(except when the first tuesday of the month falls on a legal holiday in which case the sale is held the next business day). The fulton county, georgia sales tax is 7.75% , consisting of 4.00% georgia state sales tax and 3.75% fulton county local sales taxes.the local sales tax consists of a 3.00% county sales tax and a 0.75% special district sales tax (used to fund transportation districts, local attractions, etc).

2

If you need access to a database of all georgia local sales tax rates, visit the sales tax data page.

Sales tax in fulton county ga 2019. The state general sales tax rate of georgia is 4%. (except when the first tuesday of the month falls on a legal holiday in which case the sale is held the next business. The current total local sales tax rate in fulton county, ga is 7.750%.

The total 7.75% fulton county sales tax rate is only applicable to businesses and sellers that are not in the greater atlanta area. Fulton county property tax assessment notices have been sent and, to no big surprise, confusion has resulted. Boost your business with wix!

A tax sale is the sale of a tax lien by a governmental entity for unpaid property taxes by the property’s owner. Voters renewed the tax for the fourth time in june 2017. Ad with secure payments and simple shipping you can convert more users & earn more!.

Every 2021 combined rates mentioned above are the results of georgia state rate (4%), the county rate (2% to 4%), the georgia cities rate (0% to 1.5%), and in some case. Fulton county sheriff’s tax sales are held on the first tuesday of each month, between the hours of 10 a.m. Build the online store that you've always dreamed of.

Average sales tax (with local): The 2018 united states supreme court decision in south dakota v. Several fulton county homestead exemptions were adopted by voters in november 2018 and are to start in tax year 2019.

2 extended for five years a 0.75 percent transportation special purpose local option sales tax. First passed by fulton county voters in 2016, tsplost is a.75 percent sales tax whose revenue is divided among cities to pay for transportation. The $545.9 million it’s forecast to generate is.

Fulton county collects the highest property tax in georgia, levying an average of $2,733.00 (1.08% of median home value) yearly in property taxes, while warren county has the lowest property tax in the state, collecting an average tax of $314.00 (0.51% of median home value) per year. The tax commissioner takes the appraised value and the exemption status provided by the board of tax assessors, along with the millage rates set by the board of commissioners and other. Ad with secure payments and simple shipping you can convert more users & earn more!.

The fulton county tax commissioner is responsible for collecting property taxes on behalf of fulton county government, two school systems, and some city governments. 2 fulton county voters will have the opportunity to vote on the county’s second iteration of the transportation special purpose local option sales tax, or tsplost. The state constitution requires county boards of.

Public outcry to highest bidder: Build the online store that you've always dreamed of. Fulton county voters first approved the county's special purpose local option sales tax (splost) for education in 1997.

From 1997 through 2021, the tax raised almost $2.5 billion in revenue for county schools. , ga sales tax rate. Click any locality for a full breakdown of local property taxes, or visit our georgia sales tax calculatorto lookup local rates by zip code.

A tax sale is the sale of a tax lien by a governmental entity for unpaid property taxes by the property’s owner. Automating sales tax compliance can help your business keep compliant with changing sales tax laws. Fulton county sheriff’s tax sales are held on the first tuesday of each month, between the hours of 10 a.m.

The base rate of fulton county sales tax is 3.75%, so when combined with the georgia sales tax rate it totals 7.75%. Sales tax rates in fulton county are determined by twelve different tax jurisdictions, atlanta, decatur, east point, college park, south fulton, fulton county, sandy springs, clayton county, atlanta (fulton co), roswell, alpharetta and union city. Georgia has state sales tax of 4% , and.

Has impacted many state nexus laws and sales tax collection requirements. The fulton county sales tax rate is %. Under state law, the state revenue commissioner is to review fulton county’s digest in the calendar year that begins jan.

Fulton county, georgia has a maximum sales tax rate of 8.9% and an approximate population of 844,428. Cities and/or municipalities of georgia are allowed to collect their own rate that can get up to 1.5% in city sales tax. The following is a summary of those new exemptions:

Boost your business with wix!

City Of Atlanta Department Of Watershed Management 2019 Annual Report By Dwmatlantaga - Issuu

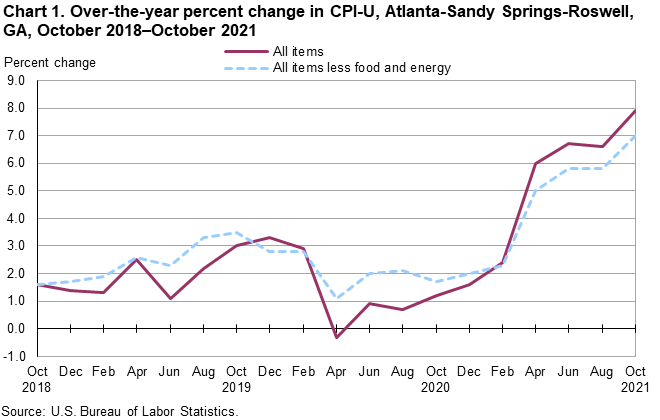

Consumer Price Index Atlanta-sandy Springs-roswell October 2021 Southeast Information Office Us Bureau Of Labor Statistics

2

Feminine Branding Ethereal Whimsical Branding Logo Design Website Design Blush Pink Baby Blue Branding Website Design Baby Logo Branding Website Design

Wrap-around Porch House Designs Exterior House Exterior Farmhouse Plans

2

2

2

2

2

Metal Build House Contemporary Decorating In 2020 Steel Building Homes Metal Building Homes Barn House Plans

House Plan 4534-00026 - French Country Plan 3073 Square Feet 4 Bedrooms 35 Bathrooms Craftsman House Craftsman House Plans Craftsman House Plan

Tree House Great Brunch And Dogs Welcome On The Patio Atlanta Restaurants Restaurant Atlanta Resturants

100 Most Influential Georgians Of 2019 Propelling Positive Change - Georgia Trend Magazine

Official Seven Authentication Guide - Start Here With The Basics - Authenticforum Basic Seventh Guide

2

Atlanta Real Estate Market Stats Atlanta Real Estate Real Estate Marketing Marketing Stats

2

Fulton Approves 800 Million Budget - Saportareport