Turbotax®, taxact® and h&r block® (desktop) 9.999999e+06. While crypto transactions are conducted anonymously, the cra does have the right to demand customer data from crypto exchanges.

Pin On Binary Options No Deposit Bonuses

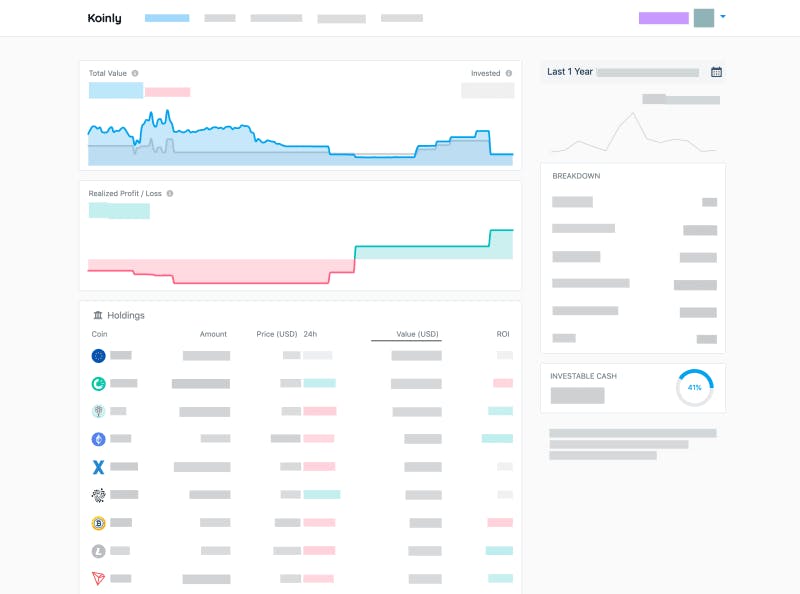

Calculate your bitcoin and crypto taxes.

Crypto tax calculator canada. The basic personal tax amount, cpp/qpp, qpip and ei premiums, and the canada employment amount. Calculate and report your crypto tax for free now. Whatever crypto sales gains you would have reported for your 2019 taxes should have been included in your 2019 tax return due july 15, 2020.

After almost handing over my crypto transactions to my accountant to calculate the gains / losses at enormous cost, i stumbled upon cryptotaxcalculator (ctc). The cra established a cryptocurrency section in 2017 to guarantee. The canada revenue agency does and they’re sending a clear message that crypto investors need to calculate their crypto taxes correctly and pay their dues.

Status of cryptocurrency in canada. There is no legal way to avoid paying taxes on cryptocurrency in canada. See our 500+ reviews on.

Bitcoin.tax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes. More specifically, the cra states that the acb is the cost of property, and that in the case of identical properties, you use the average cost of each property to determine your adjusted cost basis. File your crypto taxes in canada learn how to calculate and file your taxes if you live in canada.

Canadian citizens have to report their capital gains from cryptocurrencies. Paying taxes on cryptocurrency in canada doesn’t have to be a headache. File your tax return in under 20 minutes.

Cryptocurrency tax filing made simple. To answer these questions we need to explore the status of cryptocurrency in canada. Report crypto on your taxes easily using koinly, a crypto tax calculator and software.

Discover how much taxes you may owe in 2021. Learn about canadian crypto tax rates for 2022 and how to calculate yours. Uploaded the data via a simple api process from my crypto exchange and out came the reports, accountant ready.

Bitcoin tax calculator for canada. On march 17, 2021, the irs announced a similar extension for 2020 tax filings from april 15, 2021, to may 17, 2021. Get help with your crypto tax reports.

And are there any canadian crypto laws? Crypto.com tax offers the best free crypto tax calculator for bitcoin tax reporting and other crypto tax solutions. You can use crypto as an investment, as a currency for spending, or as a source of passive income.

Ideal tax calculator for aussie crypto traders. Crypto taxes in canada are confusing because there are so many use cases for crypto. Are you prepared for tax season?

To calculate your income/gain/loss you need track your adjusted cost base (acb), your proceeds, and your outlays and expenses related to each trade. Full integration with popular exchanges and wallets in canada with more jurisdictions to come. Read the ultimate crypto tax guide.

Koinly is the only cryptocurrency tax calculator that is fully compliant with cra's crypto guidance. Learn how to reduce your taxes for next year. Download schedule d form 8949 (us only) reports and software imports e.g.

