There are few, if any, weaknesses noted in the program. For 2019, the limit individual taxpayers are allowed to deduct is $2,435 or $4,865 if filing jointly.

Oregon Able Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

For example, if a couple contributed $15,000 to their son’s oregon college savings plan account in 2019, they may subtract a maximum of $4,865 (because they file jointly) on their 2019 oregon taxes.

Oregon 529 tax deduction carry forward. For a short window of time, oregon taxpayers can qualify for both a deduction and a. You may also carry forward a balance over the following four years for contributions made before the end of 2019. The new tax credit would be in addition to any carried forward deductions.

This is a program that offers outstanding flexibility, attractive investments, and additional economic benefits (such as generous state tax incentives) that for some people, at least, will provide a substantial boost to their savings. If you currently take advantage of this option, you are able to carry forward your unused subtraction over the following four years. If you currently take advantage of this option, you are able to carry forward your unused subtraction over the following four years.

The new tax credit would be in addition to any carried forward deductions. Our overall rating for or residents. You may elect to carry forward a balance over the following four years for contributions made before the end of 2 019, in order to help distribute your tax deduction potential.

The oregon college savings plan’s carry forward option remained available to savers through december 31, 2019. The credit replaces the current tax deduction on january 1, 2020. Also, you can carry forward a contribution greater than $2,300 ($4,600 for couples) for the next four years.

If you made a contribution before january 1, 2020 that was more than your limit, you can carry forward the remaining contribution not subtracted over the next four years. The oregon college savings plan’s carry forward option remained available to savers through december 31, 2019. For example, if a couple contributed $15,000 to their child’s oregon college savings plan account in 2019, they

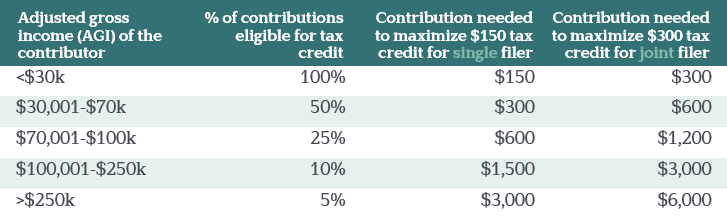

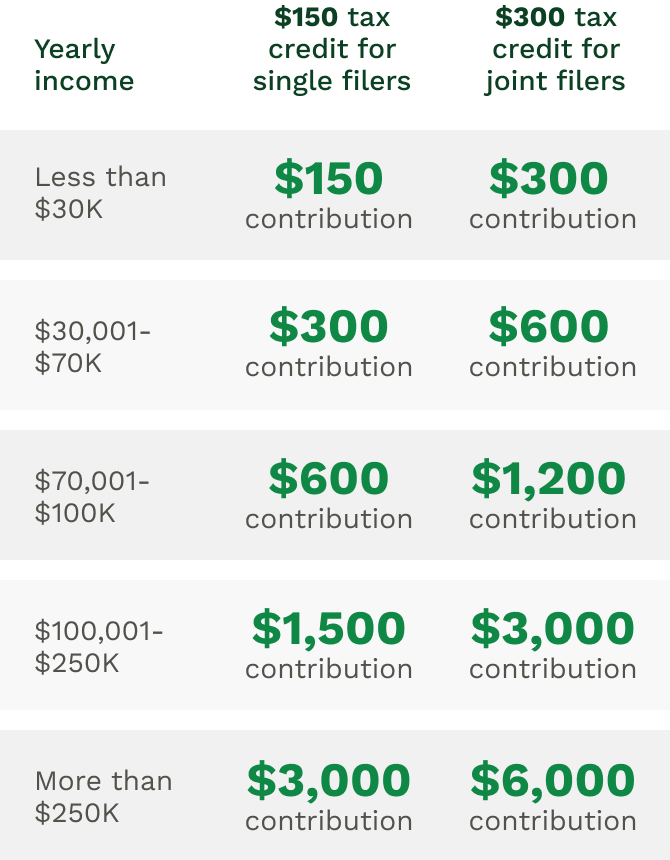

Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions. Tax year 2019 is the last year the contributions will qualify for a deduction. Can an individual with a 529 subtraction from a year prior to 2016 carry forward a

The limits are adjusted each year for inflation. Taxpayers in over 30 states may claim a state income tax deduction or tax credit for contributions to a 529 plan. If you currently take advantage of this option, you are able to carry forward your unused subtraction over the following four years.

It’s up to you to keep records showing the contribution in the event of an audit. For more on the changes to the oregon plan, continue reading or 529 part 2 here. In the past, contributions to the oregon 529 plan were deductible on your oregon state income tax return, up to certain limits.

However, contributions made in 2019 and prior can still be carried. The new tax credit would be in addition to any carried forward deductions. So, a couple can contribute $23,000 now, claim a.

Yes, oregon is currently tied to the extenders for the 7.5 percent agi floor for the medical expense deduction and the deduction for mortgage insurance premiums, as both of those impact federal taxable income (see above question about the rolling reconnect). If you contribute more than your limit, you can carry forward the remaining contribution not subtracted over the next four years. You may carry forward the balance over the following four years for contributions made before the end of 2019.

The oregon college savings plan’s carry forward option remained available to savers through december 31, 2019. If you are an oregon resident or nonresident and work for a business in oregon, your employer is required by law to withhold the stt from your wages automatically. However, each state has its own rules regarding the type of tax benefit and the amount of 529 plan contributions that are eligible for a state tax deduction or credit each year.

Rollovers from other 529 plans into an oregon 529 plan are considered new contributions and qualify for the subtraction. For 2019, you can subtract up to $4,865 for joint returns or up to $2,435 for all other returns for contributions made to a 529 oregon college savings network account in 2019. In 2019, individual taxpayers were allowed to deduct up to $2,435 for contributions made to the oregon college savings plan, while those filing jointly could deduct $4,865.

Keep a copy of your account statement with your tax records. In fact, with oregon's 529 plans, you can contribute more than the annual deduction limit and carry the excess forward for up to four years. If you file an oregon income tax return, contributions made to your account before the end of 2019 are deductible up to a certain limit.

2

2

Taxes Faqs Oregon College Savings Plan

New Considerations For 529 Plans In Oregon - Von Borstel Associates

Oregon College Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Ableforall Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

529 Plan Deductions And Credits By State Julie Jason

Oregon 529 Plan How To Save On Your Contributions - Brighton Jones

Can You Carry Forward An Oregon Tax Deduction On Contributions Made In The Previous Tax Year Oregon College Savings Plan

Tax Changes Ahead For Oregons 529 Plan Vista Capital Partners

Mfs 529 Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Big Changes To Oregon 529 And Able Accounts - Jones Roth Cpas Business Advisors

Taxes Faqs Oregon College Savings Plan

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

The Or 529 Plan - No More Tax Deduction For Savers Springwater Wealth Management

Tax Changes Ahead For Oregons 529 Plan Vista Capital Partners

Oregon College Savings Plan Changes Financial Freedom Wealth Management Group

Mcgillhillgroupcom

Tax Benefits Oregon College Savings Plan