This certificate is valid for 25 years and is renewable and entitles the holder (and any qualifying dependents) to reside in the cayman islands and work in the business in which they have invested or are employed in a senior management capacity. Applicant must reside in the cayman islands for 30 days each year;

How To Get Cayman Islands Residency And Pay Zero Tax Nomad Capitalist

Law, you should indicate that you are a u.s.

Cayman islands tax residency certificate. Dependants of the holder of a residency certificate for persons of independent means Any person who has been legally and ordinarily resident in the cayman islands for a period of at least eight years, but not more than nine years*, other than the holder of a: Restrictions • does not permit right to work •.

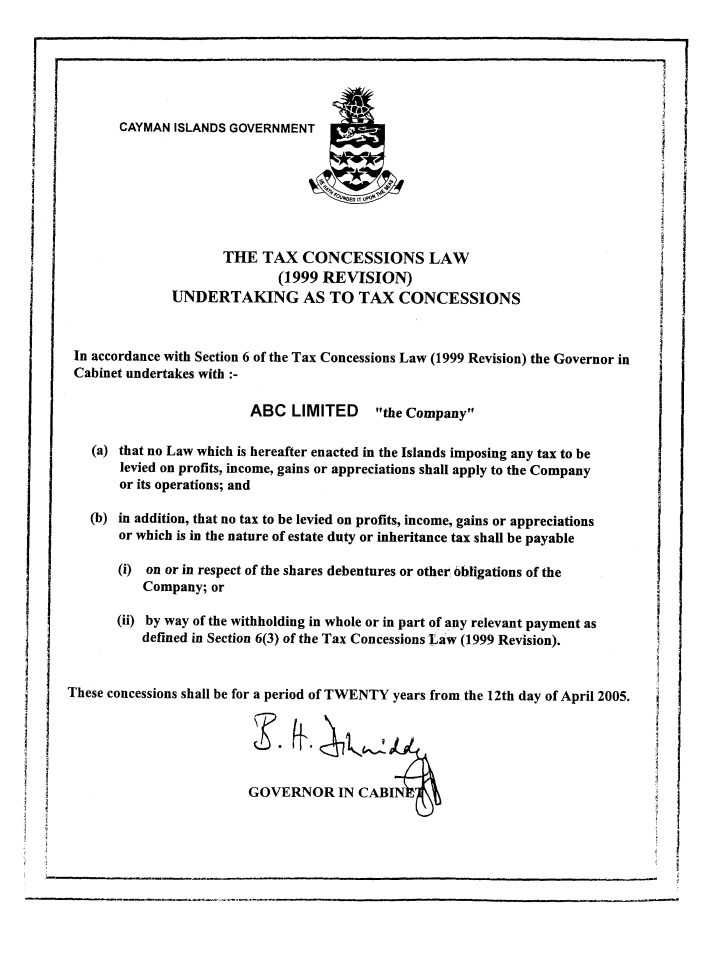

[] march 2017 4 f. Residency certificate for persons of independent means this certificate, which is valid for 25 years and renewable thereafter, entitles the holder (and any qualifying dependants) to reside in the cayman islands without the right to work. Since no corporate income, capital gains, payroll, or other direct taxes are currently imposed on corporations in the cayman islands, corporate residency is not relevant in the context of cayman islands taxation.

It is responsible for administering all of the cayman islands’ legal frameworks for international cooperation in tax matters, and for carrying out the functions of the tax information authority, the cayman islands competent authority. (crs), all matters in connection with residence are determined in accordance with the crs and its commentaries. An applicant for the grant of residency certificate (persons of independent means) must (i) provide evidence of a continued source of annual income of no less than us$150,000, (ii) at all times maintain a bank account in the cayman islands with a balance of not less than us$490,000 in assets, and (iii) have invested an amount of us$1,220,000 in the cayman islands, with at least us$675,000 of that.

Individuals aged over 18 who meet certain financial requirements and make a significant investment in the cayman islands may apply for a certificate for persons of independent means, which provides the right to reside in the cayman islands for a period of up to 25 years. Entities engaged in 'scheduled' trade and business in the cayman islands (as defined in the trade &. Residency certificate for persons of independent means grants the right to live and work.

The cayman islands competent authority the cayman islands competent authority is the tax information authority (“tia”) who is designated by law as the minister with responsibility for financial services, or his delegate. In addition to permanent residency the cayman islands offers a residency certificate requiring just $1.2 million investment in real estate. There are no corporate, income, capital gains, inheritance, sales (vat) or recurring.

