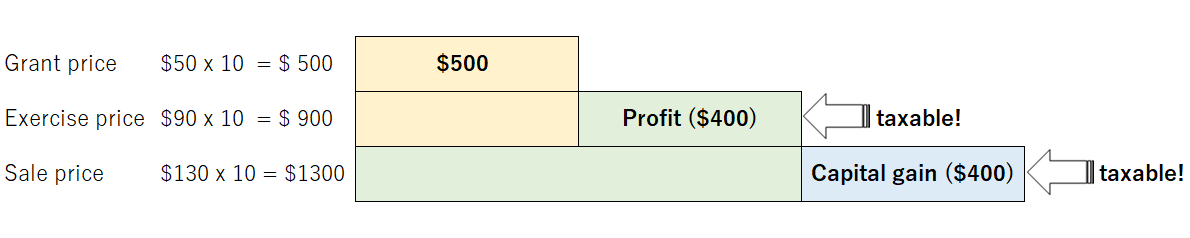

Tax upon exercising the options, not when receiving the options Its official languages are english, malay, chinese, and tamil, and the currency is the singapore dollar (sgd).

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

Singapore is one of the world's most prosperous countries, with strong international trading links.

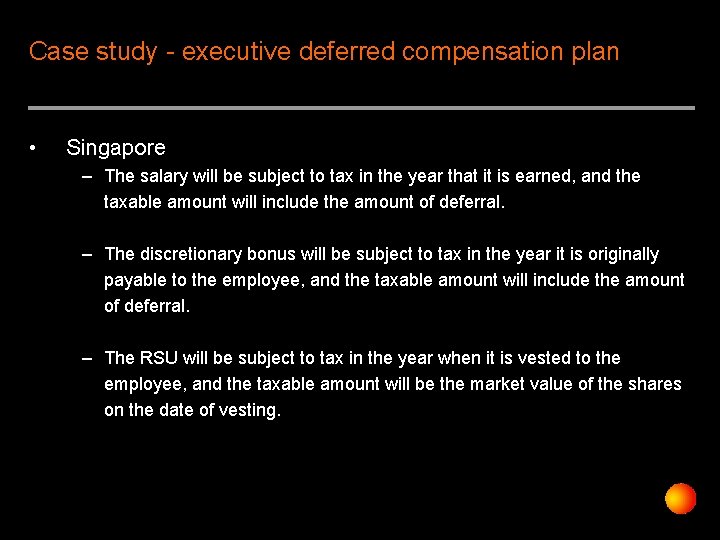

How are rsus taxed in singapore. Are employee stock options taxable in singapore? The difference thus lies in when the employee is taxed. If the employee fails to vest in the shares, the employee forfeits the right to the shares.

