How much are real estate transfer taxes in kansas (and who pays them)? What is the estate tax?

Kansas Income Tax Calculator - Smartasset

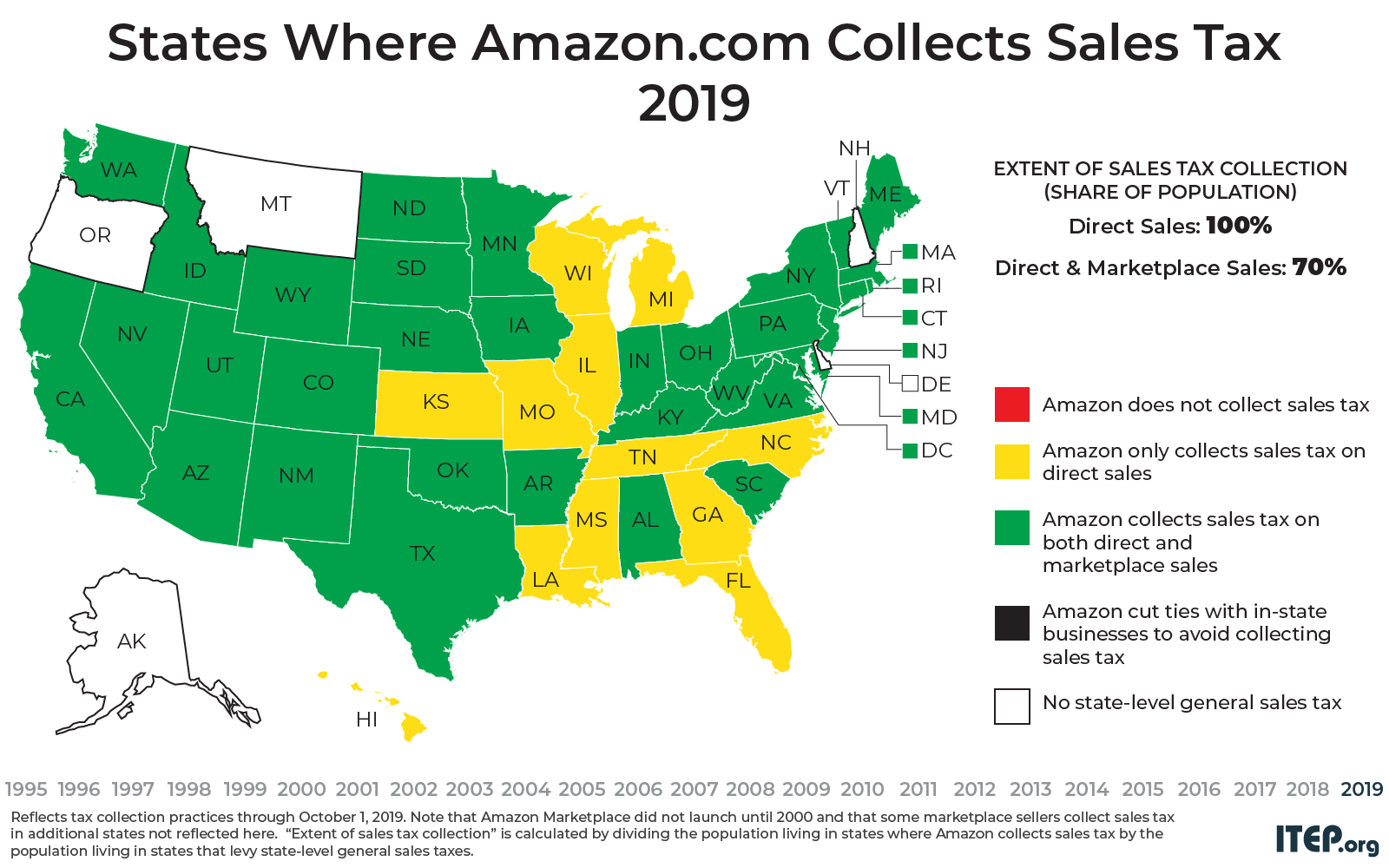

In practice, most local governments have no tax on intangible property.

Does kansas have estate tax. Federal taxes the federal government does not charge an inheritance tax, but does maintain an estate tax. Delaware repealed its estate tax at the beginning of 2018. This tax is called an ad valorem tax.