Residency certificate for persons of independent means; For joint or multiple account holders please complete a separate form for each account holder. The department for international tax cooperation is a department in the ministry of financial services and commerce.

Under the us foreign account tax compliance act (fatca) certain foreign vehicles must disclose to the cayman islands tax information exchange authority the name, address and taxpayer identification number of certain united states persons that own, directly or indirectly, an interest in such vehicle pursuant to the terms of an intergovernmental agreement between the united states and the. Cayman islands crs guidance notes version 2.0 release date: Gain full residency and complete tax efficiency through the establishment of a corporate entity in the cayman islands.

You will pay an additional $1,200 per dependent, and you will also need to pay any annual work permit fees, which vary by industry and employment capacity. 100% exempt from corporate, capital gains, sales, income tax and import duties. There are no direct taxation laws in the cayman islands and therefore there are no domestic provisions which define tax residence generally.

The cayman islands residency programme is suitable for highly successful investors and entrepreneurs who live very international lives. The certificate allows persons who are employed outside of the cayman islands with the financial independence to work remotely, to relocate and live in the cayman islands for up to 24 months. Cayman islands crs guidance notes version 3.0 release date:

The cayman islands competent authority the cayman islands competent authority is the tax information authority (“tia”) who is designated by law as the minister with responsibility for financial services, or his delegate. This may be relevant or desirable for citizens of european union (eu) member states for the purposes of compliance with reporting of savings income information law. Certificate of permanent residence for persons of independent means grants the right to live but not work.

When you will out your application for your cayman islands residency certificate, you will pay a $1,220 application fee as well as a $6,100 activation fee for your residence permit. Certificate of permanent residence for persons of independent means this provides the holder (and any qualifying dependents) with a lifetime right. The applicant must invest us$1.2 million in local real estate.

If the account holder is a u.s. The spouse and dependent children of the applicant will also be allowed to reside in the cayman islands without the right to work if they were named in the application. The cayman tax information authority can grant tax residency certificates to individuals ordinarily resident in the cayman islands.

A minimum 30 days residency is required. 15 march 2018 4 their obligations under the crs framework. What are the major benefits of cayman islands residency?

Cayman Islands Country By Country Reporting Tax Information Authority Cayman Islands Cayman Islands

