However, it is not as detailed as that of wealthfront’s whitepaper. Customer support includes live chat.

Wealthfront Vs Betterment Which Robo-advisor Is Best - One Shot Finance

Tax loss harvesting comparison for 2018.

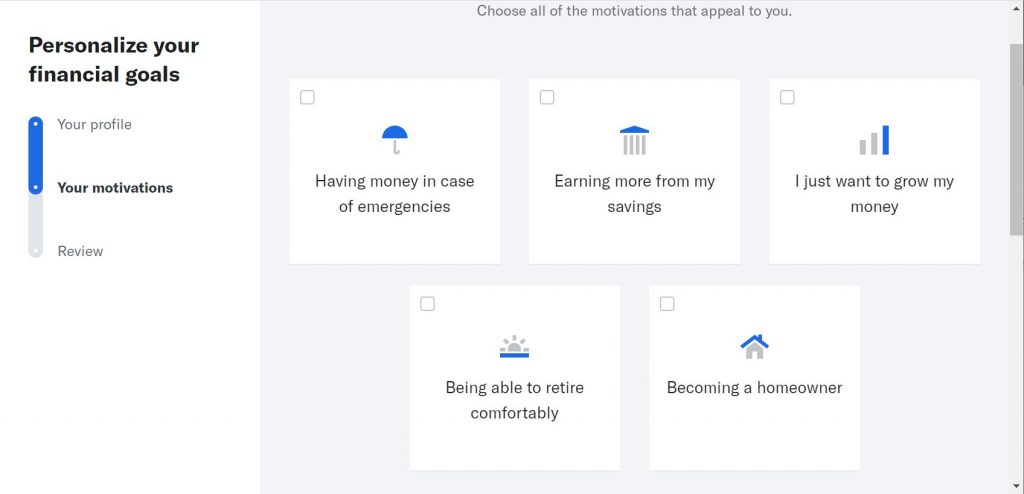

Wealthfront vs betterment tax loss harvesting. Betterment and wealthfront pros betterment: Wealthfront offers some additional tax perks too. Wealthfront and betterment both offer tax loss harvesting at no extra cost.

Having these handy allows me to write off a comparable gain and not pay taxes on them. Direct indexing makes it easier to harvest tax losses because individual securities are held which mirror an index fund. The strategy configures costs, value, and diversification in a different way than betterment’s core portfolio.

If you have the cash, wealthfront has a definite edge as the only major. Sophisticated investors have been harvesting losses manually for decades to acquire tax benefits. Betterment , on the other hand, takes a more basic approach.

For example, they’ll keep municipal bonds in a taxable account rather than your roth ira. It’s important to understand what this is offsetting. Their methods for tax harvesting are similar, involving selling assets that have generated losses and then buying related ones (of similar exposure) to replace them.

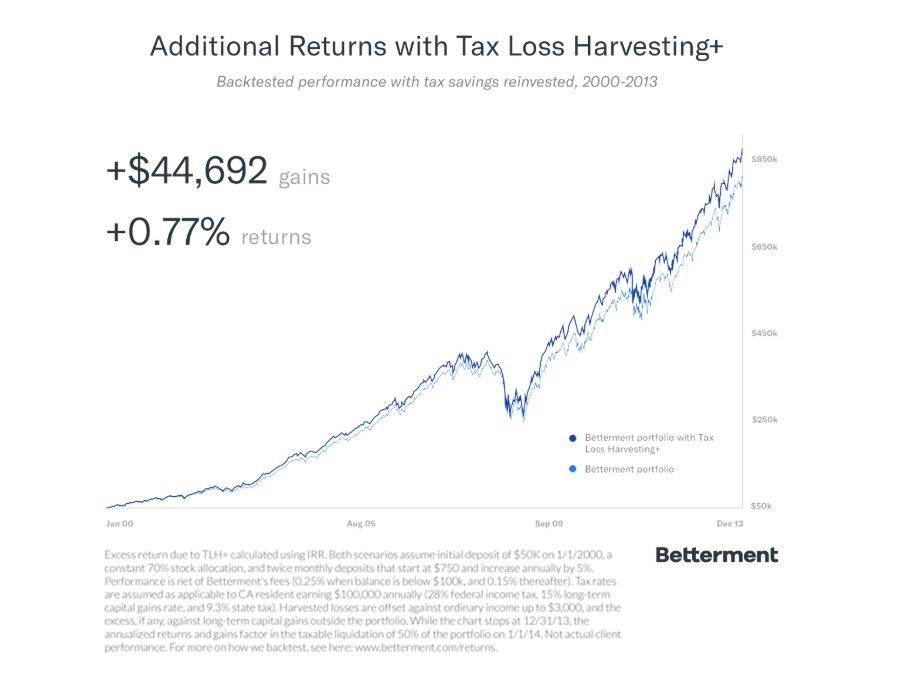

Investment options for betterment vs wealthfront. Betterment and wealthfront claim that tax loss harvesting gives an extra.77% vs 1% respectively which would more than offset their.15% and.25% respective fees. You can open an account with no money at all.

