The current total local sales tax rate in contra costa county, ca is 8.750%. Between 2018 and 2019 the median property value increased from $670,000 to $687,600, a 2.63% increase.

Pdf Improving Estimates Of Transmission Capital Costs For Utility-scale Wind And Solar Projects To Inform Renewable Energy Policy

People in contra costa county, ca have an average commute time of 36.5 minutes, and they drove alone to work.

Contra costa county sales tax rate 2019. Boost your business with wix! The sales tax rates may differ depending on the type of purchase. This is the total of state and county sales tax rates.

Build the online store that you've always dreamed of. The california state sales tax rate is currently %. County prior rate rate change new rate;

For tax rates in other cities, see california sales taxes by city and county. The contra costa county sales tax rate is %. Here's how contra costa county's maximum sales.

The average sales tax rate in california is 8.551%. City sales and use tax rate changes. City rate county american canyon* 7.750% napa anaheim* 7.750% orange anderson* 7.750% shasta angels camp* 7.250% calaveras angelus oaks 7.750% san bernardino angwin 7.750% napa annapolis 8.125% sonoma antelope 7.750% sacramento antelope acres 9.500% los angeles antioch* 8.750% contra costa anza 7.750% riverside

Several local sales and use tax rates have changed. , ca sales tax rate. The contra costa county, california sales tax is 8.25% , consisting of 6.00% california state sales tax and 2.25% contra costa county local sales taxes.the local sales tax consists of a 0.25% county sales tax and a 2.00% special district sales tax (used to fund transportation districts, local attractions, etc).

Ad with secure payments and simple shipping you can convert more users & earn more!. You can print a 9.25% sales tax table here. The california sales tax rate is 6.5%, the sales tax rates in cities may differ from 6.5% to 11.375%.

The contra costa county sales tax is 0.25%. The minimum combined 2021 sales tax rate for contra costa county, california is. Many local sales and use tax rate changes take effect on april 1, 2019, in california, as befits its size.

72 rows (located in contra costa county) 1: 1788 rows contra costa: Build the online store that you've always dreamed of.

For more information, please have a look at california’s official site. • antioch (contra costa county): Some cities and local governments in contra costa county collect additional local sales taxes, which can be as high as 4%.

Boost your business with wix! The december 2020 total local sales tax rate was also 7.250%. Ad with secure payments and simple shipping you can convert more users & earn more!.

The homeownership rate in contra costa county, ca is 65.4%, which is higher than the national average of 64.1%. Medical director contra costa county, 2019: • angels camp (calaveras county):

Contra costa county, ca sales tax rate. Usually it includes rentals, lodging, consumer purchases, sales, etc. The 9.25% sales tax rate in pittsburg consists of 6% california state sales tax, 0.25% contra costa county sales tax, 0.5% pittsburg tax and 2.5% special tax.

California Food Tax Is Food Taxable In California - Taxjar

Pdf Improving Estimates Of Transmission Capital Costs For Utility-scale Wind And Solar Projects To Inform Renewable Energy Policy

Pdf Improving Estimates Of Transmission Capital Costs For Utility-scale Wind And Solar Projects To Inform Renewable Energy Policy

California Food Tax Is Food Taxable In California - Taxjar

![]()

Victorville California Fire And Police Services Sales Tax Measure K November 2017 - Ballotpedia

2

California Food Tax Is Food Taxable In California - Taxjar

2

Louisiana Property Taxes By County - 2021

Californians Adapting To New Property Tax Rules

California Food Tax Is Food Taxable In California - Taxjar

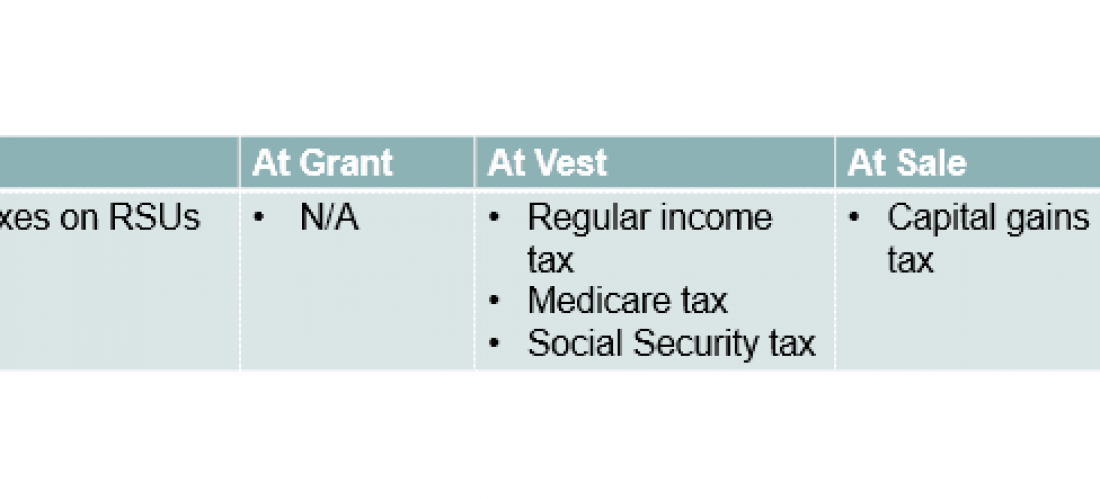

Equity Compensation 101 Rsus Restricted Stock Units

Supplemental Property Taxes

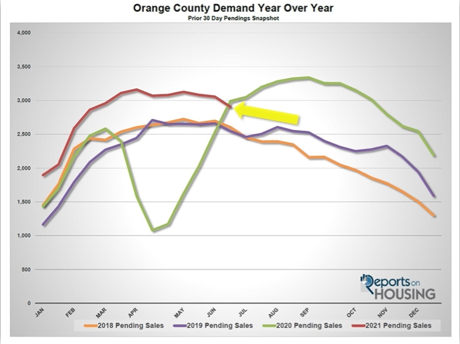

The Swan Team Real Estate Blog

The Swan Team Real Estate Blog

Driving A Taxi Marked With Advertisements Permissible Manhattan Apartment Real Estate Luxury Apartments

2

2

2