Cayman Islands Residency By Investment Tax Efficient Residency

Extracts From Commercial Register Of Cayman Islands Schmidt Schmidt

Rerc Cayman - Fill Online Printable Fillable Blank Pdffiller

Cayman Islands Gsl

Cayman Islands Gsl

Cayman Islands Gsl

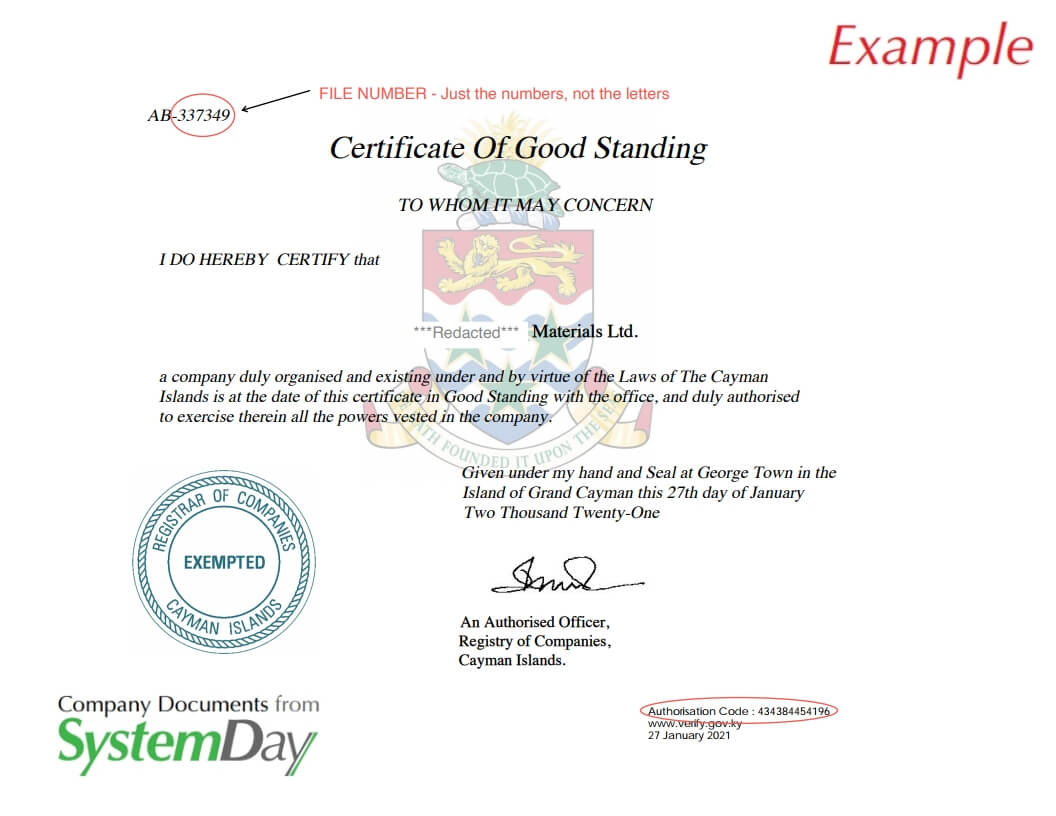

Cayman Islands Certificate Of Good Standing

Cayman Islands Gsl

