These are included in their state sales tax rates. Prior 12/2019 and $5.00 or $12.00/room/night, eff.

New Us Single-family Home Sales Race To 10-month New Homes Home And Family Science And Technology News

To fund a 1 percent increase, bgr’s report said state lawmakers could add a local hotel charge to the general state sales tax the legislature renewed at 0.55 percent last year.

New orleans sales tax percentage. Restoring a 1 percent sales tax on new orleans hotels would be a step too much for the city’s tourism industry to bear, leading industry representatives said wednesday (jan. The remaining 0.45 percent could be captured either by shrinking the current state hotel tax rate to make room for new orleans’ extra share, or by rededicating existing revenue to city coffers, the. This is the total of state, parish and city sales tax rates.

The minimum combined 2021 sales tax rate for new orleans, louisiana is. The louisiana (la) state sales tax rate is currently 4.45%. Though sales taxes can be steep due to local parish and jurisdiction sales taxes, food and medications are exempt from sales taxes.

These are included in their state sales tax rates. The new orleans sales tax rate is %. Decrease in state sales tax rate on telecommunications services and prepaid calling cards effective july 1,.

Depending on local municipalities, the total tax rate can be as high as 11.45%. The sales and use tax so levied shall be imposed by an ordinance or resolution of the council of the city of new orleans and shall be levied upon the sale at retail, the use, the lease or rental, the consumption, and the storage for use or consumption, of tangible personal property and on sales of services in the parish of orleans, all as. How 2021 sales taxes are calculated in new orleans.

