Both plans serve a similar function, in that they help you save for retirement. Ira / roth ira ($5500 for magi < $61k single) 457 ($18000) 403(b) ($18000) you can contribute the maximum in each of these categories.

Understanding The Annual Reset Method The Annuity Expert

In general, the more you make, the less you can use a roth ira.

Tax sheltered annuity vs 401k. Just as with a 401 (k) plan, a 403 (b) plan lets employees defer some of their salary into individual accounts. An additional distinction is that with an annuity, the individual has to make investments with his/her own money while a 401k is set up by an employer. 401(k) plan contribution limits 401(k) contribution limit:

The most glaring difference is the fact that you choose annuity as a financial product from an insurance company while 401k is a retirement plan offered by your employer. However, there's a limit to how much you can contribute to a 401(k), while annuities offer unlimited contributions. Instead, withdrawals from a roth 401(k) after age 59 and a half are generally not taxed, whereas traditional 401(k) withdrawals are taxed as normal income.

The main difference between both types of plans is: 403(b) contributions are invested in one of three things that are chosen by the plan administrator: The major difference between annuities and 401k plans is that with an annuity, the individual invests his/her own money while a 401k comes from an employment source.

These plans do resemble one another. Contribution limits for 2021 start decreasing when an individual makes $125,000 annually. You contribute money to it, customarily as a regular deduction from your paycheck.

Each plan is named after a different section of the u.s. However, the 403 (b) is in use by a specific set of employers, and is. The deferred salary is generally not subject to.

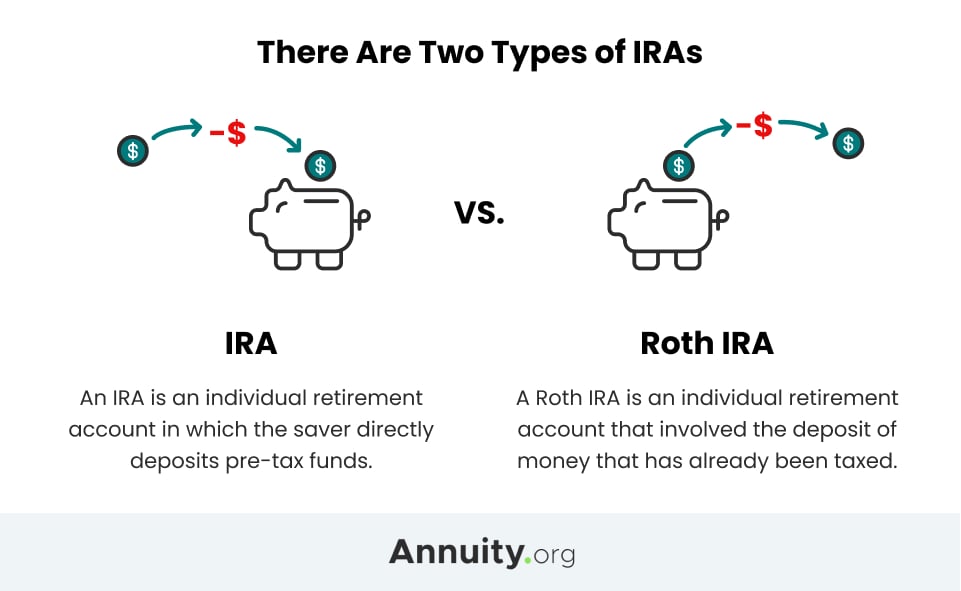

One similarity between the two instruments is the nature of tax deferral, wherein the savings are exempt from tax, and you have to pay tax on the benefits upon your retirement like any other. You will not owe income taxes on the investment returns of a 401(k) or annuity until you withdraw from the plan. The ira you may choose between the roth and traditional flavors.

Those 50 or older are allowed to save an extra $1,000 every year, bringing the 2021 total to $7,000. Annuities often have lower returns, as well as high costs. Similarly, its name refers to the tax code that established it, but 403(b)s are also known as “tax sheltered annuity” (tsa) plans.

Your income affects your roth ira eligibility. You don’t have to pay taxes on earnings contributed to a. A 403(b) account is similar to the 401(k) plan, though it usually takes the form of annuity contracts or mutual fund custodial accounts.

The main difference between the two plans is the type of employer sponsoring them. Annuity contracts with insurance companies, custodial accounts maintained by custodians (normally banks) that. These frequently asked questions and answers provide general information and should not be cited as authority.

That means you can put away up to $41,500 each year, as long as you gross under $97k.

Annuity Taxation How Various Annuities Are Taxed

All The Difference Between 403b And 401k Plans You Should Know About Financial Digits

Roll Over Ira Or 401k Into An Annuity Rollover Strategies

Difference Between 401k And 403b Retirement Plans With Table - Ask Any Difference

The Hierarchy Of Tax-preferenced Savings Vehicles

Annuity Vs 401k Comparing The Risk And Benefits

All The Difference Between 403b And 401k Plans You Should Know About Financial Digits

Annuity Vs 401k Whats The Difference Forbes Advisor

See Retirement Planning And Tax Benefits Or Tax Deductions

Roll Over Ira Or 401k Into An Annuity Rollover Strategies

403b Vs 401k Complete Retirement Plans Comparison Recommendations

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax-sheltered Annuity Definition

The Hierarchy Of Tax-preferenced Savings Vehicles

The Tax Sheltered Annuity Tsa 403b Plan

Understanding The Different Values In Annuities The Annuity Expert

Massmutual Whats In A Name A Retirement Plan Comparison

Building A Financial Foundation How Taxes Effect Your Wealth Tingting Lu 1121 Ppt Download

Withdrawing Money From An Annuity How To Avoid Penalties

Difference Between 401k And 403b Retirement Plans With Table - Ask Any Difference