The rate of interest on refunds in real property tax certiorari proceedings is the “overpayment rate” as set annually by the commissioner of taxation and finance pursuant to section 697 (j) of the tax law. A lien is a legal claim on your property.

New York Property Tax Calculator - Smartasset

We found 24 results for property tax loans llc in or near new york, ny.

Property tax loans ny. We always look for reputable property tax lenders to add to our newburgh's vendor list. The new york state mortgage recording tax is a large amount of the closing cost for a purchase or a refinance. The businesses listed also serve surrounding cities and neighborhoods including new york ny, brooklyn ny, and great neck ny.

We always look for reputable property tax lenders to add to our rochester's vendor list. Once a tax lien is placed on the property, the local government will actually sell the tax liens because the counties need the money as soon as possible so they can spend it on budgeted items. The current rate is 2.625%.

Technically the rates are 2.05% for loans below 500k and 2.175% for loans over $500k. (the overpayment rates may be found on the interest rates: If all members of your household are under age 65,.

The property tax and interest deferral program removes properties from the tax lien sale once an application is. While the county can keep adding interest to these taxes, they do not have the right to come in and actually take the home from the homeowner until you. You can start anywhere in the series or review all the modules.

When you don't pay the taxes, the delinquent amount—which includes the accrued taxes, interest, penalties, and costs resulting from the delinquency—becomes a lien on your home. However, typically, the buyer’s lender pays 0.25% of the mrt, which makes the effective mortgage recording tax rates in nyc 1.8% for loans under $500k and 1.925% for loans over 500k. They also appear in other related business categories including tax return preparation, financial services, and real estate loans.

Need help paying property taxes in ontario county new york? We always look for reputable property tax lenders to add to our tonawanda's vendor list. Completion of a satisfactory county master loan application is required, along with county approval.

The taxing authority can then foreclose the lien to collect the overdue amounts. If you run a credible property tax lending company that offers flexible and low fixed rate property tax loans for residential and commercial property owners in the state of new york, apply to get listed on our directory. You can reduce the amount of the mortgage recording tax by negotiating a purchase cema loan with.

If you run a credible property tax lending company that offers flexible and low fixed rate property tax loans for residential and commercial property owners in oneida county. Funding is continuously available through the county’s revolving loan fund as long as there is money available. The real property tax credit may be available to new york state residents who have household gross incomes of $18,000 or less, and pay either real property taxes or rent for their residences.

Get multiple loan offers from few reputable lenders. In fact, many new york counties (outside of new york city) have rates exceeding 2.50%, which is more than double the national average of 1.07%. The financial education program is a series of short modules and videos designed to take you through the benefits available to you and the responsibilities you have as a new york state taxpayer.

If you run a credible property tax lending company that offers flexible and low fixed rate property tax loans for residential and commercial property owners in rochester new york, apply to get listed on our directory. Apply for a quick loan to pay your property tax bill and receive up to 5 loan quotes from the best ontario county property tax lenders! If you qualify for the property tax and interest deferral (pt aid) program, you can defer your property tax payments so that you can remain in your home.

Here's how a new york tax foreclosure works: In new york city, property tax rates are actually fairly low. We always look for reputable property tax lenders to add to our oneida county's vendor list.

Property tax mortgage recording tax (mrt) real property transfer tax. The program sets a maximum taxable value for every hdfc unit across the city. This year it’s $11,079, in a market where the median price for a home has risen to.

If you run a credible property tax lending company that offers flexible and low fixed rate property tax loans for residential and commercial property owners in newburgh new york, apply to get listed on our directory. Therefore, the effective mortgage recording tax rates you pay as a buyer in nyc are 1.8% for loans under $500k and 1.925% for loans of $500k or more. The nyc department of finance recognizes that an unexpected event or hardship may make it difficult for you to pay your property taxes.

If you run a credible property tax lending company that offers flexible and low fixed rate property tax loans for residential and commercial property owners in tonawanda new york, apply to get listed on our directory. We always look for reputable property tax lenders to add to our new york's vendor list. Loan terms may extend for up to five years.

Commercial properties and four or more family houses have a higher mortgage recording tax rate of 2.8%.