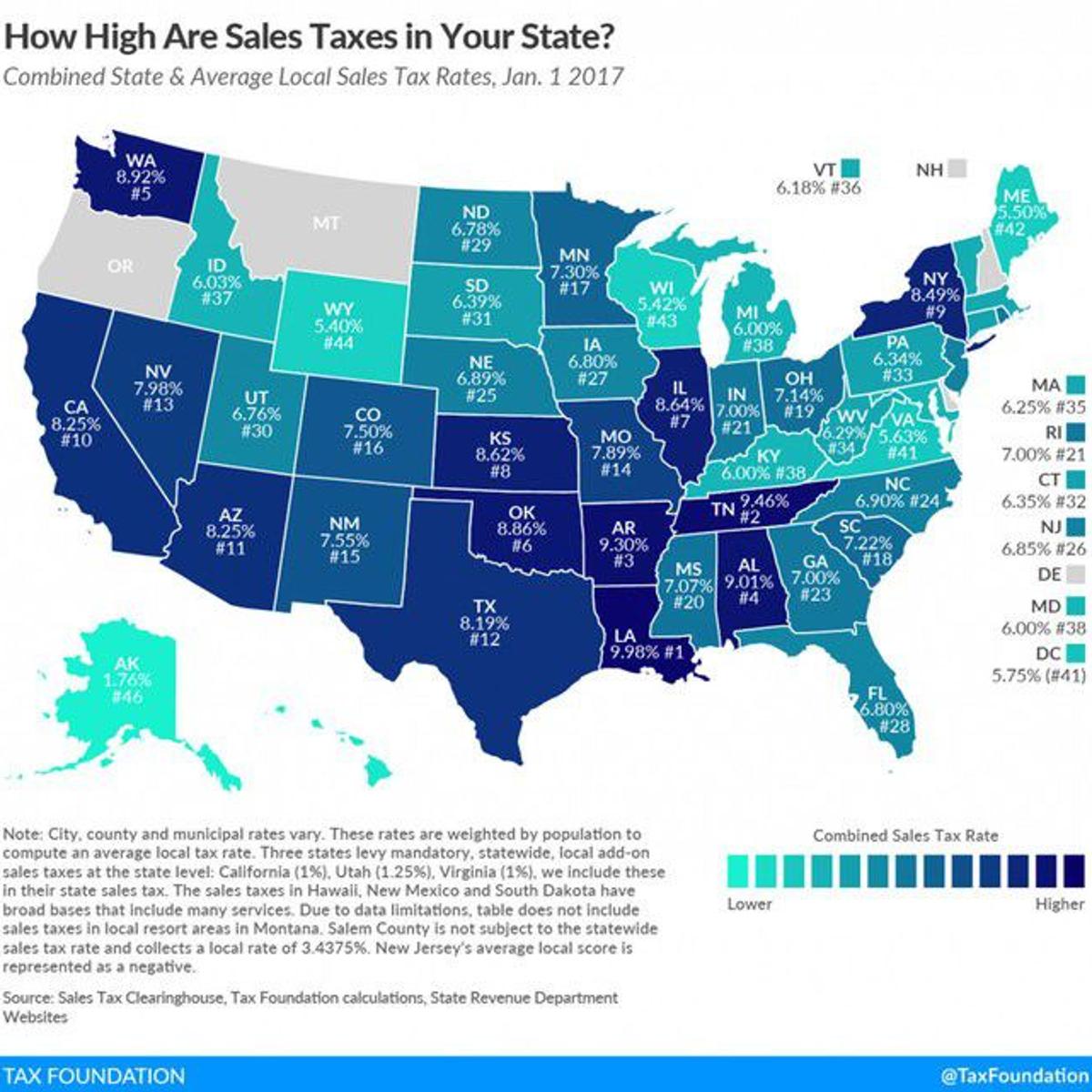

How much sales tax do they take in new mexico? The december 2020 total local sales tax rate was also 9.450%. Unfortunately for louisiana consumers and visitors, that base rate is augmented by significant parish (what louisiana calls its counties) and city sales tax rates.

The current total local sales tax rate in new orleans, la is 10.000%. Questions answered every 9 seconds. You can print a 9.45% sales tax table here.

Alone, that is one of the lowest rates in the nation. Tax/fee description rate effective date required filing tax form; Sales tax calculator | sales tax table the state sales tax rate in louisiana is 4.450%.

30), responding to a new watchdog report that called for the extra tax revenue to help pay for drainage and street improvements. However, part of the city lies in jefferson parish and is subject to a total rate of 8.75 percent. Ad a tax advisor will answer you now!

The parish sales tax rate is %. For tax rates in other cities, see louisiana sales taxes by city and county. Depending on the zipcode, the sales.

There is no applicable city tax or special tax. Restoring a 1 percent sales tax on new orleans hotels would be a step too much for the city’s tourism industry to bear, leading industry representatives said wednesday (jan. With local taxes, the total sales tax rate is between 4.450% and 11.450%.

(b) most of new orleans is located within orleans parish and is subject to a 9 percent sales tax. The state sales tax rate in new mexico is 5.125%. (b) most of new orleans is located within orleans parish and is subject to a 9 percent sales tax.

The 9.45% sales tax rate in new orleans consists of 4.45% louisiana state sales tax and 5% orleans parish sales tax. The new orleans, louisiana, general sales tax rate is 4.45%. Louisiana’s state sales tax rate is 4.45%.

The louisiana sales tax rate is currently %. The current total local sales tax rate in new orleans, la is 9.450%. The combined rate used in this calculator (10%) is the result of the louisiana state rate (5%), the.

However, part of the city lies in jefferson parish and is subject to a total rate of 8.75 percent. Questions answered every 9 seconds. Ad a tax advisor will answer you now!

11.75% (6.75% + 5%) 9/1/2020: The 70130, new orleans, louisiana, general sales tax rate is 10%.

