5.05% on the first $45,142 of taxable income, plus…. This publication outlines the retail sales tax and harmonized sales tax exemption (8% ontario portion only) and required supporting documents for vehicle transfers between related corporations, and corporations and shareholders.

2

The amount you have to pay will be determined by a border services officer when you arrive at the border.

Zamora tax services in ontario. 11.16% on the next $90,287 up to $150,000, plus…. Your average tax rate is 22.0% and your marginal tax rate is 35.3%.this marginal tax rate means that your immediate additional income will be taxed at this rate. Search for other attorneys in pomona on the real yellow pages®.

They do taxes for individuals, businesses, corporations and partnerships as well as immigration services such as family petitions, citizenship, passports, etc. Since that date, we have helped hundreds of happy customers in southern california. Throughout the country, either the goods and services tax (gst) or harmonized sales tax (hst) will usually be charged on goods and services that you buy if you live in british columbia, alberta, saskatchewan, manitoba, quebec or any of the territories you pay 5% gst (in addition, british columbia, saskatchewan and manitoba have a provincial sales tax.

Welcome to zamora tax & immigration. If two or more participating provinces are involved, the service is deemed to be supplied in the participating province among those provinces for which the rate of the. For instance, if you provide automobile repair services in ontario, the vehicles are staying in ontario while you make the repairs, and subject to hst at a rate of 13%.

If you make $52,000 a year living in the region of ontario, canada, you will be taxed $11,432.that means that your net pay will be $40,568 per year, or $3,381 per month. Here are some of our top online services, renew: Zamora tax & immigration was established in 2000.

Ad ask verified tax pros anything, anytime, 24/7/365. 8:00 am to 7:00 pm. Ad ask verified tax pros anything, anytime, 24/7/365.

8:00 am to 5:00 pm. Please note that this page replaces the former rst publication. Mto driver and vehicle licence issuing;

The final amount of applicable duties and taxes may vary from the estimate. 9.15% on the next $45,142 up to $90,287, plus…. If there is a lien (a form of security put on a vehicle to ensure its owner pays any debt that is outstanding) on the vehicle, you can contact the ministry of government and consumer services, personal property security branch, for more information:

The people at zamora tax and immigration are amazing! It's run by gustavo (everyone calls him zamora) and his wife. Reach out to similar pros.

12.16% on the next $150,000 up to $220,000, plus…. This page explains how retail sales tax (rst) applies to specified vehicles purchased privately in ontario or that are purchased privately elsewhere in canada and brought into ontario for use. 13.16 % on the amount over $220,000.

Get reviews, hours, directions, coupons and more for zamora services at 942 e holt ave, pomona, ca 91767. Amount of tax payable under the hst? For more information, including personal exemption amounts, consult paying duties and taxes.

Over 40 services are available online making it fast, easy, and convenient to renew now. This provider has not enabled messaging on yelp, but you can still request a consultation from other businesses like them. Adult clothing 5% 8% no (remains 13%) children’s clothing 5% no pst no (remains 5%) shoe repair service 5% 8% no (remains 13%) children’s footwear 5% no pst if $30 or less no for footwear up to size 6 (remains 5%) tailoring services 5% 8% no (remains 13%) dry cleaning service 5% no pst yes (changes to 13%)

Fall into sweater weather and the colours of the season. All form fields are required.

Mi Oficina Income Tax Insurance - Services Facebook

Barba Travel Income Tax Service 6040 Riverside Dr Ste F Chino Ca 2021

Zamora Services - Home

Bahan Bom Ditemukan Di Tambora - Scraperone

Zamora Services - Home

Bookkeeping In Mississauga Qs Accounting In 2021 Accounting Services Bookkeeping Services Bookkeeping

Income Tax Prep Services Time Instagram Story Instagram Story Instagram Story Ads Income Tax

