Net investment income tax (niit) The maximum rate would increase from 20% to 25% for taxpayers in the 39.6% tax bracket.

House Democrats Tax On Corporate Income Third-highest In Oecd

Nearly all of the changes we saw in the september 13th tax proposal are gone.

Net investment income tax 2021 proposal. The bill would amend sec. Increase federal employment taxes and “net investment income tax”: Application of net investment income tax to trade or business income.

Net investment income tax (niit) presents a big planning opportunity. The 3.8% net investment income tax under internal revenue code section 1411 would be broadened to include any income derived in the ordinary course of. Application of net investment income tax to trade or business income of certain high income individuals.

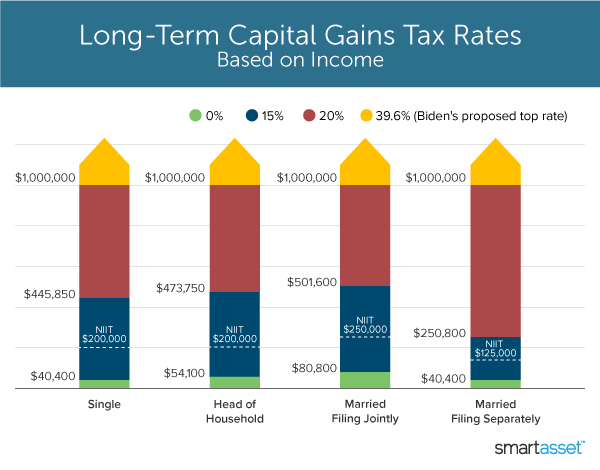

This increases the top capital gains tax rate to 25%. The biden administration earlier proposed to raise it as high as 39.6%. The amount subject to the tax is the lesser of your net investment income or the amount by which your magi exceeds the threshold ($250,000, $200,000, or $125,000) that applies to you.

Under the current rules, net investment income does not include income derived in the ordinary course of a trade or business or income attributable to the disposition of property earned outside of a passive activity. 1411 to apply the tax to net investment income derived in the ordinary course of a trade or business for taxpayers with taxable income over $400,000 (single filers), $500,000 (married taxpayers filing jointly or surviving spouses) or $250,000 (married taxpayers filing separately). The foreign earned income exclusion is $108,700 in 2021, to be increased to $112,000 in 2022.

The new proposal allows single and married filing joint taxpayers to deduct up to $72,500 per year in state and local income and real estate taxes. Revises the september version's proposal to impose a 5% tax on modified adjusted gross income 2 in excess of $10 million ($5 million for taxpayers filing as married filing separately). Net investment income includes interest, dividend, annuity, royalty, and rental income, unless those items were derived in the ordinary course of an active trade.

An additional 3% tax would apply to modified adjusted gross income over $25 million ($12.5 million for taxpayers filing as married filing separately). Expansion of the 3.8% net investment income tax (niit) We can forget about updated tax brackets, the 25% maximum capital gains rate, the refundable child tax credit extension past 2022, the death of the back door roth and the defective grantor trust, and edits to estate tax rules.

This would be in effect for tax years 2021 through 2031, after which the cap would be reduced to the current level of $10,000. The plan would expand the 3.8% net investment income tax, sometimes referred to as the medicare tax (referred to herein as the nii tax), for “those making over $400,000.” the nii tax imposes a 3.8% tax on the lesser of net investment income or the amount of modified gross income that exceeds a threshold amount. The excluded qsbs gain is considered an alternative minimum tax (amt) preference item, which, when considered along with the net investment income tax on the taxable half of the gain, results in an effective rate of 16.88% for qsbs acquired after february 17, 2009, and sold after september 13, 2021.

Redirect niit funds to the hospital insurance trust fund Deferring net investment income for the year. The proposal is also looking to expand the current 3.8% net investment income tax to be assessed on ordinary trade or.

However, some profits (namely, those of s corporations) aren't subject to the 3.8% net investment income tax, which was created by the affordable care act. Single individuals with modified adjusted gross incomes in excess of $200,000, and married individuals filing jointly with modified adjusted gross incomes in excess of $250,000,. This increase would be effective as of the date of the proposal (i.e., september 13, 2021).

The proposal would be effective for taxable years beginning after december 31, 2021.

Green Book Details Presidents Tax Reform Proposals Center For Agricultural Law And Taxation

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Whats In Bidens Capital Gains Tax Plan - Smartasset

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

2021 Guide To Potential Tax Law Changes

What The 2021 Tax Proposals Mean The American Families Plan Cpa Practice Advisor

Pass-through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

Congress Readies New Round Of Tax Increases Freeman Law - Jdsupra

Biden Tax Plan And 2020 Year-end Planning Opportunities

2021 Guide To Potential Tax Law Changes

A Closer Look At 2021 Proposed Tax Changes - Charlotte Business Journal

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step-up In Basis Among Others

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

What Is The The Net Investment Income Tax Niit Forbes Advisor

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Green Book Details Presidents Tax Reform Proposals Center For Agricultural Law And Taxation