Wealthfront and betterment automatically does tax loss harvesting for you. Wealthfront does have a distinct advantage over betterment because it offers the passiveplus option for those who qualify. Betterment harvested $918.21 while wealthfront grabbed $1,151.23.

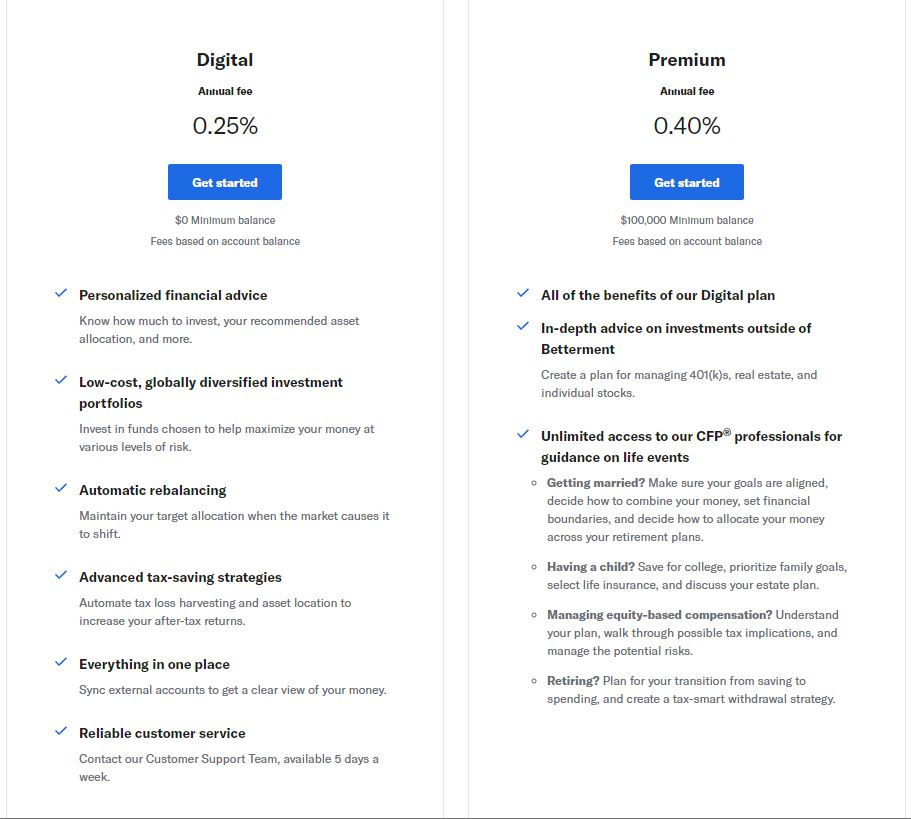

Services for those with accounts that have over $100,000, there are advanced features available, and these include, among others, direct indexing and portfolio. One low fee of 0.25% on all accounts up to $2 million. Fee drops to 0.15% on accounts above $2 million.

Betterment provides a free human advisor for accounts over $100,000: Wealthfront offers a smart beta option on account balances of $500,000 or more. Wealthfront avails tax loss harvesting, using your losses to offset taxes that would be levied on your gains, to everyone using their platform, providing benefits to all users alike.

Betterment and wealthfront both charge an annual fee of 0.25% for digital portfolio management. If this is true, then these services pay for themselves and i might as well take advantage of the better user experiences (imo). By providing tax loss harvesting at the stock level

Betterment and wealthfront made harvesting losses easier and more efficient than ever since 2008. With investment accounts over $100,000, they will tax loss harvest at the individual stock level (instead of at the etf level). Betterment provides tax loss harvesting at the index fund level, but wealthfront delivers more for those with more than $500k invested:

Best of all, if you sell more losses than gains, you can carry those forward to the following tax year. Instead of investing only in broad market etfs, wealthfront algorithms invest directly in s&p 500 stocks. Betterment alone has reached $5 billion under management.

Wealthfront Vs Betterment Which Robo-advisor Is Best - One Shot Finance

Betterment Vs Wealthfront Which One Is Better Money Under Ctrl

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Betterment Vs Wealthfront Which Is Better - Mustard Seed Money

/Bettermentvs.Wealthfront-5c61bcf246e0fb0001dcd5c2.png)

Betterment Vs Wealthfront Which Is Best For You

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Wealthfront Vs Betterment Which Robo-advisor Is Best - One Shot Finance

Betterment Vs Wealthfront Which Is Better - Mustard Seed Money

Betterment Vs Wealthfront Guide Which Is Right For You - Minafi

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Vs Wealthfront - The Simple Dollar

Betterment Vs Wealthfront A Marquee Event - Techbullion

Fin Tech Financial Technology Tamkang University Roboadvisors For

Betterment Vs Wealthfront Vs Acorns 2021 Best Platform

Wealthfront Vs Betterment Which Robo-advisor Is Best - One Shot Finance

Betterment Vs Wealthfront Which Robo-advisor Is Best For You - Clark Howard

Should I Use Wealthfront Or Vanguard To Build My Investment Portfolio