The december 2020 total local sales tax rate was also 7.250%. The chart below shows the data for sales tax measures on the ballot in california between 2008 and 2020.

Pin On Tendencias

In an april presentation on changing sales tax projections, county experts estimated 22.6% of the tax went to the public safety fund, 22% went to health and.

Placer county sales tax 2020. Rates effective 07/01/2020 through 09/30/2020. Find the resources you need here. The placer county sales tax is 0.25%.

The california sales tax rate is currently %. The placer county, california sales tax is 7.25% , the same as the california state sales tax. You can print a 7.25% sales tax table here.

The city’s overall sales tax rate would be increased to 8.25% until 2028, and officials estimate it would bring in $2.56 million annually. The 7.25% sales tax rate in lincoln consists of 6% california state sales tax, 0.25% placer county sales tax and 1% special tax. The highest number of sales tax measures (129) were on the ballot in 2020, while no sales taxes were proposed in 2010.

The minimum combined 2021 sales tax rate for roseville, california is. For tax rates in other cities, see california sales taxes by city and county. If you need access to a database of all california local sales tax rates, visit the sales tax data page.

Supervisors approve expenditure plan for pctpa proposed ballot measure. Roseville is the largest city in placer county and called home by 135,000 people. The agency is proposing an increase of sales tax by ½ a cent from the three south county cities to fund the projects.

There is no applicable city tax. Some cities and local governments in placer county collect additional local sales taxes, which can be as high as 1.5%. Click any locality for a full breakdown of local property taxes, or visit our california sales tax calculatorto lookup local rates by zip code.

We are a place where businesses small and large find success. A “yes” vote supported authorizing an additional sales tax of 1% for 7 years generating an estimated $2.56 million per year for general services including law enforcement, fire services, and code enforcement services, thereby increasing the total sales tax rate in auburn from 7.25% to 8.25%. The total cost for these improvements exceeds 3 billion dollars and with only 50% gas tax money coming from the state, and after county funds ear marked, over 1 billion dollars remains unfunded.

The “base” sales tax rate of 7.25% consists of several components. This tax is calculated at the rate of $0.55 for each $500 or fractional part thereof, if the purchase price exceeds $100. No personal checks will be accepted.

As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate. Although the percentage is relatively small, placer county collected $30.5 million in sales tax last year. The current total local sales tax rate in placer county, ca is 7.250%.

All sales require full payment, which includes the transfer tax and recording fee. This is the total of state, county and city sales tax rates. Placer county sales tax for roads and transportation:

Method to calculate placer county sales tax in 2021. Granada hills (los angeles) 9.500%: The roseville sales tax rate is %.

California city and county sales and use tax rates. All cashier's checks must be made payable to the placer county tax collector. The california sales tax rate is 6.5%, the sales tax rates in cities may differ from 6.5% to 11.375%.

Leaders said they are about nine years. The december 2020 total local sales tax rate was also 7.750%. The average sales tax rate in california is 8.551%

Enjoy the pride of homeownership for less than it costs to rent before it's too late. The county sales tax rate is %. While many other states allow counties and other localities to collect a local option sales tax, california does not permit local sales taxes to be collected.

Top Tin-producing Countries - Investing News

2

Matter Of Fact Listening Tour The Hard Truth About Bias

It Makes All The Difference Wealth Success Money Ceo Makemoneyonline Business Entrepreneur Money Management Advice Money Management Money Financial

Who Loves Passive Income Passiveincome I Help Local Businesses And E-commerce To Generate Reve Start Online Business Personal Finance Budget Business Money

2

House Of The Day Oracle Billionaire Larry Ellison Just Sold His Lake Tahoe Mansion For 20 Million Lake Tahoe Getaway Expensive Houses Mansions

Before After With Yardzen House Exterior House Front Front Yard Design

It Makes All The Difference Wealth Success Money Ceo Makemoneyonline Business Entrepreneur Money Management Advice Money Management Money Financial

California Cannabis Laws By County Cannabusiness Law

Black Wall St On Instagram Make A Plan And Work Your Way To Becoming An Investor Generationalwealth Financial Education How To Plan Finance

It Makes All The Difference Wealth Success Money Ceo Makemoneyonline Business Entrepreneur Money Management Advice Money Management Money Financial

Pin On 60 Dollar Miracle

It Makes All The Difference Wealth Success Money Ceo Makemoneyonline Business Entrepreneur Money Management Advice Money Management Money Financial

Diversity And Inclusion - City Of Roseville

Blossom Socks Side Hustle Hustle College Kids

Click The Photo For More Info And Free Real Estate Scripts Money Management Advice Finance Investing Investing

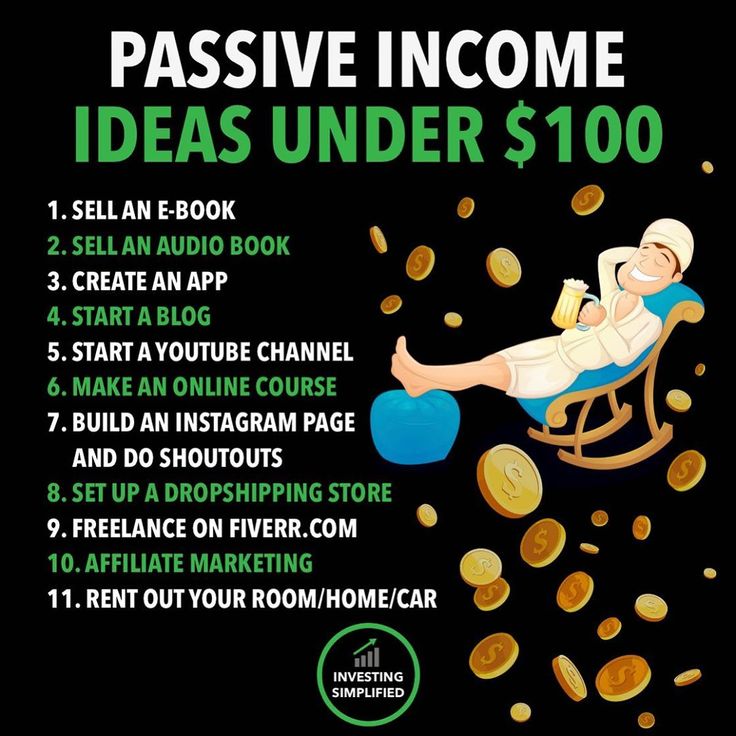

Passive Income Money Management Advice Business Money Money Financial

California Cannabis Laws By County Cannabusiness Law