is $40,000 and you paid $1,000 as union dues, your taxable income will be only $39,000. Union dues are set by the bargaining agents and calculated either by using a fixed rate or as a percentage of the employee’s salary.

Only union membership dues are deductible, and union members may not deduct initiation fees, licenses or other charges. Dues are in investment in the improvements in pay, benefits and fair treatment won through collective bargaining. At 1.5 per cent of total earnings, moveup’s dues are lower than most canadian unions.

However, most employees can no longer deduct union dues on their federal tax return in A recent tax case addressed this issue in the case of physiotherapy association. You can deduct any union dues paid by you from your taxable income.

For more information, see interpretation bulletins it103r, dues paid to a union or to a parity or advisory committee, and it158r2, employees’ professional membership dues. Under current federal law, union dues are generally not deductible. Between now and the end of february 2020, canadians will receive a variety of receipts for expenditures made during the 2019 taxation year.

Cra is requesting a copy of my union dues receipt and my t4.

6 Overlooked Tax Deductions And Credits That Could Score You A Big Return - National Globalnewsca

Deducting Union Dues Drake17 And Prior

The Top 9 Tax Deductions For Individuals In Canada

Save Tax - Home Facebook

Your Union Dues Plain And Simple

Union Dues Opseu Sefpo

Just Got A Letter From Cra They Want My Union Dues Receipts Union Wont Give Them To Me Because They Are Not Dues They Are Admin Fees Ontario Canada Rpersonalfinancecanada