How To Get Cayman Islands Residency - 7th Heaven Properties

Cayman Islands Fatca Tax Alert Tax Alert

Certificate Of Residence For Tax Purposes - General Topics - Prestashop Forums

Cayman Islands Gsl

Entity Self-certification Form - Cayman Islands Department Of

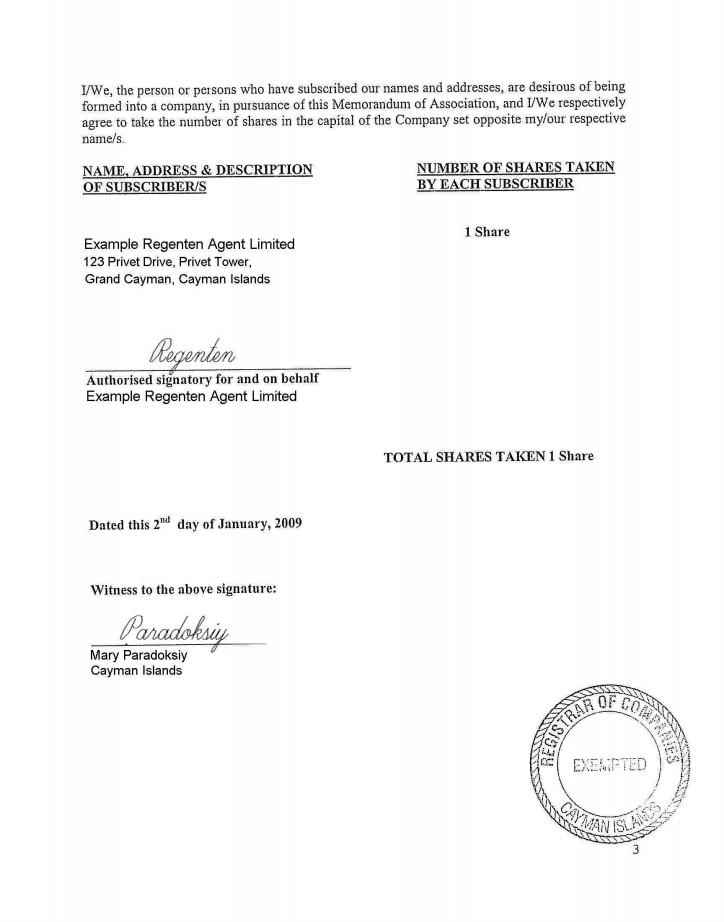

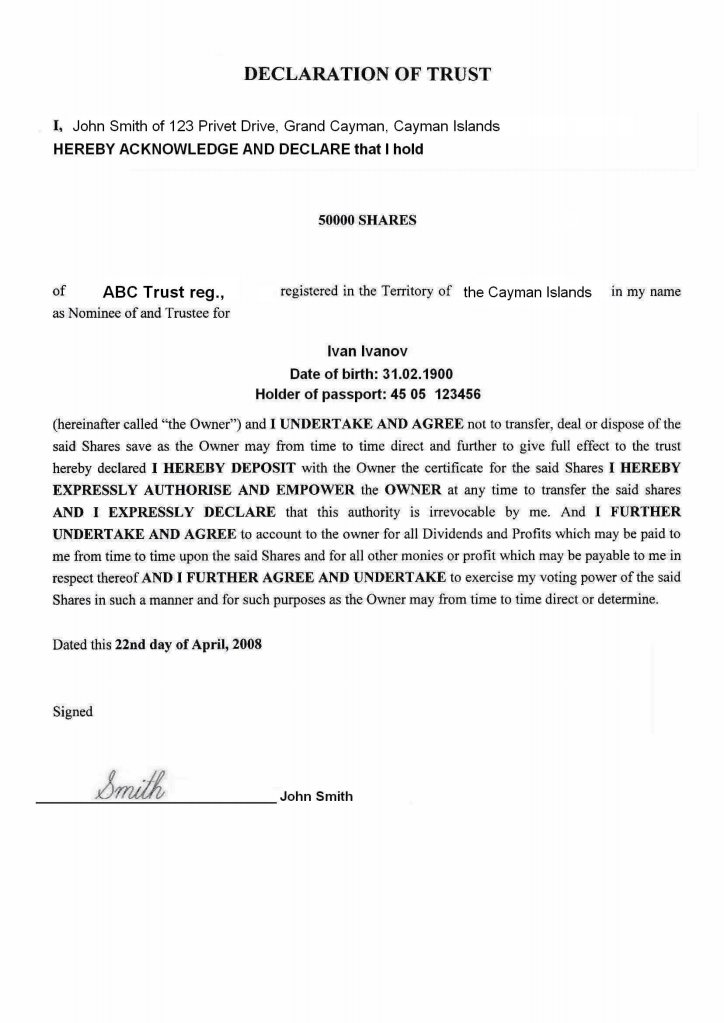