Spending The Evening Talking About State Sales Tax With The Vlaa Vlaa Regionalartscommission Taxes Iminovermyhead

Sample Process Specialist Resume Resume Specialist Process

100 Percent That Bach Party Invitation That Bach Etsy Bachelorette Invitations Bachelorette Party Invitations Party Invitations

4 Big Countries With Low Population Densities Travel Trivia Travel Facts Big Country Largest Countries

Pin On Houston Real Estate By Jairo Rodriguez

Chatsworth Garden Water Fountain Garden Water Fountains Fountains Outdoor Stone Fountains

Pin On Redcoats 1800-1815

2

How To Make An Interesting Art Piece Using Tree Branches Ehow Fountains Outdoor Outdoor Fountain Garden Water Fountains

Louisiana Has The Highest Sales Tax Rate In America Business News Nolacom

Louisiana Sales Tax - Small Business Guide Truic

New Orleans Louisianas Sales Tax Rate Is 945

Joplin Voters Approve Use Tax For Online Purchases - Koam

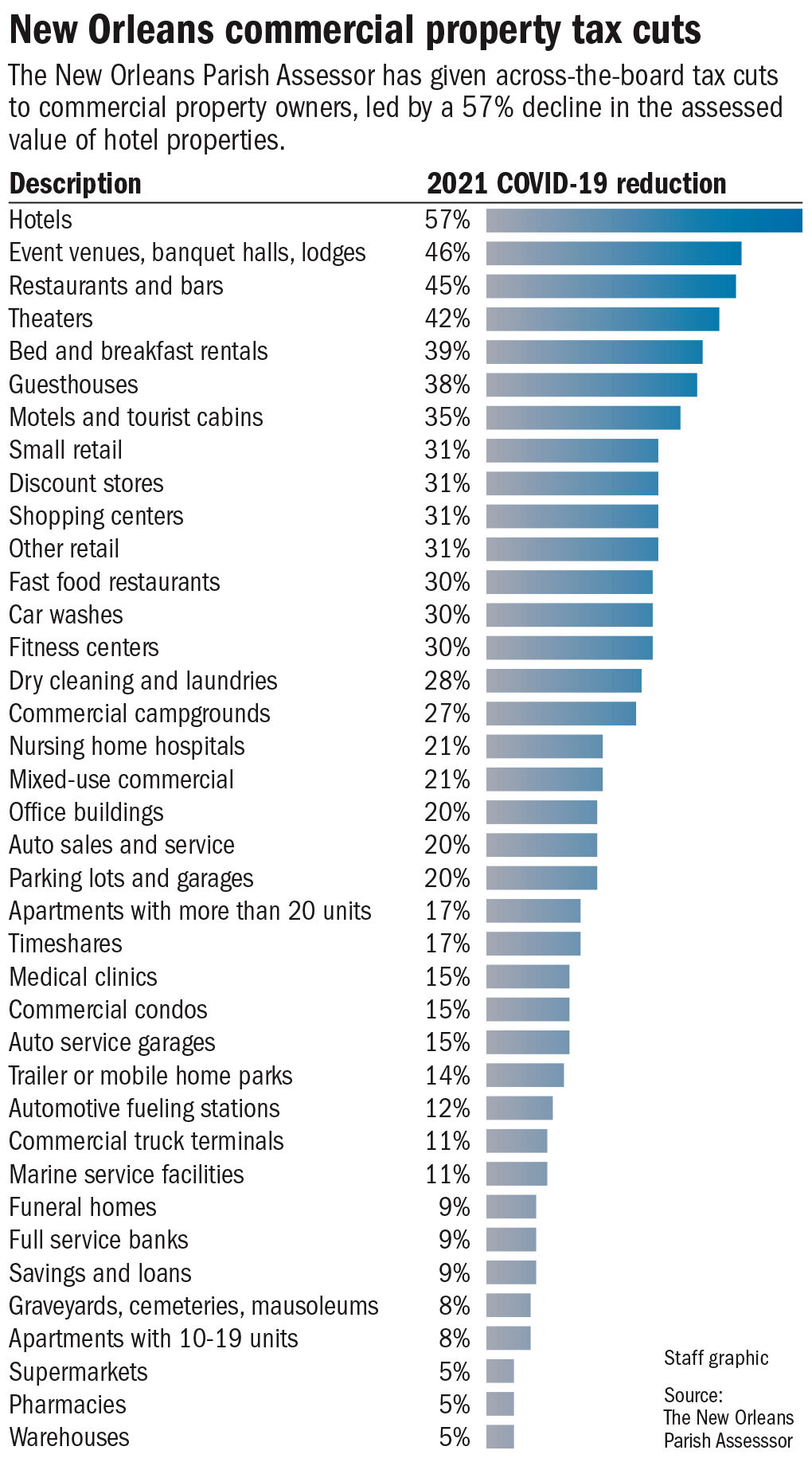

Property Taxes For New Orleans Homes Have Surged Now Businesses Could Get A Huge Tax Cut Business News Nolacom

Pin On Infographics

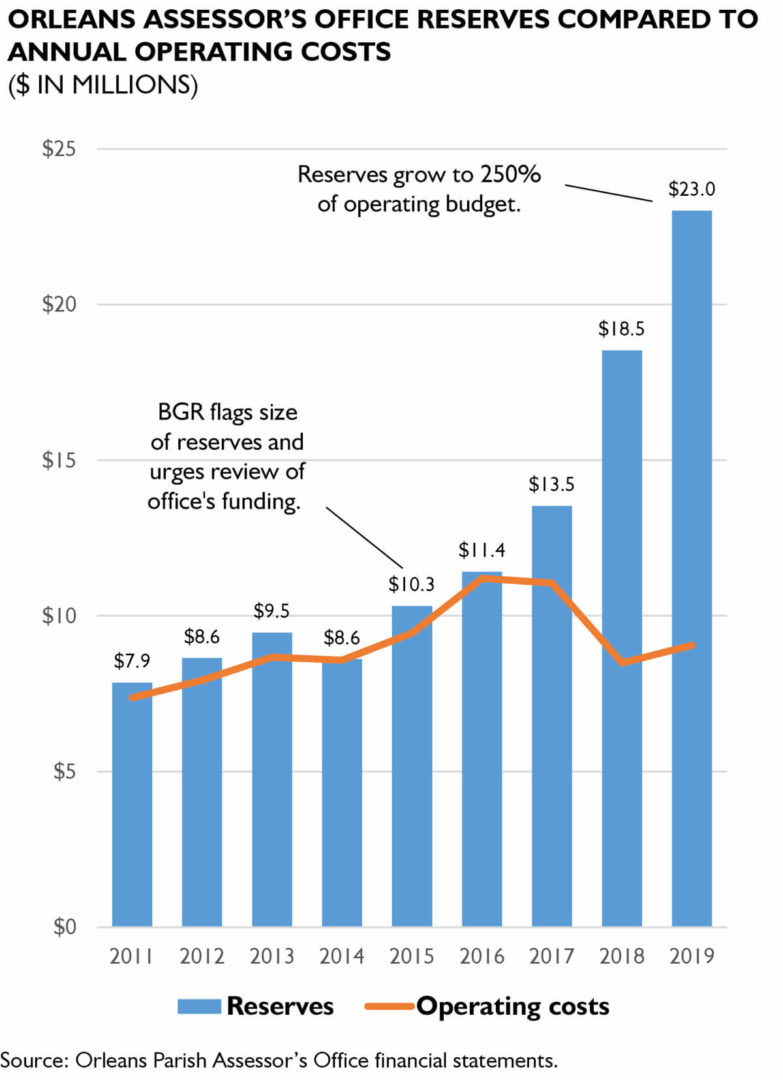

Policywatch Revisiting Assessment Issues In New Orleans

What Is A Reverse Mortgage A Complex Financial Tool Reverse Mortgage Refinance Mortgage Refinancing Mortgage

States With The Highest And Lowest Property Taxes Property Tax High Low States

Frog Plinth Garden Water Fountain Fountains Outdoor Garden Water Fountains Stone Fountains