Are Our Union Dues Tax-deductible In Canada Express Digest

Buckchart - Home Facebook

Claiming A Deduction For Professional And Union Dues

Payrolla Dollar Earned Personal Finance Employment Standards Employee

Tax Return Document Checklist Eng 17 Rev Pdf Welfare Taxes

Claiming A Deduction For Union Or Professional Dues - Virtus Group

Our Members Dues Usw Canada

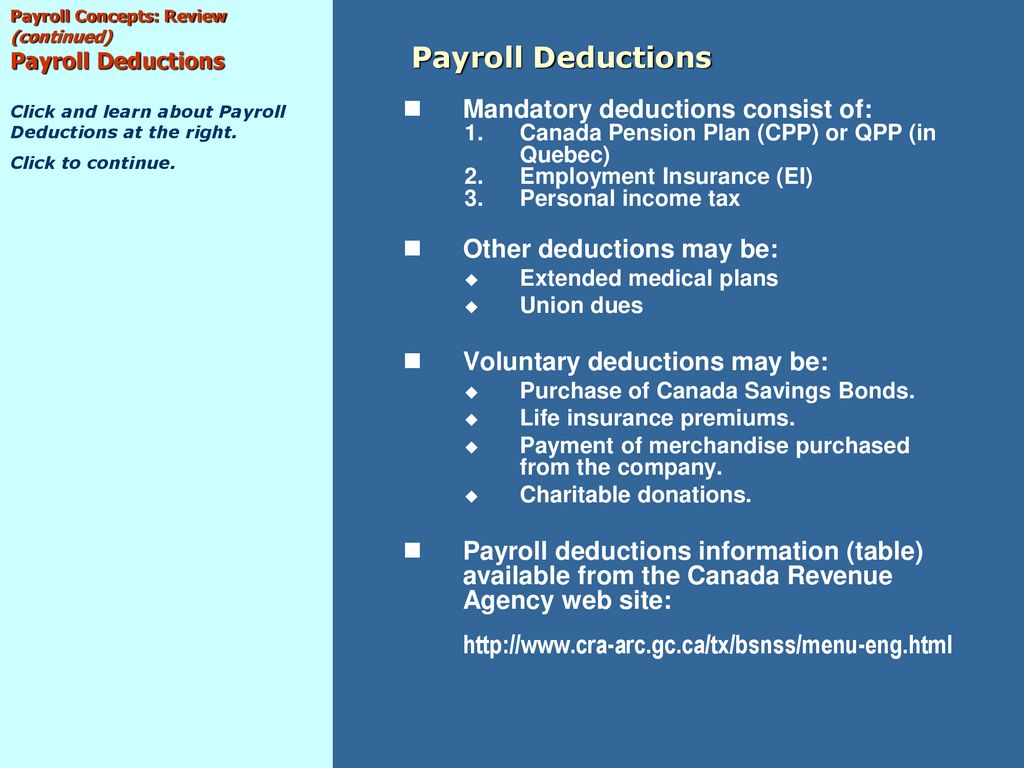

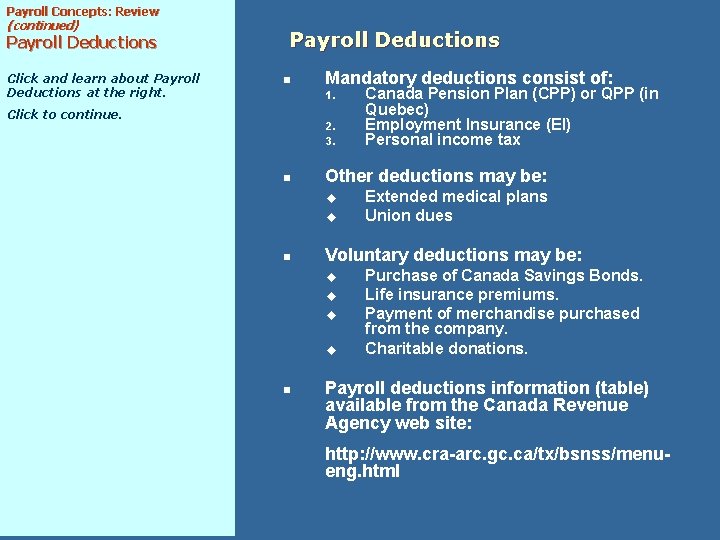