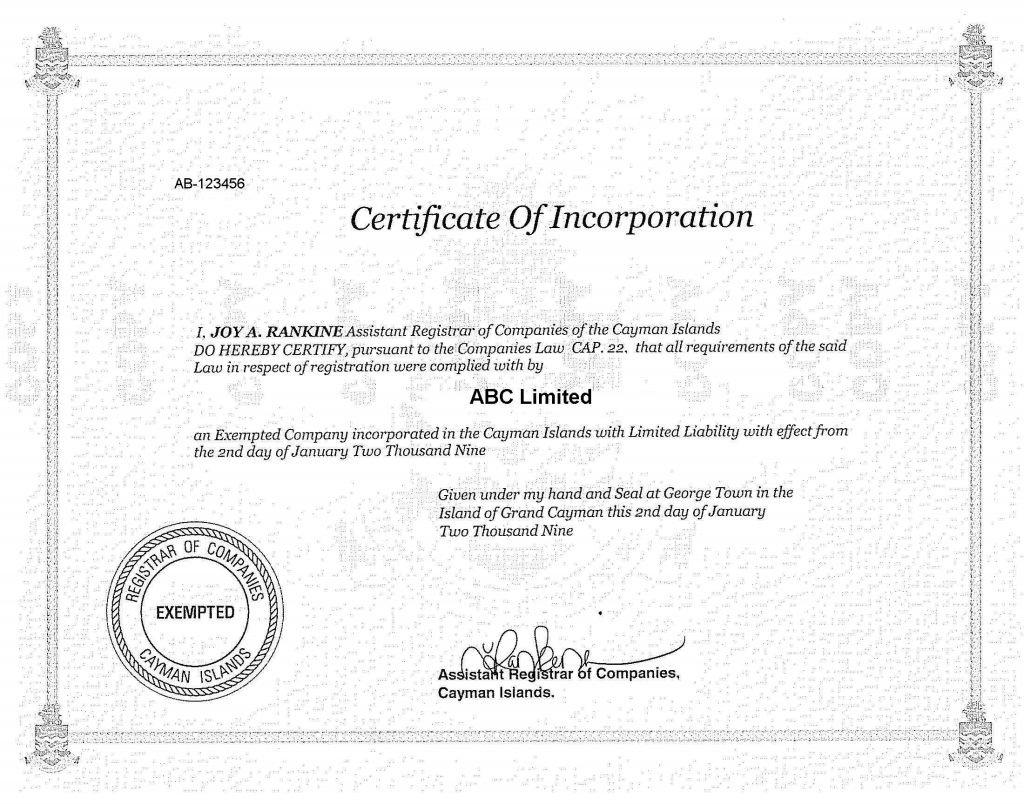

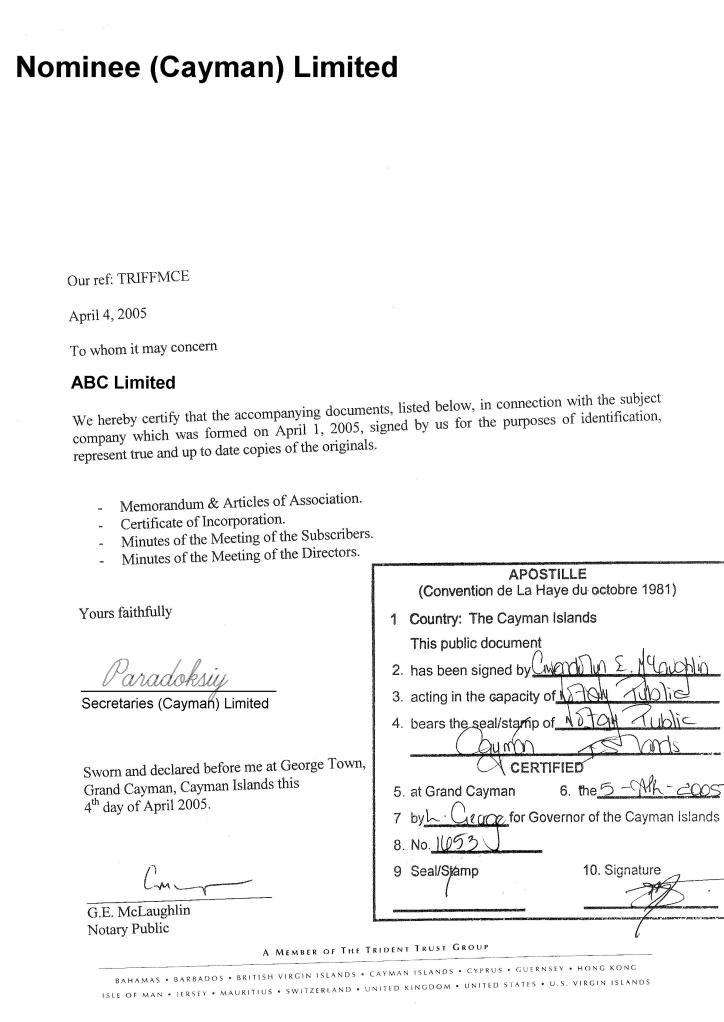

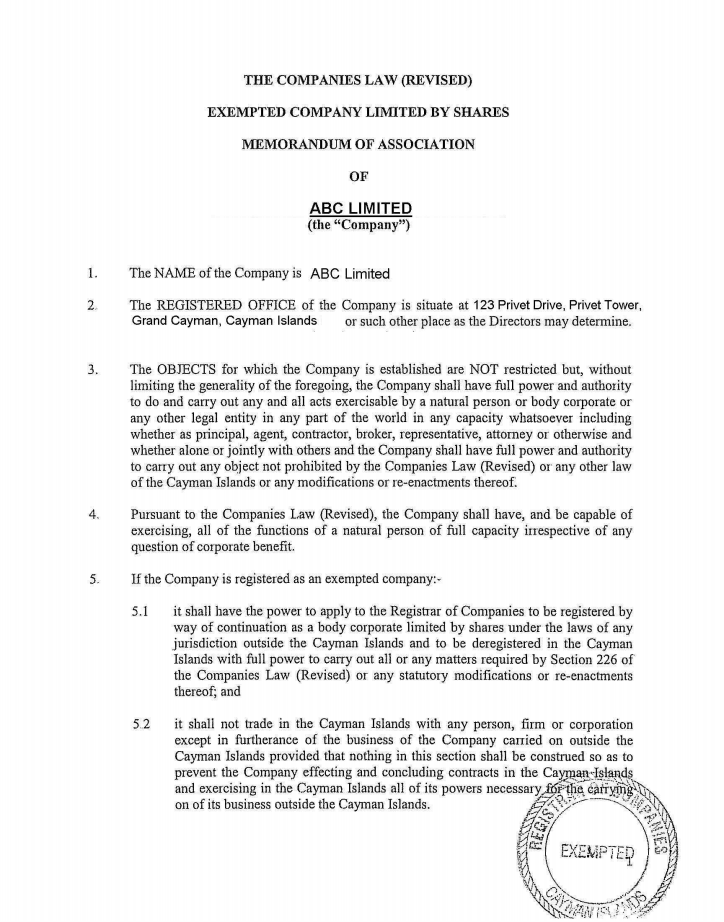

Documents And Services Offshore For Beginners

Fillable Online Person Married To A Caymanian - Cayman Islands Immigration Bb Fax Email Print - Pdffiller

Cayman Islands Gsl

Cayman Islands Gsl

Documents And Services Offshore For Beginners