In theory, it is a simple calculation. The estate tax applies before the estate is dispersed to a. Eight states and the district of.

Capital gains in kansas are taxed as regular income. The top inheritance tax rate is 16 percent ( exemption threshold for class c beneficiaries : However, small fees related to documentation and registration may still apply during the closing process, and these fees would typically be paid by the buyer.

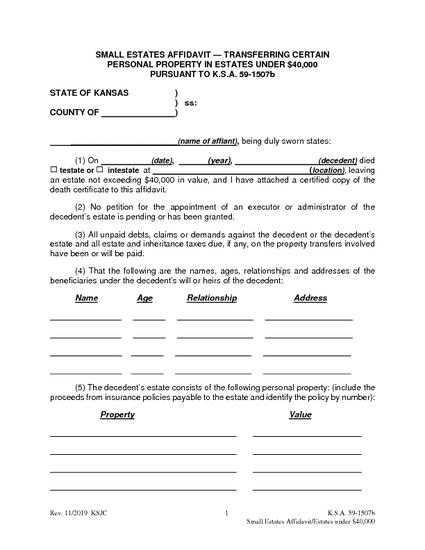

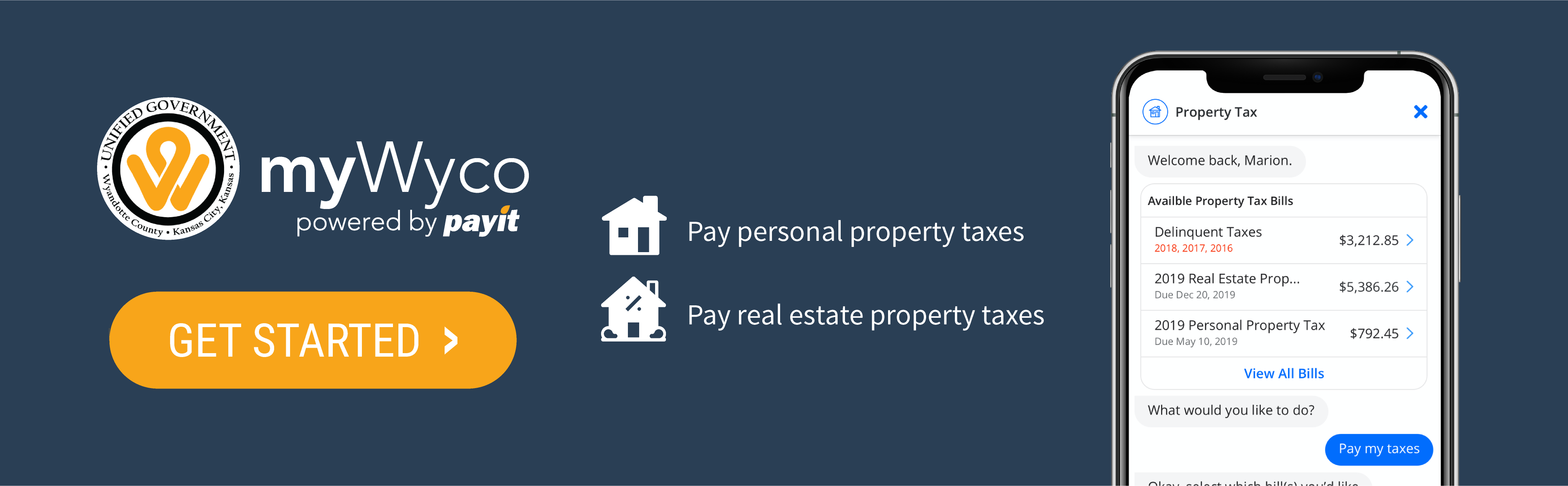

No estate tax or inheritance tax kentucky: Kansas statutes don’t provide a dollar amount or percentage of the estate that may be given as payment to the executor or administrator. If only the first half of the current year taxes are paid in december, the second half tax statements or notices are mailed out in may.

Who qualifies for a safesr refund? It is one of 38 states that does not impose such a tax. Kansas does not collect an estate tax or an inheritance tax.