The investor’s guide to canada. If you do have (or had through the course of the year) $10,000 or more, you need to report that to the irs. Your acb is the total average cost (in cad) of each unit of that cryptocurrency at any given time.

Rates are up to date as of june 22, 2021. Straightforward ui which you get your crypto taxes done in seconds at no cost. Demystify crypto taxes ← all blog post / tag:

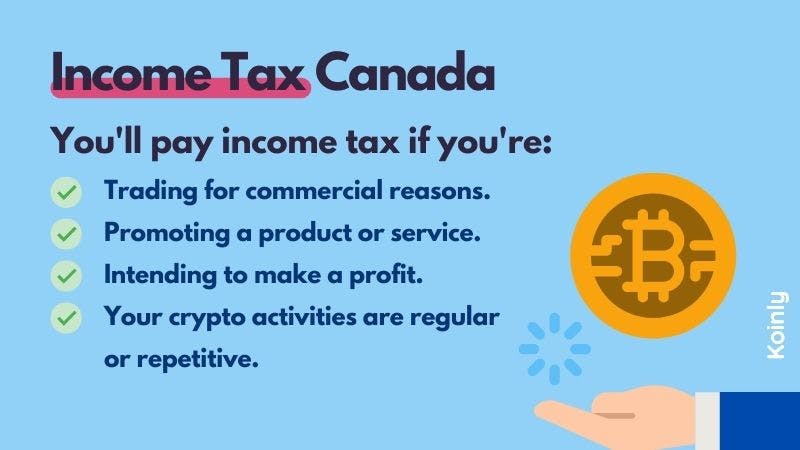

Fulfilling the purpose of the income tax act, the canada revenue agency (cra) considers cryptocurrency a commodity. When filing your taxes in canada, you will treat your cryptocurrency like any other commodity or barter. Investors, traders, miners, and thieves.

As the cryptosphere gained more traction, revenue authorities came knocking and started talking about the need for crypto traders and investors to pay tax. You pay crypto taxes on selling crypto for fiat, buying goods or services with crypto, trading crypto, earning crypto interest, crypto from airdrops, crypto earned for tasks, crypto from liquidity pools and staking, and crypto mining. Can you avoid crypto taxes in canada?

Canadian crypto taxpayers are required to use the adjusted cost basis, or average cost, for capital gains calculations. Crypto.com is excited to announce the launch of crypto.com tax for canada, which will soon be rolled out to other markets as well. Simply upload or add the transaction from the exchanges and wallets you have used, along with any crypto you might already own, and we'll calculate your capital gains.

Binance (malta), kucoin (singapore), bitfinex (hong kong, china), jaxx (canada), and huobi (korea) are widely used crypto investors in the us and abroad. Do you need to file crypto taxes? The cra treats cryptocurrencies as commodities.

Koinly Bitcoin Tax Calculator For Canada

Android App Qr Scanner Barcode

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Irs To Reshape Its Btc Tax Policy Next Year What To Expect As An Ordinary User Tax Return Investment Loss Tax Advisor

Calculate Bitcoin Taxes For Capital Gains And Income Capital Gain Bitcoin Income

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Pin By Buy The Dip Hodl On Moneybankscryptocurrencydebttaxes -news In 2021 Next Week Price Increase Money Bank

Httpsmixmio Bitcoin Investment App Buy Bitcoin

Discover Why The Gold Rate In Usa Is Skyrocketing Bitcoin Buy Cryptocurrency Bitcoin Wallet

What Your Myers-briggs Personality Says About How You Manage Money Money After Graduation Money Management Spending Money Financial Advice

Pin On Gold Rate

Hbjduk0nzcy5im

Federal Reserve Governor Talks About Crypto-market Volatility Httpsbitly2ukb8ts Instagram Photo Instagram Wonder

How To Enable Hedge Mode On Binance Futures Binance Guide Binance Tutorial In 2021 How To Get Rich Make Money Now Enabling

Everything You Need To Know About Form 1040nr In 2021 Accounting First Names Form

Crypto Tax Calculator

How To Buy And Trade Penny Cryptocurrency Trade Ripple Best Penny Penny Cryptocurrency Trading

Bitcoin Wallet Online Opus Cryptocurrency - Schwab Buy Bitcoinbest Way To Invest In Bitcoin Bitcoin Telegram Bi Bitcoin Mining Bitcoin Mining Pool Buy Bitcoin