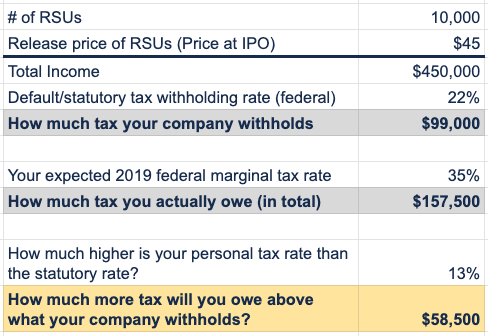

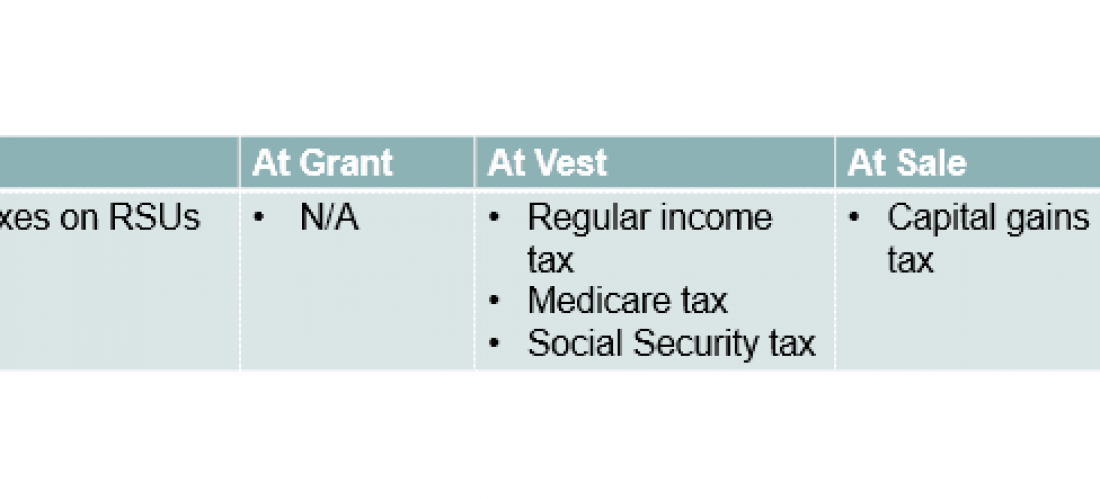

Rsu is taxed to the employee as a cash bonus when they are vested. Employees will generally be subject to income tax on rsus and restricted stock upon vesting. Founders need to be sure that they have sufficient cash for the payouts.

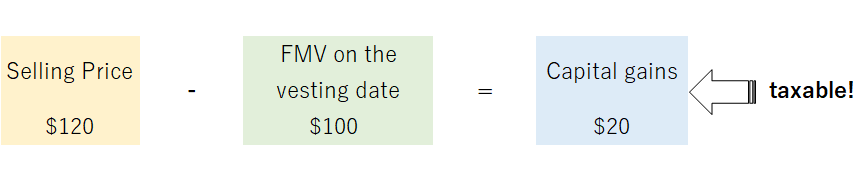

Most tech companies like tesla, google, and amazon use rsus to attract and retain top talents. The taxable amount will be the fair market value of the shares on the date of vesting. Gains from rsu and esop are all considered as part of the employee’s income, and are subject to prevailing income tax rates.

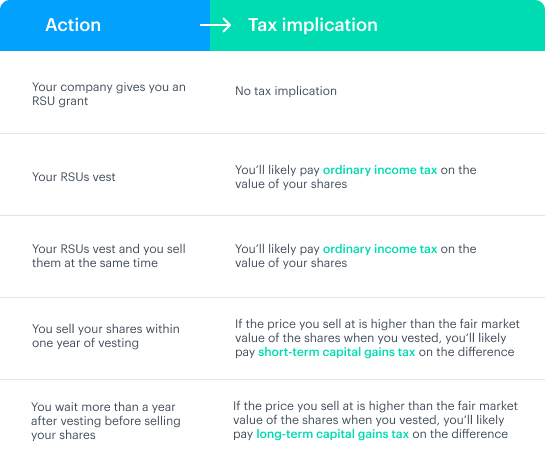

When it thereafter vests, you would generally be responsible for the taxes in that original location. It is taxed at ordinary tax rates which are higher than shareholder tax rates (capital gain tax). However, the units are taxed in the year that employees receive them, even if the stock unit declines in value.

Capital gains tax is not payable on any gain upon the net proceeds of sale of. If employees keep the restricted stock units for more than a year, the rsus are taxed at a lower rate as capital gains. Section 10(25) is applied to tax foreign income received in singapore only if the income belongs to an individual* who is resident in singapore or an entity that is located in singapore.

Leave singapore on a permanent basis, if you are a transferring employee you will be deemed to have vested in your rsus one (1) month before the date on which you terminate employment in singapore or leave singapore, and you will therefore be subject to tax on a “deemed vesting ” basis at such time. The taxable amount is the fair market value of the tock at such time less any amount paid s for the stock. Rsus are taxed upon the delivery of shares (which is generally upon vesting) as income from employment at the progressive tax rate up to 49.5 percent.

However, if you forfeit the rsus when you An employee who is granted rights under an esow plan by an employer will be taxed on any gains or profits arising from the esow plan. However, you will likely also meet us tax residency rules, which means you would be reporting it on the us side, as well, and then taking the “foreign tax credit.”