Disabled Veterans Property Tax Exemptions By State

Deducting Property Taxes Hr Block

New York State Nys Property Tax Hr Block

New York Property Tax Calculator - Smartasset

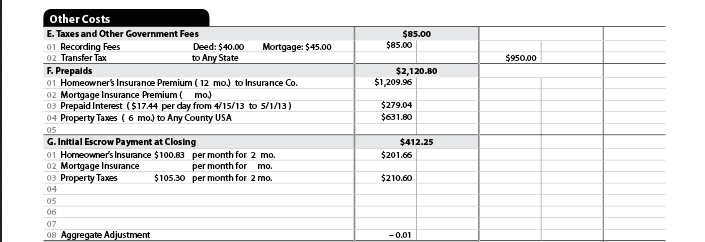

Understanding Prepaids Impounds On Closing Disclosure - Mortgage Blog

Are There Any States With No Property Tax In 2021 Free Investor Guide

Property Tax Prorations - Case Escrow

Are There Any States With No Property Tax In 2021 Free Investor Guide

What Is A Homestead Exemption And How Does It Work Lendingtree

Basics Of Property Taxes - Mortgagemarkcom

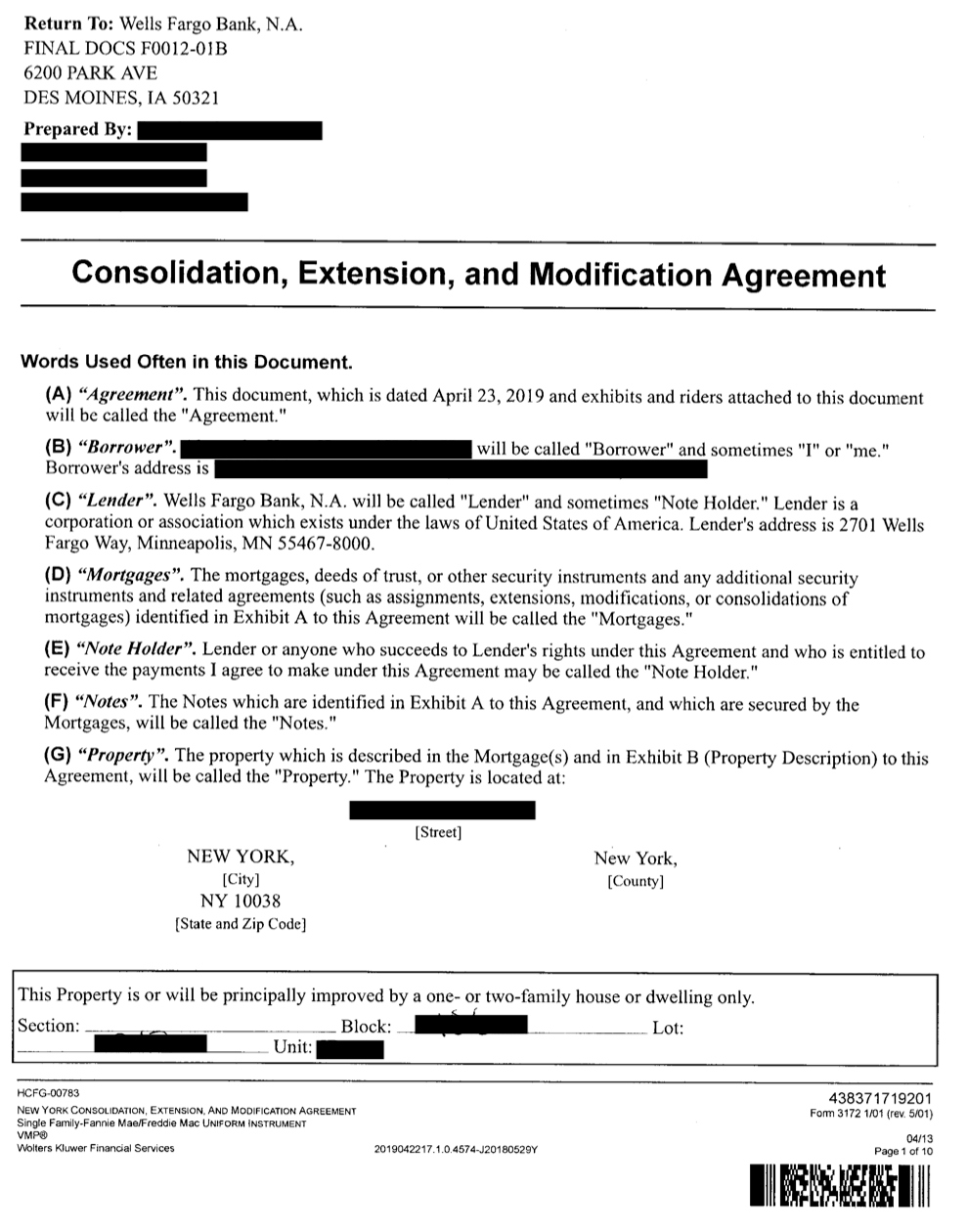

Purchase Cema What You Need To Know - Blocks Lots

Florida Property Tax Hr Block

Irs Tax Rules For Imputed Interest - Turbotax Tax Tips Videos

Real Estate Professional Status Tax Loophole Did You Know That By Being A Real Estate Professional You Can Sav Tax Deductions Property Tax Refinance Mortgage