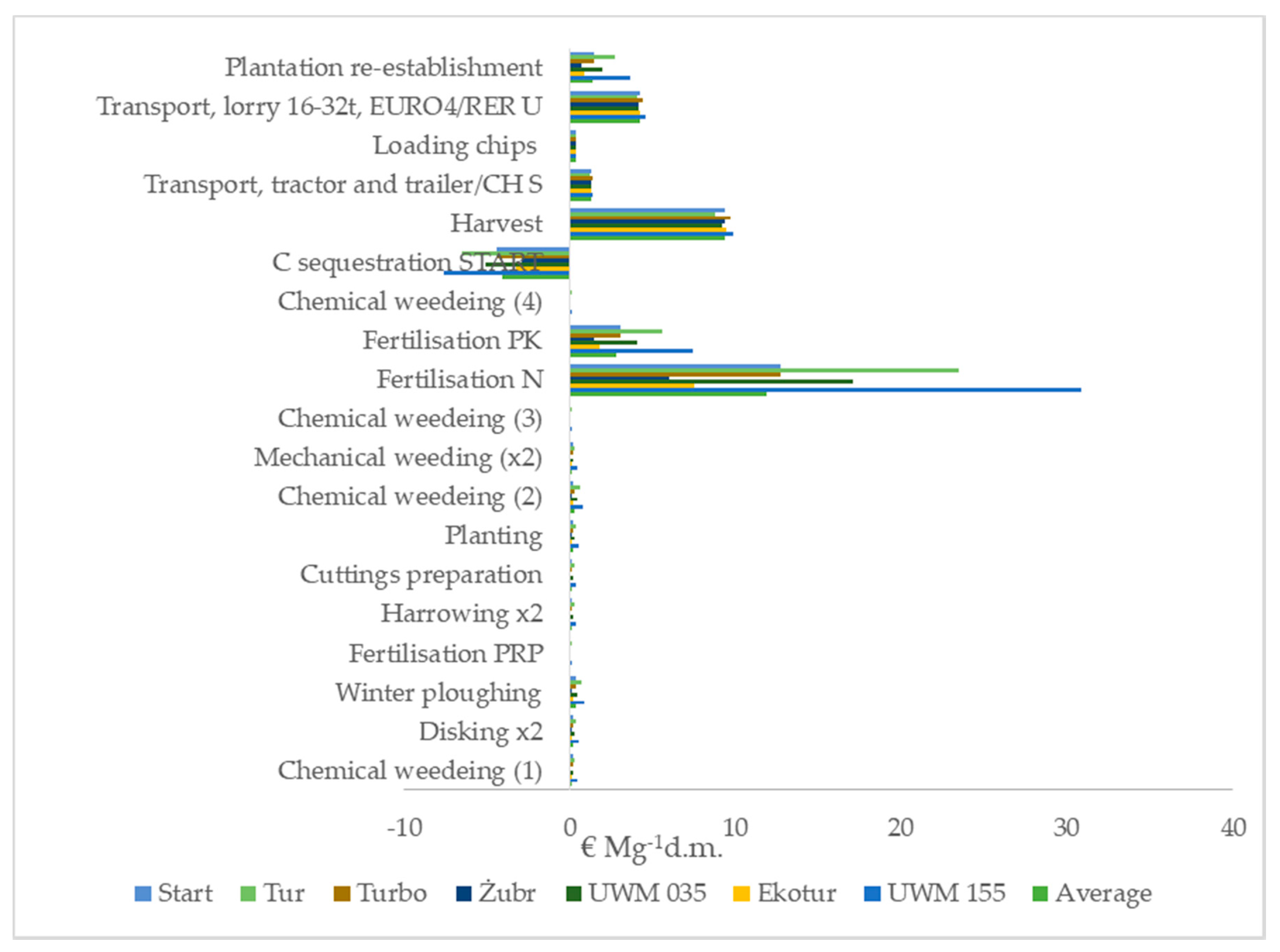

Energies Free Full-text Willow Cultivation As Feedstock For Bioenergy-external Production Cost Html

2

Pin By Mary Marina On Start Me Up Entrepeneur Me Software Development Web Application Development Website Design

2

7 Insanely Awesome Write-offs That Solopreneurs Need To Know Business Tax Tax Write Offs Business Marketing

Barba Travel Income Tax Service 6040 Riverside Dr Ste F Chino Ca 2021

Pin De Sujin Yang En Space Alberto Kalach Arquitectura House

Big News - Vn Accounting Solutions Acquired Linda Bulanda Cpa Professional Corporation Income Tax Preparation Accounting Services Tax Services

Sales And Use Tax Sales Tax Information - Tax Notes

Land For Sale 50100 Thomassin 37 Haiti Land For Sale Haiti Outdoor

Elmer M Zamora Rtrp - Ontario Ca Tax Preparer

The Best Accountants Near California - Official Accountants