Setting Up The Payroll Module - Ppt Download

2020 Year-end Tax Tips For Canadians - Cloudtax Simple Tax Application

Setting Up The Payroll Module Slideshow 7 A

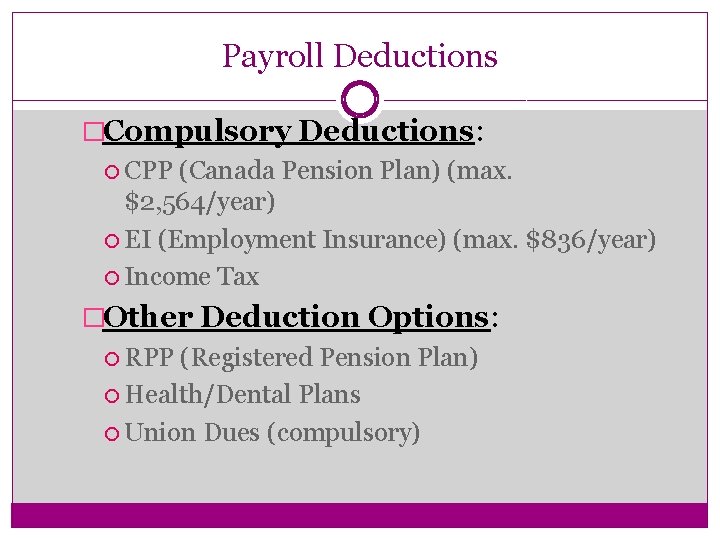

What Are Payroll Deductions Mandatory Voluntary Defined Quickbooks

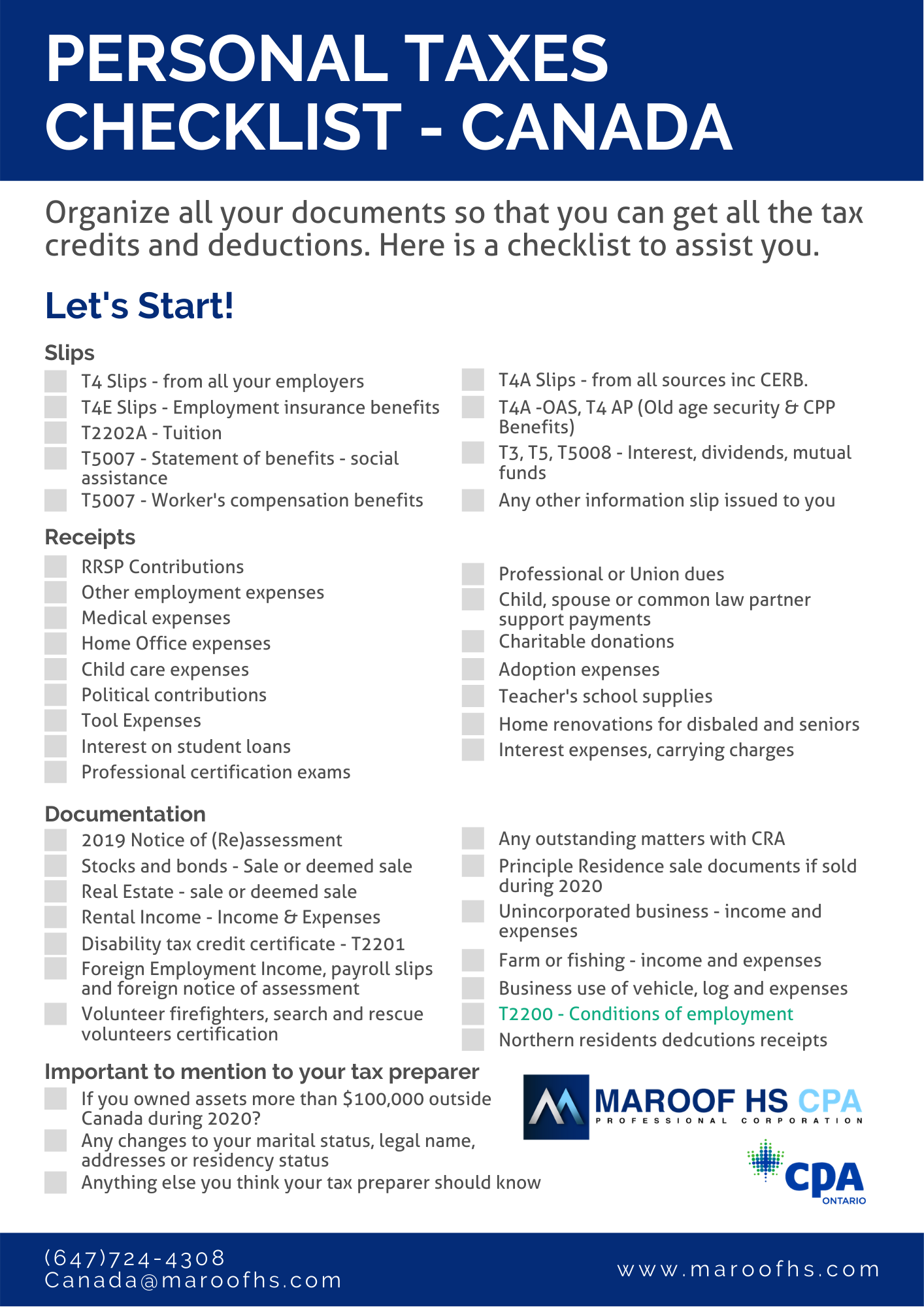

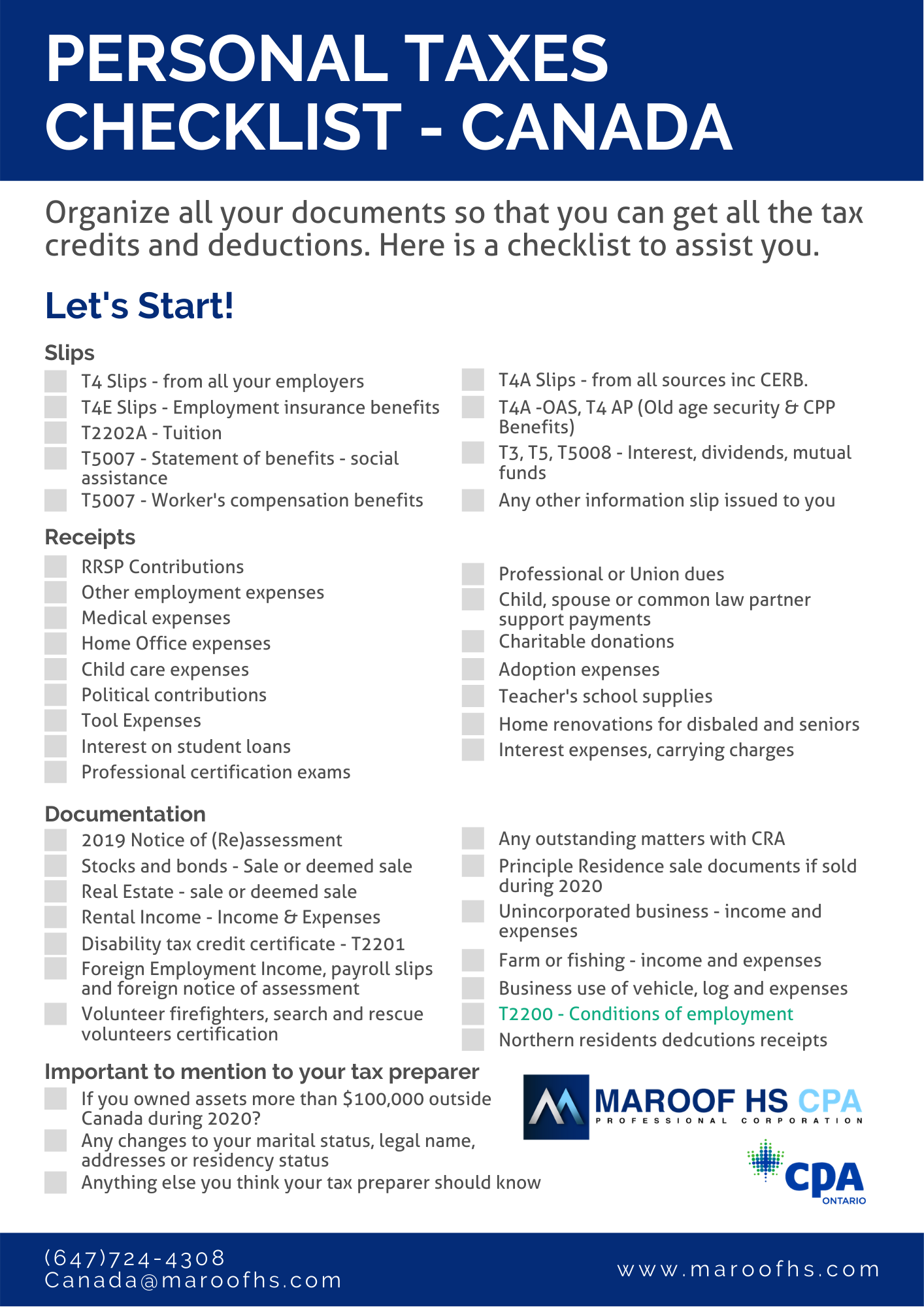

2020 Individual Income Tax Return Checklist - Maroof Hs Cpa Professional Corporation Toronto