16 states and washington, d.c. An individual that is a kansas resident that lives in kansas for all of 2019, who owned and occupied a home in kansas during 2019, who was aged 65 years or older for all of 2019 (born before january 1, 1954) and who had a household income of $20,300 or less in 2019 shall qualify for a. They impose these taxes on the transfer of legal deeds, certificates and titles to a property when a seller makes the sale to the buyer.

However, if you are inheriting property from another state, that state may have an estate tax that applies. Married americans should know that the federal estate tax that applies to them is the tax on combined marital estates worth over 22.36 million dollars. Maine, for example, levies no tax the first $5.8 million of an estate and taxes amounts above that at a rate of 8 percent to a maximum 12 percent.

A federal estate tax ranging from 18% to 40% applies to all estates worth more than $11.7 million. The kansas income tax has three tax brackets, with a maximum marginal income tax of 5.70% as of 2021. Estate taxes are levied on the value of a decedent's assets after debts have been paid.

Class a beneficiaries, which is the majority, pay no inheritance tax ) What is capital gains tax on real estate in kansas? In kansas, it is set at $0.26 for every $100 or 0.26%.

The federal estate tax applies to all estates in the united states of america that have a valued of slightly over eleven million dollars and are owned by a single person. Exemption threshold for class b beneficiaries: Twelve states and the district of columbia impose estate taxes and six impose inheritance taxes.

All other estates are nonresident estates. Assessed value of your real estate. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as estate taxes without the federal exemption hurt a state’s competitiveness.

A resident estate is the estate of a person who was a kansas resident at the time of death. New jersey finished phasing out its estate tax at the same time, and now only imposes an inheritance. Homeowners should receive their real estate and personal property tax statements for the current year on or after november 1st, but no later then december 15th.

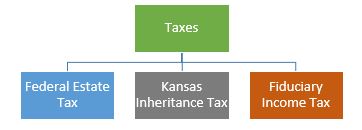

You may also need to file some taxes on behalf of the deceased. But just because you are not assessed a tax by the state of kansas, does not mean that you are free of tax at the federal level. Sometimes called the “death tax,” the estate tax is a tax levied on the estate of a person who has recently died.

Can you deduct transfer taxes? The fiduciary of a resident estate or trust must file a kansas fiduciary income tax return if the estate or trust had any taxable income and/or there is withholding tax due for the nonresident beneficiaries. Your property tax bill is calculated using two elements, namely:

Does kansas tax capital gains? However, it does address the issue of compensation. If the will stipulates an amount to pay the executor, that amount is to.

States, counties, and municipal authorities may impose transfer taxes on real estate sales. Intangible property is defined as monies and credits including gold and silver coin, united states treasury notes and stock certificates otherwise taxable to the owner or holder. What about the federal estate tax?

This is a tax based on the assessed value of an item, in. In most states, it is set at a rate for every $500 of property value. Detailed kansas state income tax rates and brackets are available on this page.

Kansas does not levy an estate tax, making it one of 38 states without an estate tax. Safesr is also referred to as, kansas property tax relief for low income seniors. Have estate or inheritance taxes.

As of january 1st, 2019, there is no longer a transfer tax or a mortgage registration tax in the state of kansas. Hawaii and washington state have the highest estate tax top rates in the nation at 20 percent. The state of kansas administers property taxes in each of its 105 counties through local treasurers that are responsible for setting the tax rate, assessing your real property, and collecting tax payments.

Kansas does not impose an estate tax on it’s residents. So how is the federal estate tax actually calculated? Kansas does not have an estate tax or inheritance tax, but there are other state inheritance laws of which you should be aware.

Maryland is the only state to impose both.

Estate Tax And Inheritance Tax In Kansas Estate Planning

Kansas Retirement Tax Friendliness - Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

A Major Issue For Many Clients When It Comes To Estate Planning Is Trying To Eliminate Estate Taxes However Th Tax Services Tax Deductions Tax Preparation

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

How Is Tax Liability Calculated Common Tax Questions Answered

Frequently Asked Questions About Probate - Kls

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Very Small Estates In Kansas - Kls

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Your State Have A Corporate Alternative Minimum Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax And Inheritance Tax In Kansas Estate Planning

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Maps Itep

Do I Have To Pay Taxes When I Inherit Money

Analysis Of The House Tax Cuts And Jobs Act Itep