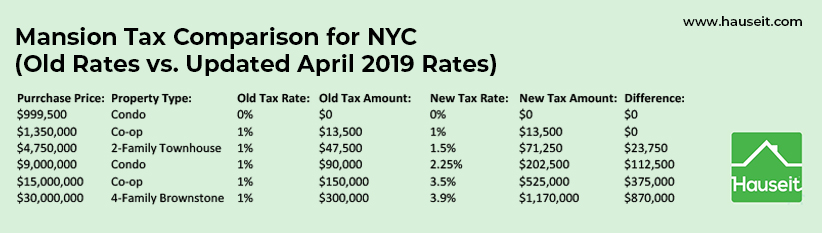

Nyc Mansion Tax Of 1 To 39 2021 Overview And Faq Hauseit

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

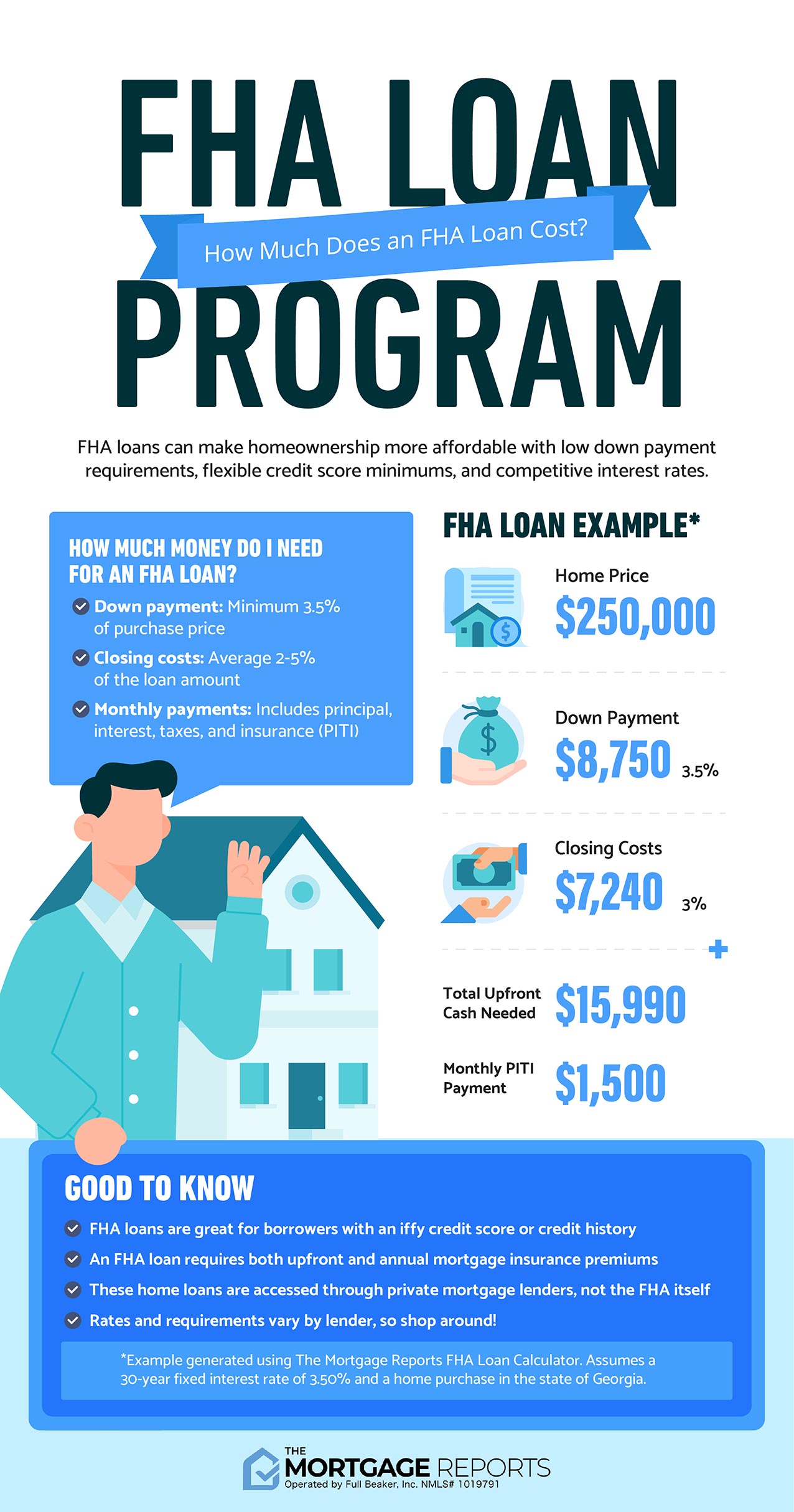

Fha Loan Calculator Check Your Fha Mortgage Payment

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Refinancing Your House How A Cema Mortgage Can Help