Information of record in jones county. Simply click on the link below to make a personal property, real estate or a 2014 or older motor vehicle payment.

Tac - Tax Assessor-collectors Association

The jones county appraisal district appraises property for ad valorem taxation of these taxing authorities.

Jones county tax assessor ms. Welcome to the jones county, mississippi online record search. Access to appraisal is subscription based: The acrevalue jones county, ms plat map, sourced from the jones county, ms tax assessor, indicates the property boundaries for each parcel of land, with information about the landowner, the parcel number, and the total acres.

The median property tax on a $79,500.00 house is $524.70 in jones county. The jones county tax assessor is the local official who is responsible for assessing the taxable value of all properties within jones county, and may establish the amount of tax due on that property based on the fair market value appraisal. Originally part of baldwin county, it was named for james jones, an early.

The assessor’s office establishes tax assessment values only. Jones county, the 30th county formed in georgia, was created in 1807. Jones county tax assessor is categorized under budget agency, government (sic code 9311).

501 n 5th ave laurel, ms 39441. Jones county collects, on average, 0.66% of a property's assessed fair market value as property tax. Find jones county, mississippi assessor, assessment, auditor's, and appraiser's offices, revenue commissions, gis, and tax equalization departments.

Jones county now offers the ability for taxpayers to pay their taxes online. Get property records from 2 assessor offices in jones county, ms. In mississippi, jones county is ranked 59th of 82 counties in assessor offices per capita, and 3rd of 82 counties in assessor offices per square mile.

Jones county has one of the lowest median property tax rates in the country, with only two thousand three hundred sixty of the 3143 counties collecting a lower property tax than. To begin your search, choose a the links below. Jones county property records are real estate documents that contain information related to real property in jones county, mississippi.

Our goal is to provide equitable and accurate appraisals to all property owners in jones county and to respond to their concerns and questions in a professional and courteous manner. Jones county online tax payments. The median property tax in jones county, mississippi is $527 per year for a home worth the median value of $79,500.

Acrevalue helps you locate parcels, property lines, and ownership information for land online, eliminating the need for plat books. This search engine will return judgment roll, appraisal, property tax, etc. List of jones county assessor offices.

The median property tax on a $79,500.00 house is $834.75 in the united states. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. Remember to have your property's tax id number or parcel number available when you call!

The jones county tax assessor, located in ellisville, mississippi, determines the value of all taxable property in jones county, ms. More details about jones county tax assessor. In laurel (in jones county), mississippi 39440, the location gps coordinates are:

1121 main street columbus ms 39701. Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to. It is the mission of the jasper county tax assessor’s office to fairly and equitably discover, list, and value all real and business personal property for the purpose of creating the annual ad valorem tax roll in accordance with applicable mississippi statutes.

According to our records, this business is located at 501 n 5th ave. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes. The median property tax on a $79,500.00 house is $413.40 in mississippi.

Jones county assessor's office services.

2

Land For Sale In Pike County Ms - Mississippi Landsource

2

Noxubee County Circuit Clerks Office - Home Facebook

Brandon Mississippi High Resolution Stock Photography And Images - Alamy

2019 Hernando Main Street Chamber Of Commerce By Desoto Magazine Exploring The South - Issuu

Jasper County News - Jasper County News 2016 In Review January Newly Elected Jasper County Sheriff Randy Johnson Wasted No Time In Fulfilling His Duty To The County When His Term Began

2

2

2

Mississippi Department Of Archives History - History Is Lunch Curtis Wilkie The Death Of Vernon Dahmer Facebook

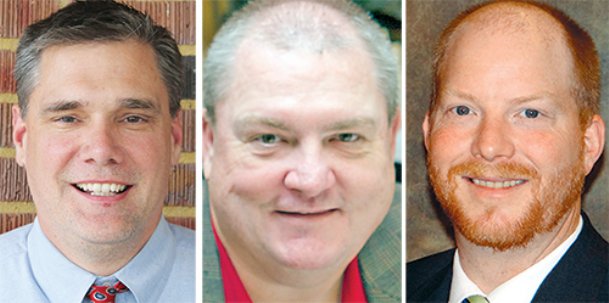

County Property Values Increase City Assessment Remains Flat - The Dispatch

Lcsd Requesting 55 Million More From Local Taxes - The Dispatch

2

Noxubee County Circuit Clerks Office - Home Facebook

Court System Lauderdale County

2

56jrq5um-ztttm

Complaint Form Jones County Ms