Us income taxes guide 17.5. When a foreign employee ceases employment in singapore with unexercised esop, the gains from these unexercised esop are taxed on a “deemed exercise” basis. The deemed exercise rule applies when a) a foreigner ceases employment in singapore or b) when a permanent resident leaves the country permanently or c) a permanent resident is posted to work overseas.

For both restricted stock and rsus, an employee is generally subject to income tax on vesting. Once when you take ownership of the shares (usually when they vest) and again (in another way) when you actually sell the shares. The above applies equally to esop/esow plans that are:

Rsus generate taxes at a couple of different milestones: In the event there are disposal restrictions on the tock acquired, tax is payable when such restrictions s lapse. If the company fails to register their rsu plan in proper fashion with the tax bureau, the preferential tax computation methods will not apply to the income from equity incentives.

Generally, there is no tax upon the sale of shares if the shareholder, together with their fiscal partner, has an interest less than 5 percent in the nominal subscribed share capital (determined per class of shares). After meeting these conditions, rsus are said to vest and the company issues the promised stocks. A restricted stock unit is actually a promise to issue one stock for every unit granted to an employee if they meet certain conditions.

The one year cliff simply refers to the fact that you have to remain associated with the company for a year before any of the rsus vest, so if (for example) you terminate your association with the company after 11 months, you get nothing. Founders need to commit to a timeline for a takeout. Restricted stock represents shares that an entity grants to an employee and are generally subject to vesting conditions.

Therefore sars results in higher tax outgo when compared to an esop scheme. The income for rsu is usually taxed in the jurisdiction of residence at the time it was granted. Those plans generally have tax.

The rsus are taxed as extra compensation. You will not be subject to tax when the restricted stock units are granted to you. 17.5 income tax accounting for restricted stock and rsus.

Singapore, an island country in southeast asia, is located off the southern edge of the malay peninsula, between malaysia and indonesia. Additionally, income from rsus which fail to meet the required registration standards will be directly added to the income of the current month and will be subject to iit. You will be subject to income tax when your restricted stock units vest and the underlying shares are issued to you.

Generally, this is when the shares under the plan vest for the employee. For an rsu that's typically $0.

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation - Flow Financial Planning

Filing A Tax Return In Japan For Share-based Compensation Rsus Employee Stock Options Employee Stock Purchase Plan From Overseas Parent Company Shimada Associates

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

What Are The Differences Between Esop Rsu And Phantom Stocks

Draft Finance Bill 2016 Restricted Stock Units

How To Reduce Your Income Tax In Singapore Make Use Of These Tax Reliefs And Deductions

Equity Compensation 101 Rsus Restricted Stock Units

Blog Upstart Wealth

Rsus - A Tech Employees Guide To Restricted Stock Units

How To Manage Us Rsus And Stock Options Awards When Living Overseas - Money Matters For Globetrotters

Rsus - A Tech Employees Guide To Restricted Stock Units

H Global Executive Share Plans Rachel E Lie

Filing A Tax Return In Japan For Share-based Compensation Rsus Employee Stock Options Employee Stock Purchase Plan From Overseas Parent Company Shimada Associates

What Are Non-qualified Stock Options Nsos - Carta Singapore

Understanding Corporate Tax In Singapore Contactone

Corporate Taxation In Singapore - Offshore News Flash

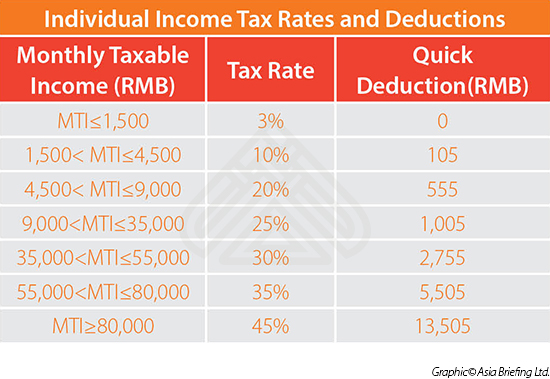

Granting Restricted Stock Units To Your Employees In China - China Briefing News

How Equity-holding Employees Can Prepare For An Ipo - Carta Singapore

Rsu Of Mnc Perquisite Tax Capital Gains Itr