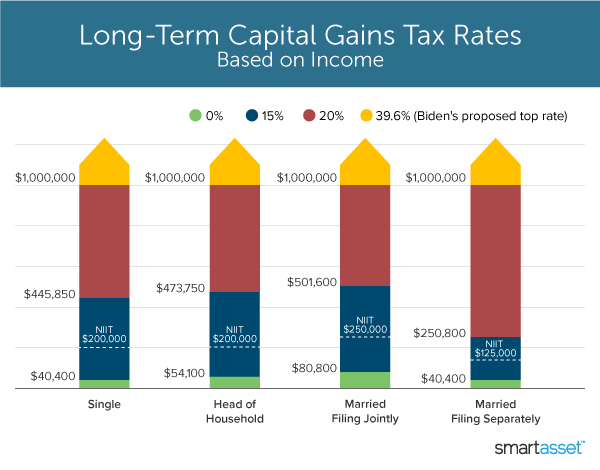

A capital gain is an increase in the value of an investment, they can be either stocks or shares in a mutual fund or exchange traded fund, a capital gain is also a real estate holding from the original purchase price. You’ll owe either 0%, 15% or 20% on gains from the sale of most assets or investments held for more than one year, depending on your annual taxable income (for more on how to calculate your long.

Pin On Tax

The irs has already released the 2022 thresholds (see table below), so you can start planning for 2022 capital asset sales now.

Capital gains tax increase 2022. In calculating how much you owe to tax on these gains, it largely relies on how long you had the. There's an additional 3.8% surtax on net investment income (nii) that you might have to pay on top of the capital gains tax. Capital gains tax rates remain the same for 2022, but the brackets for the rates will change.

Under the current proposal, “gains realized prior to sept. Biden proposed raising the top capital gains tax from 20% to 39.6% before a joint session of congress on april 28. While it is unknown what the final legislation may contain, the elimination of a rate increase on capital gains in the draft legislation is encouraging.

Such as if the value of the asset increases, you have a capital gain requiring you to pay tax on it. Washington's legislature passed a new capital gains tax in april (engrossed substitute s.b. ‘ the new tax laws.

Tax on net investment income. By dirk giseburt, michael e. As you can see, the end result shows that the increase in the capital gains inclusion rate to 75% increases the overall taxes by $13.38.

2022 capital gains tax rate thresholds capital gains Under the proposed build back better act, the top marginal tax rates will jump from 20% to 39.6% that is. Therefore, there could be an additional 8% tax on a transaction that closes in 2022 vs 2021.

The new law will take effect january 1, 2022. 5096), which was signed by governor inslee on may 4, 2021. When including the net investment income tax, the top federal rate on capital gains would be 43.4 percent.rates would be even higher in many u.s.

The standard deduction—which is claimed by the vast majority of taxpayers—will increase by $800 for married couples filing jointly, going from $25,100 for 2021 to $25,900 for 2022. Washington enacts new capital gains tax for 2022 and beyond. Gains realized after that date would be taxed at a.

The new democratic party (ndp), in particular, pledges to increase the capital gains rate to 75%. For the illustration above, we have ignored the calculation of recapture of. The refundable portion of the child tax credit is adjusted for inflation and will increase from $1,400 to $1,500 for 2022.

Additionally, there has been a proposed increase to the capital gains tax, from 29% to almost 49% if including top state and federal tax. In other words, for every $100 of capital gains generated on a sale or a disposition, there is an additional $13.38 of tax owed. Concerns that the tax law could change—and specifically that capital gains taxes will increase—is pushing investors to sell properties before the clock strikes 2022.

13 will be taxed at top rate of 20%; If you own a business and you’re considering selling, you need to plan for these tax increases. This is moot if the legislation is made retroactive but if the effective date is, for instance, january 1, 2022, gain realization in 2021 will.

Understanding capital gains and the biden tax plan.

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too In 2021 Bitcoin Currency Wealth Tax Capital Gains Tax

Latest Income Tax Slab Fy 2021-22 Ay 2022-23 Budget 2021 -22 Review In 2021 Income Tax Tax Income

Bpaas Market Revenues Worth 6876 Billion By 2022 Business Process Management Marketing Digital Asset Management

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Pin On My First Board

Pin On Feed Me More Nutrition

House Democrats Tax On Corporate Income Third-highest In Oecd

Httpswwwforbescomsitesashleaebeling20211110irs-announces-2022-tax-rates-standard-deducti In 2021 Estimated Tax Payments Standard Deduction Capital Gains Tax

Fixed Assets Depreciation Rate As Per Companies Act 2013 For Ay 2022-23 In 2021 Fixed Asset Acting Company

Whats In Bidens Capital Gains Tax Plan - Smartasset

Pin On Blog

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

How To Pay 0 Capital Gains Taxes With A Six-figure Income

10 Long Term Capital Gain Tax To Benefit P2p Lending Players Read Our Complete Article Published On Moneyc Peer To Peer Lending P2p Lending Capital Gains Tax

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Download Income Tax Calculator Fy 2021-22 Ay 2022-23 In 2021 Income Tax Tax Income

Ay 2022-23 Depreciation Rate Chart As Per Income Tax Act 1961 In 2021 Income Tax Taxact Income

Bio Based Polyethylene Terephthalate Market - Share Size Report 2023 Pet Market Marketing Share Market

Business News Today Read Latest Business News India Business News Live Share Market Economy News The Economic Times Income Tax Filing Taxes Tax Return